Real Yields Show Where the Stock Market Is Really Headed

Apr 04, 2022

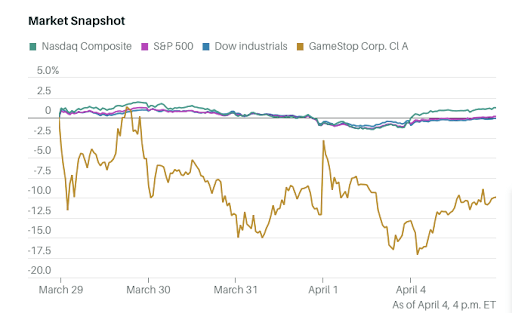

The stock market's worst nightmare has come true, yet the main indices have scarcely moved. Don't hold your breath waiting for the quiet to return. The Dow Jones Industrial Average fell 0.1 percent last week, while the S&P 500 rose 0.1 percent. The Nasdaq Composite increased by 0.7 percent.

Given the never-ending flood of statistics indicating that the United States has a significant inflation issue, those findings are outstanding. In March, wages increased by 5.6 percent year on year, up from 5.2 percent in February.

The Federal Reserve's preferred inflation indicator, the core personal consumption expenditures index, climbed 5.4 percent in February, significantly over the central bank's 2 percent objective. In March, the ISM Manufacturing PMI dropped to its lowest level since September 2020, as new orders slowed and prices rose, weighing on confidence. Financial markets reacted by pricing in ever-increasing rate hikes.

A rate rise is now a certainty at the May Federal Open Market Committee meeting, with a 71 percent likelihood of a half-point increase. Worryingly, there's a larger than 70% likelihood that rates will conclude the year between 2.5 percent and 2.7 percent, implying that the Fed will have to act quickly. The trouble is that no one knows if even that faster rate would be enough to eradicate inflation—or what effect it will have on equities.

"The market, like the Fed, has no notion how much tightening is required to arrest a wage-inflation cycle," Nordea strategist Sebastien Galy says."The concern is whether this will cause a crash in the equities market."

It hasn't happened yet. The S&P 500 gained 3.6 percent in March, putting it at 19.6 times 12-month future earnings, a tad higher than the pre-Covid top in February 2020. According to Citigroup strategist Robert Buckland, the market's resiliency might be attributed to actual yields, which remain extremely low. They were rapidly climbing at the start of the year, but this was reversed when Russia invaded Ukraine.

According to Buckland, real yields currently explain 83 percent of the MSCI USA index's price. However, historically, the market has stayed robust as long as real yields are negative, implying that seemingly illogical rallies may persist, at least for the time being.

"Negative real rates may also encourage the 'there is no choice' approach to stocks," says Buckland. "Positive real rates might put a stop to the 'buy the dips' mindset."

Stocks may be able to remain afloat for the rest of the year, but with the Fed raising rates and Russia still in conflict with Ukraine, expect the journey to be rough. Given the circumstances, small-cap stocks may make more sense than large-cap companies.

While the S&P SmallCap 600 fell 5% in 2022, trailing the S&P 500 and Dow, it currently trades at only 13.5 times 12-month ahead earnings. The S&P 600 firms are also predicted to boost profits per share by 11.7 percent in 2022, outpacing the S&P 500's 9.4 percent growth.

"Buying stocks implies embracing volatility," explains Dave Donabedian, chief investment officer at CIBC Private Wealth US. "You are paid to be volatile in small-cap industries."

The S&P 500, on the other hand, is a different story.