What is a Liquidity Provider? How LPs Work in Modern Financial Markets

May 20, 2021

In the fast-evolving realm of modern trading, where milliseconds can define outcomes and reliability is non-negotiable, one foundational force quietly upholds market fluidity: the liquidity provider.

Whether enabling smooth execution in the Forex markets, facilitating the exchange of digital assets, or supporting derivatives trading, these entities ensure that markets remain functional, even in the face of extreme volatility.

Often operating behind the scenes, liquidity providers create a constant flow of buy and sell orders, absorbing shocks and maintaining price stability. But who are these key players, what mechanisms drive their operations, and why are they essential to the infrastructure of brokers, trading platforms, and institutional investors?

This article delves into the architecture, dynamics, and strategic significance of liquidity provision within today’s financial landscape.

Key Takeaways

- Liquidity providers supply constant buy and sell quotes, enabling smooth and efficient market activity across asset classes.

- LPs come in various forms: Tier-1 banks, hedge funds, market makers, PoPs, and crypto-native providers.

- The future of liquidity is driven by AI algorithms, decentralized liquidity models, and Liquidity as a Service (LaaS) platforms.

What is a Liquidity Provider?

A liquidity provider, or LP, is a market participant or institution that continually supplies buy and sell quotes for a given asset or asset group, thereby enabling swifter and more regular trading for other market players.

LPs are simply other players in the market that engage in trades, always willing to fill an order at a given price, either to buy or sell. This function is particularly critical in over-the-counter (OTC) markets, such as Forex and cryptocurrency, where there is no centralized exchange to regulate order books.

Market makers or liquidity providers enhance market efficiency by providing continuous quotes, thereby creating a more stable and competitive trading environment. They, at a fundamental level, always ensure the availability of a counterparty to a trade.

Without the LPs, the trader could not necessarily buy or sell, particularly when a market is volatile or has low participation.

Fast Fact

Uniswap, a decentralized exchange, had over $1 billion in liquidity in its pools within just two years of launch, without a single traditional liquidity provider involved.

How Liquidity Providers Work?

The liquidity providers form the basis of financial marketplaces because there is always an entity that is willing to buy or sell an asset.

In the Forex market, stock exchange, or cryptocurrency market, they provide market liquidity, which helps market users—who are institutions, investors, and traders—to purchase or sell financial assets without considerable hindrances or restrictions.

Price Quoting and Order Execution

A liquidity provider—typically a bank, market maker, or professional company—always supplies real-time bid and ask quotes for financial instruments, such as stocks, securities, or currencies.

As soon as a market order is placed by a trader, the LP immediately completes the order from available quotes, helping to execute purchase and sale requests quickly and at favorable prices.

This continuous price quoting plays a crucial role in the evolution of liquid markets, allowing even significant numbers of trades to be conducted seamlessly. In the provision of the service, LPs reduce price slippage risk and facilitate greater price stability for institutional and retail players.

Spreads and Market Efficiency

The bid-ask spread, or the difference between the buy price and the sell price, is set directly by the liquidity provider. Smaller spreads tend to be associated with greater liquidity and lower market risk.

LPs utilize advanced algorithms that consistently move these spreads, allowing them to remain profitable while providing liquidity to the market.

During thin or volatile market phases, spreads can widen, which reflects lower available liquidity. However, qualified LPs seek to increase liquidity even under pressure, which helps financial institutions, hedge funds, and trading platforms perform well.

Relationships and Integration

Liquidity providers relish working closely with brokers, exchanges, and trading platforms. By providing liquidity for a range of financial products, they facilitate brokers to offer superior pricing, more effective execution, and superior client retention. It typically occurs via APIs or the FIX Protocol, which enable swift and secure data transfers between platforms and LPs.

Some brokers even utilize liquidity aggregator technology, whereby they cross-quote different LPs to ensure the best quotes are offered regularly. This setup enables the seamless execution of buy and sell orders, allowing platforms to gain healthy access to market liquidity.

Types of Liquidity Providers

Not all liquidity providers are identical in the financial market universe. They are quite different from one another in terms of structure, scale, market access, and the types of financial instruments they host.

Distinguishing the types of LPs helps brokers, investors, and traders find the right counterparties for them, whether they are operating in the Forex market, exchange market, or cryptocurrency market.

