NFTs Are Booming. What Investors Need to Know.

Feb 28, 2022

The majority of us have stock and bond portfolios. Venture capitalists are sprinkling Bored Apes and CryptoPunks into their portfolios.

These cartoonish-sounding creatures bear no resemblance to typical investments; they lack physical qualities, do not pay dividends and make no representations about future cash flows. However, they are among the most popular non-fungible tokens, or NFTs, which are a form of digital collectible or asset. Prized NFTs are now more expensive than a new Ferrari – bored apes on trade site OpenSea are selling for at least $300,000. Recently, CryptoPunk was sold for $11.75 million.

"Each new generation of wealth gets to define what it perceives to be attractive societal artifacts," explains Matt Hougan, a chief investment officer of Bitwise Asset Management, the sponsor of a December-launched private-placement NFT fund. Investors who are not crypto-wealthy just want exposure to the "set it and forget it" idea, he explains.

NFTs are captivating crypto-imagination. According to Chainalysis, digital assets will be worth $44 billion in 2021, up from nearly nothing in 2019. Although prices have subsequently fallen, the market is still estimated to be worth $30 billion by investment bank Jefferies. Venture capital companies are pouring money into the space, boosting OpenSea's worth to more than $13 billion. Hollywood has recognized this trend with celebrity endorsements and film deals for characters. NFT projects have been developed by companies such as Anheuser-Busch InBev (BUD), Gucci, and Adidas (ADDYY).

It's all harmless if you have some free cash and enjoy dabbling with cryptocurrency. Investors, however, would be advised to exercise caution, especially if they are considering NFTs as a supplement to core crypto holdings or assets such as actual art.

As an investment, tokens present various difficulties. Trading occurs on unregulated platforms such as OpenSea and Nifty Gateway — locations that are not authorized by any government agency. While a celebrity tweet might generate a spike in pricing, the floor may be zero once the digital glitterati has moved on. The majority of NFTs are priced in Ether, a highly volatile cryptocurrency that takes cues from Bitcoin and the larger crypto market. In September 2020, an NFT valued at ten ether tokens was worth around $3,500. It would be worth $31,000 today, depending on the current price of ten Ether at $3,100 each coin.

Another stumbling block at the moment is the diminishing supply of macro rocket fuel. Bitcoin, Ether, and other key tokens have been swayed by the Federal Reserve's preparations for higher interest rates and stricter monetary policy. As Ether derivatives, experts believe that NFTs are vulnerable to a decline in broader crypto demand, even as they continue to grow in the fields of digital art, music, and e-commerce.

"There is a significant danger of loss when pop-culture trends alter," adviser Jim Roberts recently said in a statement. "Many NFTs may ultimately lose their value."

What Is It About NFTs That Makes Them So Alluring? Two critical characteristics of NFTs are their unique features and verifiable ownership. Unlike fungible currencies — one Bitcoin or US dollar is identical to any other — each NFT is unique. Each CryptoPunk or Bored Ape, for example, has a unique appearance. While anybody may right-click the image and share it on Instagram, each NFT has a unique software code that can be used to link it to the owner's digital wallet and verify its authenticity. This can impart a digital provenance stamp, facilitating the exchange of NFTs over "trustless" networks such as a blockchain. Whether it's a video clip, work of art, musical excerpt, or simply a tweet, if you own the NFT, you may plausibly claim ownership.

Although NFTs are mostly based on the Ethereum network, the Solana blockchain is gaining traction due to its reduced costs for minting and selling tokens. If you wish to purchase an NFT, you'll almost certainly have to use Ether on a platform like OpenSea or Rarible. This involves acquiring Ether on a cryptocurrency exchange, transferring it to a digital wallet, and connecting the wallet to an NFT platform.

One objective of NFT issuers is to create scarcity value through limited-edition collections — hopefully generating enough attention to drive up the price. Only 10,000 Bored Apes and CryptoPunk NFTs were produced. CryptoPunk #7523, one of nine "aliens" in the series and the only one wearing a mask, for $11.75 million at a June Sotheby's auction. Possessing a high-priced NFT confers status — similar to hanging a Warhol in your homeroom but publicizing it. Collectors of the NFT proudly exhibit their acquisitions, tweeting about them and using them as profile images on social media.

