What is The Difference Between Liquidity Provider and Liquidity Aggregator?

July 21, 2023

Forex is a platform where everyone, from a huge corporation to a beginner trader, can start making a profit from their funds. The Forex market is so gainful, thanks to its exceptionally high liquidity. This article will discuss liquidity, how it is formed in Forex, the difference between liquidity providers and aggregators, and the latter’s benefits.

Key Takeaways

- Assets in the Foreign exchange market can be high, medium, and low liquid.

- Liquidity in FX can be affected by many factors.

- Liquidity providers and liquidity aggregators are responsible for forming liquidity in the Forex market.

- Liquidity aggregator provides a higher speed of order execution, tighter spreads and adds to effective trading.

A Definition of Asset Liquidity

Liquidity can be defined as the ability of an asset to be converted into money without losing its value. In the stock exchange market, liquidity can be assessed based on the number of orders in the order book and such parameters as trading volume and spread.

Trading volume is the total number of transactions made on the exchange within a trading session.

Spread can be defined as the difference between the best bid and ask prices in the order book.

Types of Assets

In terms of liquidity, any asset in the FX market can be highly liquid, medium liquid, or low liquid.

Low Liquid Assets

These are assets that significantly lose their value with time. Low-liquid assets cannot be quickly sold or exchanged for money or another asset. Such assets as real estate, collectibles, or cars are considered low liquid.

Medium Liquid Assets

These assets have higher liquidity, but their conversion to money still requires time. Marketable securities can be qualified as the medium liquid. These include stocks, stock shares, and bonds traded in stock markets. This category also includes commodities. The top three most traded raw materials are oil, natural gas, and gold, followed by less popular but still vital silver, coffee, sugar, and cotton.

Highly Liquid Assets

Highly liquid assets are the easiest to quickly convert into cash without losing value.

Currency is considered the most liquid asset possible because it can be exchanged for anything, including another currency. Forex trades over 100 currencies; therefore, it tops the list of the most liquid markets.

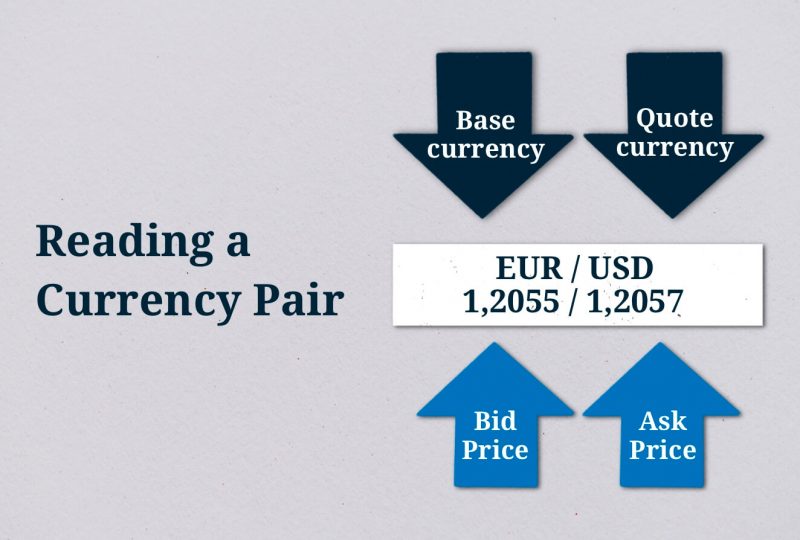

Currency trade in FX is performed in currency pairs consisting of the base and quoted currencies.

The first currency in the pair is a base one — the currency that a trader is effectively buying.

The second currency is quoted, representing the one a trader is selling against.

In simpler words, a currency pair is the amount you would pay in one currency for a unit of another currency.

For example, a trader is quoted EUR/USD 1.13. This implies that 1 Euro can be exchanged for 1.13 US Dollars.

The first price in the example pair is the bid price — the highest price a buyer would pay to purchase the specified currency.

The second price — the ask price — is the lowest price at which a seller sells the currency.

The difference between the bid and ask prices from the bid-ask spread.

Currency pairs that provide FX liquidity can be sorted into three groups based on their trading frequency, trading volume, and popularity, that is, they are grouped based on their liquidity:

- Major currency pairs: all major pairs include the currencies of the countries with large economies, such as euro, the British pound, the Japanese yen, the Swiss franc, and Canadian and Australian dollars. All majors must include the US dollar since it is now considered one of the largest economies in the world. According to the BIS research, the trading volume of USD/EUR currency pairs in FX went beyond $1,600 in 2022, making it the most convertible pair in the market.

- Minor currency pairs: minors comprise the currencies of smaller economies, such as New Zealand and Singapore dollars or South African rand.

- Exotic currency pairs: these are the least liquid currencies that include currencies of developing countries, for example, Turkish lira, Brazilian real, or Mexican peso.

