What Is Cryptocurrency Liquidity? A Complete Guide for Brokers & Exchanges

May 29, 2021

Aug 12, 2025

Crypto markets are among the most fragmented ever built—over 17,000 cryptocurrencies exist in 2025, with around 10,000 actively traded. In this environment, liquidity directly affects how your brokerage platform fills orders, handles volatility, and scales as volumes grow.

Weak liquidity leads to slippage, missed trades, and user churn. Strong liquidity improves execution, protects your P&L, and creates room for stable expansion.

This guide breaks down how cryptocurrency liquidity actually works across different sources, how to evaluate it, and how to build a setup that supports long-term growth and operational resilience.

Key Takeaways:

- Real liquidity shows up in tight spreads, deep order books, and low slippage during execution.

- Liquidity drives everything. It impacts execution quality, client trust, risk exposure, and how far your platform can scale.

- CeFi and DeFi offer different trade-offs. CeFi provides speed and depth; DeFi offers transparency, but adds smart contract and fee risks.

- Aggregation solves fragmentation. A Prime-of-Prime setup brings together multiple liquidity streams into one solution.

What Is Сrypto Liquidity?

Before we break down liquidity in operational terms, it’s worth revisiting what it means in the first place.

Liquidity is a measure of how easily an asset can be bought or sold without causing a significant change in its price. It is the engine of efficient price discovery and the foundation of price stability.

If you place a market order, how much of it gets filled immediately, at a price close to what you expected? The more that gets filled cleanly, the more liquid the market is.

In crypto, this becomes harder to manage. With thousands of tokens, dozens of venues, and highly uneven trading activity, cryptocurrency liquidity isn’t guaranteed, even on assets with large total market capitalization. Unlike traditional, highly liquid markets, crypto can be thin and unpredictable. A token can show $500 million in daily volume and still slip 2% on a $50,000 order if its depth is thin or fragmented.

Сrypto Liquidity Is More Than Just Trading Volume

Many still assume that high trading volume equals strong liquidity. It doesn’t. You can have billions in daily volume, but if trades are thinly spread or concentrated in illiquid pairs, the order book remains shallow, and the result is slippage, delays, and losses.

Institutional brokers understand that real liquidity is more than velocity. It’s about whether the market can absorb a meaningful size without breaking. That requires looking beyond volume to three practical liquidity measures:

Market Depth

Market depth shows how much capital sits in the order book—on both the buy and sell side—at or near the current price. A “deep” book can absorb large trades without distorting the price. A shallow book might fill a $5,000 market order instantly, but struggle with a $500,000 order, spreading it across less favorable price levels and creating slippage.

Depth isn’t static. It changes minute to minute, driven by shifting market dynamics and sudden changes in market sentiment, especially around news events or volatile tokens. Professional platforms monitor depth per pair, per venue, and per time-of-day—because execution quality depends on more than just what the book looks like at 12:00 UTC.

Bid-Ask Spread

The spread is the gap between the best available buy and sell prices. When liquidity is deep, the spread tightens. It directly affects the trader’s cost per order, especially for market takers.

Retail trading platforms can get away with wide spreads. Brokers competing for institutional flow can’t. Spread compression is one of the strongest signals of competitive cryptocurrency liquidity, and an easy metric to track across providers.

Slippage

Slippage is the delta between the price a client sees and the price they actually get. It’s what happens when an order exceeds the available liquidity at the expected price level and has to “walk the book.”

In crypto, where price movements can be sharp and sudden, slippage is a source of client churn and platform-level margin loss. Brokerages with weak liquidity often mask the issue with guaranteed fill logic, but over time, those costs add up in the backend.

CeFi vs. DeFi Liquidity

Crypto asset liquidity comes from two structurally different markets: centralized (off-chain) and decentralized (on-chain). Each has its own structure, risks, and operational implications for brokers.

