Triple Net Lease: Meaning, Benefits, and Strategies Explained

May 16, 2025

In commercial real estate, lease terms can differ quite a bit. One interesting type is the triple net lease, or NNN. It’s a setup where tenants handle more of the property responsibilities. This gives landlords a more hands-off investment. So, what is an NNN lease, and why do investors, big chains, and developers often prefer it?

Whether exploring passive income opportunities or looking to understand this industry-favorite structure, this guide breaks it down with clarity, insight, and real-world strategy.

Key Takeaways

- A key characteristic of triple net lease agreements is that tenants generally assume responsibility for major property operating costs.

- Properties leased to a single occupant under an NNN arrangement, known as single tenant triple net lease properties, are often favored.

- REITs, individual investors, and franchise businesses frequently seek them out due to the typical stability and degree of tenant control they offer.

- To enhance returns from NNN investments, savvy investors might employ 1031 exchanges for tax advantages, structure leases with periodic rent increases, and perform detailed capitalization rate analyses.

What Is a Triple Net Lease?

So, what is a triple net lease exactly? In commercial real estate, it’s a lease type where the tenant, beyond paying a base rent, takes on the financial load for three main operational expenditures: the property taxes, the building’s insurance, and costs related to maintenance. The very phrase ‘net net net and triple net lease’ emphasizes this pass-through of core expenses, effectively keeping them off the landlord’s accounting books.

This particular leasing model is quite common in the corporate real estate sphere. It’s frequently applied to standalone retail buildings, various office setups, and industrial facilities, often becoming the preferred arrangement when national retail chains or well-known franchises, like Walgreens, McDonald’s, or AutoZone, are the occupants.

This approach presents a clear contrast to a gross lease, under which the property owner typically shoulders most, if not all, property-related expenses. An NNN lease structure effectively transfers a significant portion of both financial and operational responsibilities directly to the tenant.

Consequently, the tenant handles local property tax payments, secures necessary insurance for the building (often with the landlord named as an additional insured party), and manages the bulk of repair and upkeep tasks. Depending on the negotiated terms, this can sometimes extend to major capital outlays, such as replacing HVAC systems or undertaking roof repairs.

Landlords like NNN leases because they can bring in steady, passive income with little day-to-day management. These leases often last a long time, offering consistent cash flow and lower risk. This makes them a good fit for real estate investment trusts (REITs) and people looking for low-effort property investments.

Tenants usually get a lower base rent in return and have more say in how the property is kept up and run. But this also means they take on more ongoing duties and need to plan their finances carefully.

Fast Fact

Triple net leases are so hands-off for landlords that many investors call them the “bond equivalents” of real estate.

How a Triple Net Lease Works?

An NNN lease is basically an agreement where the tenant pays rent plus the usual running costs of the property that a landlord might otherwise cover. The lease clearly splits what the tenant owes into two parts: a fixed base rent and the ‘pass-through’ expenses for property taxes, insurance, and maintenance. It’s structured so the tenant operates much like they own the place, without actually holding the title.

Here’s how the process typically plays out in a real-world scenario:

Lease Agreement and Allocation of Responsibilities

When a triple net lease is signed, it spells out exactly who pays for what – the landlord or the tenant. The base rent is typically lower than in a gross lease because the tenant agrees to take care of the operating costs.

Most of the time, tenants have to pay the yearly property taxes. They might pay them straight to the city or town, or they might pay the landlord back for them. They also have to insure the building, and the landlord is usually named as an additional insured person on the policy.

Maintenance tasks under an NNN lease usually include normal upkeep like yard work, pest control, HVAC checks, and clearing snow. Depending on what the lease says, the tenant might also have to pay for big repairs, like fixing the roof or structural issues. In a type called an ‘absolute’ triple net lease, the tenant handles almost everything. A standard NNN lease might still leave some major repairs for the landlord to handle.

This structure is common in tenant triple lease agreements, especially with national retailers or franchise businesses that prefer long-term control over their locations.

Rent and Expense Payments

Under a triple net lease, a tenant usually handles two main types of payments. First, there’s the base rent, a set amount paid straight to the landlord. Second are the operating costs, which the tenant might pay directly to service providers or give to the landlord as a reimbursement.

