Forecast of UK Interest Rates: Is the Bank of England Planning a Cut Soon?

Feb 02, 2024

The awaited interest rate news is released: the Bank of England (BoE) has opted to uphold the current 5.25% interest rate, marking the fourth consecutive time rates have remained unchanged. However, considering that inflation rates are dropping, many expect the interest rates to reduce soon.

BoE’s Stance Amid Inflation and Economic Growth

In the Monetary Policy Committee’s (MPC) latest meeting, a three-way split emerged, with a majority favouring the status quo. However, independent economist Swati Dhingra’s call for an immediate reduction in borrowing costs hints at a possible shift in the BoE’s stance.

Andrew Bailey, the BoE’s governor, emphasised the need for further evidence of sustained inflation below the government’s 2% target before considering a rate cut. The central bank downgraded its inflation forecasts, anticipating a fall below 2% in May, driven by robust pay growth in the British economy and diminishing impacts from lower energy prices.

Impact on Households and Market Expectations

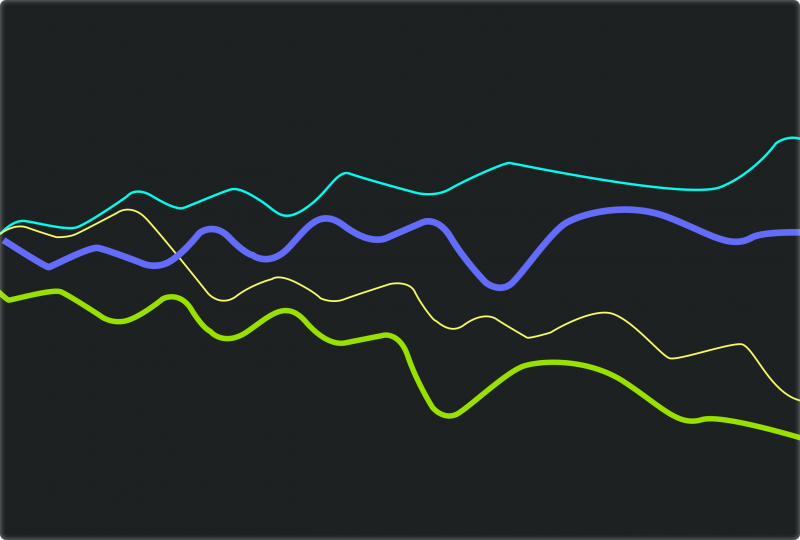

Regardless of market expectations for a rate cut as early as June, the BoE has maintained its borrowing costs since September, pausing an aggressive hiking cycle initiated in December 2021. The prolonged high interest rates, currently at their highest in 16 years, have impacted mortgage and loan costs for households. However, amidst a backdrop of economic uncertainties and inflationary pressures, the central bank has dropped a strong hint that decreased UK interest rate projections might be on the horizon.

The potential for interest rate cuts presents a positive outlook for economic growth, offering a boost for Chancellor Rishi Sunak as a general election looms. Financial markets are anticipating a significant reduction in borrowing costs, with the BoE interest rate forecast ranging up to a one percentage point cut.

Global Economic Trends and Inflationary Pressures

The BoE remains cautious about the next UK inflation report, emphasising that inflation’s fall below 2% is expected to be temporary, with short-term forecasts based on projections indicating a rise to around 2.75% by the end of the year. The central bank identifies persistent inflationary pressures in the services sector and labour market, coupled with risks from disruptions in the Red Sea amid the Israel-Gaza conflict.

The MPC’s three-way split reflects concerns over inflationary pressures, with two members advocating for a further quarter-point increase in the Bank rate. The BoE highlights robust wage growth expectations in 2024, indicating settlements of about 5.4%, only slightly below 2023 levels.

In parallel with recent news from the US Federal Reserve keeping rates high, the BoE’s decision to maintain rates aligns with global economic trends. The move is expected to ease pressures on borrowers, providing relief amid uncertainties such as shipping disruptions in the Red Sea and new Brexit border rules.

Financial markets project the first rate cut in May, with expectations of a total reduction of 1% by year-end. Despite concerns and uncertainties, policymakers have increased growth forecasts for the UK economy, expecting GDP to grow by 0.25% in 2024.As economic uncertainties persist, the Bank of England remains vigilant, underscoring the need for sustained evidence before making decisions on interest rates. The delicate balance between supporting economic growth and managing inflationary risks keeps the UK’s economic trajectory uncertain in the coming months.