Forex Liquidity in 6 Questions and Tips on How to Become Successful in Trading

July 25, 2023

In today’s context, it is a well known fact that Foreign Exchange market (or Forex, or FX) is the largest and the most gainful financial market in the world. Its trading volume reaches over $6 trillion daily.

To be simply said, Forex is a platform where everyone, be it a huge corporation, a private investor, or a beginner broker, can start trading and make a profit from their funds. Starting your journey to the trading world can be challenging since you have to learn so many terms, trading strategies and other financial aspects to make your trading profitable. So in this article we are going to discuss one of the most important elements of the Forex market — its liquidity.

Just like any other market, Forex trading revolves around asset liquidity. If assets lost their liquidity, trading them would become pointless. So, what is liquidity in Forex and why is it so critical for the functioning of the Forex market?

Key Takeaways

- Liquidity refers to the asset’s ability to be sold at the market price.

- Liquidity ensures smooth trading: a lack of liquidity can cause high volatility in the Forex market.

- Not all assets have the same level of liquidity.

- Liquidity is affected by many factors, like economic issues, world events or even traders’ sentiments.

- Forex is an unparalleled market in terms of liquidity due to its core principles, such as global nature, transparency and stability of currency pairs.

What are Degrees of Assets Liquidity?

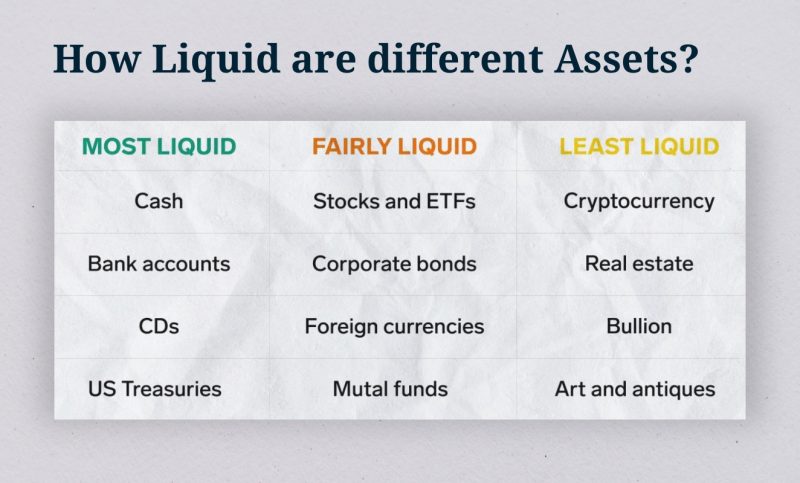

In simple words, liquidity defines how fast you can convert your asset into money without losing the asset’s value. According to this parameter, assets can be highly liquid, medium liquid and low liquid.

Highly Liquid Assets

Currency is rated as the most liquid asset possible because you can exchange it for anything, even for another currency. Forex is a market that exchanges currency pairs, so no wonder it tops the list of the most liquid markets.

Currency pairs that provide FX liquidity, can be grouped into three categories based on their trading frequency, trading volume, and popularity, that is, they are grouped based on their liquidity:

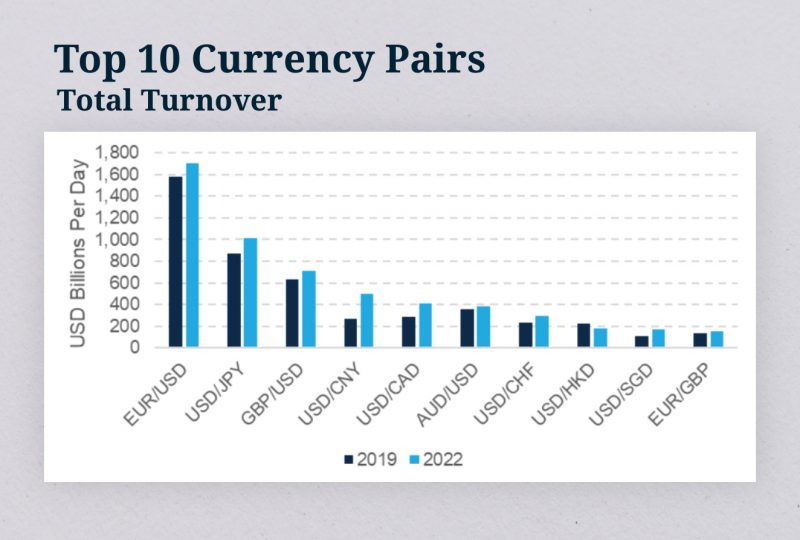

- Major currency pair: this group includes US dollar and the currencies of the countries with large economies, such as euro, british pound, japanese yen, swiss franc, and canadian and australian dollars. According to the BIS research, the trading volume of USD/EUR currency pairs in FX went beyond $1,600 in 2022, making it the most convertible pair in the market.

