What Is Crypto Exchange Liquidity? How Does It Influence a Platform’s Performance?

Mar 15, 2024

As Bitcoin continues to rise in price, with its value inching closer to its all-time high of $69,000, the cryptocurrency market is experiencing a surge of new capital arrivals. One major contributor to this influx of funds is spot Bitcoin ETFs, which brought net inflows of $562 million in just one day on March 4, 2024.

What does it mean for the broader crypto market? As more and more investors are turning to cryptocurrencies, the overall liquidity is also growing. This is good news for traders, as crypto exchange liquidity contributes greatly to the effectiveness and performance of these trading platforms.

In this article, we will delve into the concept of liquidity in cryptocurrency exchanges, the factors that affect it, and strategies for improving it.

Key Takeaways

- High liquidity in crypto exchanges is an important factor for trading, better prices, and a stable market.

- Centralised exchanges act as intermediaries, while decentralised ones operate on a peer-to-peer basis, both offering different levels of liquidity.

- Factors such as the number of participants, trading volume, market conditions, and presence of market makers can impact exchange liquidity.

- Proof-of-Reserves is a concept that aims to increase transparency and assurance regarding the reserves held by exchanges.

What Is Crypto Liquidity?

The cryptocurrency market offers thousands of virtual assets for traders and investors, from well-known cryptocurrencies like Bitcoin to lesser-known coins. However, amidst all this diversity, one aspect remains crucial for market participants: liquidity.

This concept refers to the ease and speed at which an asset can be bought or sold on the market. High-liquidity assets are those that can be easily traded, with a large number of buyers and sellers present in the market at any given time. On the other hand, illiquid assets have fewer buyers and sellers, making it harder to buy or sell them quickly.

Crypto Asset Liquidity vs Crypto Exchange Liquidity

Crypto liquidity can be divided into two categories: crypto asset liquidity and crypto exchange liquidity.

Asset Liquidity

High asset liquidity means that a large number of buyers and sellers are actively trading the asset, leading to minimal impact on its price when buying or selling. Liquidity can also indicate the stability of a particular asset, as assets with higher liquidity tend to have less volatile price fluctuations.

Examples of highly liquid cryptocurrencies:

- Bitcoin

- Ethereum

- BNB

- Solana

Exchange Liquidity

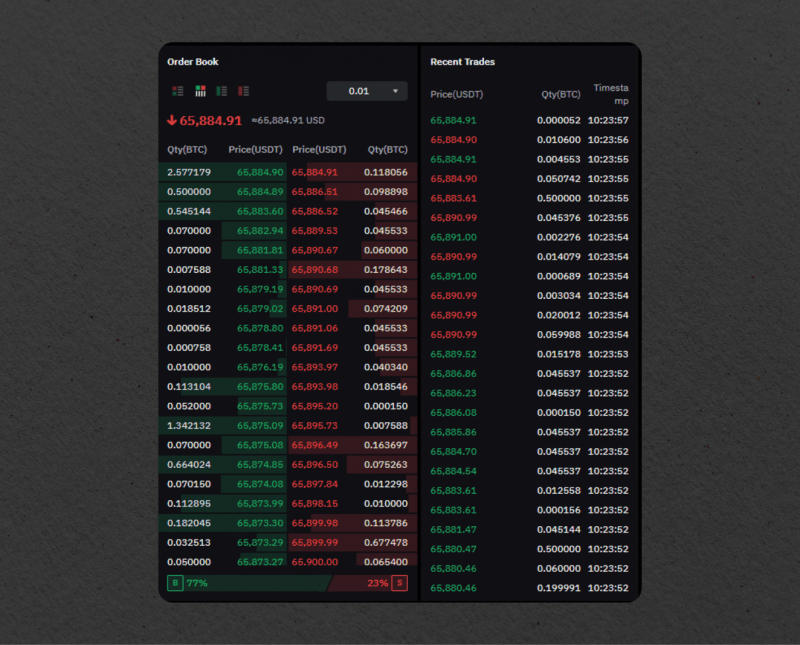

Crypto exchange liquidity is the ability of a particular cryptocurrency exchange to facilitate large trades without significantly affecting the market price. This type of liquidity is important for traders and investors who want to buy or sell large quantities of a particular cryptocurrency without causing drastic price changes.

