Options Trading Strategies Every Investor Should Know

Mar 19, 2024

Financial contracts, known as options, allow people to decide in advance whether to purchase or sell an asset at a certain price before a specified date. Investors may use these decisions to correctly anticipate the performance of the overall market or particular equities.

Options traders use the underlying asset’s market position in various ways to achieve certain monetary goals. The strategies are designed to cater to traders with different levels of expertise and risk tolerance. They try to minimise investment risk, maximise gains from existing market positions, or capitalise on predicted market volatility.

We will examine some of the most popular options trading strategies and highlight their benefits and drawbacks.

Key Takeaways:

- Options trading strategies provide means to create revenue, manage risks, or speculate on shifts in the market by using contracts to buy or sell assets at a determined price.

- Covered calls and cash-secured puts are examples of fundamental income-generation strategies. More advanced approaches, including Iron Condors and Iron Butterflies, are appropriate for markets with minimal volatility or stability.

- Before beginning to trade, getting to know the benefits and drawbacks of options trading is essential. Success requires both ongoing education and a thorough trading plan.

The Components of Options Trading

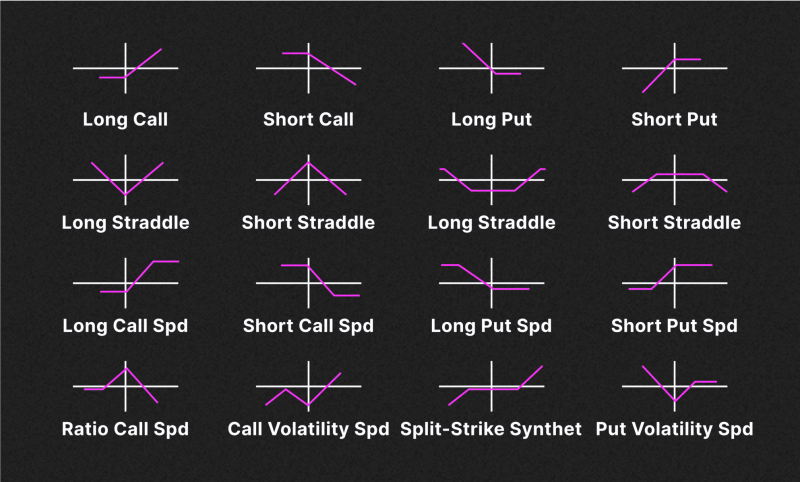

The foundation is simple: options trading involves contracts that give the holder the option to buy (call options) or sell (put options) assets at a predetermined price, known as the strike price, by a certain expiration date.

The price paid for these options, referred to as the premium, is influenced by several factors, including the current price of the asset, the time remaining until expiration, and the volatility of the market. When traders buy options, they acquire these rights; when traders sell options, they assume the responsibility to execute the contract if the purchaser opts to exercise the option.

Developing effective strategies for options trading aimed at either managing risk or achieving speculative profits necessitates an understanding of the fundamental principles that we will outline below.

Methods for Generating Income

Cash-secured puts and covered calls are the two most commonly used options for trading. However, there are several more.

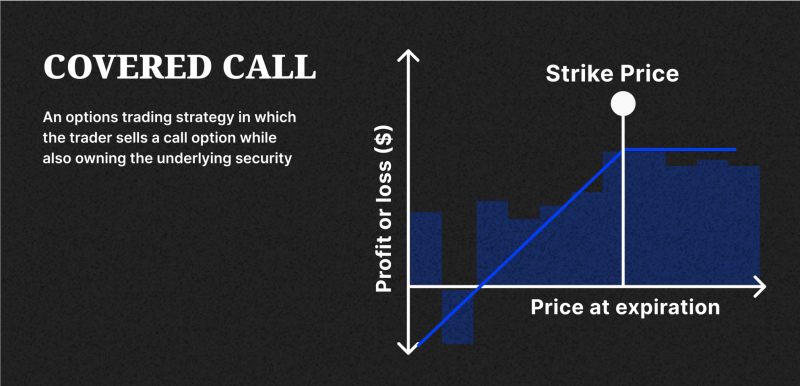

Covered Calls

Covered calls are like having a safety net for the stocks you own. Here’s how it works: The stock owner sells someone else the right to buy that stock at a specific price. After selling the stock, the owner profits from the premium.

