NASDAQ vs NYSE: How Do They Differ?

Nov 06, 2024

From a number of exchanges out there, there are the two main stock exchanges that support the U.S. stock market and are essential venues – NASDAQ and NYSE.

In this article, you will read the main distinctions between NASDAQ vs NYSE, along with their rules for company listings and the kinds of businesses that trade on each exchange.

Key Takeaways:

- The two leading stock exchanges, NASDAQ and NYSE, have unique traits and appeal to investors.

- The NYSE prioritizes well-established, large-cap corporations, while the NASDAQ emphasizes technology and growth-oriented businesses.

- Both of them have particular listing standards; the NASDAQ favors innovation and development potential more, while the NYSE prioritizes stability and financial performance.

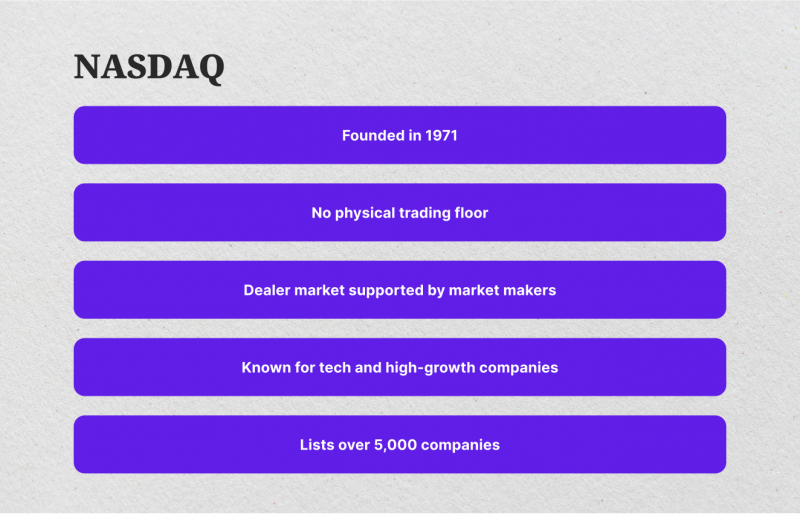

What is NASDAQ?

The world’s first fully electronic stock exchange, NASDAQ (National Association of Securities Dealers Automated Quotations), was founded in 1971. Unlike traditional exchanges, NASDAQ does not have a physical trading floor. Instead, it connects buyers and sellers through an automated system, enabling fast and efficient transactions.

Since NASDAQ is a dealer market, deals are facilitated by market makers rather than by buyers and sellers who do business directly. By providing buy and sell prices for certain stocks, purchasing stocks at the bid price, and selling at the asking price, market makers—usually big financial institutions—play a crucial role on the NASDAQ exchange. This mechanism’s liquidity allows buyers and sellers to execute trades efficiently and at competitive prices.

The NASDAQ exchange is frequently linked to businesses in the technology and high-growth sectors. Known for housing some of the industry’s most creative and quickly expanding firms, the NASDAQ is home to several well-known IT companies. To be more precise, over 5,000 companies are listed and traded on the exchange daily.

The NASDAQ Global Select Market, which focuses on bigger businesses with higher market capitalization and more stringent financial requirements, offers different degrees of listing standards than the NASDAQ Global Market.

NASDAQ has become a primary venue for investors seeking exposure to growth-oriented companies, with a strong focus on tech stocks and innovation.

How Does it Work?

As we mentioned, a computer system matches buyers and sellers in the NASDAQ’s electronic marketplace. This automatization guarantees efficient and transparent trading. Let’s now discuss Important elements of the NASDAQ’s trading system:

- Market makers are financial organizations that quote the ask and bid prices for securities to supply liquidity to the market. They ensure smooth trading by purchasing and disposing of securities at specified rates.

- Electronic order books are documents that contain securities purchase and sale orders. The system matches buy and sell orders according to time priority and price.

- Computer systems known as trading algorithms carry out deals automatically, frequently using intricate techniques and real-time market data.

The IPO Process on NASDAQ

The process by which a private company goes public by first making its shares available to the general public is known as an initial public offering or IPO. The NASDAQ is essential to the process of IPO facilitation. This is a simplified synopsis of the procedure:

- Underwriter Selection: The business chooses an investment bank to handle the offering process and market the stock to investors as the underwriter for the IPO.

- SEC Filing: The business provides the Securities and Exchange Commission (SEC) with a registration statement with comprehensive details about its operations, financials, and management group.

- Roadshow: To determine investor interest, the underwriter hosts a roadshow where company officials give presentations to possible investors.

