These Big Cap Stocks Of 18 Companies Are About to Make Money

July 13, 2023

Many firms and the larger big cap stocks market are entering a new phase in the second half of 2023. Whether due to the end of the Covid-19 epidemic or individual firms reaching tipping points, many enterprises are set to go from losing money to gaining money.

According to Jefferies stock strategists, focusing on such companies might be profitable for investors. Since 1996, Russell 3000 businesses that transitioned from negative to positive profits per share outperformed the index by an average of more than five percentage points during the following year.

Investors are insisting, “show me the money” before jumping in.

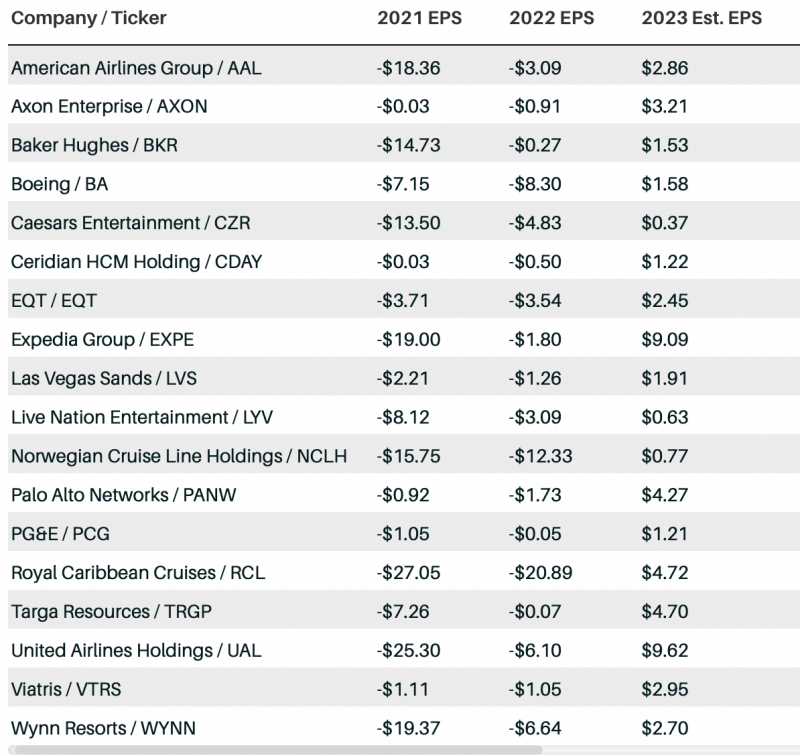

We searched the S&P 500 for firms that have posted negative earnings per share over the last two years but are expected to show positive earnings per share this year and next. The screen produced 18 names.

Many firms are seeing profit inflections due to the conclusion of the Covid-19 outbreak and the revival of in-person travel and entertainment expenditures.

American Airlines Group (AAL) and United Airlines Holdings (UAL) are among those with large capitalizations as well as its big cap stocks are cruise lines Norwegian Cruise Line Holdings (NCLH) and Royal Caribbean Cruises RCL (RCL); and casino operators Caesars Entertainment (CZR), Las Vegas Sands (LVS), and Wynn Resorts (WYNN).

Add Expedia Group (EXPE) and ticket marketplace Live Nation Entertainment (LYV) to that list, and you have half the names on the list.

Investors are well aware of the pandemic-recovery trade. In 2023, all of those firms outperform the market, some by a significant margin, like Royal Caribbean’s 105% year-to-date increase.

The remaining nine are a diverse group. The airplane manufacturer Boeing (BA) hasn’t declared full-year, unadjusted earnings per share since 2018 due to 737 MAX issues and the pandemic. Analysts expect GAAP profits per share of $1.58 this year, rising to $7.42 in 2024. That would be after a cumulative loss of $15.45 in 2021 and 2022. Boeing shares are behind the S&P 500 this year but are still down more than 50% from their early 2019 highs.

PG&E (PCG) is another corporation anticipated to turn the page on a string of bad luck. The California utility has not been profitable under GAAP since 2017, as penalties for its involvement in igniting a fatal wildfire and pricey infrastructure upgrades piled up. This year, shares are behind the S&P 500 but among the best-performing utility companies in the index.

The screen included three oil-and-gas companies: Baker Hughes (BKR), EQT (EQT), and Targa Resources (TRGP). Axon Enterprise (AXON), Ceridian HCM Holding (CDAY), Palo Alto Networks (PANW), and Viatris (VTRS) round out the list.

However, free cash flow is more important than earnings on the income statement. By adding a comparable FCF inflection condition to the screen, the list is reduced to only four organizations. Analysts expect them to return to positive EPS and FCF this year and next after reporting negative EPS and FCF the previous two years. PG&E, Las Vegas Sands, Wynn Resorts, and Royal Caribbean Cruises are among them.

Another big cap stocks of Uber Technologies (UBER) is an intriguing name that didn’t make the cut since it isn’t in the S&P 500…yet. Analysts predict the ride-hailing giant will narrowly return to profitability this year, with free cash flow surging. This might make it a candidate for inclusion in the index just when it hits an earnings inflection point. Shares are up 79% year so far but are nearly equal with their 2019 IPO price.