How to Start a Liquidity Provider Business?

June 11, 2025

It was not so long ago that establishing a liquidity provider firm entailed venturing into a financial citadel protected by solid capital barriers, specially-built infrastructure, and a labyrinth of regulation. The domain was accessible only to a select few — Tier-1 banks, non-bank market makers, and institutional investors. But 2025 tells a very different story.

Today, with the rise of fintech innovation and powerful turnkey solutions, the liquidity landscape is being reshaped into something far more accessible.

Ambitious entrepreneurs, regional brokers, and crypto-native firms are no longer on the outside looking in — they’re building full-scale, multi-asset liquidity operations in record time and at a fraction of the cost.

This article will help you understand the intricacies of starting a liquidity provider business by highlighting the steps you need to take and what the future holds for this space.

Key Takeaways

- With turnkey solutions, launching a liquidity provision business no longer requires massive capital or in-house tech teams.

- Success in 2025 means offering cross-asset liquidity—Forex, crypto, indices, and more—all under one roof.

- Navigating licensing and regulation is essential; the best liquidity provider models integrate legal support from day one.

Liquidity Providers Market in 2025 — A Real-World Overview

In 2025, the market for the liquidity provider business (LP) is in the process of a critical transition underpinned by novel technologies, changing regulations, and rising interest from both conventional as well as digital finance participants.

What was once a domain of Tier-1 banks and institutional desks is increasingly becoming available to a broader universe of market participants, including agile fintech players, crypto-centric platforms, as well as regional brokers and market makers upgrading their infrastructure.

The key driver behind this shift is accessibility. In the past, entering the LP arena meant building everything from the ground up — trading systems, risk engines, compliance frameworks — often with capital requirements running into the millions. Today, however, turnkey solutions are changing the game.

Providers like B2BROKER have lowered the barrier to entry, enabling smaller firms to launch institutional-grade liquidity operations without having to reinvent the wheel. This democratization is injecting fresh competition into the market, pushing incumbents to innovate and diversify their offerings.

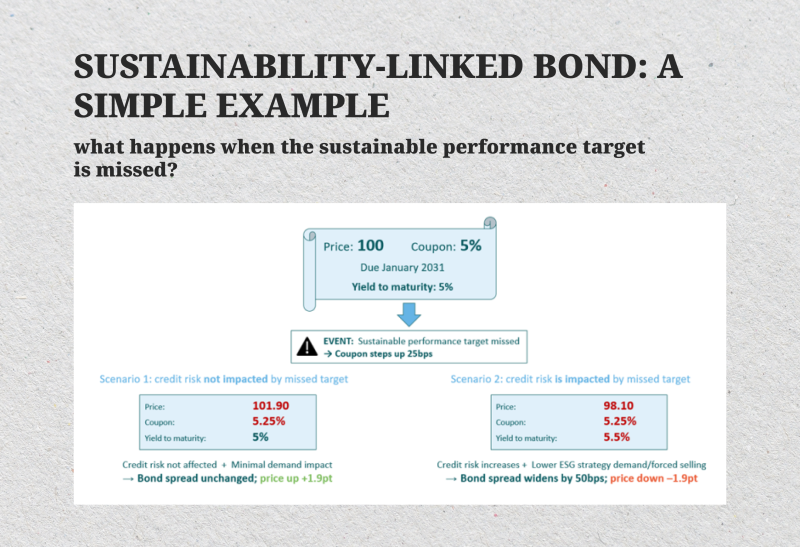

Meanwhile, the rise of multi-asset trading has forced liquidity provider business operators to expand beyond the traditional Forex industry and commodity pools. In 2025, demand for deep and reliable liquidity now spans a wide range of financial instruments, including crypto derivatives, tokenized assets, ESG-linked securities, and even synthetic indices.

As a result, modern LPs are evolving into cross-asset specialists, integrating with trading platforms and market data vendors to deliver ultra-low latency execution and consistent pricing.

Looking ahead, the LP space is poised to continue growing—but with a caveat. Only those firms that can blend smart technology, deep market knowledge, and a client-first mentality will stand out. In this environment, being a liquidity provider depends on reliability, flexibility, and trust rather than just merely offering better spreads.