Tier-1 Liquidity Providers (Large Banks)

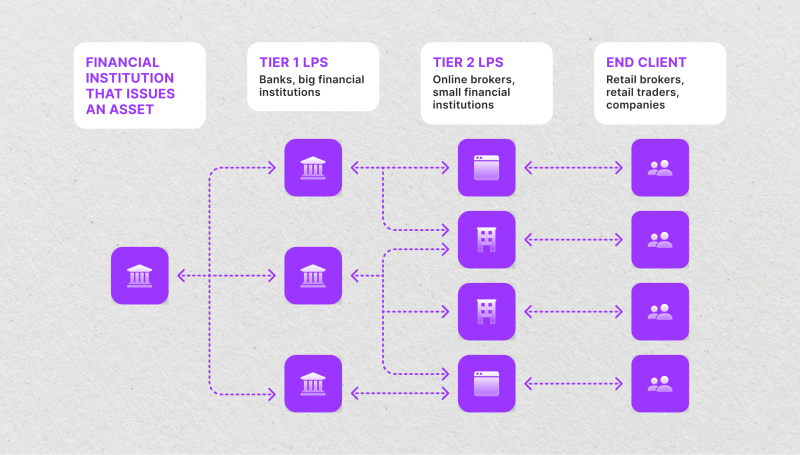

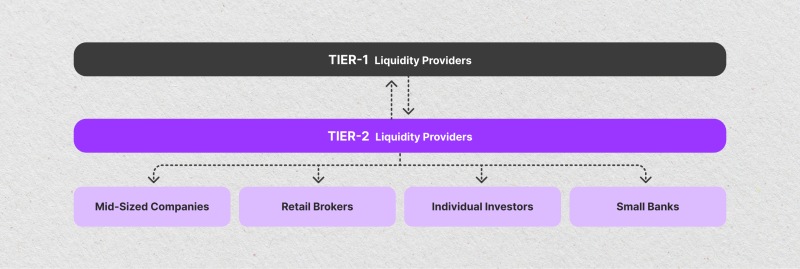

At the top of the liquidity pyramid are the Tier-1 banks, which are global leading institutions with large balance sheets that can enter the interbank market directly.

Such banks include JPMorgan Chase, Goldman Sachs, Citigroup (or Citibank), and Deutsche Bank. These banks are the leading market makers of the majority of securities, equities, and currencies.

They offer extensive market liquidity and extremely competitive pricing, which are otherwise available only to large-scale institutional clients.

Through their trading desks, these banks execute billions of buy and sell orders daily, which contributes to price discovery and more stable prices in global markets.

Tier-2 Liquidity Providers (Non-Bank Institutions)

Tier-2 LPs comprise non-financial institutions, including proprietary trading firms, boutiques, and specialized hedge funds. These are typically affiliated with available Tier-1 bank liquidity but can also act as market makers, utilizing algorithmic programs for pricing quotes and providing liquidity for specific instruments.

Although they might not enjoy the scale of a large bank, Tier-2 suppliers are agile, technology-minded, and often more flexible when interacting with trading platforms, new brokers, or new fintech companies. They can offer differentiated solutions that fit niche marketplaces or less liquid financial instruments.

Prime of Prime (PoP) Providers

Prime of Prime (PoP) brokers are intermediaries between small institutions or retail brokers and Tier-1 banks. Such businesses bring together liquidity from primary sources and sell it to retail brokers and mid-sized institutions that are not qualified for bank relationships due to their high volume or capital requirements.

PoPs tend to aggregate quotes from multiple liquidity providers, maximize execution quality, and offer sophisticated risk management tools.

It is a critical function of leveling the playing field—giving smaller firms a way to tap institutional-grade liquid markets and sell securities or transact large quantities with minimized spreads and superior execution speed.

Market Makers

A market maker is an institutional provider of liquidity that actively quotes the instrument or asset’s ask-bid prices, profiting from the spread between the bid and ask. Market makers can also be banks, brokers, or high-tech trading houses. Their primary intention is to ensure uninterrupted market liquidity even during volatile times.

Whereas other exchanges simply fill pre-established orders, market makers assume the burdens of risk of carrying inventory, allowing for efficient flows of commerce and minimizing slippage.

For cryptocurrency exchanges, most employ professional market makers to stabilize newly traded coins or tokens.

Crypto-Focused Liquidity Providers

As digital asset popularity increases, new forms of liquidity providers are found in the cryptocurrency market. These are businesses that offer niche liquidity for tokenized financial instruments, decentralized exchanges (DEXs), and cryptocurrency trading platforms.

They often utilize high-frequency trading models and intelligent order routing to increase liquidity on fragmented cryptocurrency platforms. Some even support hybrid models that blend market maker functions with centralized and decentralized provision of liquidity.

Liquidity Provision For Different Markets

While the essential function of a liquidity provider—a means of undertaking buy and sell orders with minimal friction—remains unchanged, the methods of providing liquidity differ significantly from one asset class to another.