- Pricing the IPO: The underwriter establishes the offer price for the shares by considering the company’s valuation and market demand.

- IPO Launch: A public offering is used to sell shares to investors when the IPO is launched.

- Trading Starts: The company’s shares start trading on the NASDAQ following the completion of the IPO.

The Role of NASDAQ in the Global Economy

The NASDAQ is vital to the global economy because it offers a venue for capital development and innovation. It now represents innovation in technology and a spirit of entrepreneurship. The NASDAQ promotes economic expansion and employment creation by enabling the listing and trading of creative businesses.

The NASDAQ continues to lead technical innovation in the financial sector as the world changes, influencing how trading and investing will develop.

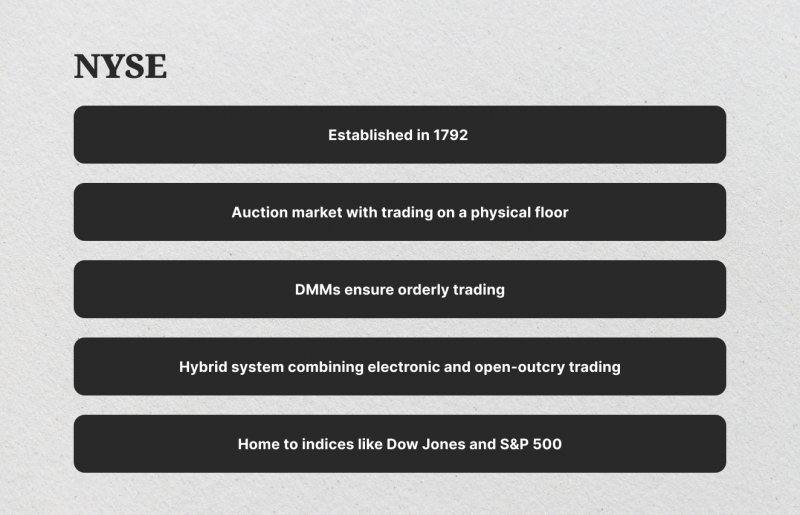

What is the NYSE?

The New York Stock Exchange (NYSE) was founded in 1792 with the signing of the Buttonwood Agreement by 24 Wall Street traders. As the largest stock exchange globally by market capitalization, the NYSE operates through an auction market mechanism, with most trading taking place on its physical trading floor.

Designated Market Makers (DMMs) connect buyers and sellers by managing bids and offers, ensuring orderly trading, controlling auction pricing, and providing liquidity for listed stocks.

The NYSE also uses a hybrid trading approach for large-scale transactions that combines electronic trading platforms with a conventional open outcry method. This configuration enables automated order processing and direct human involvement when DMMs maintain a stable market and reduce volatility, particularly at the opening and closing of auctions.

Many of the biggest names in various industries are listed on the NYSE, which is well-known for its stability and affiliation with blue-chip businesses. Its equities, which comprise indices like the Dow Jones Industrial Average and the S&P 500, draw in investment firms and market players looking for steady growth and dividend payments.

A vital portion of the U.S. capital market, the NYSE, is situated on Wall Street, where brokers, brokerage firms, and other players engage in extensive trading.

How Does It Operate?

To trade securities at the best price, buyers and sellers compete on the NYSE, which largely functions as an auction market. The NYSE uses a system of DMMs to provide liquidity, in contrast to a dealer market where market makers do so.

- DMMs are specialist companies that are given particular stocks to trade. They are in charge of upholding a fair and orderly market by quoting bids, asking prices, and purchasing or disposing of shares to control price swings.

- DMMs and floor brokers work together to execute trades on the NYSE’s famous trading floor. This conventional approach to open outcry trading gives the market a human touch while facilitating speedy bargaining and decision-making.

- The NYSE has recently added computerized trading platforms to supplement traditional floor-based trading. These platforms give access to a larger pool of investors and enable quicker order execution.

The IPO Process on the NYSE

Companies must conform to strict financial, operational, and governance standards to list on the NYSE. The following steps are commonly included in the NYSE IPO process:

- The business chooses an investment bank to handle the offering process and market the stock to investors as the initial public offering underwriter.

- The business provides the SEC with a registration statement with comprehensive details about its operations, financials, and management group.

- To determine investor interest, the underwriter hosts a roadshow where company officials give presentations to possible investors.

- The underwriter establishes the offer price for the shares by considering the company’s valuation and market demand.

- A public offering is used to sell shares to investors when the IPO is launched.

- The company’s shares start trading on the NYSE following the completion of the IPO.

