Irrevocable Trusts: What is it, and How Does it Work?

Sep 30, 2024

Suppose you are an individual who loves rules and plans everything beforehand. In that case, you definitely know you must consider trusts, an essential tool in estate planning, protection, and control over asset distribution.

One type that stands out for its permanence and unique advantages is irrevocable trust. This legal arrangement differs significantly from other trusts, particularly in its unchangeable nature and potential benefits for tax planning, asset protection, and long-term care.

If you’ve been wondering, “What is an irrevocable trust?” or need a detailed comparison of revocable vs irrevocable trusts, this guide will cover everything you need to know.

Key Takeaways

- Irrevocable trusts are a valuable estate planning tool, but unlike revocable trusts, they cannot be altered once they are set up.

- These trusts remove assets from your taxable estate, potentially providing substantial tax savings for your heirs.

- They also offer asset protection from creditors and ensure your wealth is distributed to beneficiaries according to your specific instructions.

What is an Irrevocable Trust?

An irrevocable trust is a legal arrangement that, once established, cannot be easily modified or dissolved. When assets are placed in an irrevocable trust, the grantor (the creator of the trust) relinquishes ownership and control over them. This lack of control is a key feature that makes irrevocable trusts valuable for estate planning and asset protection.

The trust becomes the assets’ legal owner, and a designated trustee manages them according to the terms outlined in the trust document. Beneficiaries, the individuals who will eventually receive the assets, do not have immediate control but are designated to benefit from the trust in the future.

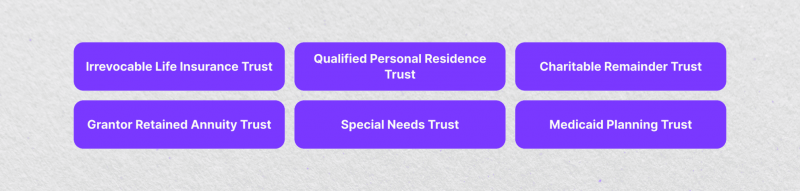

Types of Irrevocable Trusts

Several types of irrevocable trusts are designed to serve specific purposes. Some common types include:

Irrevocable Life Insurance Trust (ILIT)

This trust is specifically designed to hold life insurance policies. Transferring a life insurance policy ownership into an ILIT removes the proceeds from the grantor’s estate, thereby avoiding estate taxes.

Qualified Personal Residence Trust (QPRT)

This allows you to transfer assets – a primary residence or vacation home – to a trust while retaining the right to live there for a set period. This removes the property’s value from your taxable estate at your death.

Charitable Remainder Trust (CRT)

A CRT allows the grantor to donate assets to charity while still receiving income from those assets for a specified period. Once the period expires, the remaining assets go to the designated charity.

Grantor Retained Annuity Trust (GRAT)

This type allows you to receive a fixed annuity stream from the trust for a set period. The remaining assets then pass to beneficiaries with potentially reduced federal estate taxes.

Special Needs Trust

Designed for beneficiaries with disabilities, this type of trust ensures that the individual receives financial support without risking their eligibility for government benefits such as Social Security or Medicaid.

Medicaid Planning Trust

This type may be used to qualify for Medicaid long-term care benefits while preserving beneficiaries’ assets. However, specific rules and eligibility requirements vary by state.

Fast Fact

A Cook Islands Trust is an asset protection trust set up under the laws of the Cook Islands, widely considered the most secure trust jurisdiction on the planet. Cook Islands Trusts were established in 1984 with the passage of the Cook Islands International Trusts Act.