Whether from the deep interbank networks of the foreign exchange market, the emerging infrastructure of cryptocurrency markets, or the synthetic arrangements underlying derivatives, all markets rely on specially designed liquidity arrangements for stability, effectiveness, and greater price transparency.

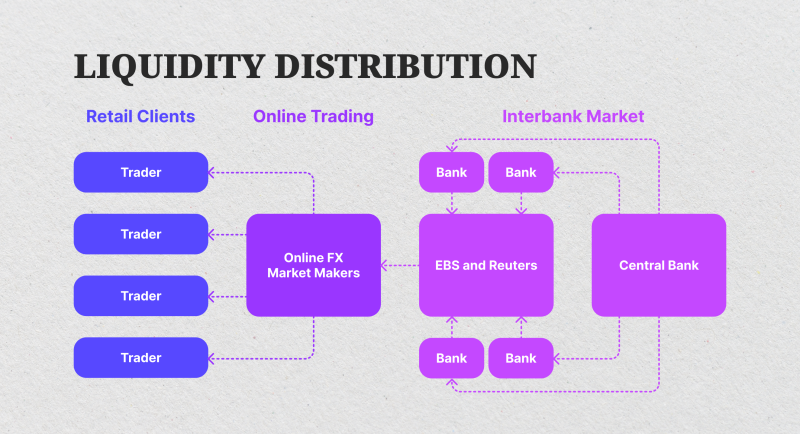

Forex Market

The FX market is one of the most decentralized and liquid of all financial markets globally, with trillions of financial instruments being traded daily.

Liquidity provision begins with Tier-1 banks, such as Citigroup, UBS, and JPMorgan, which constitute the global interbank network of active banks. These banks are the largest market makers, setting bid/ask quotes for an overwhelming majority of currency pairs.

It is typically only feasible for big institutions to enjoy direct access to this type of market liquidity. That is where PoP brokers fit in. PoPs brokers, aggregating liquidity from a diverse range of institutional LPs, offer the resultant liquidity to trading platforms, small to medium-sized market players, and retail brokers.

This is a platform designed for liquid markets, facilitated through real-time prices, deep order books, and low latency. Its architecture minimizes execution for both small and large sell orders, with small spreads and high fill rates, even for large sizes.

Cryptocurrency Markets

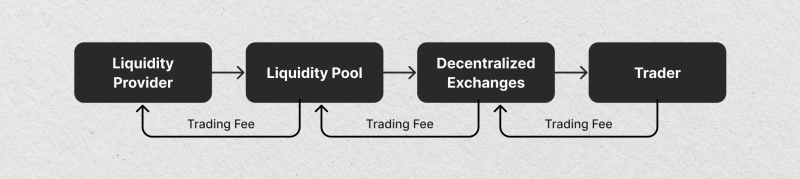

The introduction of cryptocurrency markets provided a new avenue for liquidity providers. In comparison with traditional finance, which is centralized, distributed crypto liquidity lies between CEXs and DEXs, which require varying forms of liquidity provision.

On centralized exchanges, liquidity providers are similar to those for equities or Forex—posting continuous buy and sell quotes and filling trade requests instantly.

These providers comprise specialist market makers, hedge funds, and algorithmic trading houses that match inventory and risk across a range of exchanges.

By comparison, decentralized exchanges are based on automated market makers (AMMs) and liquidity pools, through which users deposit tokens to enable trading. In these, liquidity provision can often be incentivized through yield farming or fee structures, but may be less robust or speedy than that of centralized exchanges.

While centralized LPs cripple high-traffic token pairs, decentralized liquidity is playing a greater role in sustaining financial instruments like DeFi derivatives, synthetic coins, and token exchanges. However, remaining concerns are available liquidity issues and slippage.

CFDs, Derivatives, and Provision of Synthetic Liquidity

In CFDs and other derivative products, the provision of liquidity becomes more artificial. These products enable traders to place bets against financial instruments, such as stocks, commodities, or indices, without owning the underlying instrument.

As a result, liquidity is typically provided through a market maker or a broker, which becomes the counterparty to customers’ transactions.

This is a synthetic provision of liquidity model, where the broker or liquidity provider mimics the pricing of some other market outside one exchange, say, but may risk manage internally or hedge outside via a Tier-1 LP. Some CFD-providing financial institutions use a hybrid model, routing more trades outside but handling small flows internally.

Synthetic LPs sit at the heart of bringing exposure to otherwise leveraged or illiquid financial instruments; however, transparency is essential for brokers, who require reasonable spread execution of trades with low latency.

Future of Liquidity Provision

The future of liquidity provision is being drastically rewritten, driven by rapid technological innovation, shifting financial regulations, and the decentralization of global markets.

