Simple and Compound Interest — How Do They Differ?

Dec 05, 2023

The concept of interest plays an important role in the world of investing, borrowing and lending money. Whether you deal with banks, brokerage houses or credit cards, you’ll constantly be exposed to interest rates and calculations.

If you’re taking out a loan or depositing money in a savings account, you should know about different types of interest and how they are calculated. This knowledge can empower you to make informed financial decisions and potentially save or earn more money in the long run.

Key Takeaways:

- Interest is a compensation for risk that lenders charge on loans and an incentive for individuals to save their money in financial institutions.

- Simple interest is calculated based on principle, making it a simpler method of calculating interest.

- Compound interest considers both principal amount and interest accumulated from previous periods, resulting in exponential growth over time.

- Understanding the impact of interest and compounding can help individuals choose the right type of loan, savings account, or investment to suit their needs.

What Is Interest?

Interest is a key concept in the world of finance and economics. It refers to the cost of borrowing money or the return on investment for lending money. In simple terms, interest can be seen as the price paid for using someone else’s money.

But what exactly is interest, and why does it exist? Let’s dive deeper into this financial concept to understand its significance and impact on our daily lives.

The Purpose of Interest

Interest is essentially compensation for risk. When a bank lends money to a borrower, it takes on the risk that the borrower may not repay the loan. This risk increases with factors such as the borrower’s creditworthiness and economic conditions. Therefore, to mitigate this risk and ensure profit, lenders charge an additional amount known as interest. This interest is added on top of the principal amount and is calculated as a percentage of the loan.

On the other hand, when individuals or organizations deposit money in savings accounts or invest in bonds, they are essentially lending money to financial institutions. In return for this loan, the lender receives interest on their deposited amount. The purpose of this interest is to incentivize individuals to save their money and lend it to financial institutions. This, in turn, allows these institutions to use the deposited funds for loans and investments.

Simple Interest

Simple interest is calculated based solely on the original principal amount of a loan or investment. It does not take into account any interest that has accrued over time.

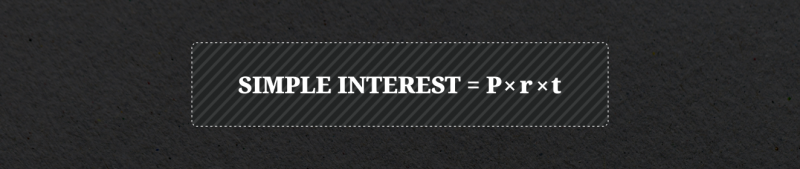

The simple interest formula is straightforward:

In this formula, the principal refers to the initial amount of money borrowed or invested, the interest rate is the percentage charged or earned, and the time represents the duration of the loan or investment. Let’s consider an example to illustrate how simple interest works.

Imagine you borrowed $15,000 with a simple interest rate of 7% for a period of 5 years. The total amount of interest payable can be calculated as follows:

Simple Interest = $15,000 x 0.07 x 5 = $5,250

Therefore, the interest on this loan would amount to $5,250, with an annual payment of $1,050.

Compound Interest

Compound interest, on the other hand, takes into account both the principal amount and the accumulated interest from previous periods. It can be thought of as “interest on interest.” As a result, compound interest has the potential to grow at an exponential rate over time.

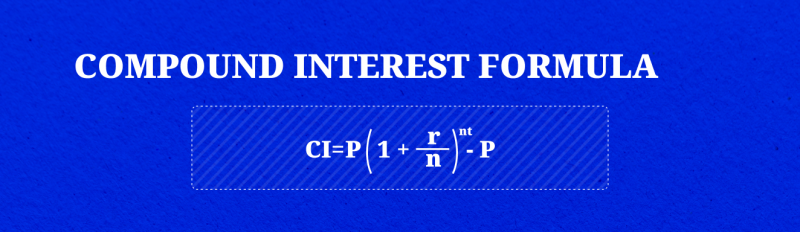

The formula for calculating compound interest is as follows:

In this formula, the principal represents the initial amount, the interest rate is the annual rate, the number of compounding periods is the frequency at which interest is compounded, and the time refers to the duration of the investment or loan. Let’s see how compound interest can make a significant difference.