- Minor currency pairs: minors comprise the currencies of smaller economies, such as New Zealand and Singapore dollars, or South African rand.

- Exotic currency pairs: these are the least liquid currencies that include currencies of developing countries, for example, Turkish lira, Brazilian real, or Mexican peso.

Medium Liquid Assets

The second liquid asset is marketable securities. These include stocks, shares of stocks and bonds which are traded in stock markets. The most traded here are stocks of large-cap companies.

This category also includes commodities. The top three of the most traded raw materials are oil, natural gas and gold, followed by less popular but still vital silver, coffee, sugar, and cotton.

Low Liquid Assets

Such illiquid assets can significantly lose their value in the long run. Low liquid assets cannot be easily sold or exchanged for another asset. The examples of the low liquid assets can be immovables, various electronic devices, collectibles, or cars.

What is Liquidity vs Volatility?

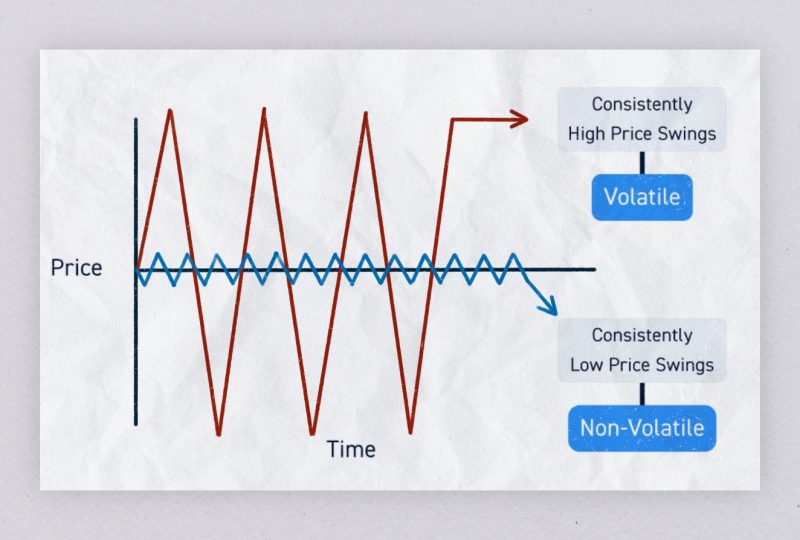

Volatility is another term that is crucial for asset trading and is closely connected with liquidity. Let’s take a closer look at it.

Irrespective of the asset type, its liquidity and volatility are co-dependent. The general rule of trading: the greater the volatility of an asset, the lower its liquidity for the investor. This also works in reverse: the lower the liquidity, that is, the fewer people want to buy and sell assets at a specified moment, the higher the volatility of this asset.

This is the reason why investing in low liquid assets is believed to be less risky, though also less profitable. If investors are aimed at high profit, they commonly tend to deal with high liquid assets implementing diverse trading strategies and taking into account all possible risks.

As well as liquidity, the degree of volatility can be affected by many factors. For instance, asset volatility can increase before some major economic events (such as statements of central banks authorities in case of possible depreciation of national currency). Generally, an overall economic environment in a country or in a certain industry has a major impact on volatility: if the business climate is more or less stable and predictable, it is less likely that the volatility of assets in the market increases drastically.

How Liquidity is Formed?

Trading in Forex looks like lots and lots of trades and order executions. A huge and integral part of the FX market is various finance institutions, banks and huge brokers who act as counterparties ready to buy or sell the required amount of currency. These counterparties are called liquidity providers, and they form liquidity in Forex. They are also responsible for forming such vital parameters as spread and volatility, which are very important for traders.

FX liquidity providers (or LPs) act as market makers: they facilitate trading by offering bid/ask prices for pairs of currencies thus ensuring constant flow of liquidity in the market.