Traditionally well-established providers of liquidity, previously the domain of large banks and old-school financial institutions, are being complemented—even competed against—by technology-driven models and new concepts like Liquidity as a Service (LaaS).

Trends: Algorithmic LPs, AI-Powered Pricing, and Decentralized Liquidity

Modern liquidity providers are shifting towards algorithmic trading models based on AI, machine learning, and predictive analytics that optimally price, execute, and maximize liquidity.

Algorithmic LPs analyze vast data sets in real time—volatility, order flow, macroeconomic data—constantly to tweak bid-ask spreads, fine-tune risk management, and supply continuous market liquidity for a host of financial markets.

AI-powered price engines are even redefining spread calculations, allowing LPs to remain competitive without taking large sizes or volatile exposures. As automation improves, platforms, players, and brokers benefit from faster execution, better buy and sell pricing, and hardened infrastructure during periods of high stress.

However, the ascendance of decentralized liquidity is reconfiguring cryptocurrency markets. On-chain market makers (like automated liquidity pools, e.g., Uniswap, Curve) enable individuals rather than institutions to provide liquidity, constituting permissionless, noncustodial alternatives for traditional LPs.

Decentralized models, even now, still encounter issues such as impermanent loss and limited depth for niche coins, but foreshadow a future where liquidity is distributed, rather than centralized on corporate balance sheets.

Regulation: MiFID II, ESMA, and Crypto Policy

The regulatory environment is having a major impact on the liquidity provider’s business. In Europe, ESMA (European Securities and Markets Authority) and MiFID II (Markets in Financial Instruments Directive II) introduced stricter best execution and transparency obligations.

These rules compel the LPs to disclose how prices are generated, the routing of orders, and the setting of spreads—all for the protection of end-users and to achieve more stable prices.

Compliance for market makers and financial institutions requires advanced reporting tools, clearer execution policies, and increased transparency in disclosures to clients. It also requires trading platforms to deal only with regulated, reputable LPs, which are safe from a governance perspective.

While that ensues, the crypto markets are headed towards a new era of regulation. Global policymakers—from the EU’s MiCA regulation to the SEC and FCA—are moving toward legal definitions of crypto, particular assets, stablecoins, and decentralized protocols.

As a mature cryptocurrency market, licensed liquidity providers will be compelled to register, report volume of trades, and be subject to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This could create more centralized and compliant liquidity, but also provide a clearer path towards institutional adoption.

Development of Liquidity as a Service (LaaS)

Likely most revolutionary of all these trends, though, is the rise of Liquidity as a Service, or LaaS. LaaS enables interbank brokers, fintechs, and exchange operators to integrate third-party sources of liquidity via plug-and-play APIs, eliminating the need to build a proprietary infrastructure.

LaaS providers offer multi-asset coverage, including Forex, equities, CFDs, and cryptocurrencies, and provide real-time buy and sell quotes via cloud infrastructure.

This model unleashes market liquidity to a wider group of market participants, reduces technical and regulatory overhead, and enables accelerated go-to-market strategies for scaling platforms and new startups. In a cost-efficiency comparison, LaaS eliminates internal market-making, but still delivers high-quality execution, a deep order book, and competitive spreads.

Visionary businesses implementing LaaS can gain a significant competitive advantage by accessing scalable, compliant, and instantly deployable liquidity solutions that can scale to meet user demand and market flows in real-time.

Conclusion

As financial markets become more digital, decentralized, and data-driven, the role of the liquidity provider is more crucial—and more dynamic—than ever.

From traditional banks and hedge funds to emerging algorithmic LPs and decentralized protocols, today’s liquidity ecosystem is a blend of speed, scalability, and strategy.

With the rise of LaaS and tighter global regulations, only those providers who adapt to change and embrace innovation will remain essential players in tomorrow’s markets. For brokers, exchanges, and traders alike, one thing is clear: understanding liquidity is no longer optional—it’s a competitive advantage.

FAQ

What does a liquidity provider do?

A liquidity provider offers continuous buy and sell quotes, allowing traders to enter or exit positions quickly, even in volatile markets.

Is a market maker the same as a liquidity provider?

Yes, a market maker is a type of liquidity provider that profits from the bid-ask spread while ensuring market activity.

Who uses liquidity providers?

Brokers, exchanges, trading platforms, and institutional investors rely on LPs to provide market liquidity and execution efficiency.

What is Liquidity as a Service (LaaS)?

LaaS enables companies to integrate third-party liquidity through plug-and-play APIs, offering real-time pricing without the need for infrastructure development.

Are LPs regulated?

Yes. In traditional finance, LPs must adhere to rules such as MiFID II and ESMA. In the crypto industry, global regulations are tightening to ensure compliance.