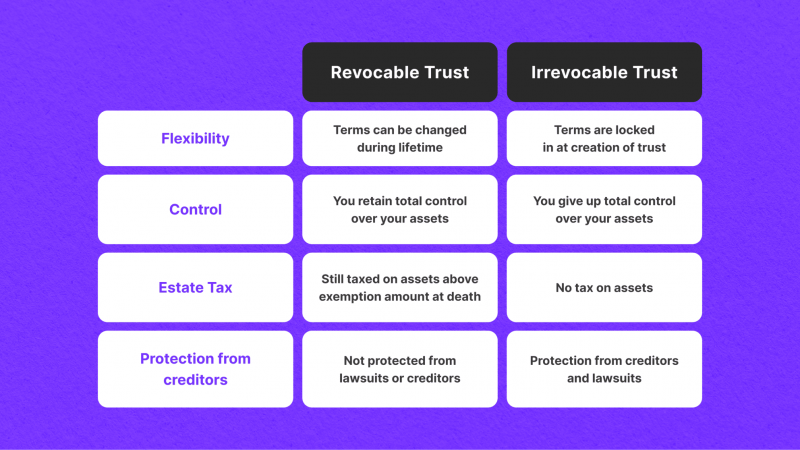

Irrevocable Trust vs Revocable Trust

One of the most common estate planning questions is, “What is the difference between revocable and irrevocable trusts?” At first glance, these two types of trusts may seem similar, but they have some major differences that are important to understand. Let’s examine this in-depth.

Revocable Trust

A revocable trust allows the grantor to modify, amend, or even dissolve the trust during their lifetime. This flexibility gives the grantor more control, but it also means the trust’s assets are not shielded from creditors or included in tax planning strategies. Since the grantor retains control, the assets are still considered part of their estate and subject to income taxes upon death.

Irrevocable Trust

In contrast, an irrevocable trust locks in the terms of the trust and transfers asset ownership to the trust itself. The grantor no longer controls these assets, which can offer significant tax advantages and protection from creditors. These features make the irrevocable trust an essential tool for individuals looking to minimize estate taxes, safeguard assets, and manage their wealth across generations.

Why Would Someone Want an Irrevocable Trust?

Choosing an irrevocable trust can have several advantages, particularly for those concerned about taxes, creditor protection, and long-term estate planning. Here are some reasons why someone might opt for an irrevocable trust:

Tax Benefits

This is often the primary motivation. An irrevocable trust can remove assets from your taxable estate, which can significantly minimize taxes that need to be paid upon your death. By transferring assets to the trust, the grantor also avoids gift taxes on those assets, as they are no longer considered part of their estate. This mainly benefits individuals with large estates exceeding the current federal estate tax exemption.

Asset Protection

Assets placed within an irrevocable trust are protected from creditors. Since the grantor no longer legally owns the assets, they cannot be claimed in lawsuits or to pay off debts.

Manage Inherited Assets for Beneficiaries

An irrevocable trust allows the grantor to establish specific terms regarding how and when the beneficiaries receive the trust assets. You can establish specific age triggers and disbursement schedules or even limit access based on certain conditions (e.g., completing education or demonstrating responsible financial management). This can help ensure that wealth is managed responsibly and transferred according to the grantor’s wishes rather than subject to disputes or mismanagement.

Qualify for Means-Tested Benefits

For beneficiaries receiving government assistance programs with asset limits (e.g., Medicaid), assets held in an irrevocable trust generally don’t count toward the beneficiary’s eligibility.

Irrevocable trusts may be suitable for individuals who:

- Have a high net worth and are concerned about estate taxes.

- Want to protect assets from creditors or potential lawsuits.

- Need to qualify for Medicaid long-term care benefits while preserving assets.

- Desire to provide for beneficiaries with special needs or financial challenges.

- Have specific goals for how their assets will be distributed after their death.

Considerations Before Establishing an Irrevocable Trust

While irrevocable trusts offer significant benefits, it’s essential to carefully consider the following:

Irreversibility

Once established, you cannot change the terms of the trust. This means it’s crucial to clearly understand your goals and potential future needs before making this decision.

Tax Implications

Consult with a tax advisor to understand the potential tax consequences of creating an irrevocable trust. This can help you determine if the benefits outweigh the possible costs.

Complexity

Irrevocable trusts can be more complex than revocable trusts. Working with a qualified estate planning attorney is essential to ensure the trust is properly structured and meets your specific needs.

Conclusion

Irrevocable trusts are powerful estate planning tools that offer significant tax, legal, and financial benefits. However, they require careful consideration due to their permanent nature and associated costs. Consulting with an experienced estate planning attorney or financial advisor is crucial to determining whether an irrevocable trust aligns with your long-term financial goals.

FAQ

How does an irrevocable trust in California?

Irrevocable trusts are permanent and cannot be changed, except in California, where all beneficiaries and the trustee can agree to dissolve it.

Who owns the property in an irrevocable trust?

An irrevocable trust permanently transfers ownership of assets to the trust itself. The grantor no longer has control, and the trustee manages the trust.

What is an irrevocable living trust?

It is a trust that cannot be revoked and takes effect during the grantor’s life.