Liquidity in FX can be influenced by many factors, such as trading intensity, the number of participants in the Forex market and the availability of liquidity providers.

What Affects Liquidity?

Among many factors that can influence liquidity of assets in Forex, there are several most frequent. Let’s look at them closely.

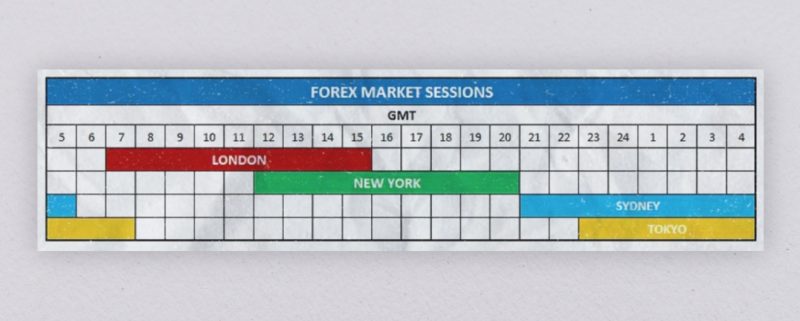

- Market hours. Though the Forex market functions 24 hours a day, liquidity levels can vary depending on trading sessions. The peak liquidity is usually observed when sessions in major financial centers overlap. The lowest levels of liquidity are usually on weekends and during holidays.

- Participants of the FX market. The number of traders and brokers in the market, as well as their activity have a significant impact on the market liquidity. Briefly, the more actors in the market, the higher assets convertibility. And vice versa, decreased number of participants leads to lower level of liquidity.

- Global news. Various world events and economic news greatly influence the foreign exchange market. Market actors follow the news and adjust their positions accordingly which can cause fluctuations in liquidity and market volatility.

- Market depth and spread. A deep market ensures higher liquidity, since traders can execute large orders and have significant profit. A bid/ask spread also affects liquidity: the lower the spread, the higher the liquidity.

- Liquidity of currency pairs. Major and the most popular currency pairs, like USD/EUR, or USD/JPY commonly exhibit higher levels of convertibility due to their popularity and active trading. On the other hand, minor and exotic currencies are less popular and subjected to wider spreads, which make it challenging for most traders to execute such trades with good prices.

- Market sentiment. This parameter reflects the overall mood and confidence of traders. Positive sentiment can increase trading activity, while negative one can decrease it and reduce trading volumes.

It is also worth pointing out that liquidity can vary between different currency pairs as well as it can depend on the different time periods. And finally, various unpredictable events, such as geopolitical situations, “black swans” and so on can significantly disrupt liquidity patterns in the market.

Why is Forex Considered the Most Liquid Market?

Forex is considered to be the market with the highest level of convertibility, and there are many reasons for this. Let us elaborate on some of them.

- Global nature. The FX market operates globally, covering multiple time zones and continents. As a result, trading takes place 24 hours a day, 5 days a week, and when one major financial center closes, another one opens, ensuring that the market remains active at all times. This worldwide presence and continuous trading add to the high liquidity of Forex.

- Large volume of trades. An enormous daily trading volume in FX arises from the numerous market participants who are engaged in active trade around the globe. The high volume ensures a constant presence of a significant number of buyers and sellers, creating ample liquidity.

- Diversity and market participants quality. Forex attracts a wide range of participants, such as central banks, individual traders, and big corporations. They encourage a high level of liquidity by increasing the number of buyers and sellers and adding market depth.

- Low entry barriers. In comparison with other financial markets, Forex allows both individual and institutional traders to play in the market. Moreover, opening an account for an individual trader does not imply huge capital, and retail traders can have easy access to the market via user-friendly online platforms. This diversity of traders ensures more market participants which in its turn leads to enhanced market liquidity.

- Market transparency. FX is a decentralized market where price formation is based on supply and demand, and all market participants have access to real-time pricing information. This contributes to the transparent nature of Forex and fair trade.

- Stable currency pairs. Major currency pairs, such as EUR/USD, GBP/USD, or USD/JPY, are highly liquid and have significant trading volumes thanks to the fact that they are stable and widely used in international trade. This aspect raises the interest of traders to Forex thus ensuring market liquidity.

The combination of these factors ensures a continuous flow of market players, making Forex a highly liquid market

How to Become a Successful Trader in Forex?

