Pfizer’s Covid Pill Gets Green Light. Investors Are Starting to Pay Attention to the Stock

Dec 23, 2021

The Covid-19 tablet has arrived, and it could not have arrived at a more opportune moment.

The epidemic has intensified over the last two weeks, as the Omicron variety has spread throughout the United States. With the majority of commonly used medicines becoming ineffective as a result of the variant's mutations and case numbers rapidly growing, clinicians and public health officials have grown more concerned.

On Wednesday, the Food and Drug Administration approved Pfizer's (PFE) Covid-19 tablet Paxlovid. The drug has been approved for use only in high-risk people, and initial supplies will be restricted, but it will save lives.

The approval is a remarkable triumph for Pfizer, its second of the epidemic. According to FactSet, analysts anticipate Pfizer to sell $21.7 billion worth of the medicine in 2022, however the firm just announced that it will manufacture 120 million courses of the drug next year, 40 million more than originally expected, likely driving those projections higher.

As Barron's noted in November, Paxlovid's performance demonstrates that the company's choice to divest itself of all but its breakthrough biopharma business in 2019 was a wise one.

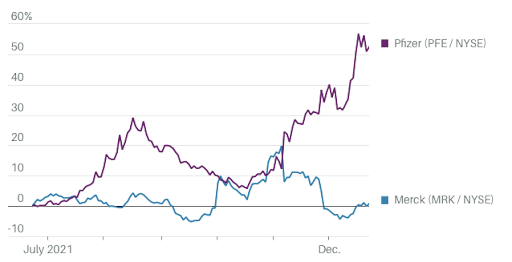

Pill Power

Both Pfizer and Merck have produced antiviral agents against Covid-19. The following chart illustrates their stock performance.

Investors had been hesitant to embrace the reimagined Pfizer, but they caught up quickly late this year. Prior to November of this year, Pfizer shares lagged the S&P 500 index, despite the company's rollout of the Covid-19 vaccine. However, since the beginning of November, Pfizer's stock has soared. Since then, the stock has gained 36.4 percent, while the S&P 500 has gained just 1.6 percent.

And the company continues to trade at a discount to rivals such as Eli Lilly (LLY), which trades at 31.7 times earnings, and Johnson & Johnson (JNJ), which trades at 16.1 times earnings.

This week's positive news for Pfizer was tempered by bad news for Merck (MRK). Though early results on Merck's Covid-19 tablet molnupiravir drove vaccine stocks lower and Merck shares higher, the drug's luster has since worn off as new data indicate that it is less effective than first indicated and safety concerns persist.

The FDA approved molnupiravir for emergency use on Thursday, a day after it approved Paxlovid, but with far more stringent restrictions. Molnupiravir is authorized for usage only when other Covid-19 medications, such as Paxlovid, are not available or therapeutically acceptable. Additionally, the agency encouraged males who use molnupiravir to utilize reproductive control for at least three months following.

Earlier aspirations for molnupiravir as a long-term income generator are dwindling. The letdown serves as a reminder of the threat that Merck faces before the end of this decade: the expiration of patent protection on Keytruda, the cancer medicine that accounts for nearly a third of its sales. Merck has been attempting to close that gap. Molnupiravir does not appear to be a significant contributor to that endeavor.