Another attraction is membership in a private club or community. Owners of bored Apes can join the "Yacht Club" and contribute to the "The Bathroom" graffiti board. More importantly, they may obtain admission to celebrity-filled parties — in November, one included Chris Rock, Aziz Ansari, and the Strokes.

Additionally, members may receive first dibs on future tokens. Owners of the original CryptoPunks received complimentary Meebits, a non-fungible token collection produced by the developer of CryptoPunks, Larva Labs. Meebits are now available for purchase on OpenSea, with prices beginning at around $6,818 per unit. World of Women, another popular collection, includes monthly "airdrops” from NFT artists, presales, and invites to an annual gala. The tokens, which first sold for around $225 apiece, now cost at least $30,000 on OpenSea, with some exceeding $100,000.

Additionally, NFTs are employed as assets in virtual marketplaces and videogames, such as a sought sword. NFTs are used as collateral for the purchase and sale of virtual real estate. The high-end art market has also entered, with artists such as Damien Hirst and auction house Sotheby's participating. Incentives for converting physical art to NFTs skyrocketed with the sale of paintings by Beeple and Pak for $69 million and $91 million, respectively.

Additionally, major corporations are minting NFTs. One motive is to increase sales through online marketplaces and to connect with crypto-savvy consumers. Burberry (BURBY), an 1856 fashion house, released 2,250 NFTs through an online marketplace called Blankos Block Party. Nike (NKE) now controls RTFKT, a virtual shoe manufacturer that makes NFTs; token holders may trade their tokens for genuine products. This business strategy is also responsible for Bud Light's recent decline in NFT. Adidas, on the other hand, sold roughly 30,000 "Into the Metaverse" NFTs in December for more than $22 million. Adidas said that owners would be able to redeem tokens for items this year.

While purchasing non-fungible tokens is now inconvenient, this may soon change. Coinbase Global (COIN) and other firms are working on ways for investors to invest in cryptocurrency with a few clicks and a credit card. Coinbase claims to be developing a marketplace and has partnered with Mastercard (MA) to handle payments. GameStop(GME), the troubled video game retailer, has also announced the development of an NFT marketplace.

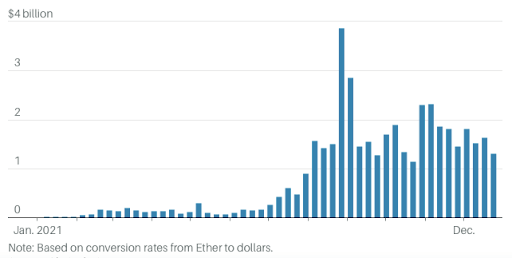

NFTs Development

The NFT market exploded in popularity as the prices of a few large collectibles skyrocketed and additional tokens began trading. Weekly total value transacted.

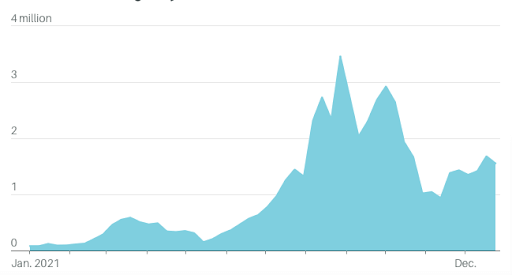

More Tokens, More Trading

Over 1 million NFTs are being traded on a daily basis on platforms like Opensea. Daily count of NFTs trading.

The question for investors, of course, is whether this is just a speculative frenzy — or whether it makes sense to include NFTs in a digital asset portfolio.

Advisors have conflicting feelings about NFTs. According to Michael Batnick, director of research at Ritholtz Wealth Management, a sizable portion of the market consists of crypto-wealthy individuals or those who just enjoy gambling. "To these folks, this is not genuine money," he explains. "These NFTs have the appearance of poker chips. When you're at a casino, you behave differently than when you're depositing your own money."

Ric Edelman, a creator of the Financial Professionals' Digital Assets Council, directly invests in cryptocurrency and promotes it to long-term investors. However, he is suspicious about single NFTs. "Demand for digital assets will increase," he argues, "but if you're looking to make a quick buck or a killing with NFTs, you're speculating, not investing."