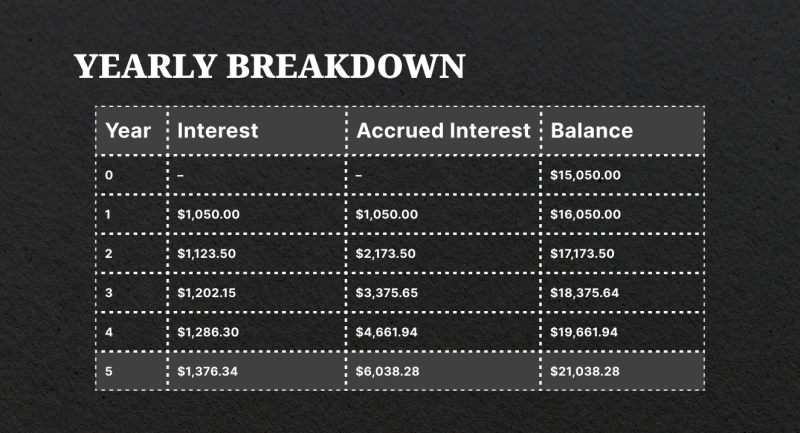

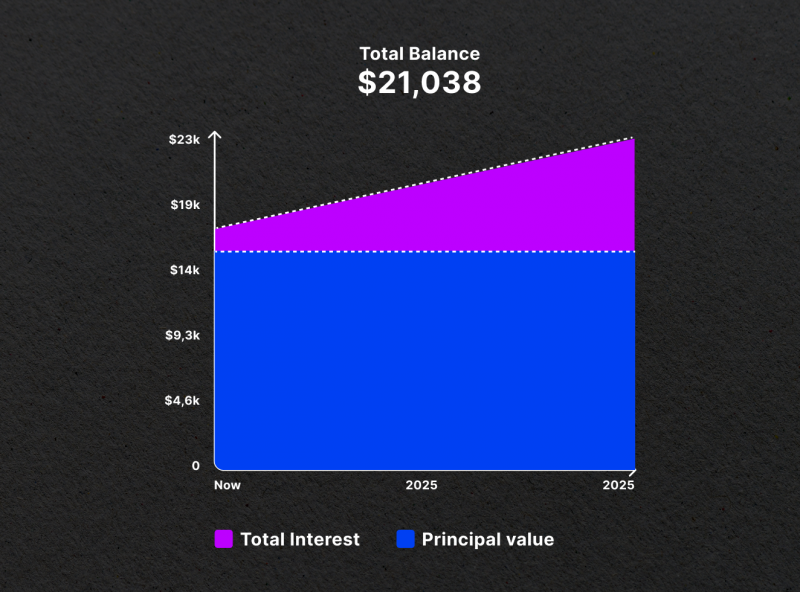

Consider a $15,000 loan with a compound interest rate of 7% compounded annually for 5 years. Using the formula, we find:

Compound Interest = $15,000 x ((1 + 0.07)^5 – 1) = $6,038.28

In this case, the total interest payable over the three-year period is $6,038.28. However, it’s worth noting that the interest amount is not the same for each year, as compound interest factors in interest accumulated from previous periods.

To illustrate this, let’s examine the interest payable at the end of each year:

As you can see, the interest payments increase each year due to the compounding effect.