The NYSE’s Role in the Global Economy

The NYSE is vital to the world economy because it offers a venue for investment and capital formation. It acts as a benchmark for international stock markets and a gauge of the US economy. Some of the most well-known businesses in the world are listed on the NYSE, drawing in investors from all over the world.

Investors can learn more about the variables influencing market movements, how trades are completed, and how stock values are set by comprehending the NYSE’s workings. Investors can use this information to understand the intricacies of the stock market and make well-informed investing decisions.

Fast Fact:

The world’s first stock exchange was created in Amsterdam when the Dutch East India Company became the first publicly traded corporation. To raise capital, the company decided to sell shares and pay dividends to investors. This led to the establishment of the Amsterdam Stock Exchange in 1611.

Listing Requirements on NYSE

The NYSE has a rigorous set of listing standards to ensure the quality and integrity of its listed companies. These standards are designed to protect investors and maintain the exchange’s reputation as a premier global marketplace.

Companies must fulfill a number of requirements to be listed on the NYSE, including:

- Depending on the particular listing requirement, the company must have a minimum market capitalization. It is generally in the range of $15 million to $200 million. This guarantees the company’s financial stability and substantial market presence.

- Investors must own a specific proportion of the company’s shares in the open market. This criterion aids in guaranteeing stock liquidity and active trading.

- The business must meet certain financial performance parameters, including cash flow, revenue growth, and profitability. These standards aid in evaluating the company’s financial standing and prospects for the future.

- The business must follow strong corporate governance principles, such as having an independent board of directors, consistent financial reporting, and efficient internal controls.

- Businesses are required to pay the NYSE one-time and recurring listing costs. These fees cover the expenses of listing services, including investor communications, regulatory compliance, and surveillance.

Each listing standard that the NYSE offers has unique criteria. These guidelines are made to work with businesses of various sizes and sectors:

- The NYSE American standard is intended for smaller businesses that might not be able to satisfy the demands of the NYSE’s primary market.

- For big, well-established businesses, the NYSE Main Market is the Priority.

Listing Requirements on NASDAQ

The NASDAQ Stock Market, on the other hand, has more accommodating listing standards and typically lower expenses. High-growth and developing businesses find this strategy appealing, especially those in the technology industry.

By emphasizing growth-oriented listings, NASDAQ has developed into a vital marketplace for forward-thinking businesses, attracting well-known brands from technology, healthcare, and other rapidly growing industries.

In contrast to the NYSE, the NASDAQ has less demanding listing standards. Because of this, it is a desirable choice for startups and high-growth businesses, especially those in the technology industry.

Although particular requirements may change over time, the following are typical NASDAQ listing requirements:

- Smaller businesses can enter the NASDAQ because of its lower market capitalization thresholds than the NYSE.

- To guarantee liquidity and active trading, the general public must hold a specific proportion of the company’s shares.

- Although these standards are typically less demanding than those of the NYSE, companies are nonetheless required to fulfill certain financial performance indicators, such as revenue growth and profitability.

- Although they might not be as strict as those of the NYSE, NASDAQ enforces corporate governance rules to guarantee accountability and openness.

- In general, the NASDAQ has lower listing fees than the NYSE.

By reducing entry hurdles, NASDAQ has developed into a magnet for creative businesses, especially in the technology industry. The NASDAQ is home to numerous well-known tech giants, including Apple, Microsoft, and Google.

These listing policies shape the firm profile and industry repute of each exchange. While NASDAQ’s support for growth-oriented listings strengthens its reputation as an electronic exchange catered to cutting-edge, tech-driven enterprises, the NYSE’s emphasis on stable corporations cultivates a sense of security and tradition.

Fast Fact:

The NYSE, valued at $28.42 trillion in 2024, leads in market capitalization, attracting stability-seeking investors and large-cap companies. NASDAQ, at $25.43 trillion, focuses on high-growth, tech-driven sectors, offering dynamic trading but higher volatility.

NASDAQ vs NYSE: Key Differences

Let’s now point out some of the main distinctions between the New York Stock Exchange vs NASDAQ.

- Market Type: Direct trading between buyers and sellers occurs on the NYSE floor, which functions as an auction market. On the other hand, the NASDAQ is a dealer market that facilitates trades using electronic networks.

- Trading Mechanism: The NASDAQ is a fully electronic exchange with automated processes, whereas the NYSE is a trading floor that blends electronic and physical trading.

- Listing Requirements: The NYSE has strict listing requirements that prioritize well-established businesses. Because of its more lenient regulations, NASDAQ attracts high-growth, up-and-coming businesses, especially in technology.