To make things simpler, some landlords estimate the annual operating costs upfront. They then collect this estimated amount from tenants in equal monthly payments. At the end of the year, they’ll do a reconciliation to adjust for any differences between what was paid and what was actually spent.

Property Management and Control

When a property operates under a triple net lease, especially in single tenant triple net lease setups, the tenant generally takes on nearly all aspects of day-to-day property management. This means they’re often the ones dealing with contractors, making sure the property meets local codes, and keeping the building in good condition according to the lease terms. Landlords usually step back, intervening mostly to ensure the lease is followed or that things like insurance coverage are properly maintained.

This way of managing a property often works well for national brands that want all their locations to look and feel consistent. For instance, a company might want to update its store design to match new branding. As long as these changes follow local zoning laws and the terms of their lease, tenants usually have the green light to make them.

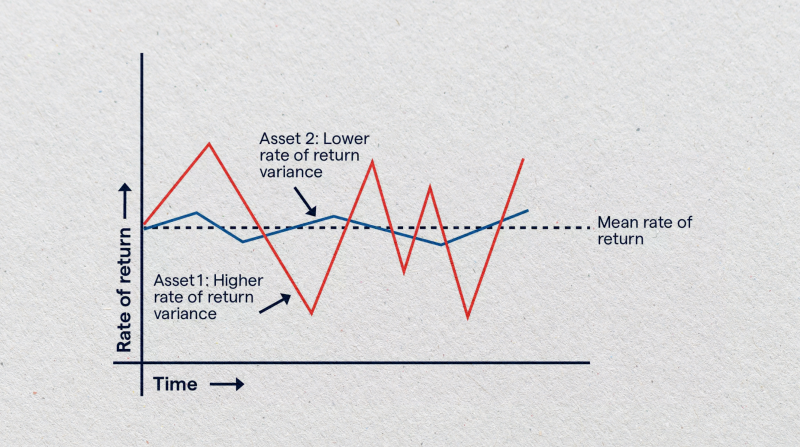

Risk and Reward Distribution

A key element of any triple net lease is how it divides up the financial risks and potential rewards. For property owners, the setup generally means a steady and fairly predictable income stream with minimal hands-on involvement in managing the property. This kind of passive income appeals to many institutional investors, REITs, and retirees looking for lower-risk, long-term financial returns.

In this lease structure, tenants take on more of the variable operational and financial aspects. This can include unexpected rises in property taxes, sudden maintenance needs, or changes in insurance costs. However, these added responsibilities often come with benefits like a lower starting rent, more control over how the property is used and maintained, and the freedom to customize their space, which can be very important in competitive business environments.

Looking at the triple net vs gross lease comparison, there’s a clear difference in approach: gross leases typically offer tenants simpler payment terms but often at a higher overall rent. NNN leases, on the other hand, usually provide tenants with more operational say and a lower base rent, but this comes with taking on more of the property’s running costs and responsibilities.

End-of-Lease Considerations

As a triple net lease period draws to a close, tenants are usually expected to return the property in a condition similar to how they received it. This could mean removing any company signs, reversing alterations made during their occupancy, and taking care of any outstanding maintenance items.

Lease agreements themselves often include options for renewal. These renewal clauses typically specify how rent will increase, perhaps by linking it to an inflation measure like the Consumer Price Index (CPI) or by setting a fixed percentage increase. This helps protect the landlord’s income from losing value over the lease term.

For tenants with long-term strategic goals, owning a single tenant triple net lease property can even be part of their overall operational plan. This approach, sometimes known in the industry as the ‘single tenant triple net lease game,’ is about using sustained property control and brand presence to their advantage over many years.

NNN Lease Investment Strategies

Unlike real estate ventures that require more active involvement, NNN lease investments tend to offer predictable cash flow, long-term occupancy by tenants, and fewer day-to-day duties for the landlord. However, getting the best results from this type of asset still means making smart choices about which properties to select, the quality of the tenants, market timing, and how these investments fit into a broader, diversified portfolio.

Below are expert investors’ key strategies to capitalise on the NNN model:

Target Investment-Grade, Single-Tenant Properties

When looking to invest in NNN properties, many find it effective to focus on single-tenant buildings leased to companies with strong, investment-grade credit. Often, these are well-known national or major regional businesses that have solid financials, such as Walgreens, FedEx, or Starbucks.