Why Compounding Period Intervals Matter

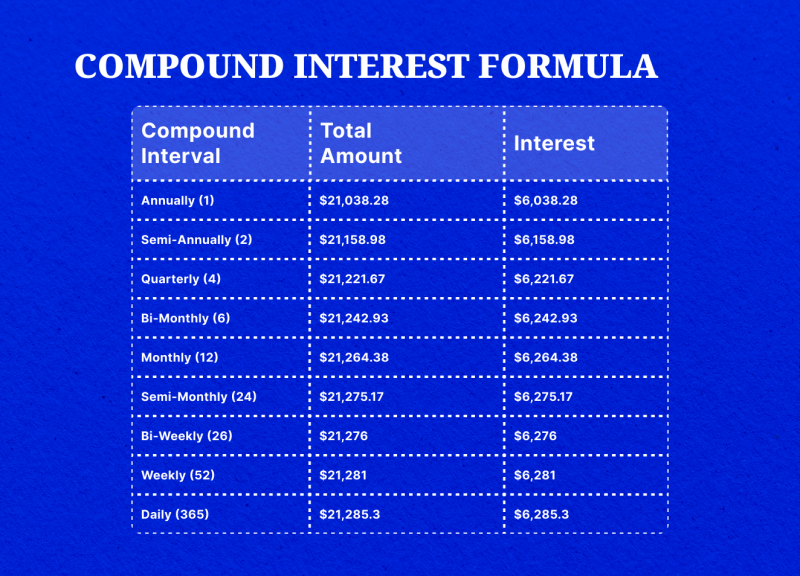

Did you know that this type of interest can actually be calculated in different intervals? Instead of just looking at yearly compounding, we can also consider monthly compounding.

How does it work? You need to take the same formula used for yearly compounding and simply change the number of compounding periods (n). For yearly compounding, n is equal to 1, but for monthly compounding, n becomes 12.

Let’s see how this works in practice with our previous example:

Compound Interest = $15,000 x ((1 + 0.07/12)^(12×5) – 1) = $6,285.3

As we can see, the interest earned with monthly compounding is greater than that of annual compounding. This is due to the fact that monthly compounding allows for more frequent growth and, thus, higher overall returns.

Compounding period intervals play a crucial role in determining the amount of interest earned on an investment. Generally, the more frequent the compounding, the greater the effect of compound interest:

As it is evident from the table, the highest interest is earned with daily compounding intervals – $6,285.3. The lowest interest is earned with annual intervals – $6,038.28.

Remember that these calculations provide a general comparison of compounding periods and do not include factors such as taxation or inflation.

The Rule of 72

The Rule of 72 is a handy rule of thumb that can help estimate the time it takes for an investment to double at a given interest rate. By dividing 72 by the interest rate, you can approximate the number of years it would take for your investment to double.

For example, if you have an investment with a 10% annual rate of return, it would take approximately 7 years for the investment to double (72 ÷ 10%). Likewise, an investment with an 8% annual rate of return would double in around 14 years.

The Rule of 72 provides a quick and easy way to assess the potential growth of an investment and can be useful for retirement planning or setting financial goals.

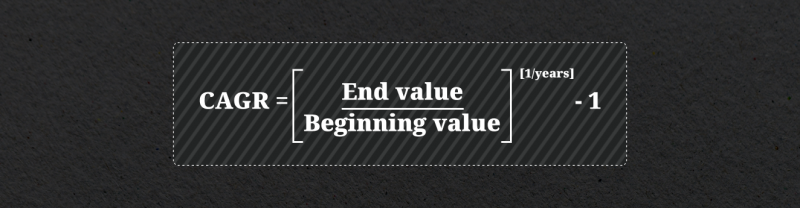

Compound Annual Growth Rate (CAGR)

The Compound Annual Growth Rate (CAGR) is a widely used measure for calculating the average growth rate of an investment over a specific period. It is commonly employed in financial analysis to determine the performance of stocks, mutual funds, and investment portfolios.

To calculate the CAGR, you need to know the initial and final values of the investment over the given period. The formula for CAGR is as follows:

For example, if your investment portfolio has grown from $15,000 to $25,000 over 10 years, you can calculate the CAGR as follows:

CAGR = ($25,000 / $15,000)^(1 / 10) – 1 ≈ 0.0524 or 5.24%

The CAGR of 9.86% indicates the average annual growth rate of your investment over the ten-year period.

CAGR not only helps you track your returns over time, but it also allows you to compare the performance of different investment options against each other. Imagine this scenario: you have invested in a mutual fund managed by a professional fund manager. Over the past year, your investment has generated an annual return of 8%. However, when you look at the overall market performance during the same period, it shows a total return of 10%. This means that your fund manager has underperformed the market.