What Affects Liquidity

Among many factors that can influence the liquidity of assets in Forex, the most frequent are the following:

- Forex market operates 24 hours a day; however, its market hours can influence the level of market liquidity. Thus, peak liquidity is usually observed when sessions in major financial centers overlap. The lowest levels of liquidity are usually on weekends and during holidays.

- A bid/ask spread also affects liquidity: the lower the spread, the higher the liquidity.

- The number of traders and brokers in the Forex market and their activity can significantly impact the liquidity in the market: the more actors in the market, the higher asset convertibility, and vice versa, fewer participants lead to a lower level of liquidity.

- Currency pairs that are traded in the FX market influence its liquidity. Major and the most popular currency pairs, like USD/EUR or USD/JPY, commonly show higher levels of convertibility due to their popularity and active trading. In contrast, minor and exotic currencies are less popular and subjected to wider spreads.

- Various world events and economic news greatly influence the market. Forex actors adjust their positions according to the news, causing volatility in the market and liquidity swings.

- The overall mood and confidence of traders can also affect the level of liquidity. Positive sentiment can increase marketing activity, while negative sentiment can decrease it and reduce volumes of trades.

How Liquidity is Formed

Liquidity in Forex does not come from anywhere.

Various finance institutions, banks, and huge brokers who act as counterparties ready to buy or sell the required amount of currency are a vast and integral part of the FX market. These counterparties are called liquidity providers, and they form liquidity in Forex.

FX liquidity providers (or LPs) act as market makers: they facilitate marketing by offering bid/ask prices for pairs of currencies and, as a result, ensure a constant flow of liquidity in the market.

A liquidity provider can be compared to wholesale suppliers, but instead of supplying goods, LPs provide liquidity.

LPs offer more favorable marketing conditions due to the ample supply and demand volumes.

Liquidity Providers vs. Liquidity Aggregators

Liquidity providers help to facilitate trades between buyers and sellers by pooling requests together, thus making order execution smoother and more efficient, ultimately leading to lower prices and an increased overall number of transactions.

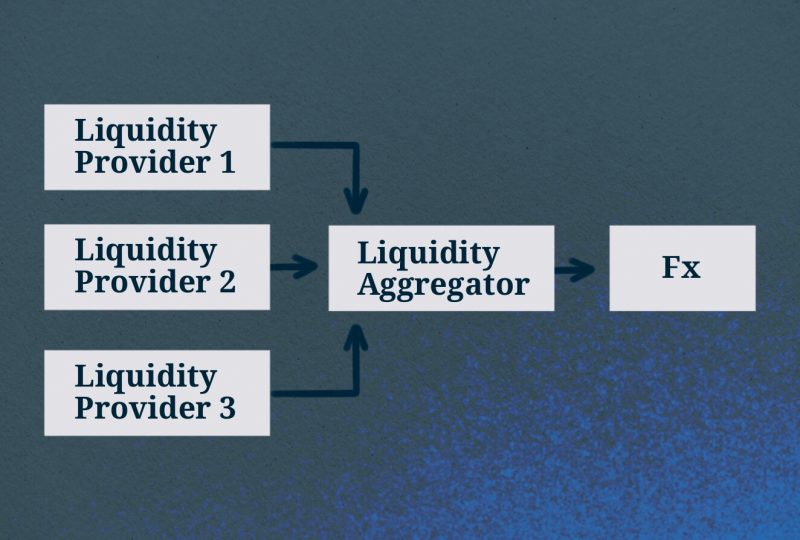

Liquidity aggregators offer a service similar to that of liquidity providers. Still, there is one key difference: while LPs source bids and asks from a single exchange, LAs aggregate this information from multiple sources to find the best prices. This enables a FX aggregator to profit from the price differences between sources.

How Liquidity Aggregators Work

However, Liquidity providers are not the only ones responsible for the formation of a liquid market. LAs can also form liquidity in Forex.

So, what is a Forex liquidity aggregator?

Liquidity aggregation is the process of pooling liquidity from different sources.

It can be compared to thousands of smaller streams forming significant liquidity flows. This aggregation allows traders to simultaneously obtain streamed prices from multiple LPs or liquidity pools.

A liquidity aggregator itself is a specific computer algorithm that scans various liquidity sources and performs aggregation. This software allows you to choose the best asset price among the prices provided by other LPs.

LAs consolidate order books by bringing together data from various sources. They also select sources with the best liquidity using predefined criteria, thus ensuring better order execution.

We can name the largest LAs in the market, such as smartTrade LiquidityFX, Liquid-X, FlexTrade, Quotix, Integral, Seamless FX, Currenex, and many others.

Liquidity aggregators can be very useful for traders who want to get the best price possible for a specific asset. They can give you simple, cost-efficient, and reliable access to high-quality liquidity pools.

A Forex liquidity aggregator can be an excellent tool for traders since LAs can help them receive the best possible prices for their assets and focus on more important things like investing in assets and growing their portfolios.