The advantage of this strategy is that it can increase a stock holding’s revenue, particularly in a flat or marginally optimistic market. But, there’s a chance that the stock’s potential for growth may be limited because the seller must sell the shares at the strike price upon option exercise.

Cash-Secured Puts

An investor sells a put option and maintains a cash reserve identical to the cost of the underlying asset in case the option is exercised. This is known as the cash-secured put method.

Using this method, the seller can profit from the option premium they get. It’s a clever method of earning money and might even enable you to purchase the underlying asset for a lower cost. The seller would have to accept a price that is greater than the asset’s present cost of the market if the price of the underlying asset dropped below the strike price.

Both strategies are well-liked by traders because they can generate revenue and carry comparatively less risk than other trading methods. They offer a practical means of controlling risk and optimising portfolio returns, which makes them appropriate for newcomers wishing to get started in options trading.

Fast Fact:

The first known option buyer is thought to have been the Greek mathematician and philosopher Thales of Miletus, who made money by buying olive presses at lower prices in anticipation of a bountiful crop and then renting them out at a premium.

Hedging Strategies

Traders can use hedging methods as a risk management tool to shield their investments from negative price fluctuations.

Protective Puts

Purchasing a put option on an underlying asset that a shareholder already owns is known as a protective put strategy. This approach acts as an insurance policy against a decrease in the asset’s value. The main advantage is restricting possible losses without limiting upside potential if the asset’s price rises. However, if the asset’s price does not drop, the premium represents a possible drawback that could lower total ROI.

Collars

Buying a put option, selling a call option, and holding the underlying asset all at the same time are the components of a collar strategy. This technique narrows the range of potential returns by offering both downside protection and an income component from the premium received by selling the call option.

The advantage of a collar is that it can protect against large losses while still offering room for profit if the asset’s value rises. The main risk is that the call option limits the asset’s upside potential, which means that if the asset’s price climbs over the call option’s strike price, the investor may lose out on significant rewards.

For both rookie and seasoned traders, protective puts and collars are practical hedging techniques. They are important elements of a diversified trading strategy because they balance prospective returns and risk management.

Speculative Strategies

Traders who want to profit from changes in the underlying asset’s stock price use techniques such as long straddles and vertical spreads.

Long Straddles

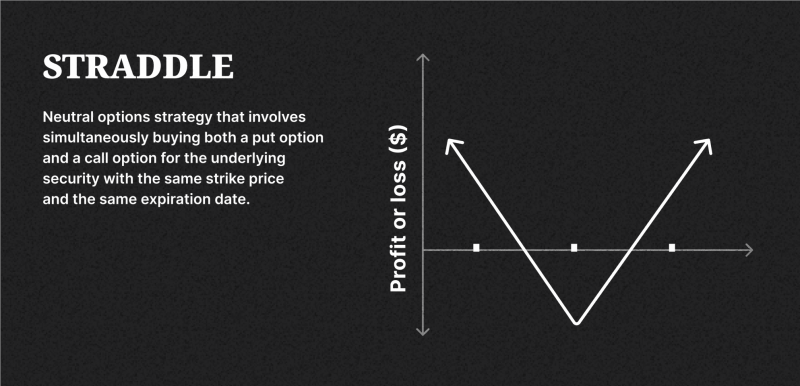

This is when you buy a call and a put option on the same stock, both with the same strike price and expiration date. It works well for traders expecting significant stock price changes but is uncertain which direction it will go.

If the stock goes sharply in either direction, it presents the possibility of unlimited gains. If the stock price stays close to the strike price when the options expire, there’s a chance of losing the entire premium paid.

Vertical Spreads

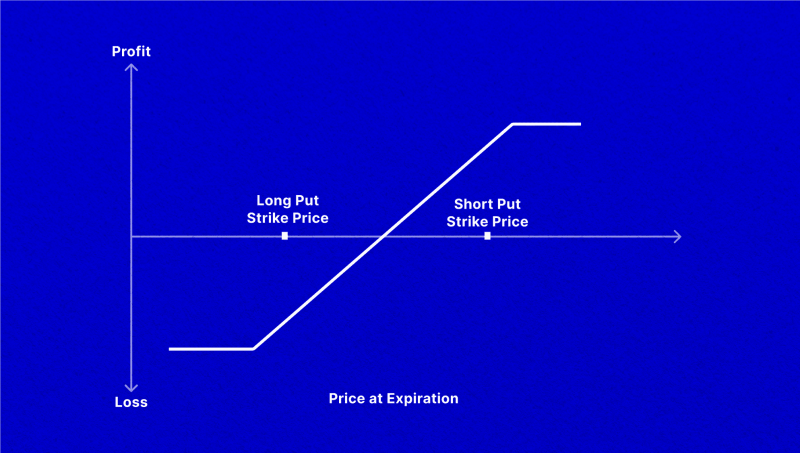

In order to balance possible gains and losses, vertical spreading is the trading of call or put options with various strike prices but the same expiration dates. It comes in two characteristics: bull spreads, which forecast price gains, and bear spreads, which wager on price declines.

