Bitcoin Liquidation Heatmap Shows Massive Price Drop: What Happened?

July 11, 2024

In a dramatic turn of events for the cryptocurrency market, a Bitcoin liquidation heatmap highlighted a massive price drop, sending global shockwaves through investors. The recent Bitcoin sell-off, triggered by the German government’s decision, has intensified concerns over market liquidity and stability.

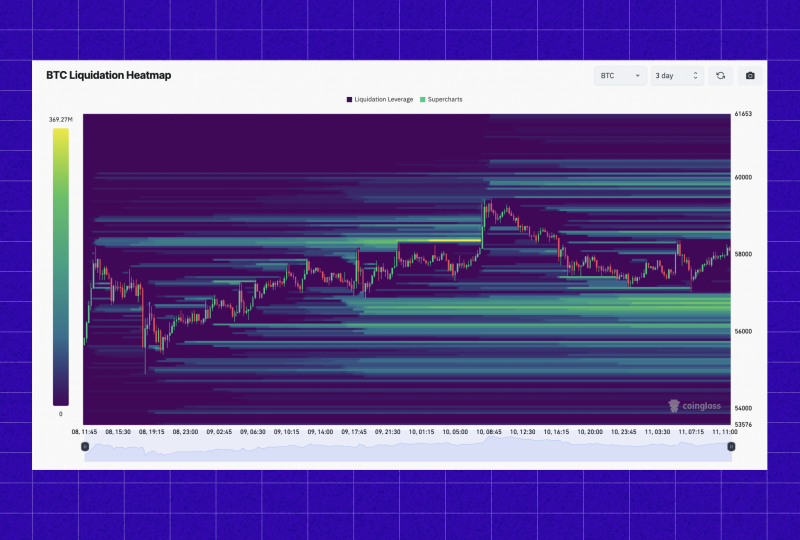

The Bitcoin liquidation heatmap illuminated widespread activity following Germany’s unprecedented move. According to data from CoinGlass, the second-largest Bitcoin liquidation event in recent history occurred, amplifying fears of heightened market volatility.

Explaining Liquidation Heatmap

Before exploring the reasons for liquidation, let’s explain what a liquidation heatmap is. This tool predicts areas where large trader losses (liquidations) might happen. When prices move against leveraged bets, exchanges close those positions to avoid excessive risk. The heatmap shows these potential “liquidation zones” as hot spots, helping traders identify areas of high liquidity.

How it Works:

- Analyses market data and leverage levels.

- Colors on the heatmap indicate the intensity of potential liquidations (yellow = high).

- Focuses on where liquidations might start, not necessarily end.

The liquidation heatmap allows traders to identify areas of high liquidity, which can be helpful in various ways:

Magnet Zones: Areas with high potential liquidations might attract price movement.

Support/Resistance: Big traders can exploit these zones for favorable trades, potentially causing price reversals.

German Government Sell-Off Triggers Bitcoin Liquidations

According to reports, the German government’s decision to sell a portion of its Bitcoin holdings ($900 million worth of Bitcoin) triggered a domino effect. This large-scale sell-off created downward pressure on the price, causing leveraged positions to fall below their margin requirements. As a result, exchanges initiated Bitcoin liquidations to close these positions automatically.

The Bitcoin liquidation heatmap provides a visual representation of this phenomenon. It shows a concentration of liquidations occurring at specific price points, indicating where a large number of leveraged traders were forced out of their positions. This sudden increase in selling pressure further amplified the price drop, creating a negative feedback loop.

Why Did the German Government Sell?

The reasons behind the German government’s decision to sell its Bitcoin remain unclear. Some speculate it was a strategic move to raise funds or mitigate potential risks associated with cryptocurrency holdings. However, others criticize the move as “insensible” and “counterproductive,” arguing that it destabilized the market during a vulnerable time.

Impact on Bitcoin Liquidity and Market Sentiment

The Bitcoin liquidity chart has shown a stark decline, reflecting diminished investor confidence and increased sell-off pressures. Traders and institutional investors are grappling with the aftermath of this significant market event, reassessing risk management strategies and market exposure.

The sell-off, which occurred against the backdrop of broader economic uncertainties, has underscored the vulnerability of digital assets to geopolitical decisions and regulatory actions. Market participants have expressed concerns over the ripple effects on other cryptocurrencies and traditional financial markets.

The event also raises concerns about the potential impact of institutional investors on the market. While the inclusion of significant institutions like the German government can be seen as a sign of mainstream adoption, their actions can also significantly influence price movements.

Looking Forward

The recent Bitcoin biggest price drop serves as a cautionary story for both individual investors and institutions. Understanding how Bitcoin liquidity works and the risks associated with leveraged trading is crucial for operating in the volatile cryptocurrency market. In parallel with the growing market, it will be interesting to see how regulators and institutions approach cryptocurrency holdings and trading in the future.