Off-Chain Liquidity (CeFi)

Centralized exchanges (CEXs) and OTC desks offer deep cryptocurrency liquidity built on the classic order book model. Execution is fast, and capital is pooled from institutional market participants. That makes CeFi liquidity well-suited for high-frequency trading strategies and institutional flow.

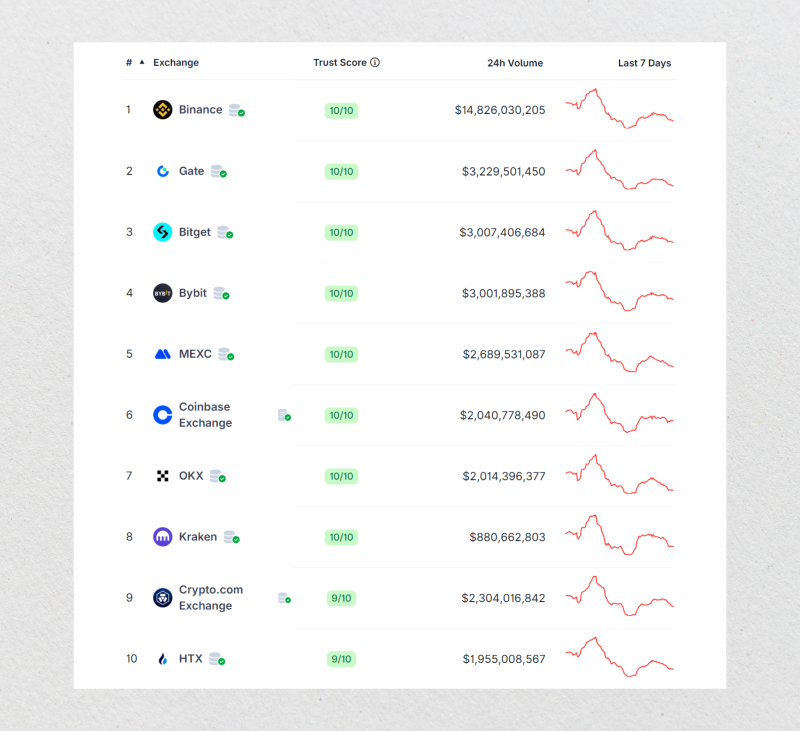

But it’s fragmented. With over 210 active exchanges globally, the best price for a given asset might sit on a venue you’re not connected to. CeFi also carries custodial risk: funds are held with third parties, and order flow is exposed to opaque internal routing.

On-Chain Liquidity (DeFi)

