High-Yield Checking Account: Maximize Your Money with High-Interest Returns

Oct 01, 2024

In today’s economic climate, every penny counts. For many, traditional checking accounts offer inadequate interest rates, essentially leaving your money stagnant. However, there’s a more innovative way to manage your everyday banking – introducing the high-yield checking account.

In this guide, we’ll explore the best high-yield checking accounts, how they work, and what you should consider when choosing one to optimize your savings.

Key Takeaways

- High-yield checking accounts offer better interest rates than traditional accounts, allowing you to earn money on your balance while still having easy access to your funds.

- Key factors to consider are interest rates, fees, ATM accessibility, and transaction requirements when choosing the best high-yield checking account for your needs.

- It’s important to consistently meet all account requirements, maintain the optimal balance, and use account features strategically to maximize the benefits.

What Is a High-Yield Checking Account?

A high-yield checking account, also known as a high-interest checking account, is a type of bank account that offers a higher interest rate compared to traditional checking accounts. These accounts allow you to earn more on your deposited funds while still maintaining the flexibility and accessibility of a regular checking account.

A high-yield checking account functions similarly to a traditional checking account, providing you with features like check writing, debit card access, bill pay, and online banking. The key difference lies in the interest rate. High-yield checking accounts offer significantly higher rates than standard accounts, often exceeding the savings accounts rates, allowing you to earn meaningful returns on your everyday deposits.

Many such accounts come with low or no monthly maintenance fees. You can access your money through ATMs, online banking, and mobile apps like standard checking accounts. Furthermore, many banks offer refunds on out-of-network ATM fees, which adds extra value to your account.

Benefits of High-Interest Checking Accounts

Choosing a high-interest checking account can be highly advantageous, especially if you keep a higher balance in your checking account. Here’s why these accounts are gaining popularity:

Earn More on Your Money

Even a slight increase in interest can make a significant difference over time. High-yield checking accounts can potentially earn you several times the interest compared to traditional accounts.

Maintain Easy Access

Unlike certificates of deposit (CDs) that lock away your money for a set period, high-interest checking accounts offer easy access to your funds. This allows you to readily use your money for everyday expenses while still earning interest.

Boost Your Financial Goals

The additional earnings from a high-yield checking account can contribute to achieving your financial goals, whether it’s saving for a down payment on a house, building an emergency fund, or simply growing your wealth over time.

Fast Fact

If you deposit $50,000 into a traditional savings account with a 0.46%, you’ll earn just $230 in total interest after one year. But if you deposit that amount into a high-yield savings account with a 5.32% APY, your one-year interest soars to over $2,660.

How High-Yield Checking Accounts Work

A high-yield checking account functions similarly to a traditional checking account but with the added benefit of earning interest on your balance. The interest is often compounded daily or monthly, making your money grow passively.

However, specific criteria must be met to maintain the advertised interest rates. While the exact features may vary between banks, most high-yield checking accounts operate on similar principles:

- Minimum Balance Requirements: Some banks require maintaining a specific balance to earn high interest.

- Account Requirements: To qualify for the highest rates, you may need to meet certain criteria, such as maintaining a minimum balance, making a specified number of debit card transactions, or setting up direct deposits.

- Electronic Statements: To avoid fees and enjoy higher rates, some accounts require that you opt into electronic statements rather than paper ones.

- Variable Rates: Interest rates on these accounts are typically variable, meaning they can change based on market conditions.