Fast Fact

A liquidity provider using a unified margin account can manage over 1,500 trading instruments across 10+ asset classes from a single platform.

How to Become a Liquidity Provider?

Launching a liquidity provider business is no longer reserved for big banks or institutional giants. In today’s rapidly changing financial markets, technology and ready-made solutions have enabled companies and entrepreneurs to swiftly and accurately enter the market.

This chapter guides you through the essential steps to build a successful liquidity provider business—from selecting your niche and obtaining licenses to establishing the right technical infrastructure and securing institutional-grade liquidity.

Understand What a Liquidity Provider Really Is

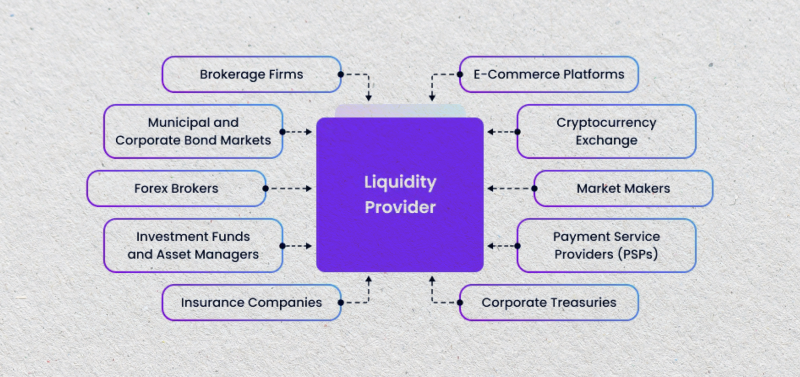

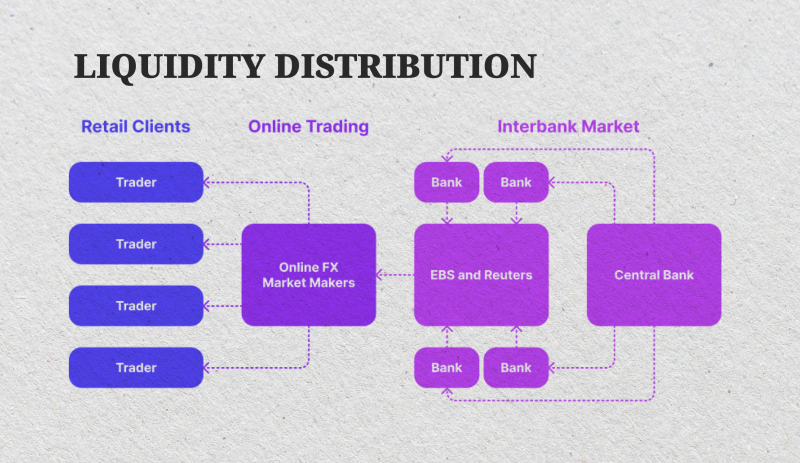

Before diving in, it’s essential to understand the role of a liquidity provider (LP). At its core, an LP ensures that trading runs smoothly by constantly offering buy and sell prices. The availability of pricing creates “market depth,” allowing traders to open or close positions with minimal delay and tight spreads, and boosts overall market stability.

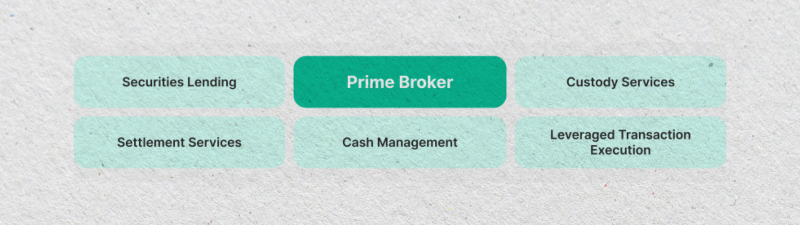

LPs generate revenue from spreads, commissions, and, in some cases, by taking proprietary positions. Depending on your approach, you might act as a market maker who sets prices, a liquidity aggregator who pulls quotes from multiple sources, or a Prime-of-Prime broker who extends institutional-grade liquidity to smaller firms that wouldn’t otherwise have access.

