Fed Keeps Close Eye on Labour Market as New July Data Shows Mixed Signals.

Aug 16, 2023

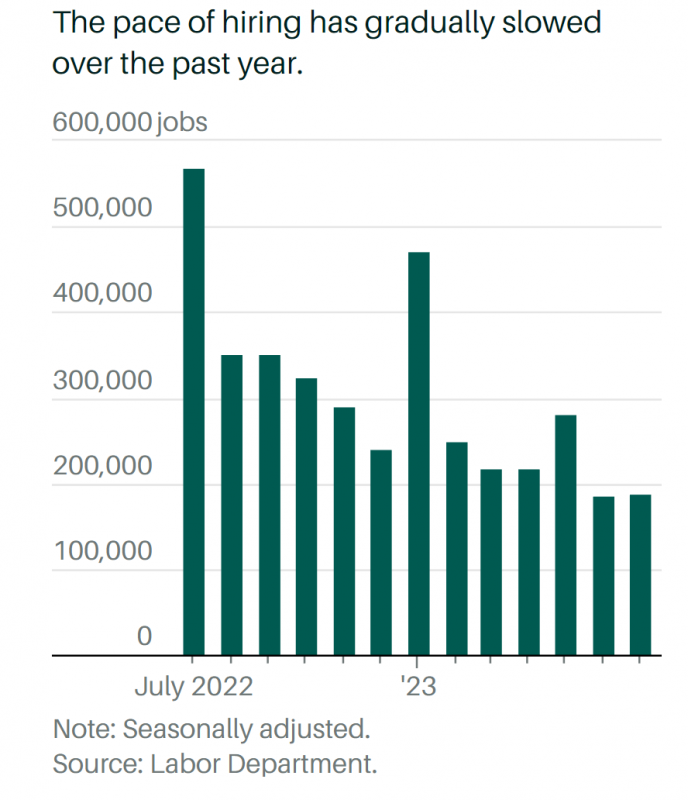

The US labour market continued its recovery in July, as employers added 187,000 jobs and the unemployment rate fell to 10.2%. Despite this growth, job gains were lower than expected and remain far below pre-pandemic levels. With this news in mind, economists are now looking to see if the Federal Reserve will consider raising interest rates again in the near future.

Although experts polled by FactSet expected 200,000 job gains, the lower result is still a faster rate of increase than some economists believe the US labour force can sustain in the long run.

The unemployment rate fell to 3.5% in July from 3.6% in June, indicating that the labour market remains tight. Based on FactSet surveys, economists predicted that unemployment would remain steady month to month.

The US Bureau of Labor Statistics reported that the unemployment rate in July was slightly higher than the record low of 3.4% seen earlier this year in January and April. Nevertheless, it was still considered to be well below the threshold many experts believe reflects a healthy labour market — hovering between 4.1% and 4.7%.

Officials at the Federal Reserve have stated that they expect moderate growth in employment, with supply and demand rebalancing, as they consider whether to continue raising interest rates to combat inflation. While the employment market remains resilient, the data released on August 4th showed that labour-market pressures are diminishing. The Bureau of Labour Statistics lowered June’s employment increase to 209,000 from 306,000 originally reported, as well as May’s payroll gain to 281,000 from 306,000 previously reported.

According to Seema Shah, chief global strategist at Principal Asset Management, the recent report is not a “game-changer.” The softer job growth, in combination with weaker inflation figures, suggests that the Federal Reserve will remain on hold for the September rate decision; however, there is still potential for additional hikes later this year, depending on new economic data.

The CME FedWatch Tool predicted only a 13.5% chance of an interest-rate rise in September. The chances of a November rise are 24.8%, while the chances of a December increase are 22.7%.

Analysts suggest that Fed Chair Jerome Powell would need to see a significant improvement in job gains and wage growth for the Federal Reserve to choose to raise interest rates again this September. Without any clear direction emerging, Shah believes it’s more likely the central bank will remain where it is.

Wage growth, another indicator of labour-market health regularly monitored by Fed policymakers, increased little last month, and the average work week slipped slightly.

According to the report, the average hourly wage for private, nonfarm workers was $33.74 in July, up 0.4% from June and 4.4% year on year. Economists predicted that hourly wages would rise 0.3% from June and 4.2% from the previous year.

According to the BLSt, the average number of hours worked by employees in July decreased by 0.1 hours to 34.3 hours. This shows that businesses are being more cautious and reducing employee hours in response to slowing activity, according to Lydia Boussour, senior economist with Ernst & Young’s global strategy consulting department.

Quincy Krosby, chief global strategist for LPL Financial, noted that unless productivity gains continue, it will be difficult to bring inflation back down to 2%. This is due to the higher hourly wages than desired, which has been a key source of persistently high inflation.

Despite the continuing job losses in many industries, there have been some positive reports regarding employment. According to government data, healthcare, social assistance, financial activities, and wholesale trade are among those showing signs of progress. The July Employment Diffusion Index – a measure of how many sectors are increasing their workforces on a monthly basis – has fallen to 57.2 from 72.2 last year. This was the second-lowest number since the onset of the Covid-19 pandemic, according to Boussour projections.

Despite the bustling summer travel season, the leisure and hospitality industry, which had historically driven much of the employment growth, created only 17,000 positions in July. Booking.com CEO Glenn Fogel stated on Thursday that the firm is anticipating a record third-quarter travel level.

Employment in the technology business, which many people are keeping an eye on amid the ongoing Hollywood strikes, has stayed reasonably stable month after month. While it is too early to discern the impacts of the Screen Actors Guild strike (which began on July 14th and will most likely be reflected in August statistics), some economists were looking for signs that the previously announced writers’ strike had severely slowed payroll growth.

The latest jobs report showed that the US labour-force participation rate stayed at 62.6% in July, staying consistent with a five-month trend. The participation rate among prime-age workers aged 25 to 54 saw a slight decrease to 83.4% after reaching a 21-year peak in June.On September 1st, the August payroll data will be released, providing further insight into the labour market conditions ahead of the Federal Reserve’s policy committee meeting on September 19-20. Thus, the report from August 4th is not likely to be the final word on the topic for the Fed.