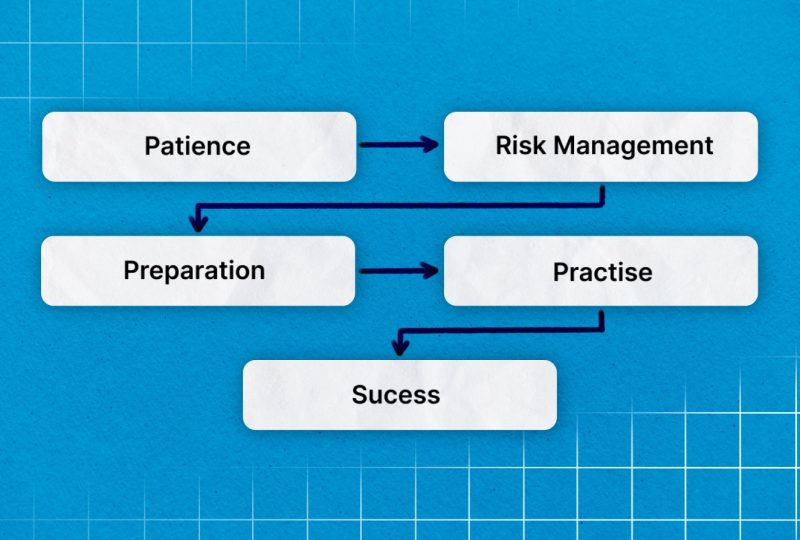

With all the terms and tons of information you have to keep in mind as you enter the FX market, it might seem extremely challenging to gain any success at trading. Here are some tips that might help you to get things loud and clear.

- Always stick to a strategy. It implies that you not only choose one of the official strategies, but you also have a plan of action, meaning that you are aware of how and when you enter the market, you know the amount of money you can risk with, and you know when he purpose of your trading, a goal you want to achieve, and you have your out-strategy, that is, you know when the risks are intolerable for you and youtube leave if things go wrong for you in the market.

- Use reasonable amounts of your funds in trades. Do not trade with too much volume or too frequently. Both approaches may lead you to huge losses. There is no harm in trading with reasonable amounts, or in waiting for a longer period for a good opportunity.

- Investigate the market and follow market news. Before the start, make a comprehensive research of the market and things that can affect your currency values and liquidity. Keep your finger on the pulse of market news and never stop learning new things about FX trading.

- Be realistic. Trading in the Forex market can be really profitable. Nevertheless, it is a complex and demanding work that takes a lot of effort and knowledge. To be successful in trading, have realistic expectations as to the size of your possible profit and time period needed for gaining it, and also keep in mind the possibility of risks and losses.

- Tune down your emotions. In trading, emotions are not your best friends. In fact, they are your enemies. To be effective, try to stay calm and disciplined, trust not your emotions but your thorough analysis and the selected trading strategy.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs

Is Liquidity Good in Forex?

Owing to many factors, among which are its global nature, large trading volumes, and diversity of actors in the market, FX can provide a high level of liquidity for traders as well as price stability.

However, it should be noted that different assets have different liquidity, so if you choose an exotic currency pair for trading, most likely that such an asset would not be very liquid.

It is also significant to note that extremely high levels of liquidity can cause such issues in the market as increased competition and potential for market manipulations. So it is crucial for traders to take into account not only such parameters as volatility and liquidity, but also pick out suitable trading strategies and be mindful about risk tolerances.

What is Liquidity as Opposed to Volatility in Forex?

Liquidity and volatility in FX are interconnected. Higher liquidity causes lower volatility, and vice versa, low liquidity accompanies high volatility. Investing in low liquid but highly volatile assets is considered less risky, although the profit from such investments can be also low. To gain more profit, it is better to look into highly liquid and less volatile assets. However, various trading and risk management strategies should be considered to prevent huge funds loss.

What Are the Top Forex Liquidity Providers?

Big banks and numerous other financial institutions take on the role of providers of liquidity in the market. Though the top list of LPs in Forex may vary from year to year, here some long-time leaders in this sphere:

- B2Broker is the top provider of liquidity services and technology. B2Broker plays both in crypto and Forex markets.

- FXCM Prime offers liquidity solutions for retail brokers, hedge funds, as well as for emerging market banks.

- Top FX has been providing solutions since 2010 and today offers unmatched liquidity services to many startups and established brokers in the e-FX & CFD industry.