Choosing the Best High-Yield Checking Account

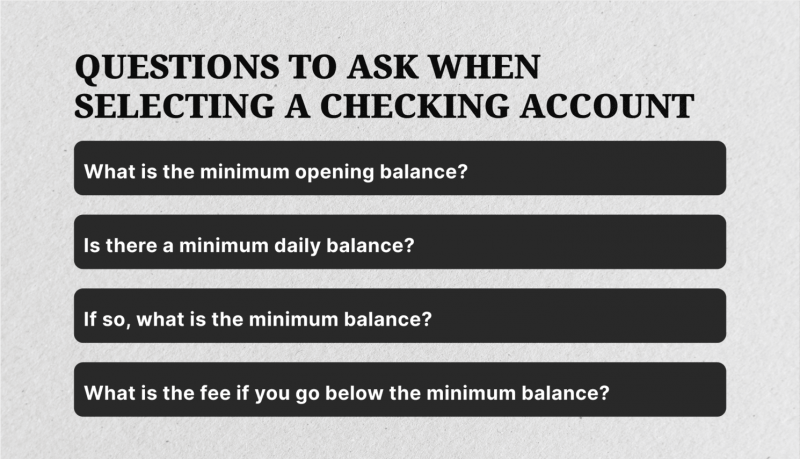

With a vast array of high-yield checking accounts, choosing the right one requires careful consideration of your banking habits and needs. Here are some key factors to evaluate:

Interest Rates

The primary reason for opening a high-yield checking account is to earn higher interest. Banks and credit unions offer varying rates, so it’s crucial to compare options. Look for the highest checking account interest rates that meet your needs, but remember, rates can change over time. Compare the Annual Percentage Yield (APY) offered by different banks, and keep in mind that the highest rate isn’t always the best option if it comes with stringent requirements or high fees.

Monthly Fees

While many high-yield checking accounts come with no fees, others may have monthly maintenance charges that could minimize your interest earnings. Some banks ignore fees if you meet specific criteria, such as maintaining a minimum balance or conducting a required number of monthly transactions. Also, consider other potential charges like ATM fees or overdraft fees.

ATM Accessibility

Look for accounts that provide access to a vast network of ATMs. Some banks offer free ATM withdrawals nationwide or reimburse out-of-network ATM fees, which can be a valuable perk if you frequently withdraw cash.

Balance Requirements

Some banks require a minimum balance to qualify for high interest rates. Be sure to review the terms and conditions and ensure that you can meet the balance requirements consistently.

Account Accessibility

Whether you prefer online, mobile, or in-person banking, ensure your chosen account fits your lifestyle. Many high-yield checking accounts offer robust digital tools, such as mobile apps and online platforms, for easy account management.

Transaction Requirements

To earn the highest yield, banks may require you to make a certain number of debit card transactions monthly or set up direct deposits. Check the specific requirements to make sure they align with your spending habits.

FDIC Insurance

Ensure the bank is FDIC-insured to protect your deposits up to $250,000.

Top 5 High-Yield Checking Accounts

Below, we outline some of the best high-yield checking accounts available based on interest rates, fees, and other perks.

1. Ally Bank

Ally Bank is a digital-only bank known for its high interest rates and excellent customer service. Its online-only model allows it to offer competitive rates and minimal fees, including no overdraft charges. Ally also provides convenient customer support options and a large ATM network.

However, it’s important to note that Ally doesn’t allow cash deposits, so you’ll need to use other methods, like online check deposit or direct deposit, to add funds to your account.

2. Charles Schwab Bank

Schwab Bank’s checking account is ideal for those who want to avoid ATM fees and monthly charges. While primarily known for its investment services, Schwab offers a competitive interest checking account with free ATM usage worldwide. However, it’s important to note that a minimum daily balance requirement applies, and Schwab doesn’t allow cash deposits. This might not be the best option if you frequently need to deposit cash.

3. PNC Bank

PNC Bank, a major regional bank with a long history, offers a wide range of personal banking services. It offers a tiered interest rate based on maintaining a minimum balance and completing qualifying activities. While it provides a full suite of digital banking tools, some of its products, like the high-yield Savings account and certain CDs, may not be available in all areas. Additionally, PNC’s overdraft fees are relatively high and come with a monthly service fee.

4. Axos Bank

Axos Bank is a digital-only bank that offers competitive interest rates on its checking and savings accounts, along with no monthly fees and a wide range of reward checking options. While its CD rates may not be as competitive as other online banks, Axos’s overall value proposition is strong, especially for those who prioritize convenience and low fees.

With its expansive ATM network and unlimited ATM fee reimbursements on many accounts, Axos is a great choice for digital-savvy customers seeking a feature-rich banking experience.