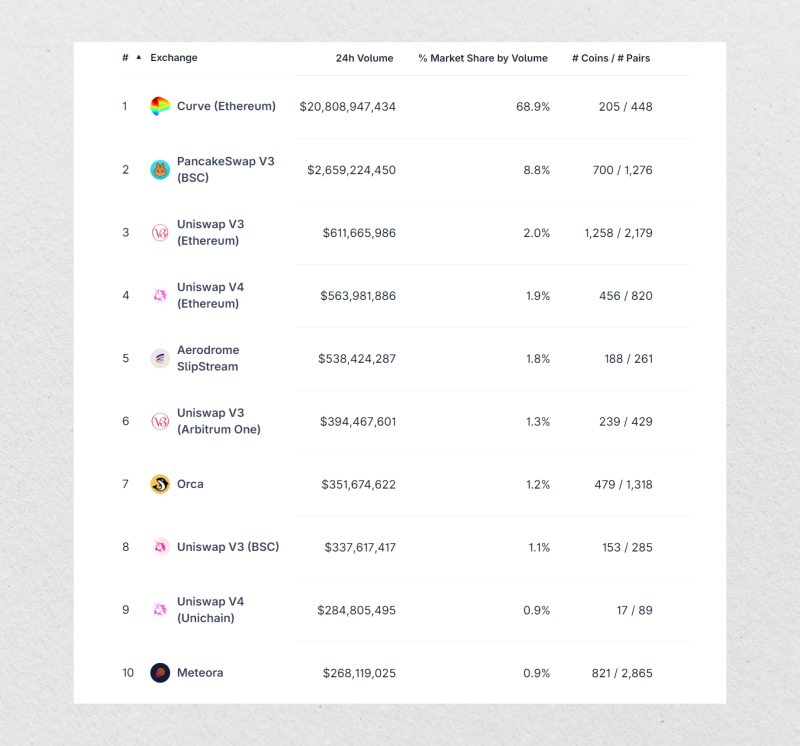

DeFi liquidity lives inside smart contracts—usually via Automated Market Makers (AMMs) like Uniswap. Access is permissionless, and transparency is built-in: every transaction is traceable, every liquidity pool visible.

However, execution is slower, and costs vary. Gas transaction fees apply per trade, especially during network congestion. There’s also protocol risk. According to Chainalysis, DeFi platforms were the primary target of over $2 billion of crypto exploits in 2024. Smart contract audits help, but they don’t eliminate risk.

How to Measure and Monitor Liquidity in Crypto Markets

Understanding the cryptocurrency liquidity conceptually is one thing, but managing it in production is another. Brokerages that treat liquidity as a “feel-based” metric end up reacting to problems after clients complain. Professional platforms treat it as a measurable, continuously monitored system component.

Key Performance Indicators (KPIs) for Liquidity

There are three core KPIs that give a real-time picture of market liquidity performance:

- Fill Rate — The percentage of client orders that are fully executed at the requested volume. A low fill rate suggests insufficient depth or poor routing. Anything below 95% in normal market conditions is a concern.

- Average Slippage (by order size) — Slippage should be measured across multiple trade sizes. For example, 0.1% slippage on a $1,000 order is fine; the same slippage on a $100,000 order is a red flag.

- Spread Volatility — How much does the bid-ask spread widen during volatile periods or news events? Spreads that swing unpredictably under pressure signal shallow liquidity and limited depth across venues.

Tracking these KPIs over time—by asset, by session, and by volume band—gives insight into the real behavior of your liquidity.

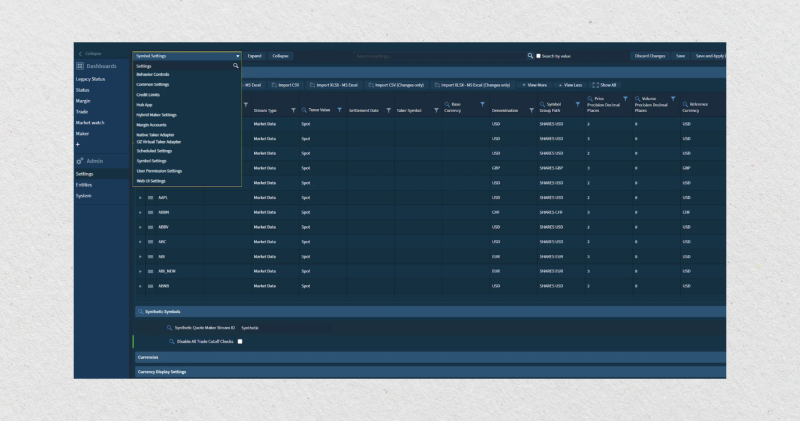

Technology for Real-Time Monitoring

Modern brokerages integrate real-time dashboards and custom API-based tools to track liquidity health. LPs often provide visual dashboards with latency, spread, and depth snapshots—but relying solely on vendor views creates blind spots.

Instead, top firms build independent monitoring systems, often tied directly to their execution engine or OMS. These tools track slippage, failed orders, and order queue depth in real time, flagging degradation before clients notice.

Why Stress-Testing Your Liquidity Is Important

KPIs are useful in normal conditions, but what happens when the liquid market spikes?

Stress testing your liquidity setup means simulating large orders, high volatility, or latency issues to evaluate how your infrastructure and provider behave under pressure. Does the fill rate collapse? Does slippage explode? Does execution stall altogether?