Choose Your Market Niche

One of the very first actual choices you will make is which particular asset class—or classes—you’d like to specialize in. The foreign exchange (Forex) market remains the most popular entry point due to its size and volume, although it’s also highly competitive. Crypto, meanwhile, is all about the potential for explosive growth but with regulatory gray areas that vary based on your location.

CFDs, commodities, indices, and equities are good options as well if you’re looking to diversify and serve multi-asset brokerages. More and more, providers of liquidity are choosing this route, becoming “one-stop shops” for a broad array of financial products.

Secure the Right Licensing in a Suitable Jurisdiction

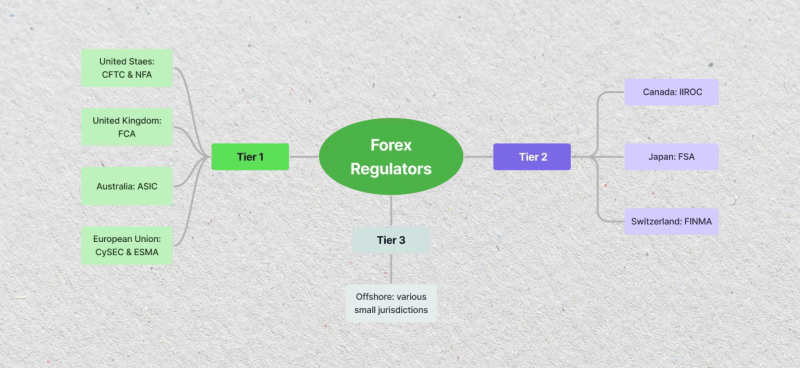

Providing liquidity is not a side hustle—it is a very regulated enterprise. You must determine a place that you would like to do business from, as well as the type of clients you want to have. From there, you can determine a jurisdiction that is both credible and affordable.

Tier-1 liquidity providers, such as those in the UK, are prestigious and have access to large markets, yet they incur high compliance expenses. Tier-2 jurisdictions, like Seychelles or Mauritius, are not as rigid or expensive, though they might curtail your capacity to partner with the highest institutions.

Build or Source the Right Technology Infrastructure

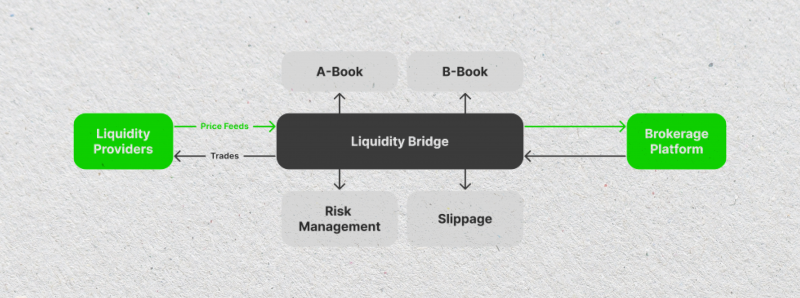

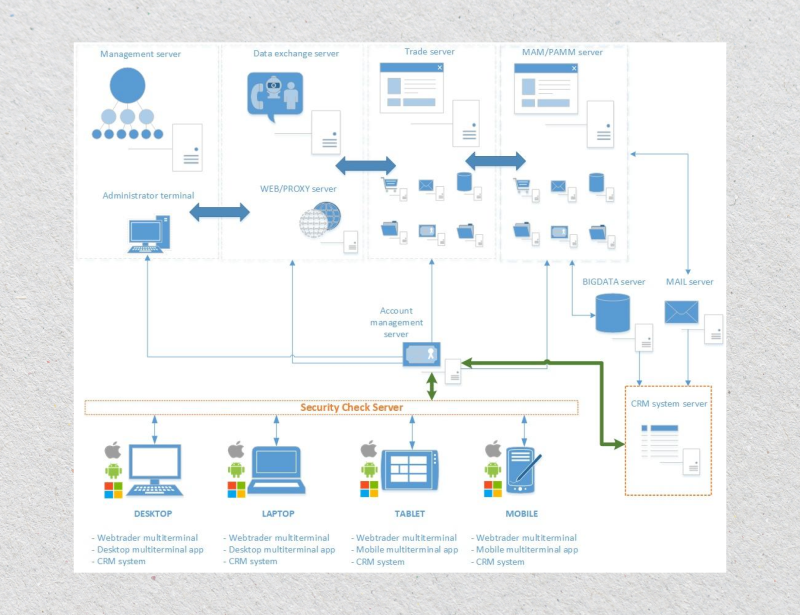

The quality of your technology is just as strong as that of your liquidity provider. You will need a solid system that brings you together with upstream sources of liquidity pools, fuels your pricing engine, and manages your real-time risk.