Moreover, CAGR can also help individuals estimate the expected growth rate of their investment portfolios over long periods. This information is particularly valuable for planning purposes, such as saving for retirement or other financial goals.

Real-Life Applications of Interest Concepts

The concepts of simple and compound interest have numerous real-life applications that can impact our financial decisions. Let’s explore a few scenarios where understanding these concepts is crucial.

1. Impact on Loans and Mortgages

When applying for a loan or mortgage, it’s essential to consider the type of interest used in the calculation. Mortgages and car loans typically use simple interest, where the interest is calculated only on the principal amount. This means that as you make payments towards the loan, the interest portion of the payment decreases over time.

On the other hand, credit card loans use compound interest, where the unpaid interest is added back to the balance, resulting in interest on interest. This compounding effect can quickly accumulate and make it challenging to pay off high-interest debts.

2. Impact on Savings and Investments

For investors, the type of interest has a significant effect on the growth of their money. Savings accounts and certificates of deposit typically use compound interest, allowing individuals to earn interest on their initial deposit and any accumulated interest.

The frequency of compounding can affect the final amount earned. Savings accounts that compound interest monthly will accumulate faster than those that compound interest quarterly or annually.

3. Time Horizon and the Compounding Effect

One of the most important benefits of compound interest is its ability to amplify returns over long periods. The longer the money remains invested, the greater the impact of compounding.

Let’s compare two individuals who have the same investment goal. Both individuals want to save $1 million by retirement at age 65, and they both earn a 6% annual return on their investments. However, one individual starts investing at age 25, while the other starts at age 40.

The results are staggering. The younger investor would only need to save $6,462 per year to reach their goal, while the older investor would have to save over three times as much annually – $18,227.

What Else Can Be Handy for Investors

While simple interest and compound interest provide a solid foundation for understanding the cost and benefits of borrowing and lending, there are a few other factors to take into account.

Annual Percentage Rate (APR)

When comparing loans or credit card offers, it’s important to consider the Annual Percentage Rate (APR). The APR reflects the true cost of borrowing by incorporating both the interest rate and any additional fees or charges.

Lenders are required to disclose the APR for their financial products, allowing borrowers to make more informed decisions and compare offers effectively.

Impact of High-Interest Debt

Compound interest can work against borrowers when dealing with high-interest debt, such as credit card balances. The compounding effect can quickly accumulate interest charges, making it challenging to pay off the debt.

It’s crucial to prioritize paying down high-interest debt to minimize the impact of compounding and reduce the overall cost of borrowing.

Using Compounding to Your Advantage

On the other hand, compounding can work in your favor when it comes to investments and savings. By regularly contributing to investments and taking advantage of compound interest, individuals can build wealth over time.

For example, making additional contributions to retirement accounts or investing in stocks that provide dividends can accelerate the growth of your savings through compounding.

Last Thoughts

By grasping the difference between simple interest and compound interest, individuals can make educated choices when taking out loans, choosing investment products, or planning for retirement. Whether you’re a borrower or a saver, knowing how interest works can help you make the most of your financial resources and achieve your long-term goals.

Disclaimer: The information in this document is for educational purposes only and should not be considered financial advice. Please consult with a professional financial advisor before making any significant financial decisions.

FAQs

What is the interest rate in the economy?

The interest rate in the economy refers to the percentage charged on loans or returns on savings and investments. It is determined by various factors such as inflation, economic growth, central bank policies, and market demand and supply. In general, a higher interest rate means it will cost more to borrow money and less to save or invest, while a lower interest rate makes borrowing more affordable, but savings and investments yield lower returns.

Are simple and compound interests Haram?

Yes, interest is considered Haram in Islam. This is because it involves receiving additional money based on the initial amount lent, which goes against the principles of fairness and risk-sharing in Islamic finance.

Why compound interest can be bad?

Compound interest can be bad because it allows your debt to grow at a faster rate. This means that for every month you don’t pay off your debt, the amount you owe increases. It’s like a snowball effect – the longer you wait to pay off, the more interest is added onto it, making it harder to settle in the long run.