Bitcoin Mining Rigs: Why Are BTC Miners Leaving The Scene?

May 16, 2024

The BTC halving rush has finished, and the moment many crypto investors and speculators were waiting for has come. What will happen next?

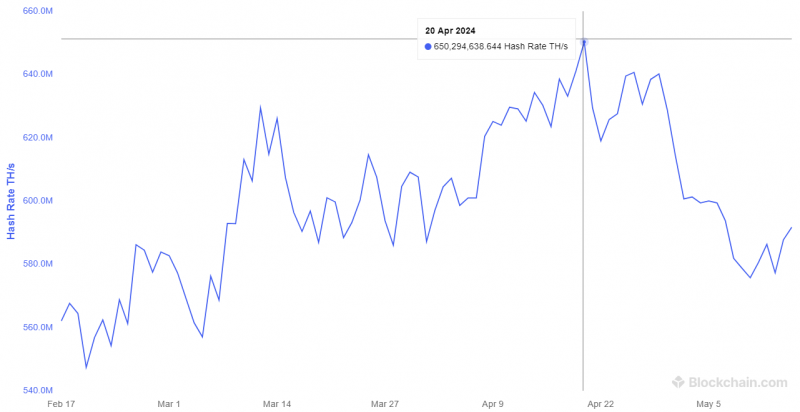

After the halving, the first impact we saw was the declining hash rate, a natural dynamic after slashing the number of BTC in circulation and the miners’ rewards. Many Bitcoin mining rigs saw their output decline due to dramatic fluctuations in price and the overall Bitcoin blockchain elements.

Let’s navigate the details of this Bitcoin event and how it affected BTC miners.

Post-Halving Mining Drop

The Bitcoin halving, which occurs every year to sustain ecosystem development and avoid overheating influences, took place on April 20th. As such, the rate at which new coins are created is reduced, the BTC miners’ rewards are cut in half, and the supply is decreased.

This economic axiom means that the BTC market price should increase. However, the impact on other blockchain inputs has sent the coin price trembling.

Other factors, such as miner’s revenue, average block size, mining output (hash rate), and transaction cost, have also been on a roller coaster, going up and down the chart.

Bitcoin mining rigs were the most concerned about this change because declining mining output and rewards meant lower revenue. As a result, many miners re-strategized their operations and redefined their priorities, as most of their work had become unprofitable.

Bitcoin Hash Rate Fluctuation

The hash rate refers to the computing power spent to mine a Bitcoin. This includes the number of attempts made by BTC mining rigs to solve a highly complicated equation. Generally, a greater hash rate means higher power consumption and transaction costs.

However, the hash rate drop can be attributed to either a high attempts/success rate or a decreasing number of Bitcoin mining rigs, and the latter is what concerns the market at the moment.

The declining revenue streams led to many Bitcoin mining shutdowns, and several unprofitable rigs opted for less-consuming machines or relocated for lower energy costs.

Experts predict that the current trend of Bitcoin mining firms leaving the scene might continue for a few months this year, especially with the anticipation of higher electricity prices in the summer. However, optimistic forecasts say that we may see a recovery by the end of 2024.

How Did it Affect Bitcoin Mining Rigs Stocks?

Many Bitcoin mining rigs had to cease operations or restructure their assets because the mining rewards dropped tremendously.

The collective mining revenues dropped from $73 million to less than $30 million in one week, driving the stocks of many BTC mining companies down.

However, the drop was only noticeable in some firms with huge output. Riot Platforms Inc. had its stock price drop from $12 to $9 in five days. CleanSpark Inc., one of the leading US mining firms, also suffered a stock price decline from $20 to $15 between April 23rd and May 1st.

Conclusion

Many investors and crypto traders were waiting for the recent BTC blockchain halving. However, Bitcoin mining rigs definitely did not wait for the severe damage that followed this event.

The slashing of miners’ rewards led to a total decline in the computing output to solve a Bitcoin. Eventually, many mining companies had to downscale their operations as they were deemed unworthy of the hefty power bills they were paying.

This might last a few months, and major mining firms can weather this storm, predicting a recovery by the end of 2024 and the beginning of 2025.