- Sector Focus: Large-cap, blue-chip businesses from various industries are listed on the NYSE. Most NASDAQ’s listings are tech-related and frequently include creative, growth-oriented businesses.

- Market Capitalization and Trading Volume: With some of the largest companies based there, the NYSE has the largest market capitalization in the world. The NASDAQ’s tech stocks and vibrant investor base are major contributors to its high trading volumes.

- Volatility: NASDAQ equities, frequently found in the technology industry, exhibit greater volatility. Regarding blue-chip stocks, the NYSE takes a more stability-focused approach.

- Market Makers: To maintain liquidity and reasonable pricing, NASDAQ depends on many market makers. On the floor of the NYSE, designated market makers contribute to stability and order.

- Investor Appeal: The NYSE draws in long-term investors because of its consistent listings. Growth-oriented investors who seek newer companies with the potential for large profits are drawn to the NASDAQ.

Which Option is Better: Listing on NASDAQ vs NYSE

A number of variables, such as the industry, investor base, and growth stage of the company, influence the choice of where to list or invest. Let’s examine NASDAQ or NYSE for companies:

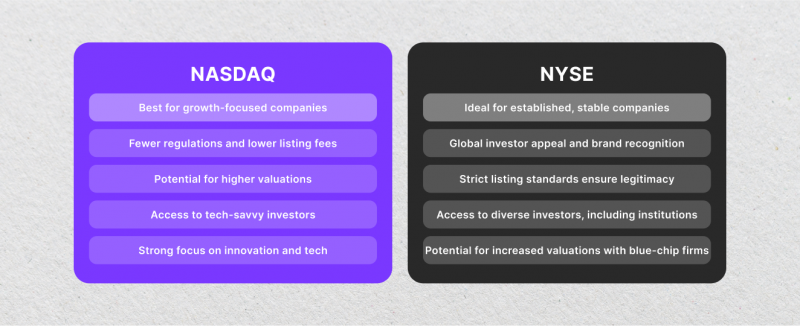

Listing on NASDAQ

Ideal for: Businesses focused on expansion, particularly those in the biotechnology, technology, and other cutting-edge industries.

Advantages:

- Less demanding regulations and less listing fees.

- Strong emphasis on innovation and technology.

- Possibility of increased valuations, especially for businesses with rapid expansion.

- Access to an investment base that is tech-savvy.

Listing on NYSE

Perfect for: Well-established, sizable businesses looking for stability, prestige, and sustained investor trust.

Advantages:

- Global investor appeal and high brand familiarity.

- Strict listing requirements that guarantee legitimacy and confidence.

- Access to a wide range of investors, such as pension funds and institutional investors.

- Possibility of increased valuations due to affiliation with well-known, blue-chip businesses.

So, to wrap up:

NYSE It is perfect for Investors looking for long-term growth, dividend income, and stability. Investing in the NYSE has several advantages, as it has less volatility than the NASDAQ. Has a particular focus on well-known businesses that pay dividends and offer the possibility of consistent, long-term profits.

NASDAQ is perfect for Investors seeking exposure to cutting-edge businesses and significant growth prospects. Its advantages include more potential for capital growth and access to innovative breakthroughs and technologies. If you decide to invest, you might have a chance to participate in the expansion of developing industries. Also, NASDAQ has increased volatility, which may result in notable profits or losses.

Conclusion

The NASDAQ and NYSE each have unique features that serve particular business categories and investment objectives. While the NYSE, with its well-established reputation and strict standards, is a good choice for companies looking for stability and long-term growth, the NASDAQ emphasizes innovation and growth, making it appropriate for tech-driven and developing businesses.

When selecting between exchanges, brokers, traders, and businesses should consider investor preferences, market visibility, and listing criteria. Future trajectories for both markets may be shaped by changes in listed sectors and trading volumes brought about by technological advancements and shifting investor priorities.

FAQs:

1. What are the similarities between NYSE and NASDAQ?

They both provide trading platforms and simplify businesses’ access to public markets. Although these rules differ, each has strict criteria for listing.

2. How do businesses decide between NASDAQ vs NYSE?

Businesses usually choose an exchange based on industry emphasis, investor reach, and listing requirements. While NASDAQ draws tech-driven and growth-focused companies, NYSE is better suited for companies looking for conventional status.

3. What impact does each exchange have on investment and trading strategies?

While NASDAQ’s growth-focused atmosphere frequently attracts investors seeking significant growth potential and sector diversity, NYSE’s emphasis on established enterprises is better suited for long-term and conservative tactics.