A key benefit is risk reduction, as income from selling higher-priced options offsets the cost of cheaper ones, with the net premium minus the price gap representing the total risk. This strategy is preferred because it is adaptable to different market conditions and can be tailored to individual risk-reward choices.

Advanced Mechanisms for Expert Traders

Options trading methods like iron condors and iron butterflies are made for experienced traders who want to generate income from stable markets.

One can create an iron condor using two call and two put options with different strike prices and the same expiration date. The goal of this technique is to keep the stock price within a predetermined range to generate income from option premiums.

The distinction between the strike prices and the premium that was composed indicates the maximum possible loss, while the profit that may be made is marked by the premium collected.

Iron condors perform best in markets with low volatility or consistency. If the underlying stock price stays within the middle strike values at expiration, the trader’s profit is maximised.

An iron butterfly is a trade that uses four separate contracts to profit from movements in stock or futures prices that fall or rise within a predetermined range.

Additionally, the strategy is set up to profit from a decline in implied volatility. Predicting when option prices will normally drop in value is crucial to utilising this transaction as part of a profitable trading plan. This usually happens when there is a slight upward trend or sideways movement.

Iron butterflies’ maximum profit is the first premium paid, making them appropriate for circumstances in which little volatility in the underlying stock is expected. If the stock price diverges considerably from the at-the-money strike price, the maximum loss is limited by the premiums of the purchased options.

Things to Consider

Knowing the risks and benefits of options trading is essential before engaging in it. With this knowledge, traders may make wise choices and establish reasonable investment expectations.

Also, creating an in-depth trading plan is crucial. The objectives, risk tolerance, and trading entry and exit tactics should all be outlined in this plan.

Ongoing education is also essential in the continuous process. Trading success can be impacted by remaining up to date on new strategies, regulatory changes, and market movements. Traders who embrace education and preparation are better equipped to handle the complex rules of options trading.

Final Thoughts

Options trading strategies provide a variety of ways to improve trading portfolios while effectively balancing risk and profit. Before beginning, traders should dedicate time to learning and thoroughly understanding these methods. Strategic planning and ongoing education are the foundation of any successful options trading venture.

FAQs

Which option strategy will provide me with the most returns?

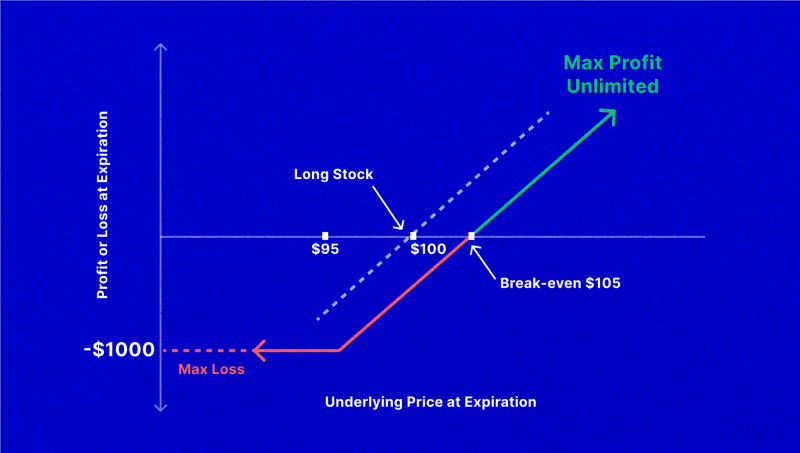

If you are looking for a low-risk, limitless profit strategy, the synthetic call method might be just for you. As part of this approach, the trader uses put options on the stock they own and believe will rise in value in the future.

Which method is the safest?

Depends on your specific needs and situation. Still, it’s believed that the covered call is a safe way to trade options.