A FX liquidity aggregator benefits brokers nowadays since LAs support various combinations of order types, currencies, and tiered pricing. FX aggregator compares the client demand to the LPs’ supply, thus ensuring the best price for the client’s request processing. Moreover, LAs give all the traders anonymous and equal access to multiple liquidity providers, thus optimizing their market access.

The foreign exchange aggregator can be either a broker itself or a separate organization.

Currently, two leading FX liquidity aggregation platforms are in the market: ECN and MTF.

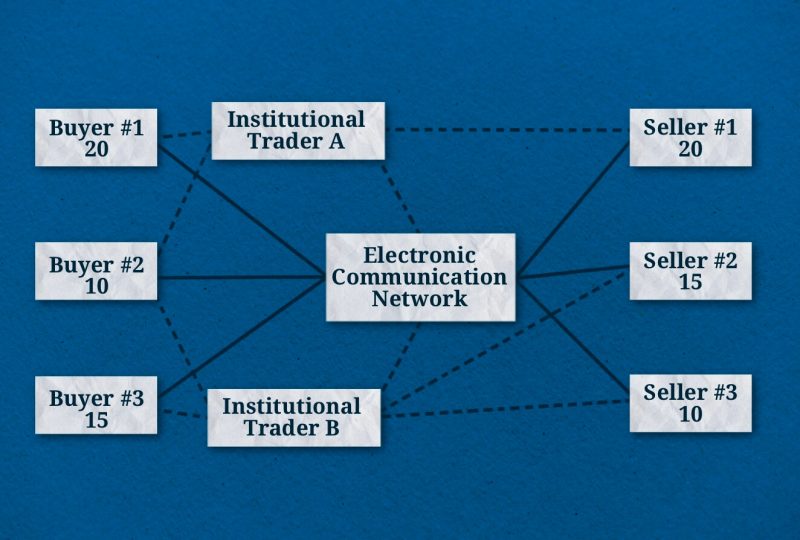

Electronic Communication Network (ECN)

The Electronic Communication Network (ECN) provides secure trading by combining the liquidity of primary providers and automatically matching buy and sell orders.

This computerized system contributes to better prices and tighter spreads. Another benefit of ECN is its privacy: the network connects brokers allowing them to trade between themselves and avoid an intermediate.

The traders’ orders are routed directly to the order book, where they are mixed with all other orders. The market demand and supply determine the spread, and the broker receives the revenue as a commission on the transaction volume.

ECN technology adds to the protection of a trader against manipulations and guarantees brokers’ noninterference. Plus, the technology allows brokers to trade outside the Forex trading hours, which can be helpful for those who aim for more flexibility.

The main drawback of ECN, however, is that you have to pay to use it, and the fees and commissions can be relatively high, affecting your profitability.

Multilateral Trading Facility (MTF)

Another FX aggregator platform is Multilateral Trading Facility (MTF). Both banks and ordinary traders can use the platform. MTF guarantees an order execution at the set price since it requires no transaction confirmation from a counterparty. With MTF, traders have almost the same rights as banks because all orders match in one centralized order book.

MTFs are very popular in Europe since they offer faster order execution speeds, lower costs, and different trading incentives.

One of the critical advantages of MTF is that the operators cannot choose the trades to execute; instead, they must set and follow clear rules. This approach adds to transparency in trades and pricing.

Why Do We Need Liquidity Aggregators?

Forex Liquidity aggregators come with a lot of benefits. Here are their core advantages:

- Forex LA can reduce the market impact in case of larger transactions and minimize slippage.

- Liquidity aggregation in the Forex offers greater transparency due to its feature to display prices from multiple sources.

- FX aggregators can grant access to multiple markets and search for the best liquidity pool through a single platform, thus ensuring better pricing, lower transaction costs, and risk diversification.

- By bringing together multiple sources of liquidity, aggregators enrich the market depth and offer better order execution at higher volumes.

- The orders are executed faster, thanks to liquidity aggregation. All orders are simultaneously routed to multiple liquidity sources, which speeds up order fulfillment and increases trading efficiency.

However, like any other technology, liquidity aggregation has some downsides.

Thus, implementing liquidity aggregation requires the use of powerful technology and robust infrastructure, as well as high-speed connectivity.

Conclusion

By collecting liquidity from different sources, Forex liquidity aggregators can offer increased market depth, faster order execution, and access to multiple markets. Considering all this, LAs can become an outstanding tool for improving marketing efficiency and lowering transaction costs.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs

What is the critical difference between a Liquidity Aggregator and a Liquidity Provider in Forex?

LPs match buy and sell orders by providing liquidity from a single exchange, while LAs pool liquidity from several liquidity providers or pools to find the best price.

What is the biggest liquidity aggregator in Forex?

Among the biggest LAs that collect liquidity from different liquidity providers in Forex, you can find such as smartTrade LiquidityFX, Liquid-X, FlexTrade, BidFX, Quotix, Integral, Currenex, MarketFactory, EBS Direct, DealHub, Seamless FX, and many others.