Factors that can affect crypto exchange liquidity include transaction fees, trading volume, and order book depth. Exchanges with high liquidity usually have a large number of active users, high trading volume and deep order books.

Why Is High Liquidity Important for Crypto Traders?

High liquidity in a crypto exchange is vital for traders for several reasons.

- It allows for faster execution of trades: This is necessary in fast-paced markets where prices can change rapidly. With high liquidity, traders can enter or exit positions without facing significant price slippage.

- It provides traders with better pricing opportunities: With a large number of buyers and sellers in the market, bid-ask spreads tend to be tighter, reducing the cost of trading. Tight spreads mean that traders can buy at lower prices and sell at higher prices, maximising their potential profits.

- It helps maintain market stability: When there is a significant volume of trading activity, large orders are less likely to cause sudden price movements.

Centralised vs Decentralised Market Liquidity

There are two main types of market structures when it comes to crypto exchange liquidity: centralised and decentralised.

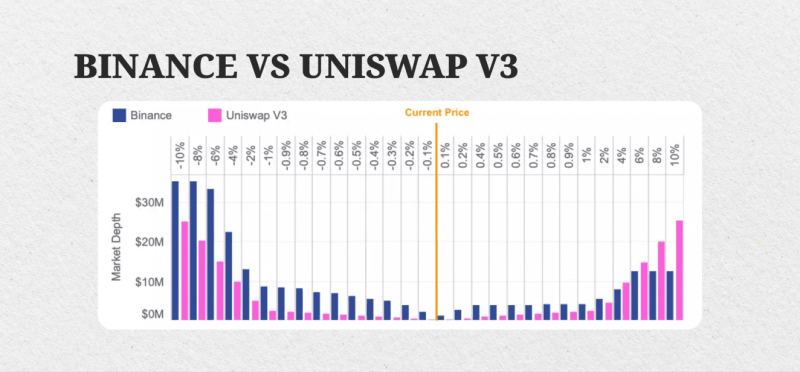

Centralised exchanges (CEXs) act as trusted third parties, holding user funds in custody and matching buy and sell orders. These venues typically have higher liquidity due to their large user base and established reputation. They offer a wide range of trading pairs and have faster execution times.

Examples:

- Binance

- Coinbase

- ByBit

Decentralised exchanges (DEXs), on the other hand, operate on a peer-to-peer basis without a centralised authority. They use smart contracts to facilitate trading directly between users, eliminating the need for intermediaries.

Examples:

- Uniswap

- dYdX

- Raydium

Factors Influencing Crypto Exchange Liquidity

Several factors influence the liquidity of a cryptocurrency exchange:

- Number of Participants: The number of active traders on an exchange has a major impact on liquidity. A higher number of participants increases the supply and demand for cryptocurrencies, making it easier to find trading partners and execute trades.

- Trading Volume: The trading volume of a cryptocurrency is a key indicator of its liquidity. Higher trading volumes indicate a more liquid market, as there is a larger pool of buyers and sellers.

- Market Conditions: Market conditions and economic factors can significantly impact the trading environment. During periods of market uncertainty or economic downturns, liquidity can dry up quickly as traders become more cautious and less willing to buy or sell. Conversely, during periods of positive market sentiment, liquidity may increase as more participants enter the market.

- Market Maker Presence: The presence of market makers or big players can elevate trading volumes in an exchange.

How Liquidity Is Supported on Different Types of Exchanges

Different types of exchanges have different approaches to supporting liquidity in the market. Let’s look at how centralised and decentralised platforms achieve this goal.

