Big Oil Is Spending Serious Money On Clean Energy

Feb 17, 2022

In the midst of the energy revolution, the renewable and low-carbon energy industries have seen unprecedented investments as governments, public organizations and businesses redouble their commitment to climatic targets. According to Bloomberg New Energy information, worldwide investment in green power would increase by 27% year on year to a peak of $755 billion in the previous year. This contrasted positively with yearly worldwide energy expenditures, which are expected to have climbed 10% year on year to $1.9 trillion, matching pre-pandemic figures.

For a long time, fossil fuel firms have been scolded for 'greenwashing' and allocating just a small portion of their massive capital expenditures to green sources. However, that tendency looks to be reversing.

According to Evaluate Energy, worldwide upstream M&A hit a new high of $144 billion last year, with Woodside Petroleum, Santos, and BHP Group undertaking multibillion-dollar international mergers and acquisitions, while Pioneer Natural Resources, ConocoPhillips, and Continental Resources made massive Permian purchases and scores of natural gas firms joined the consolidation wave in the United States.

But a far more intriguing tendency has appeared: conventional oil and gas corporations were one of the most proactive in making alternative energy partnerships and investments in 2021.

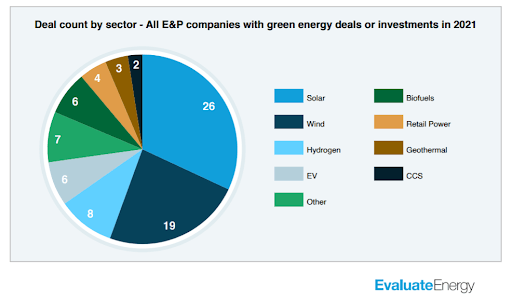

In 2021, upstream oil and gas firms inked 81 renewable power partnerships, with Shell Plc., Eni S.p.A, BP Plc., TotalEnergies SE, and Chevron leading the way. Another intriguing discovery was that a bigger amount of developing industries, such as hydrogen generation facilities, electric car chargers, and biofuels, had gained momentum.

1. Shell Plc

Shell committed to ten green/low-carbon energy agreements, according to Evaluate Energy.

In 2021, it will be the most active firm amongst oil and gas production companies.

The firm's expenditures were very diversified, with no more than three transactions tied to any particular industry. Half of its agreements were connected with solar and wind power but it also had contracts in the electric car, biofuel, and retail energy industries internationally.

Shell signed four new contracts in the fourth quarter alone, two of which were in the solar energy industry in the United States. Firstly, it bought Cleanloop, a clean technology solar energy service firm, via a solar subsidiary in the United States. The company then purchased Savion LLC, a big utility-scale solar and power storage provider, from Macquarie's Green Investment Group. The other two fourth-quarter contracts were in the retail electricity industry in Australia and the offshore wind industry in Ireland.

According to Reuters, Shell has hastened the sale of its oil and gas assets and is planning to sell holdings in two natural gas-producing groups in the British North Sea.

The Clipper Hub and Leman Alpha complex might be worth up to $1 billion to the supermajor.

Over the past few years, Shell has sold a number of aged upstream assets in the North Sea, including a $3.8 billion deal with Harbour Energy in 2017.

2. Eni S.p.A.

Eni S.p.A., Italy's biggest integrated oil and gas business, signed nine renewable power projects in 2021, six of which were wind or solar. If all associated initiatives are completed, Eni's total wind and solar assets in Italy, France, Spain, and the United Kingdom may rise by more than 5 GW in annual capacity.

Eni reached agreements on two of its transactions in the fourth quarter. It paid £70 million for a 20% interest in the Dogger Bank Wind Farm C project in the United Kingdom from Equinor and SSE. The total capacity of the aggregate shareholding is around 240 MW. The facility is presently under development and is the third stage of the planet's biggest offshore wind farm (3.6 GW). The production of this stage is set to begin in 2025.

In other news, Var Energi, a private North Sea oil and gas company owned by Eni and HitecVision, is slated to go public in Oslo on February 16th at an $8.0 billion value.

Eni holds 70% of Var after transferring its North Sea holdings to Var in return for stock in 2018. Speculation of an IPO has been circulating for a while, and Bloomberg reported preparations to list the company for a $10 billion offering in the previous month.

3. BP Plc

In comparison to its competitors, BP has been highly active in the electric car area over the last few years, according to Evaluate Energy.

The British conglomerate, together with BMW Group and Daimler Mobility AG, purchased holdings in the German startup Digital Charging Solutions GmbH in March. DCS is a European provider of electronic chargers for automakers and fleet managers.

In June, BP led a $13.2 million funding phase and decided to invest $7 million in IoTecha, an EV charging company located in the United States. In December, BP concluded its EV activities for the year by purchasing AMPLY Power, another US-based EV charging provider.

4. TotalEnergies SE

TotalEnergiesSE, a French energy giant, signed six low-carbon contracts in 2021. The majority of TotalEnergies' alternative power initiatives occurred in the first half of the previous year, with the solar industry perhaps receiving the most attention.

In January, the business purchased a 20% investment in Indian Adani Green Energy Ltd., followed by another big purchase a week later in the US. Both agreements are critical to Total's goals to attain 35 GW of gross production capacity from solar and wind power sources by 2025, with an additional 10 GW added each year after that. AGEL has around 14.6 GW of signed green capacity, including 3 GW of operational capacity, 3 GW under construction, and 8.6 GW in progress. The firm's goal is to generate 25 GW of green energy by 2025.

Total acquired SunChase Power's development pipeline of 2.2 GW of solar initiatives and 600 MW of battery storage facilities in Texas as part of the purchase in the US.

5. Chevron Corporation

Chevron Corp. is the only company on this list that is not from Europe. The US major has been notably engaged in the renewable power market's most developing segments. Among the year's achievements, Chevron supported two hydrogen-based ventures in the United States.

The first was a joint investment in Raven SR Inc. by a group of partner companies. Chevron then decided to buy ACES Delta LLC, which had earlier been a joint project between Mitsubishi Power Americas Inc. and Magnum Development LLC.