The best providers offer sandbox environments or load-testing support, so your team can rehearse for worst-case scenarios instead of guessing how they’ll play out.

Why Strong Liquidity Is the Foundation of a Healthy Brokerage

For a brokerage’s management, securing deep cryptocurrency liquidity is a core business function that directly impacts the bottom line.

- It Drives Execution Quality and Client Retention

Low slippage and tight spreads keep execution consistent. That improves client satisfaction and retention. Traders who trust their fills stay longer and move more volume through the platform.

- It Supports Scaling Without System Failures

When volumes rise, liquidity needs to match. If the order book can’t handle size or velocity, trades get delayed, prices degrade, and errors pile up in the backend. Liquidity is what lets platforms scale without breaking workflows.

- It Reduces Financial Exposure

During fast-moving financial markets, every millisecond matters. A thin book caused by low liquidity turns normal volatility into serious losses—missed fills, liquidations, or sudden balance shifts. Without depth, your risk engine can’t act in time.

- It Simplifies Product Expansion

Launching new assets requires more than just listing them. The liquidity behind each instrument needs to be stable and accessible. If that’s in place, adding new pairs is fast and operationally safe.

How to Source and Manage Crypto Liquidity: A Broker’s Options

There’s no one-size-fits-all approach. Liquidity sourcing strategies differ based on business model, client base, asset range, and infrastructure maturity. But in practice, most brokerages move between several options.

Direct Exchange Integrations — The DIY Approach

This model connects your platform directly to multiple centralized exchanges via their APIs. You pull Bitcoin liquidity independently from each venue, handle authentication, routing logic, and capital management internally.

It gives you full visibility and control—but at a steep cost. Maintaining connections to 10+ exchanges means dealing with different API formats, throttling rules, rate limits, and reconciliation processes. You’ll need engineers maintaining adapters full-time, plus capital allocated to each venue.

Worse, the order books across those venues are fragmented. The best price for BTC/USDT might sit on Exchange A at 9:00, and on Exchange B five minutes later. If you’re not fast enough—or integrated widely enough—you miss it.

Benefits:

- Full visibility and control

- Access to raw order books and native depth

- No dependency on aggregators or intermediaries

Trade-offs:

- Requires ongoing engineering work to maintain connections, format conversions, and rate-limit compliance

- Capital must be spread across venues, increasing operational complexity

- Fragmented liquidity: best prices move between venues constantly

This approach suits large, infrastructure-heavy players that want full control and have the resources to manage that complexity. For most brokers, it becomes unsustainable beyond a few venues.

OTC Desks — The Specialist Approach

OTC desks offer a way to source significant cryptocurrency liquidity off the public book, often via direct negotiation or request-for-quote (RFQ). They’re ideal for block trades, treasury operations, or clients moving size without triggering price slippage.

OTC isn’t designed for retail flow or high-frequency execution. Pricing isn’t always instant, and coverage may be limited to specific pairs or regions. Integration is typically manual or semi-automated via chat, ticketing, or API bridges.

Use cases:

- Executing large trades without price impact

- Rebalancing internal treasury

- Hedging exposure outside of market trading hours

Limitations:

- Not suited for high-frequency algorithmic trading, API-driven flow

- Pricing may require human intervention or a delayed response

- Limited to specific assets and regions

For specific use cases (hedging exposure, onboarding institutions, or moving large volumes without disrupting the market), OTC is an essential piece of a broader cryptocurrency liquidity strategy.

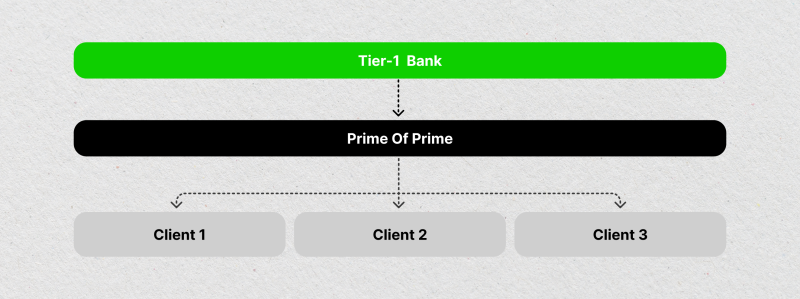

Prime-of-Prime (PoP) Aggregation — The Professional Solution

Prime-of-Prime providers offer aggregated cryptocurrency liquidity from multiple sources (centralized exchanges, OTC desks, and even DeFi protocols) through a single connection.