Liquidity on CEXs

Centralised exchanges have several mechanisms in place to support liquidity on their platforms. These include:

- Market Making: CEXs often employ market makers (liquidity providers) to create liquidity for certain trading pairs. These are special companies that buy and sell assets on the exchange to maintain a stable market and ensure there is always someone to buy or sell from.

- Trading Incentives: Centralised exchanges usually offer trading incentives to encourage users to provide liquidity. These can include reduced trading fees or rewards for market makers.

- API Access: Many CEXs offer API access to their order books, allowing third-party trading bots and algorithms to participate in the market. This can increase liquidity by providing more buying and selling activity.

- Liquidity Aggregation: Some CEXs use liquidity aggregation platforms to combine liquidity from multiple sources, making it easier for users to find the best prices and execute trades quickly.

Liquidity on DEXs

Decentralised exchanges have a different approach to supporting liquidity, as they do not have centralised control over the market. Some strategies used by DEXs include:

- Automated Market Makers (AMMs): DEXs often use AMMs, which are smart contracts that automatically adjust token prices based on supply and demand. This creates a more liquid market by ensuring there is always a price available to buy or sell at.

- Liquidity Mining: DEXs incentivise users to provide liquidity by rewarding them with additional tokens. This encourages users to lock up their funds in liquidity pools, increasing the overall crypto market liquidity.

- Cross-chain Swaps: DEXs that support cross-chain trading also help to increase liquidity by allowing users to trade assets from different networks. This opens up more trading opportunities and attracts a larger user base.

- Decentralised Price Oracles: Price oracles are used to provide accurate and timely price information for assets on a DEX. These help to maintain liquidity by keeping prices consistent with the overall market.

Challenges to Achieving Optimal Liquidity in Crypto Exchanges

While liquidity is crucial for a well-functioning crypto exchange, there are several challenges that platforms may face in achieving optimal liquidity. These challenges can impact the trading experience for users and create inefficiencies in the market.

- Fragmentation: The liquidity of cryptocurrencies is often fragmented across multiple exchanges. Traders sometimes may need to navigate different exchanges or use aggregator platforms to access the liquidity they want.

- Liquidity Gaps: Liquidity gaps occur when there are significant discrepancies in liquidity between different trading pairs or time intervals. This can cause price slippage and hinder the execution of trades at the desired price.

- Lack of Standardisation: Different exchanges may have varying trading rules, order types, and fee structures, confusing traders when it comes to comparing liquidity across platforms. This lack of standardisation can create fragmentation and inefficiencies in the market.

- Regulatory Uncertainty: Regulatory uncertainty surrounding cryptocurrencies can also impact liquidity. Unclear or restrictive regulations in certain jurisdictions may deter market participants and limit the availability of certain assets.

Strategies for Improving Crypto Exchange Liquidity

Crypto exchanges today use a variety of strategies to enhance the experience for their users. These strategies aim to attract more participants, increase trading volumes, and create a more liquid market environment.

- Partnerships with Liquidity Providers: Collaborating with institutional investors or market-making firms can help exchanges enhance their liquidity.

- Market Maker Programs: These programs incentivise big players to place buy and sell orders on the exchange’s platforms.

- Enhanced Trading Features and Bonuses: Introducing advanced trading features, such as stop-loss orders and margin trading, as well as NFTs, DeFi features and passive income opportunities, will be a great advantage when it comes to marketing.

- Listing Popular Coins and Tokens: Listing popular or trending currencies can also encourage inflows of traders to the venue. Such cryptocurrencies have established markets and active trading communities, which is perfect for growing your user base.

What Is Proof-of-Reserves?

