European Stocks Bounce Back As Russia Withdraws Some Troops From Ukraine Border

Feb 15, 2022

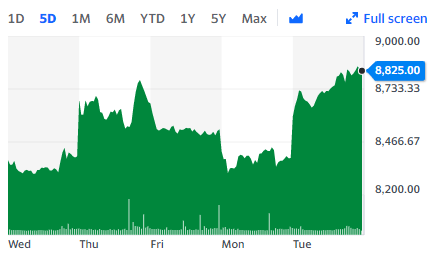

On Tuesday, equities in Europe turned their falling trend and finished in the positive, indicating that Russia may be moving away from the edge of conflict.

The FTSE 100 ended 0.9% higher in London, whereas the CAC concluded 1.9% higher in Paris and the DAX rose 1.9% in Frankfurt.

Miners were among the biggest gainers in London, with Glencore rising as high as 3.9% before retreating somewhat after recording massive profits due to rising commodities prices.

AstraZeneca, though, led the FTSE 100 climbers after announcing excellent findings from late-stage studies of its cancer medication Lynparza.

A sense of peace has also fallen on the tourism industry, as the prospect of a Russia-Ukraine confrontation has receded, amid optimism that bookings would be more durable. At the same time, banking equities were falling.

According to Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, investors breathed a sigh of relief at the first hints that Russia may be drawing back from the brink of conflict, with certain industries making minor gains toward a rebound.

"As some Russian forces are said to be withdrawing back to bases from a number of important frontlines, the DAX in Frankfurt and the CAC 40 in Paris have recovered sharply, and the FTSE 100 has also recovered some ground after Monday's falls.”

"However, there is still much skepticism about Moscow's intentions, and investors stay acutely aware of the political landscape."

"Fears are still high since Moscow is plainly worried about the likelihood of Ukraine wanting to join NATO," said David Madden, market analyst at Equiti Capital. "The markets, however, seem to be only concerned with the question of whether or not a war will start."

It occurred as wage growth in the UK fell to 3.6%, from 3.8% before, putting more strain on earnings amid fears about a squeeze of cost of living.

This trailed UK inflation, which reached 5.4% in the year to December and is forecast to increase beyond 7% by April when the prices of energy threshold will be raised.

Despite a robust comeback in bonuses, actual overall income dropped in the year to October-December 2021 after correcting for recent increases in consumer prices. Earnings excluding incentives plummeted 1.2% on average, the largest drop in almost 8 years.

It happened as the UK jobless rate stayed stable at 4.1% in the third quarter. Even though the unemployment numbers stayed unaffected, as experts predicted, it is higher than pre-COVID figures of 3.8%.

Across the Atlantic, the S&P 500 climbed 1.4%, while the tech-heavy Nasdaq surged 1.9%. During the afternoon trade, the Dow Jones fell 1.3%.

Despite the fact that US manufacturers raised their prices quicker than predicted in January, contributing to the nation's rising inflation, the atmosphere was optimistic.

The PPI index increased by 1.0% last month, up from 0.4% in December and more than twice as quickly as predicted. Product prices increased by 1.3% in the month, while services cost increased by 0.7%.

Final demand prices increased by 9.7% year-over-year as enterprises raised their pricing over the previous year. This was somewhat lower than the previous month's number of 9.8%, but more than anticipated.

It also came after remarks from a Fed official that the central bank's reputation was "on the line" in battling inflation, fueling speculation that the Federal Reserve is mulling a more hawkish stance. This would start with a 0.5% increase in interest rates next month.

Following the last stormy trading day, the Dow Jones is now down 4.9% year to date, the S&P 500 dropped 7.6%, and the Nasdaq is down 11.9%.

Overnight, Asian stocks mainly sank again, continuing the worldwide sell-off fueled by concerns over the political situation in Europe.

The Nikkei 225 index lost 0.8% in Tokyo after investors dismissed statistics suggesting Japan's economy revived in the last three months of the previous year. In Hong Kong, the Hang Seng dropped 1.1%, while the Shanghai Composite gained 0.5%.