How do Shopify and Shop Pay Generate Money?

July 5, 2024

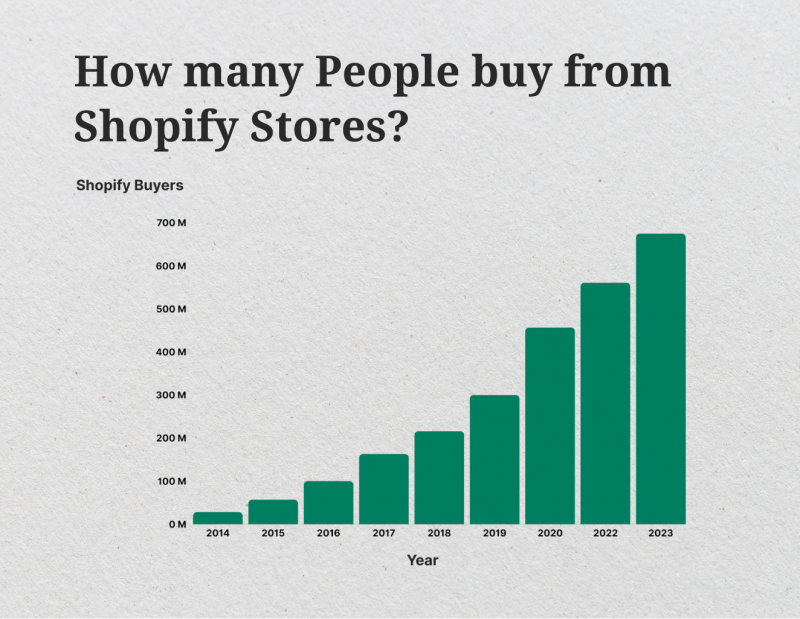

The rise of CMSs has simplified multiple technical aspects for organizations. Shopify is one of the major players in e-commerce, offering companies a solid platform to launch and expand their online presence. Shop Pay, a simplified checkout option that improves the shopping experience for customers and Shopify merchants, is at the center of Shopify’s system.

The article explores the several revenue sources that Shopify and Shop Pay provide. By examining their respective functionalities, we will offer an understanding of their roles in e-commerce.

Key Takeaways:

- Shopify supports e-commerce demands through partner programs, transaction fees, subscriptions, and POS services.

- Shop Pay increases revenue for merchants by streamlining checkout, lowering cart abandonment, and providing installment payments.

- Shopify’s use of cryptocurrency payments allows for safe, inexpensive transactions and increases its clientele worldwide.

Shopify’s Revenue Model

Shopify provides several subscription plans, including Basic Shopify, Advanced Shopify, Shopify Starter, and Shopify Plus, designed to meet various business requirements. Retailers can select the best choice because each plan has different features and prices.

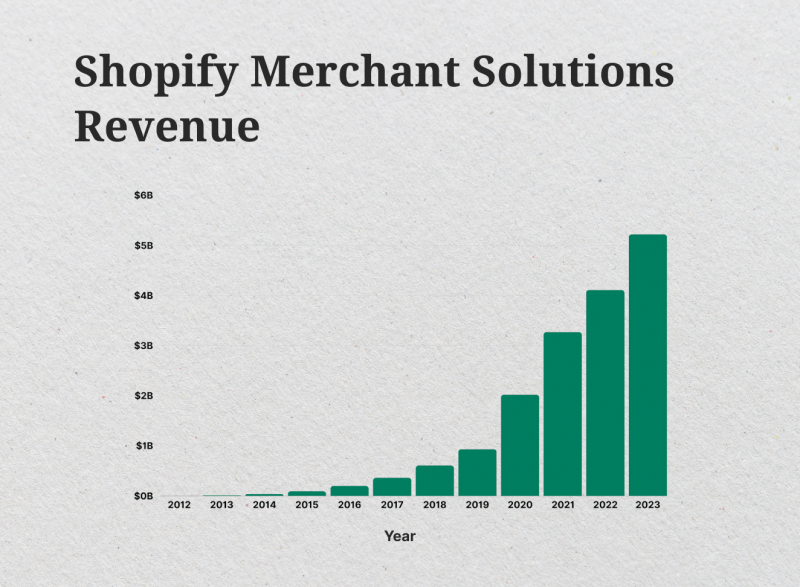

Shopify also receives income from transaction fees, primarily through its Shopify Payments system. Average transaction values and sales volume determine transaction fees for merchants using Shopify Payments volume. Shopify also charges extra for using third-party payment gateways.

The Shopify Partner Program offers an additional means of generating income. Through this system, developers can produce apps and themes for the Shop Apps Store, with Shopify and the developer splitting the profits. The Partner Program’s revenue model is derived from the sales of apps and themes.