Due to the fact that NFTs are not securities, most advising companies are not authorized to purchase them on behalf of clients. "That implies an advisor is unable to do their duties," Edelman explains. "They are unable to incorporate NFTs into a portfolio or bill on the asset, which frustrates the majority of advisers because they are unable to collect their fee."

Arbor Capital Management, situated in Anchorage, Alaska, is one consulting business that supports digital assets, including non-fungible tokens. While the business does not directly purchase NFTs, it does invest in two of the most popular cryptocurrencies for new blockchain-based virtual worlds: Sandbox and Decentraland. NFTs are widely employed in these worlds. "This is how we acquire exposure to the NFT area," explains Marc Nichols, product director at Arbor Digital, the company's digital subsidiary.

However, purchasing NFTs on behalf of clients entails more than simply investing risk. Scams abound in NFT marketplaces, which are unregulated and unsupervised by any authority. Tokens might be forged or used in a "pump and dump" operation. Prices may also be inflated by wash-sale trading — attempts to increase the price of the NFT by selling it to oneself. "Some vendors of NFTs are profiting handsomely from wash trading," Chainalysis stated in a recent analysis on the practice.

OpenSea, which hosts over 20 million NFTs, has also had difficulties. In September, the business acknowledged an unpleasant instance of insider trading, pledging to tighten personnel monitoring. It stated on Twitter in January that a handful of NFTs made using a free application on its site were forgeries or plagiarized works. Additionally, the business recently reimbursed $1.8 million to collectors who sold NFTs at expired prices as a result of glitched software issues exploited by buyers.

All of this places advisors in danger of breaching their fiduciary duties, according to Nichols. "There are several hazards associated with technology, smart contracts, and vulnerabilities in the NFT software code that may be abused," he explains. "As an SEC-registered fund and wealth manager, we are required to work in the best interests of our clients."

Investors who have dabbled in trading have had varying degrees of success. According to Chainalysis, just 28.5 percent of NFTs acquired directly from the issuer and subsequently sold on the platform resulted in a profit. Purchasing and reselling NFTs on OpenSea resulted in profits 65% of the time. However, this does not account for high transaction costs. Purchasing directly from an issuer typically results in the payment of "gas fees" to the Ethereum blockchain network's administrators. For purchasing, selling, or even canceling a bid, OpenSea levies a 2.5 percent transaction fee in addition to the gas fees.

Additionally, trading "bots" may purchase all of the NFTs in an initial offering or push up secondary market prices. "While we have not witnessed explicit bot trading on secondary markets, there is little to prevent NFT trade from being automated on these platforms," says Chainalysis economist Ethan McMahon.

The bull thesis asserts that non-fungible tokens constitute a new type of digital asset. If Coinbase, which already has 73 million users, establishes a marketplace, it would offer up NFTs to a far larger pool of retail and institutional investors. Additionally, Coinbase holds a stake in OpenSea, which has been termed the eBay of NFTs. According to Dune Analytics, OpenSea achieved a record $5 billion in sales in January, with fees exceeding $386 million. "Ultimately, we're talking about tokenizing everything," OpenSea CEO Devin Finzer stated last year on a podcast.

The Bitwise Blue-Chip NFT Index fund is one of the few options to invest in a security that contains a basket of NFTs. However, it is not for everyone. The fund, which is structured as a limited partnership, is only open to authorized investors with a net worth of at least $1 million. It is not publicly traded, has a minimum investment of $25,000, and charges a high annual expense ratio of 3%.

The fund got off to a strong start — it was up 14% year to date as of early February but was down 12.6 percent year to date as of Feb. 22. However, Bitwise is not in the business of picking winners and losers. The fund monitors a market capitalization-weighted index of the top ten NFTs, with 37% of the portfolio presently in Bored Apes and 27% in CryptoPunks — significant concentrations in just two collections. The fund is 0.7 percentage points behind the index, owing mostly to its high management costs.

Hougan anticipates significant evolution for non-fungible tokens, suggesting that items tied to music royalties will be the next phase of growth. NFTs, he asserts, "is not a one-trick pony." The Bitwise fund will change, too, as NFTs come and go with quarterly rebalancing. At least for now, investors are banking on Bored Apes and CryptoPunks holding on to their crypto glories for the time being.