5. SoFi Bank N.A.

SoFi Bank N.A. is a digital-only bank that offers a combined checking and savings account with competitive interest rates and various perks. The account comes with no fees, including overdraft and maintenance charges, and provides a solid APY, a large ATM network, early direct deposit, overdraft protection, and cash back.

The SoFi app, available on both Google Play and the App Store, provides a user-friendly banking experience. While SoFi Bank N.A. is a great choice for those seeking a feature-rich, fee-free bank account, it’s important to note that it doesn’t offer other banking services like loans or credit cards.

Remember: This list is not exhaustive, and the best high-yield checking account for you will depend on your specific needs and priorities. Conduct thorough research and compare options before making a decision.

How to Open a High-Yield Checking Account

Opening a high-interest checking account is straightforward, but you must provide certain information and meet eligibility criteria. Here’s a quick guide to getting started:

- Use online tools and resources to compare the best high-yield checking accounts, considering factors like interest rates, fees, and accessibility.

- Check your eligibility, as some accounts may require membership in a specific bank, credit union, or geographic location.

- Most banks and credit unions offer online applications. You’ll need to provide personal details like your Social Security number and proof of identification.

- After approval, you must add a minimum opening deposit to the balance to activate your account.

- If the account requires a direct deposit to earn the highest interest rate, set this up immediately to start earning.

Potential Drawbacks

While these accounts offer many benefits, be aware of potential downsides:

- Complex Requirements: Some accounts may have complicated criteria that can be challenging to meet consistently.

- Balance Caps: You may not earn the highest rate on your entire balance if the account has a cap.

- Variable Rates: Interest rates can change, potentially reducing your earnings over time.

- Limited Availability: Some of the best high-yield checking accounts are offered by online banks or smaller institutions, which may have limited physical presence.

Are High-Yield Checking Accounts Worth It?

A high-yield checking account is absolutely worth considering if you want your money to grow while keeping it accessible. The interest rates on these accounts can significantly enhance your financial flexibility, making them a smart choice for those looking to maximize their income without sacrificing liquidity.

To get the most out of your high-interest checking account, you should consider the following points:

- Consistently fulfill all account criteria to ensure you earn the highest possible rate.

- Keep enough money in the account to earn a reasonable rate, but consider moving excess funds to higher-yielding options if there’s a balance cap.

- Many accounts offer higher rates or waive fees for customers who set up direct deposit.

- If your account requires a certain number of debit transactions, plan your spending accordingly.

- Regularly review your account to ensure you meet requirements and earn the expected interest.

If you meet these conditions comfortably, the rewards of a high-interest checking account are well worth it.

Conclusion

High-yield checking accounts empower you to make your money work harder for you. It can be an excellent tool for maximizing your money’s potential, offering savings and checking account benefits.

By carefully considering your options and choosing an account that aligns with your financial habits and goals, you can enjoy higher interest rates while maintaining easy access to your funds.

Remember to regularly review your account and stay informed about rate changes or requirements to ensure you always get the best return on your money.

FAQ

What is the truth about high-yield savings accounts?

High-yield savings accounts earn you more money than brick-and-mortar bank accounts do. But you often won’t earn enough to keep up with inflation.

Which bank pays the highest interest on checking accounts?

The best checking account interest rates are offered by: Credit Union of New Jersey (6.00% APY), Fitness Bank(6.00% APY), Orion Federal Credit Union(6.00% APY), Garden Savings Federal Credit Union (5.12% APY), Presidential Bank (4.62% APY), Consumers Credit Union (5.00% APY), Signature Federal Credit Union (4.00% APY).

Who has the highest interest checking accounts?

Pibank offers the highest yield checking accounts – 5.50% APY, Poppy Bank – 5.50% APY, and Western Alliance Bank – 5.31% APY.

What is an interest-bearing checking account?

Interest-bearing checking accounts work a lot like savings or money market accounts: You put money in the account, and the bank periodically pays interest on your balance according to its terms and conditions.

How work checking accounts with interest?

Rates are stated annually, but you typically accrue monthly interest on your balance. To calculate the interest you’ll earn, multiply your account balance by the interest rate. Then, adjust this amount for the applicable period.