9 Growth Stocks That Can Thrive in a Labor Shortage

Feb 05, 2022

The difficulty to hire new employees and a labor scarcity are often expressed concerns by business CEOs navigating the Great Resignation. The race for talent in the face of acute labor shortages and the pandemic highlights the critical elements of a company's connection with its employees — including compensation, perks, and flexibility, as well as the manner in which they promote and train their personnel.

Employer-Friendly

9 Stocks Well-Positioned to Take Advantage of Labor Shortage, Excellent Resignation

Omens adds that inefficient labor practices reduce output. Over-reliance on part-time or contract work also receives negative grades, in part because it might result in lower levels of employee loyalty and turnover. Over the last year, earnings announcements have highlighted several labor-related difficulties. FedEx (FDX), which depends on independent contractors, highlighted labor difficulties last autumn when it posted weaker-than-expected first-quarter results.

However, United Parcel Service (UPS), which employs unionized workers and pays a higher rate, has outperformed competitors. Its stock has also excelled, rising 41% in the last year, outpacing the S&P 500's 17% gain, while FedEx's shares have fallen 0.9 percent. The issue is almost certain to persist.

One in ten workers questioned by the Conference Board this month said that they intended to leave their companies within the next six months, with 45 percent claiming higher salary and 28 percent noting the opportunity to work from anywhere as the reason. Investors' interest in labor-related indicators is rising and may gain more impetus as the Securities and Exchange Commission contemplates mandating corporations to disclose "human capital" information.

These may contain data relating to employee attrition, remuneration, perks, skill development, and training, as well as demographic information.

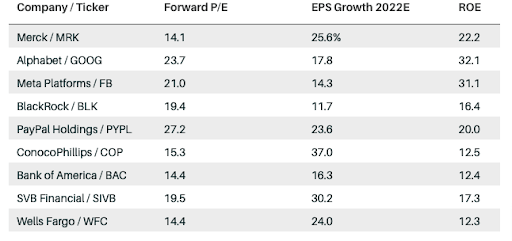

Barron's reviewed Just Capital's list of firms that rate well on a variety of employment-related measures for those with profits growth equal to or more than the average S&P 500 company at 10%, as well as those trading at a discount to the market, or less than 20 times projected earnings. Further screening for firms having a double-digit return on equity as a proxy for quality resulted in the identification of nine equities for further examination.

The list includes technological heavyweights such as Alphabet (GOOGL), which is one of the 11% of Russell 1000 businesses that disclose intersectional demographic data on its employees by gender, race, ethnic origin, and job type according to Just Capital. In the philosophy of "you cannot change what you cannot see," this sort of disclosure distinguishes the organization, particularly in light of its goal to increase the representation of underrepresented groups in senior positions by 2025.

PayPal Holdings (PYPL), which reported dismal profits and lowered its growth estimates, ranks highly on Just Capital's ranking of companies in terms of workers. One explanation is that the firm examines its workforce's financial health using measurements such as net disposable income and adjusts remuneration to ensure employees earn enough to fulfill basic necessities. PayPal also focuses on financial wellbeing, including financial coaching and stipends for remote work, and has committed to closing the worldwide gender pay gap and the ethnic pay gap in the United States by 2020, according to Just's analysts. However, the corporation may face some difficulties in the meantime while it concentrates on fewer consumers who generate more revenue.

According to Just Capital, Bank of America (BAC) also discloses more information on its workforce and is pursuing pay equity measures. Additionally, the bank increased its hourly minimum wage to $21, with the goal of increasing it to $25 by 2025 and mandated that all vendors pay an hourly minimum salary of at least $15.

BlackRock (BLK) ranks at the top of financial services businesses in terms of employee salaries, benefits packages, and measures to promote work-life balance. Larry Fink, the head of the investment firm whose assets recently surpassed $10 trillion, highlighted the shift in the relationship between employees and employers during the pandemic, telling corporate leaders that expecting workers to report to work five days a week, never discussing mental health, and offering low and middle-income workers static wages are relics of the past.