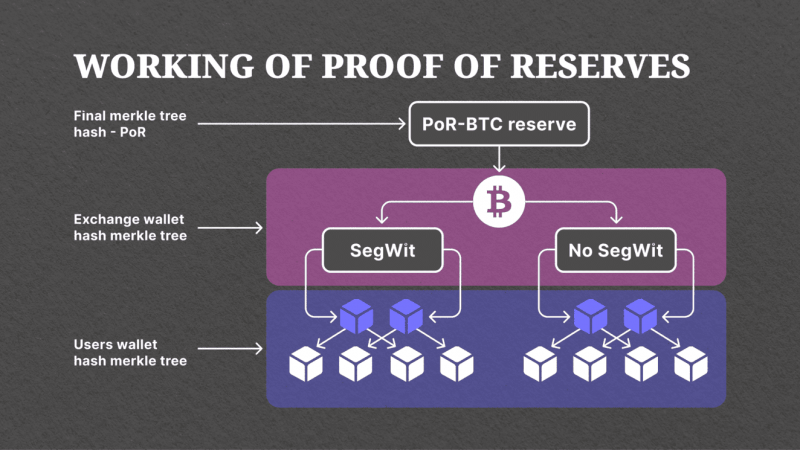

Proof-of-Reserves (PoR) is a concept that aims to establish transparency and assurance regarding the reserves held by a crypto exchange and their liquidity.

It involves verifying that the digital assets held by the exchange on behalf of its customers correspond to the number of assets claimed by the exchange. PoR audits are typically conducted by third-party auditors who analyse the exchange’s holdings and liabilities to ensure they match and publish the results for public consumption.

The results of these audits are then made publicly available for verification. These reports provide a snapshot of the exchange’s reserves, including the amount of Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) held.

The goal of PoR is to reduce the chances of exchanges misusing customer funds or experiencing liquidity issues. PoR audits help exchanges demonstrate their solvency and provide assurance to traders that their funds are secure and available for withdrawal at any time.

Fast Fact

The need for PoR became apparent after the high-profile collapse of FTX in November 2022, which left investors questioning the safety of their funds on centralised platforms. This incident highlighted the need for exchanges to demonstrate their solvency and reassure customers that their assets are secure.

How Does It Work?

The PoR process involves several steps to verify the exchange’s reserves, which typically include the following:

- Snapshot of Liabilities: The auditor generates a snapshot of the exchange’s liabilities, which represents the total amount of customer deposits held by the exchange.

- Verification of Ownership: The auditor verifies the ownership of the exchange’s crypto assets by requesting a digital signature from the private keys corresponding to the exchange’s addresses.

- Verification of Asset-to-Liability Ratio: The auditor ensures that the exchange’s assets exceed the liabilities, confirming that the exchange holds sufficient reserves to cover customer deposits.

Some exchanges also implement customer verification measures to enhance transparency. These measures involve aggregating customer account balances into a Merkle tree, which allows auditors to verify the inclusion of individual customer accounts without disclosing specific account balances.

Closing Thoughts

The recent surge in the market, led by Bitcoin’s rally, is propelling the overall sector’s liquidity. USDT, one of the leading stablecoins, for example, has reaped the benefits of this boom, reaching a market capitalisation of $100 billion for the first time since its inception. All of this is contributing to more participants joining the market, which favourably influences the exchanges’ liquidity.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQ

Which crypto exchanges have the most liquidity?

As of March 2024, the top cryptocurrency exchanges with the highest liquidity are Binance, Coinbase, OKX and Bybit. These exchanges have a large number of traders and investors actively buying and selling cryptocurrencies on their platforms.

What is the best crypto liquidity provider?

There is no single “best” crypto liquidity provider, as different providers may excel in different areas depending on your specific needs. However, some top-rated and well-respected providers as of 2024 include Galaxy Digital Trading, GSR Markets, Empirica, and B2Broker.

Which is the safest crypto exchange?

The safest crypto exchange is one that prioritises security measures and has a strong reputation within the industry. Some popular options include Kraken and Coinbase.

Kraken is known for its strict compliance with financial regulations and its dedicated security team. They have also never been hacked since their establishment in 2011. Coinbase, on the other hand, has a strong reputation for its security measures, such as storing 99% of digital assets in offline cold storage and requiring phone number validation for additional protection.