This encompasses trusted bridges or aggregation tools, Forex trading platform integrations such as MT4, MT5, or FIX API, as well as analytical dashboards that enable you to monitor your performance and ensure regulatory compliance.

It is possible to build this from the ground up, though it is expensive and labor-intensive. Instead, most new LPs utilize turnkey options, such as B2BROKER’s Turnkey Liquidity Provider, which bundles everything needed, including compliance support and 24/7 technical assistance, all in a pre-configurable package.

Secure Reliable Liquidity Solutions

Before you can offer liquidity to others, you need to access it yourself. This typically involves forming relationships with Tier-1 banks, prime brokers, institutional limited partners (LPs), or, in the case of cryptocurrency, reputable exchanges.

You’ll likely combine several sources to offer deep liquidity and competitive pricing. Innovative routing tools, such as PrimeXM or oneZero, can help you manage this flow efficiently, minimizing slippage and latency while ensuring price stability across volatile markets.

Plan Your Capital Strategy and Risk Model

Starting a liquidity provider business isn’t cheap. Depending on the financial assets and currency pairs you support and the scale you aim for, initial capital requirements can range from $100,000 to several million.

You’ll also need to define your leverage offering—many LPs operate at a 1:100 or higher leverage—and create a risk management model that protects your exposure during times of market stress.

It’s crucial to monitor your client types, trading volumes, and margin usage in real time. Failing to manage risk effectively is the fastest way for a liquidity provider business to go under.

Streamline Your Client Onboarding Process

Your future clients may be Forex brokers, hedge funds, prop trading firms, or even exchanges. Regardless, they’ll expect a professional and efficient onboarding experience. This involves everything from proper know-your-customer (KYC) and know-your-business (KYB) checks and regulatory alignment to integration with their trading platforms and backend systems.

Having a reliable CRM system can make this process smoother by tracking client interactions, automating documentation, and streamlining communication.

Deliver Exceptional Support and Customization

Once you’re up and running, support becomes your most important product. Your clients will require technical assistance, customized liquidity settings, and clear reporting—often in real time. The best LPs offer 24/7 support, prime brokerage services, dedicated asset managers, and ongoing feedback to drive improvement.

Small touches, such as configurable spreads, custom instrument lists, or latency optimization, can go a long way in building loyalty and growing your client base through word of mouth.

Promote Your Liquidity Offering Effectively

This business is built on trust. While you don’t need to shout from the rooftops, you do need to establish credibility. Use SEO, content marketing, and platforms like LinkedIn to share your insights and attract attention. Attend expos, speak at conferences, and nurture broker relationships.

The most successful LPs are recognized not only for their spreads but also for being stable, transparent, and responsive. Make that your message.

Continue Evolving and Expanding

Your first year might be about getting off the ground—but year two should be about scaling. Add asset classes, refine your tech stack, and explore innovative tools, such as AI, for flow analysis and detecting toxic orders. You might even offer your own white-label liquidity product to smaller firms, expanding your revenue streams.

The liquidity space is evolving fast. If you continually refine your operations, adapt to trends, and listen to your clients, you’ll not only stay relevant—you’ll lead.

The Future of Liquidity Services: A New Era for Financial Institutions

The liquidity provision industry is entering a transformative era—one that redefines how financial institutions operate, innovate, and compete. As traditional boundaries between asset classes blur and technology reshapes the way markets function, different liquidity providers find themselves at the intersection of a new financial ecosystem.

Over the past decade, running a liquidity provider business meant maintaining access to deep markets and delivering a tight bid-ask spread. That hasn’t changed—but what has is the expectation to do so across multiple asset classes, under evolving regulations, and with real-time adaptability.

