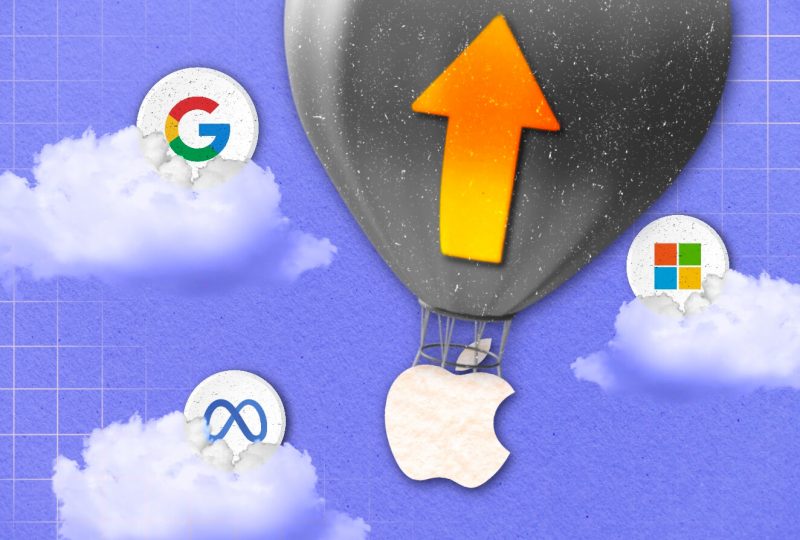

The S&P 500 was Lifted By Big Tech Stocks. The Rest of The Market is Poised to Rise.

May 17, 2023

Big Tech stocks have saved the S&P 500 this year as most other stocks have struggled. This might imply that there is potential outside of tech companies. However, certain dangers should make investors wary.

The S&P 500 has gained about 8% this year because Big Tech companies like Apple (AAPL) and Microsoft (MSFT) have risen more than 30%. Their combined market capitalizations are little more than $5 trillion, accounting for over 15% of the total market capitalization of the S&P 500. Because the index is weighted by market value, the share price changes of these highly valued firms significantly impact the index’s movement.

The two key drivers of Big Tech’s rise are lower bond rates and higher-than-expected profitability. Lower long-term bond rates make future cash profits more desirable — and these developing businesses are still valued on the assumption that most of their revenues will arrive many years in the future. Artificial intelligence is boosting sales and profitability by driving product improvements.

Meanwhile, the rest of the market has underperformed. The Invesco S&P 500 Equal Weight exchange-traded fund (RSP) has been relatively flat this year. This ETF weights each firm in the index equally, removing the disproportionate impact of Big Tech and displaying the movement of the average stock. According to Morgan Stanley, it has underperformed the conventional market value-weighted S&P 500 since the end of 2022, and the degree of underperformance has been nearly as severe as it has been in any period in the past couple of years.

The difference is that, except for technology, most equities have been dragged down by a predicted drop in economic demand. The market is concerned about the long-term implications of the Federal Reserve‘s interest-rate hikes. Furthermore, recent financial issues appear to be further damper lending and expenditure.

There is some good news in all of this for people looking for non-tech names. Given previous patterns, the underperformance of the equal-weighted S&P 500 ETF is unlikely to worsen. After all, the ETF’s price compared to the traditional S&P 500 is about as low as it’s been in the last couple of years.

As a result, if the market increases, most non-tech equities might beat Big Tech stocks and the traditional S&P 500. If the market and technology both collapse, the average stock may do better. This is especially true if the slowdown in economic growth is nearing an end. Already, both GDP growth and the pace of inflation have slowed slightly. Investors are concerned that more devastation is on the way. Still, if the economy stabilizes by the end of this year, most equities might begin to experience significant gains, especially if the Fed stops raising interest rates.These are significant issues to keep an eye on for people who are hesitant to buy Big Tech stocks following their tremendous upward run.