Instead of maintaining 10 integrations or 10 capital accounts, you access a unified stream via one API. The PoP handles aggregation, smart routing, and execution optimization behind the scenes.

Why it works:

- You get multi-venue depth without managing 10+ APIs

- Capital stays centralized, and high market efficiency

- Smart routing, risk controls, and reporting come built-in

What to check:

- Is the routing logic transparent and auditable?

- Does the PoP give visibility into upstream sources?

- Are spreads, slippage, and fill rates consistent under load?

This model drastically reduces complexity and capital fragmentation, while still giving access to deep, multi-venue liquidity. It’s ideal for multi-asset brokers who need professional-grade execution without running a connectivity engineering team in-house.

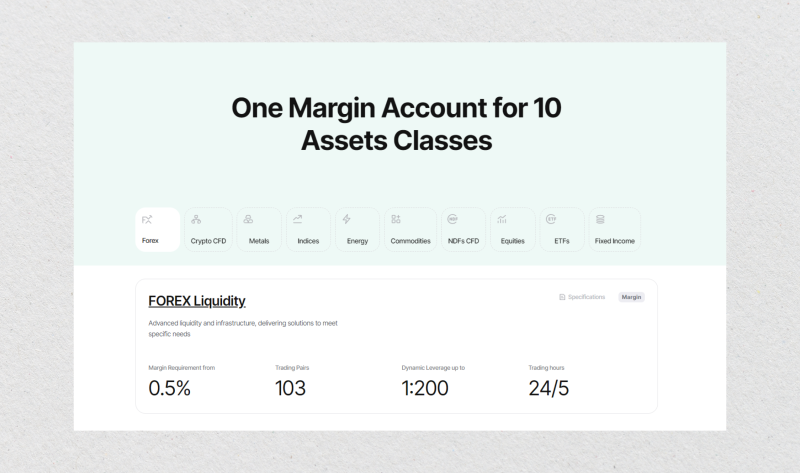

Liquidity providers like B2BROKER streamline this model further, providing Prime-of-Prime liquidity across 10 asset classes through a single margin account, so brokers can access Forex, Crypto, Commodities, and other financial markets without managing multiple integrations or capital pools.

Explore B2BROKER’s Liquidity Offering

Next Steps: Finding Your Cryptocurrency Liquidity Provider

Understanding cryptocurrency liquidity is only the starting point. The next step is operational: selecting the partner who’ll power your execution, risk controls, and expansion.

The best providers combine reliable technology, strong regulatory practices, transparent pricing, and responsive support. Those are the qualities that separate an infrastructure vendor from a long-term liquidity partner.

Ready to compare providers?

See our list of top liquidity providers on the market today.

FAQ

Is high trading volume a guarantee of liquidity?

Not necessarily. Wash trading and fake volume are systemic issues in cryptocurrency markets. In fact, a Forbes report suggested that over half of Bitcoin’s reported volume in some periods came from artificial trading. Always dig deeper than surface-level numbers when evaluating cryptocurrency liquidity.

How does slippage work in digital asset trading?

Slippage happens when there’s not enough liquidity at the expected price. A large order “walks the book,” filling at worse levels than quoted, resulting in a higher cost for the trader.

Can on-chain data alone tell me how liquid an asset really is?

On-chain data helps, but it can be misleading. Techniques like wash trading and automated market maker behavior can create illusions of liquidity. Reliable assessment requires combining on-chain signals with order book analytics and execution testing.