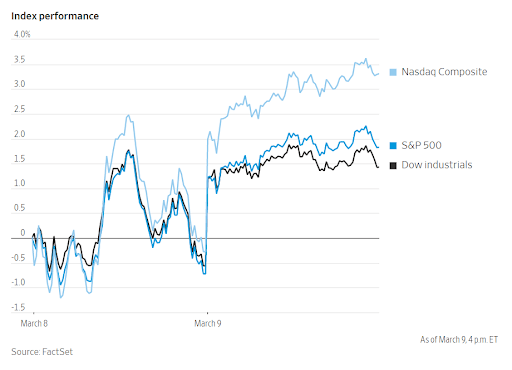

Stocks End Losing Streak as S&P 500 Rallies 2.6%

Mar 09, 2022

US equities rose Wednesday, while oil prices fell, prolonging a phase of volatility as investors monitor the economic effects of Ukraine's conflict.

The S&P 500 index increased 107.18 points, or 2.6%, to 4277.88, its highest one-day percentage rise since June 2020. The tech-heavy Nasdaq Composite Index gained 459.99 points, or 3.6%, to 13255.55, while the Dow Jones Industrial Average gained 653.61 points, or 2%, to 33286.25. Each of the three indices snapped a four-day losing run.

The Ukraine conflict has caused significant price movements in equities, commodities, currencies, and bonds. Assessing the war's progress, the rapidly evolving Western sanctions on Russia and their impact on the global economy is tough for investors.

"Market mood and daily, and even intraday, movement have undoubtedly been whipsawed by reports about the Ukraine crisis," remarked David Sekera, Morningstar's senior US market analyst.

Stock indices have plummeted as a result of the turmoil, wiping off a big part of last year's profits. Both the Dow industrials and the Nasdaq — which has entered a bear market after plummeting more than 20% from their November high — finished Tuesday at levels last seen approximately a year ago. According to experts, Wednesday's surge might be a sign that markets are taking a breather.

"Investors must be extremely careful here in pursuing this downturn, particularly when these economic consequences and anxieties begin to influence our economy through consumer confidence," warned Jerry Braakman, president and chief investment officer of First American Trust.

A jump in oil prices, fueled by the US ban on Russian energy, has sparked fears of a collision between prolonged inflation and slower economic development, ushering in a stagflationary period akin to the 1970s.

Prior to Russia's invasion of Ukrain, central banks around the world were on pace to start tightening monetary policy. Jerome Powell, Chair of the Federal Reserve, stated last week that he hoped to recommend a quarter-point rate hike at the Fed's meeting in March. Thursday morning's consumer price index data will offer investors some insights regarding the rate of inflation.

Brent oil futures fell $16.84 a barrel, or 13%, to $111.14, the worst one-day percentage loss since April 2020. The United States has imposed a restriction on Russian oil and gas supplies, while Russian President Vladimir Putin has signed an order prohibiting the export of various goods and raw materials.

"Whenever there is a reprieve in commodities prices, we are likely to see a good reaction in shares," noted Kristina Hooper, Invesco's chief global market strategist.

Wednesday's surge in equities markets prompted investors to retreat from safe-haven assets. The Wall Street Journal Dollar Index, which measures the currency's value against a basket of foreign currencies, fell 0.74 points, or 0.8%, to 90.83. This turn follows a winning run in which the dollar reached its highest level in over two years. For the third straight trading day, the yield on 10-year Treasury notes increased to 1.946%, the highest three-day advance since June 2020. The yield curve and the price of bonds move in opposing directions.

Gold prices, another asset that is seen as relatively protected by investors, fell $54.20 a troy ounce, or 2.7%, to $1,985.90, the worst one-day loss in both dollar and percentage terms since June 2021. Trades in the nickel market have been halted for another day, after wild swings Tuesday that saw the metal rising to temporarily breach the $100,000-a-ton level.

Travel and textile companies surged in the New York trade. Carnival Cruise Lines increased by $1.39, or 8.8%, to $17.27, while Royal Caribbean increased by $3.52, or 5.5%, to $68.06. American Airlines Group increased by $0.79, or 5.9%, to $14.30, while United Airlines Holdings increased by $2.665, or 8.3%, to $34.90. Tapestry Inc. increased by $3.45, or 11%, to $35.88, its highest percentage gain since April 2020.

Similarly, Amazon.com's stock jumped 8.2% in after-hours trading after the e-commerce giant announced a 20-for-1 stock split and a $10 billion share repurchase program.

Goldman Sachs increased its forecast for S&P 500 stock buybacks to $1 trillion in 2022 on Monday. According to Jessica Bemer, portfolio manager at Easterly Investment Partners, investors are comforted by firms' healthy financial sheets.

"We are aware that the market is practically working on the sand. We don't know if today is the low or tomorrow will be low, but we do realize that these businesses will continue to operate and survive," she added.

Energy stocks, which have outpaced the market this year, have fallen. Halliburton slid $1.92, or 5.2%, to $34.84, while Marathon Oil fell $0.69, or 2.9%, to $23.40.

Bitcoin staged a rebound in the crypto market after a recent drop, increasing nearly 8.7% from its Tuesday closing price at roughly $41,909.59. President Biden issued an executive order on Wednesday directing federal agencies to examine the formation of a US digital currency.

Overseas, the Stoxx Europe 600 index increased by 4.7%. Other European markets climbed as well, with Germany's blue-chip DAX finishing 7.9% higher. This is its greatest day since March 2020, when it broke out of the bear market zone. Russia's equity market stayed closed, while currency trade continued. In tumultuous trading on the foreign exchange market, the ruble dropped marginally lower to roughly 128 rubles to the dollar. Russia's ruble has been volatile since the authorities adopted steps to halt the selloff, and Western banks have shied away from Russian holdings.

Asia's markets mostly declined in line with Wall Street's Tuesday session. The Nikkei 225 index in Japan declined by 0.3%, while Hong Kong's Hang Seng Index plummeted by 0.7%. The Shanghai Composite Index fell 1.1%.