What are Crypto Hedge Funds? Which Companies Are the Most Influential in the Crypto Market?

Jan 30, 2024

Recently, the interest in cryptocurrencies as an alternative investment class has grown. This trend is evident in the rising number of traditional financial institutions engaging with digital assets. Consequently, several big crypto hedge funds and companies emerged seeking to bridge the gap between traditional and blockchain-based finance.

In this article, we will delve into the world of crypto hedge funds and explore some of the most influential firms and their investment strategies.

Key Takeaways:

- Hedge funds are investment vehicles that use various strategies to generate high returns for investors.

- Hedge funds are typically only available to accredited or high-net-worth investors and are subject to different regulations than traditional funds.

- Crypto hedge funds specialise in investing in digital assets and blockchain-based projects.

- Some of the top crypto hedge funds include DCG, Galaxy Digital, Morgan Creek Capital Management, Andreessen Horowitz (a16z), and some others.

What Is a Hedge Fund?

A hedge fund is a type of investment vehicle that utilises various strategies to generate high returns for its investors. The name “hedge fund” comes from the fact that these funds were originally designed to “hedge” against market volatility and minimise risk. However, they have evolved over time into more complex and diverse investment structures.

Hedge funds are typically only available to accredited or high-net-worth investors and are not subject to the same regulations as traditional investment funds. Fund managers have more flexibility in their investment strategies and can take on higher levels of risk.

How Are Hedge Funds Regulated?

Hedge funds are regulated by two levels – at the issuer level and the adviser level. The fund and the managers responsible for making investment decisions are subject to certain laws and regulations.

- At the issuer level, the Securities and Exchange Commission (SEC) and individual state regulations govern hedge funds in the US. This includes digital asset funds, which are considered private securities offerings under US law.

- At the adviser level, managers may be regulated by either the SEC or the Commodity Futures Trading Commission (CFTC), depending on the classification of the fund’s portfolio assets.

In the United States, hedge funds can only work with qualified investors with a capital of $5 million or more. Offshore funds may have different eligibility thresholds, typically requiring investors to have a capital of $100,000 or more. These limitations aim to protect retail investors from the high-risk nature of hedge fund investments.

The Investment Advisers Act of 1940 imposes registration and reporting requirements on investment advisers, including hedge fund managers. Registered investment advisers must maintain records, report to regulatory authorities, and undergo audits. Compliance with this act ensures that hedge funds operate transparently and accountable, safeguarding investors’ interests.

What Are Crypto Hedge Funds?

Crypto hedge funds, as the name suggests, are hedge funds that focus on investing in digital assets. Unlike traditional hedge funds, crypto hedge funds focus exclusively on digital assets and blockchain-based investments.

These entities invest in a wide range of cryptocurrencies, including Bitcoin, Ethereum, and different altcoins. Moreover, they may also be involved in initial coin offerings (ICOs), decentralised finance (DeFi) projects, and other emerging opportunities in the crypto space.

While some crypto hedge funds solely invest in crypto projects, others diversify their portfolios by investing in stocks, Forex, and commodities. These funds often employ high-risk investment strategies such as leverage, short-selling, and speculative financial instruments.

Main Features of Crypto Hedge Funds

Cryptocurrency hedge funds offer unique features that differentiate them from traditional investment options. Let’s take a look at some of the key characteristics that define crypto hedge funds:

- Active trading strategies: Unlike traditional funds adopting a passive buy-and-hold approach, crypto hedge funds pursue active trading strategies. They actively buy and sell cryptocurrencies in short time periods to take advantage of market fluctuations.

- High-risk profile: Due to aggressive investment strategies as well as the volatile nature of the crypto market, crypto hedge funds have higher risk profiles compared to, for example, index funds. They offer the potential for higher returns but also carry a greater risk of losses.

- Professional management: Crypto hedge funds are managed by highly qualified professionals with extensive knowledge of both risk management and the cryptocurrency industry, which is especially important in the complex crypto market, where inexperienced investors can easily become victims of price fluctuations or scams.

- Limited availability: Shares in crypto hedge funds are usually only available to qualified investors, with entry thresholds starting at several hundred thousand dollars.

- Diversification: Crypto hedge funds offer investors an opportunity to diversify their portfolios by investing in different cryptocurrency options. The benefit is especially great for those already heavily invested in traditional assets like mutual funds, stocks, and bonds.

- High fees: While traditional funds generally charge management and performance fees, crypto hedge funds usually have much higher fee structures. Third parties managing cryptocurrency funds charge fees ranging from 1% to 4% of the fund’s net worth, with performance fees reaching up to 20%. These numbers can be explained by the risk of managing digital assets and the potential for high returns.