What is Shop Pay?

Shopify created Shop Pay as a checkout solution to make purchases easier for customers and merchants. It provides several features that improve customer satisfaction and increase revenue.

Activating Shop Pay offers retailers one-tap checkout, making it easy and quick for customers to finish their transactions. It also provides trackable checkout buttons, customizable mobile app stores, and Shop Pay installments, enhancing the smooth purchasing experience.

Integrating Shop Pay with a Shopify store is simple. Store owners who want to personalize the checkout process to reflect their brand can enable Shop Pay in their store settings. Shop Pay helps retailers boost sales and profitability by lowering cart abandonment rates and promoting repeat purchases.

In case you were wondering how does Shop pay make money, transaction fees and interest on instalment payments are how it happens. Shop Pay charges merchants a modest fee for each transaction, and customers who choose installment payments plans may be charged interest.

Additionally, Shop Pay offers data and analytics services to retailers, enabling them to monitor consumer behavior and sales patterns. This information may be used to improve sales tactics and drive additional expansion.

Fast Fact:

Shopify launched an App Store and API platform in 2009 to allow developers to create and sell apps for Shopify stores.

Additional Revenue Streams for Shopify

Beyond its primary e-commerce services, Shopify has expanded its revenue sources to include POS services. These firms offer subscription fees for POS software and POS hardware sales to physical retail shops.

Shopify also makes money from selling apps and themes through the Shopify App Store and Theme Store. These adaptable choices are essential for retailers and a significant source of income for Shopify. Apps and popular themes bring in a lot of money for the platform.

Shopify’s POS systems are indispensable for physical retailers to merge their online and offline businesses smoothly. Devices like card readers and barcode scanners generate income from the selling of POS gear. POS software subscription fees provide a consistent source of income for Shopify.

Merchants can customize their online store with various options offered by the themes and applications available on the Shopify Theme Store and App Store. A Shopify store’s functionality and design can be improved with these themes and applications, drawing in more customers and increasing sales. The amount of money made from these sources varies greatly; some themes and apps bring in a sizable sum of money for their creators.

Emerging Trends In Cryptocurrencies

Shopify is expanding its client base and attracting tech-savvy consumers by offering a cryptocurrency payment gateway in response to the growing demand. Unlike existing methods, cryptocurrency payments provide a decentralized, secure, and frequently speedier transaction option.

Accepting crypto has several benefits for retailers. It broadens its reach by drawing in a worldwide audience—including those residing in areas with little access to traditional bank account services.

Another advantage of using cryptocurrencies is that they usually have lower transaction fees than credit card payments, which might boost business margins. Faster transactions also reduce the time retailers must wait for the cash to clear, and blockchain technology improves security by lowering the possibility of chargebacks and fraud.

Shopify has partnered with a payment provider to integrate alternatives. Popular cryptos are now available for merchants to accept. The procedure entails choosing a payment processor from the Shopify App Store, establishing digital wallets and payment settings to set up the gateway, and advertising the new payment option to clients.

These integrations present new revenue streams for Shopify. Like with conventional payment methods, transaction fees from cryptocurrency payments can generate a consistent source of income. Upgrading membership levels with more services or reduced transaction fees may entice retailers to do so. Shopify’s income from transaction and subscription fees can increase sales by providing additional payment choices.

Despite these advantages, issues still need to be resolved, like price volatility, regulatory worries, and the requirement that retailers comprehend and handle virtual currencies. Shopify must provide solid resources and assistance to merchants to enable them to manage these complications successfully.

Final Thoughts

Shopify and Shop Pay make money through subscriptions, transaction fees, partner programs, and other services like POS and themes. With tools for smooth transactions, effective shipping and billing information, and customizable online stores, this extensive environment helps e-commerce enterprises. Installment plans and interest-free financing further improve user experience and boost revenue.

Shopify’s revenue growth is promising as it keeps innovating and expanding its offerings, especially with crypto payment connections. A pioneer in the e-commerce space, Shopify embraces new trends and provides businesses with adaptable solutions that serve a wide range of clientele and promote long-term growth.

FAQs:

Who Uses Shop Pay?

It has been utilized quite a bit since its creation. From time to time, individuals can benefit from interest-free payments. Over a million users have a Shoppay account.

Is Shop Pay the same as Shopify?

Shopify provides an online checkout option called Shop Pay. Customers can store credit card, email, shipping, and billing details in Shop Pay, which can subsequently be used to automatically fill out checkout forms when they return to a website.

Who owns Shop App?

Many consumers are unaware that Shopify is the owner of the Shop app. They not only created it initially, but they are also working to improve their capabilities.