The big plus with such properties comes from the tenant’s strong credit and operational stability; these types of tenants are much less likely to miss lease payments. Moreover, these lease agreements are often long-term, typically running from 10 to 25 years, and usually include clauses for rent to go up over time.

This specific investment strategy, sometimes called the ‘single tenant triple net lease game’ by those in the industry, aims to create reliable, long-term income. Success often hinges on finding tenants who are not only financially strong but also have good strategic reasons to stay in that particular property for many years.

Evaluate Lease Terms and Rent Escalations

Thoroughly understanding the specific details within the lease document is crucial. While a true triple net lease shifts nearly all operational costs to the tenant, the way rent increases are structured can greatly impact the investment’s financial outcome over many years.

Provisions for fixed annual rent bumps, or adjustments tied to inflation indicators like the CPI, are important for protecting the investor’s actual yield from eroding due to rising costs.

Investors should also pay close attention to lease duration, renewal options, and termination rights or co-tenancy clauses that may impact long-term cash flow predictability.

Geographic and Market-Based Diversification

Just as in stock investing, spreading investments helps manage risk. Many experienced NNN investors build their portfolios by including properties across different geographic areas and various commercial types (like retail, industrial, healthcare, or office spaces).

As an illustration, putting capital into properties in fast-expanding Sun Belt states might offer a better chance for property value growth. In contrast, NNN assets in more established Midwest markets could provide more defensive, steady cash-flow opportunities.

Investors can also diversify by choosing properties in both urban and suburban locations, keeping in mind long-term population trends, local economic growth plans, and any significant infrastructure projects planned for the area.

Pay Attention to Cap Rates and Exit Strategy

Cap rate compression has been a major trend in the NNN sector. Lower cap rates often reflect lower risk, especially in deals involving high-credit tenants in prime locations. However, investors must assess whether the risk-return ratio is justified, especially if interest rates are rising.

A smart investor doesn’t just buy well — they plan the exit. Understanding how lease duration, tenant credit, and market conditions affect resale value is key to ensuring that the investment remains liquid and competitive if a disposition is necessary.

Leverage 1031 Exchanges for Tax Efficiency

A common strategy used by many seasoned real estate investors is the Section 1031 Exchange. This tax code provision allows them to defer paying capital gains taxes when they sell one investment property and quickly reinvest the proceeds into another similar NNN property.

Because triple net leases often meet the passive-income and long-term hold criteria required by the IRS, they’re frequently used to complete like-kind exchanges, allowing investors to roll equity forward tax-deferred and scale up their portfolios efficiently.

This strategy is especially common among retirees and legacy planners seeking to rebalance management-heavy assets (like multifamily or retail centers) into hands-off NNN deals.

Work with Niche Brokers and Underwriting Experts

The triple net lease model is a common fixture across many areas of the commercial real estate world. While both property owners and tenants can find advantages in this structure, the specific parties drawn to triple net lease agreements—and their motivations—often differ significantly based on individual strategic aims, risk comfort levels, and day-to-day operational requirements.

A deal may look attractive at face value. Still, the triple net lease meaning can shift significantly depending on local tax trends, insurance volatility, or deferred maintenance risks not covered in a shallow due diligence process.

Balance Yield with Risk Tolerance

While the triple net vs gross lease debate often focuses on operational simplicity, the financial side tells a deeper story. NNN leases typically yield lower initial returns than value-add or development plays — but they offer superior predictability and risk-adjusted performance.

Higher cap rates often indicate greater risk: a dollar store in a rural area may offer a 7% cap rate, while a Walgreens in a dense metro might yield only 4.5%. The difference reflects tenant quality, lease term, location liquidity, and likelihood of lease renewal.

Investors must align their risk tolerance, cash flow goals, and timeline with the specific attributes of the property and lease.

Who Uses Triple Net Leases?

Triple net leases are a favored structure across a broad spectrum of the corporate real estate ecosystem. While the model benefits both landlords and tenants, the type of parties who use triple net leases — and their reasons for doing so — can vary significantly based on their strategic goals, risk tolerance, and operational needs.

Let’s explore the main players who actively use and benefit from NNN leases.

Institutional and Private Real Estate Investors

Among the primary adopters of triple net lease arrangements are large-scale institutional investors. This group includes entities like REITs, managers of pension funds, insurance companies, and private equity firms focused on real estate. For these organizations, the priority is often on securing stable, long-duration income flows that require minimal hands-on asset management—a goal that aligns well with what a triple net lease typically offers.