Notable Crypto Hedge Funds

The digital asset industry is home to several prominent firms that have significantly impacted the market. Let’s take a closer look at some of the most noteworthy crypto hedge funds today:

Digital Currency Group (DCG)

One of the most prominent players in the crypto hedge fund space is the Digital Currency Group (DCG). The company was founded in 2015 by Barry Silbert and operates as a parent company to various subsidiaries, including Grayscale Investments, Genesis Global Trading, and CoinDesk.

Unlike traditional hedge funds, DCG does not follow a typical structure. Instead, it provides single-asset and diversified cryptocurrency funds through its subsidiary, Grayscale Investments.

Investing in DCG’s crypto funds, such as the Grayscale Bitcoin Trust (GBTC), Grayscale Ethereum Trust (ETHE), and Grayscale Smart Contract Platform Ex-Ethereum Fund, can be done through private placements or publicly-quoted products.

Apart from managing funds, DCG also invests in different projects to support the development of blockchain networks. The company’s core cryptocurrency holdings include Bitcoin, Ethereum, Ethereum Classic, Decentraland, Sandbox, Filecoin, Horizen, Livepeer, and Zcash.

Additionally, DCG has invested in crypto-related companies such as BitGo, Brave, Chainalysis, Circle, Coinbase, Kraken, FTX, Etherscan, Lightning Network, Dapper Labs, and Ripple.

However, DCG has faced challenges in the volatile crypto market like any other hedge fund firm. The collapse of Luna’s stablecoin and the bankruptcy of the FTX exchange have put significant stress on the company. All the events of the crypto market’s winter caused the Grayscale Bitcoin Trust to trade at a considerable discount compared to its underlying Bitcoin value.

Additionally, the company’s life and wealth management arm, HQ, which offered private investments, wealth advisory services, and tax planning, was shut down in January 2023.

Fast Fact

Grayscale experienced massive outflows from its GBTC Bitcoin spot ETF fund shortly after the SEC’s approval of BTC ETFs, dragging down the price of the largest cryptocurrency.

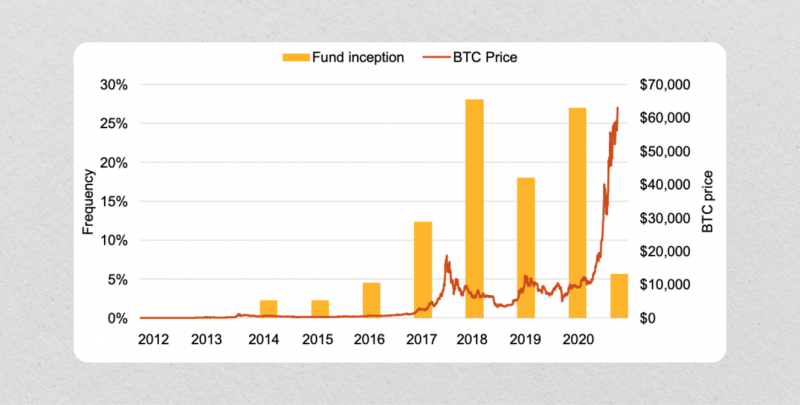

Pantera Capital

Pantera Capital is another significant player in the crypto hedge fund industry. It was founded in 2013, when Bitcoin’s price reached $65, and is known as the first cryptocurrency hedge fund in the United States.

Pantera offers various capital allocation options, including venture equity in the blockchain sector, early-stage tokens, and liquid cryptocurrencies.

Pantera’s flagship fund, the Liquid Token Fund, focuses on DeFi and adjacent assets. The fund has 210 venture capital and token investments to its credit.

Pantera also operates other funds, such as the Blockchain Fund, which invests in venture equity, early-stage tokens, and liquid tokens. The Select Fund, Early Stage Token Fund, Bitcoin Fund, and Venture Fund are also part of the institution’s investment offerings.

As of April 2023, Pantera’s assets under management (AUM) stood at $4.7 billion. Despite experiencing a significant loss in value during the bear market of 2022 due to crypto market crashes, Pantera Capital remains a prominent player in the crypto hedge fund space.

Galaxy Digital

Another leading crypto hedge fund is Galaxy Digital, founded in New York in 2018 by former Goldman Sachs partner Michael Novogratz. With an initial $400 million investment from Novogratz, the company also raised an additional $200 million by listing on the Canadian TSX exchange.

Apart from investing in various cryptocurrencies, such as Bitcoin and Ethereum, Galaxy Digital has invested in about 20 cryptocurrency projects. These include notable names like BlockFi, Ripple, and Bitstamp. In 2019, the company also led a $30 million funding round for Bakkt, which operates one of the leading institutional crypto trading platforms.

