Stock Market News Live Updates: Stocks Come Back From Session Lows To End Mixed After Fed Minutes

Feb 16, 2022

Equities climbed into green territory Wednesday afternoon as the Fed's recent meeting gave further insight into the central bank's approach to countering inflationary concerns. Investors also focused on the newest Commerce Department commercial sales data, which revealed a stronger-than-expected rise in consumption at the beginning of 2022.

The S&P 500 index edged marginally higher and recouped losses after falling about 0.9% earlier in the day. Federal Reserve members underlined in their most recent meeting minutes that they were targeting a near-term rate rise and would assess the timetable of their balance sheet cutting process "at following meetings." Nevertheless, the minutes include no reference of a possible 50 basis point rate rise at the Federal Reserve's March meeting. The possibility of such a rate rise has been a cause of concern for investors.

Wednesday's market fluctuations followed a strong performance on Tuesday, when the S&P 500 finished 1.6% higher, the first gain in four sessions. The rise occurred in the aftermath of Russia's statement that it had withdrawn military forces from the Ukrainian border and was striving to maintain diplomatic relations with the West. President Joe Biden, meanwhile, stated at a Tuesday afternoon press conference that a Russian invasion of Ukraine still "distinctly possible," while emphasizing the need for dialogue being given "every opportunity to succeed."

Crude oil prices and energy equities gained Wednesday, recouping some of Tuesday's losses, even as recent political reports seemed to diminish the possibility of rapid military action and possible interruption of the Russian energy supply. Intermediate crude oil equities in West Texas increased beyond $93 per barrel, holding around a seven-year high.

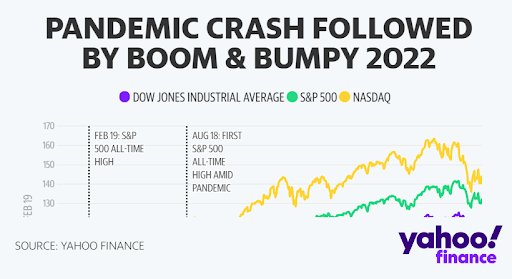

Tuesday's rise in the broad market indexes provided a brief reprieve after a three-day losing skid, but only partially reversed year-to-date losses as worries about inflation and the Fed's upcoming decision persisted. And, with inflation reaching multi-decade peaks, investors have continued to be concerned about the direction of domestic economic development. Wholesale prices increased 9.7% year over year in January, a near-record increase.

"Now, markets are swayed by the news, and we would not exaggerate either way. There is still some ambiguity around this geopolitical threat," Matthew Miskin, co-chief investment strategist at John Hancock Investment Management, commented. "We're examining the revenue situation, which is still very favorable. Economic data is fine. However, we are now trapped in a stagflationary climate, with economic indicators stalling as inflationary pressures continue to grow."

"We're still in this stagflationary environment," he continued. "We believe economic recovery will resume in the next months, incomes will remain stable, and stocks provide a bit of a potential."

Corporate results from another batch of companies came in mixed. Roblox's stock dipped after the video game business reported quarterly gross bookings that ultimately failed Wall Street expectations, indicating some slowdown in growth as stay-in-place behavior waned. ViacomCBS missed fourth-quarter earnings projections and introduced the company's rebranding as Paramount, a reference to its streaming service, Paramount+. At the same time, Airbnb reported fourth-quarter revenues and bookings that were above expectations, becoming the latest hotel company to note positive patterns in the tourism rebound.