In today’s world, retail brokers, prop firms, and even exchanges are no longer just clients—they’re increasingly becoming one of the top liquidity providers, thanks to more accessible infrastructure and streamlined regulatory pathways.

The rise of turnkey LP solutions is a game-changer. Platforms like B2BROKER’s institutional-grade liquidity framework are enabling newcomers to launch fully operational Prime-of-Prime liquidity businesses without spending years on development.

This is dramatically lowering the entry barrier, encouraging a wave of agile firms to join the space with fresh ideas and niche offerings.

Technology is no longer just a support system—it’s the lifeblood of the LP business. From ultra-low latency pricing engines to dynamic margin management and AI-powered risk analysis, innovation is now the key differentiator. Firms that embrace automation and smarter data systems are not only surviving—they’re thriving.

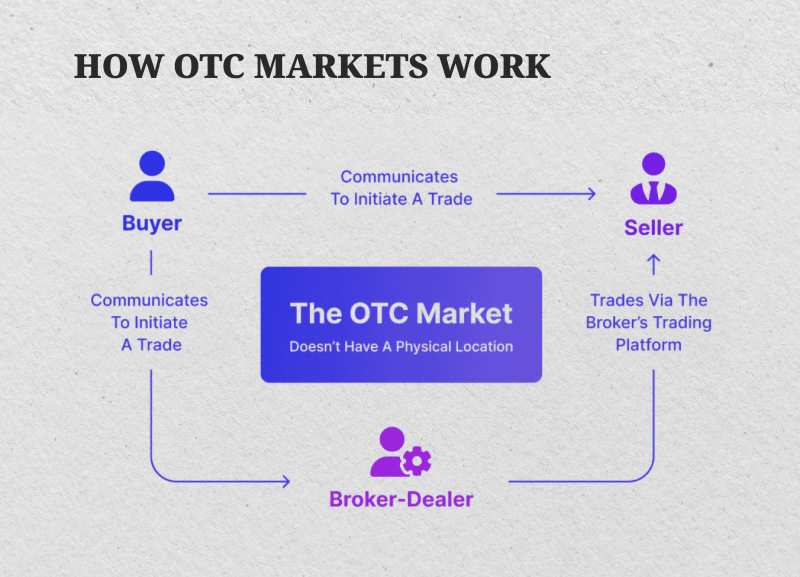

Regulation is also reshaping the landscape. With tighter oversight in OTC and crypto markets, global liquidity providers must now operate with full transparency, detailed reporting, and compliant risk controls. This shift is driving a more mature and trustworthy market where clients demand not only performance but also accountability.

Looking ahead, offering and maintaining market liquidity is set to become more interconnected, data-driven, and client-centric. Large financial institutions that adapt quickly, offer real customization, and deliver institutional-quality services at scale will lead the way. Those stuck in legacy systems or unwilling to evolve may struggle to remain relevant.

Final Remarks

The world of liquidity provision is rapidly evolving—and so are the opportunities. With the rise of liquidity provider turnkey services like B2BROKER, the barriers to entry are disappearing. Whether you’re looking to build a Forex liquidity provider business or a fully diversified multi-asset firm, now is the time to act.

By combining modern technology, solid regulation, and a clear client-centric approach, you can position your business not just to participate—but to lead—in the future of institutional trading. Becoming the best liquidity provider in your niche starts with the right tools, mindset, and strategy.

FAQ

What does it take to become a liquidity provider?

You need licensing, capital, infrastructure, and direct market access to deep liquidity—often best achieved through a turnkey solution.

What is a liquidity provider turnkey solution?

It’s an all-in-one service that includes trading tech, compliance support, and access to institutional-grade liquidity—ready to launch.

How much capital is required to start a Forex liquidity provider business?

Startup costs can range from $100,000 to several million dollars, depending on the scale, asset coverage, and licensing requirements.

Can I become both a Forex and crypto liquidity provider?

Yes. Many modern LPs offer multi-asset coverage through aggregated liquidity and unified margin accounts, providing investors with a more comprehensive approach to managing their investments.

What makes a liquidity provider business the best in 2025?

Speed, reliability, customization, transparency, and seamless client support across asset classes.