Galaxy Digital offers various cryptocurrency investment services, including asset management, principal investments, and mining. The firm’s asset management arm manages over $1 billion in digital assets through its Galaxy Bitcoin Fund and Galaxy Ethereum Funds. Its principal investment arm invests in early-stage blockchain projects, while its mining division mines and sells cryptocurrencies.

Furthermore, Galaxy Digital is also involved in developing the crypto market infrastructure. The company has launched a cryptocurrency trading platform for institutional clients called Galaxy Digital Trading (GDT). Additionally, it offers banking services to crypto firms through its partnership with Silvergate Bank.

Morgan Creek Capital Management

Morgan Creek was founded in 2004 and has been providing investment management services to institutional and qualifying clients for 20 years now.

The company has its own crypto venture capital fund arm, Morgan Creek Digital, which focuses on investments in seed and early-stage blockchain and AI companies.

Morgan Creek Digital partners with Bitwise Asset Management to offer institutional clients exposure to leading cryptocurrencies through the Digital Asset Index Fund. This fund tracks the performance of Bitcoin, Ethereum, Cardano, Polkadot, Avalanche, Litecoin, Uniswap, Cosmos, Bitcoin Cash, and Tezos.

The company’s CEO, Mark Yusko, has also been vocal about his bullish stance on Bitcoin, predicting that it will eventually replace gold as a store of value.

In terms of funding rounds, Morgan Creek Digital has been involved in several major deals, including BlockFi’s Series D funding round that raised $350 million. This investment helped BlockFi achieve a valuation of $3 billion as it continues to grow its crypto lending and borrowing platform.

Moreover, Morgan Creek Digital has also led funding rounds for Blockdaemon and Gemini, two prominent players in the crypto industry.

Andreessen Horowitz (a16z)

Another prominent venture capital firm and a hedge fund that has significantly impacted the crypto industry is Andreessen Horowitz, also known as a16z. Since its founding in 2009 by Marc Andreessen and Ben Horowitz, a16z has invested in the crypto sector since 2013.

a16z’s investments in the crypto space include prominent names such as Solana, Maker, Ava Labs, OpenSea, Sky Mavis, and Polychain Capital. The firm has a unique approach to investing in the crypto market by focusing on layer-one networks and DeFi projects.

One of a16z’s most notable investments is in layer-one network Solana. The firm led a $314 million funding round for the project in June 2021. Additionally, a16z has invested in stablecoin protocol Maker, which currently has over $5 billion worth of assets locked in its platform.

Brevan Howard Digital

Brevan Howard Asset Management, a London-based hedge fund giant, made headlines in September 2021 when it announced the launch of its crypto and digital asset division, BH Digital. This move marked the company’s expansion into the crypto market after years of exploring blockchain technology.

BH Digital aims to strengthen its crypto investments through a range of services, such as blockchain development, public relations support, capital raising, compliance assistance, and talent acquisition. The division actively participates in staking, running nodes, and network governance to ensure a strong foothold in the ever-growing crypto landscape.

In August 2022, Brevan Howard raised over $1 billion from institutional investors for its dedicated crypto fund. The company further solidified its presence in the industry by acquiring Dragonfly Capital, a well-known crypto hedge fund, in March 2023.

Closing Thoughts

The cryptocurrency market is undergoing constant regulatory evolution, with market participants striving to establish clear guidelines and safeguard investor interests. As the industry gains more regulatory clarity and wider adoption, the entry of more and more institutional investors and emergence of crypto venture capital firms and hedge funds is anticipated, which will likely contribute to the industry’s growth and development.

FAQs

How big is Grayscale?

Grayscale currently has over $50 billion in assets under management as of 2021, making it the largest crypto asset manager in the world. For comparison, Multicoin Capital has nearly $9 billion in AUM, while Pantera has an AUM of $3.5 billion.

What’s the difference between hedge funds and asset management companies?

An asset manager is a financial institution or company that manages and invests funds on behalf of clients, typically in various assets such as stocks, bonds, and commodities. In the case of Grayscale, they specialise in managing crypto assets.

On the other hand, hedge funds are private investment partnerships that use a variety of strategies to generate high returns for their investors. Unlike asset management companies, hedge funds can employ riskier investment techniques and can short-sell assets.

However, companies that offer hedge funds services usually also provide asset management services and vice versa.

Is BlackRock a hedge fund?

BlackRock is not solely a hedge fund. While it does have some hedge fund strategies in its portfolio, it also operates as an asset manager and fiduciary to its clients. It manages various assets, including securities and derivative securities, to help individuals achieve financial well-being.

Are crypto hedge funds safe?

Crypto hedge funds generally have a higher risk profile than other popular funds, such as index funds. However, they are managed by highly qualified professional fund managers who use various strategies to mitigate risks and generate returns for investors.