Since the tenant in an NNN setup takes on the costs of property taxes, insurance, and upkeep, these investors can often anticipate a more predictable net operating income (NOI). Such financial consistency proves especially valuable for portfolios structured around meeting long-term obligations, like funding retirement payouts or delivering regular dividends.

Individual private investors, too, often seek out NNN properties. This includes high-net-worth individuals (HNWIs) and those involved in 1031 tax-deferred exchanges. They frequently see these properties as a source of passive income, especially when compared to more management-intensive real estate categories like apartment buildings or hotels. In fact, it’s not uncommon for real estate professionals to refer to single tenant triple net lease properties as being akin to ‘bond alternatives’ in the property investment landscape.

Corporate Tenants and Franchise Operators

From the tenant’s viewpoint, major corporations and national franchise businesses are significant users of triple net lease agreements. Well-known brands such as Walgreens, McDonald’s, AutoZone, Dollar General, and Starbucks frequently opt for long-term single tenant triple net lease setups. These allow them to maintain consistent operational control over their business locations without the capital commitment of actually owning the property.

This lease model enables businesses to expand their footprint more rapidly by keeping capital free for core operations and by minimizing real estate liabilities on their balance sheets. The tenant gains extensive day-to-day control of the property, which helps in applying consistent branding, upholding uniform maintenance standards, and having the flexibility to implement store redesigns or other operational changes with little need for landlord approval.

Franchise operators, particularly in sectors like fast food, healthcare services, and convenience retail, also find NNN leases useful. This structure allows them to manage their business premises effectively while often benefiting from lower, predictable base rents. It can be a win-win: landlords secure dependable tenants, while tenants gain substantial control over their operational environment.

Developers and Build-to-Suit Specialists

Commercial developers often structure their projects around build-to-suit triple net leases, where the property is custom-built to a tenant’s specifications and leased under long-term NNN terms. This model ensures that the asset is fully pre-leased before construction begins, lowering the risk for the developer and creating a valuable, income-producing property from day one.

This is particularly common in retail, medical, logistics, and even data center developments, where tenants require tailored spaces and are willing to commit to 10- to 25-year leases in exchange for control and customization.

For developers, the goal is to create and sell stabilised NNN assets to passive investors at a profit, often using cap rate arbitrage as the spread between construction cost and market valuation.

Family Offices and Legacy Estate Planners

Family offices and individuals in legacy estate planning frequently allocate capital to triple net lease commitments. Their primary motivation is wealth preservation and income stability over speculative growth.

Because NNN leases require minimal landlord involvement and provide long-duration cash flows, they are ideal for portfolios emphasising low volatility and predictable returns. In these cases, single-tenant triple net properties can be generational assets passed down while providing a consistent yield.

Tax-deferred strategies like 1031 exchanges are often employed to transition active real estate into more passive triple-net lease holdings.

Real Estate Brokers and Syndicators

Brokers and investment syndicators are critical in connecting buyers with NNN opportunities. They facilitate transactions between developers, private equity funds, REITs, and individuals seeking passive income.

Syndicators may also pool capital from multiple investors to acquire NNN properties and distribute income through partnership shares or private REIT structures. These investment vehicles often focus on acquiring portfolios of single-tenant triple-net lease properties diversified by geography and tenant type.

Conclusion

Triple net leases are more than legal agreements — they’re a proven strategy for earning stable, long-term returns with minimal landlord involvement. By passing property charges, insurance, and repair costs to the tenant, NNN leases provide a hands-off, bond-like income stream.

In today’s market, where stability matters more than ever, understanding how triple net leases work can give you a clear advantage. Especially in single-tenant setups, the NNN model offers one of the most reliable paths to passive income and portfolio growth.

FAQ

What does triple net lease mean?

A lease in which the tenant is responsible for covering property taxes, indemnity, and maintenance, along with the rent.

Who typically signs NNN leases?

National retailers, franchisees, REITs, and passive real estate investors.

What does the landlord pay in a triple net lease?

Usually, there is nothing beyond scheduled structural replacements, depending on the lease.

How is a triple net lease different from a gross lease?

In a gross lease, the landlord pays expenses. In NNN, the tenant does.