What is a Token Maker? – Creating Your Own Crypto Token Without Coding Skills

Nov 7, 2023

In the world of blockchain technology, tokens serve as a means of representing various assets and features. Today, there are over 22,900 cryptocurrencies in existence (though many of them are inactive or not valuable), and more tokens are created every day as more and more crypto projects are introduced.

While creating tokens traditionally required advanced programming skills and knowledge of blockchain protocols, token-creating programs have made it easier than ever for anyone to create and issue their tokens. This has opened up a whole new world of possibilities for new individuals and businesses looking to enter the blockchain sphere.

Key Takeaways:

- A crypto token is a digital asset that can be used for a variety of purposes, such as representing a digital currency, utility, or asset on a blockchain network.

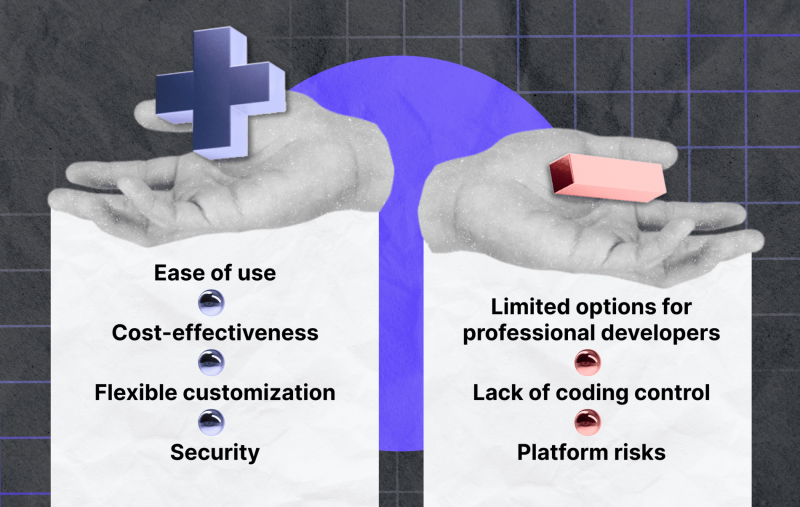

- Token makers offer convenience and customization but may have limitations in complexity and coding control.

- The process of creating a crypto token generally involves creating a smart contract that defines the rules and parameters of the token and then deploying the smart contract onto the blockchain, which will then issue the tokens.

What is a Token Maker?

A token maker is a powerful tool that allows individuals, businesses, and developers to create their own crypto tokens on blockchains without the need for technical expertise. These platforms provide a user-friendly interface and automate the token creation process, making it accessible to a wider audience.

Token makers offer a range of features and customization options, allowing users to tailor their tokens to specific requirements in just a few clicks. They support various token standards, such as ERC-20 (Ethereum Request for Comments) and BEP-20 (Binance Smart Chain Token Standard), ensuring compatibility with different blockchain networks.

A token standard is a set of protocols and rules that define a certain type of token and its features. Token standards are used to ensure that tokens are compatible with different blockchains and wallets. Token standards define various features such as the token’s name, symbol, total supply, and transferability. They also define how the token can be used, such as for use in a specific application or for the purchase of goods and services.

What Are Tokens on Blockchain?

Tokens are an essential part of various economic systems and have been used for centuries as a means of trade and exchange. Examples include casino chips, subway tokens, or loyalty points.

In the digital realm, tokens hold a significant role in the world of cryptocurrency and blockchain technology. They represent a unit of value that can be traded or exchanged between users on a particular network. Each token is assigned a unique identifier, allowing for seamless traceability and accountability.

On the blockchain, tokens can represent a wide range of assets and utilities. They can be divided into several main categories:

- Utility Tokens: Tokens that enable users to access and utilize services or resources within a blockchain platform. They act as an internal currency and provide holders with special privileges, such as discounted fees or exclusive access to certain features. They are often used within decentralized applications (DApps) to enable various functionalities or as a means of exchange within a specific network.

- Security Tokens: Security tokens are tokenized representations of a real-world asset, such as company stocks, bonds, or precious metals. Investments in these tokens are governed by government regulations and provide owners with legal ownership rights and potential profit sharing. Security tokens are often used in security token offerings (STOs) as a way to raise capital for a project or business.

Fast Fact

The emergence of the term “security token” was driven by increasing regulatory concerns. Regulatory authorities, especially the U.S. Securities and Exchange Commission (SEC), wanted to classify cryptocurrencies using terminology that wouldn’t conflict with existing legal concepts.

- Governance Tokens: Such tokens are used to govern and make decisions on a blockchain network. Holders of these tokens have the power to vote on proposals, changes, or upgrades to the network. This type of token is commonly seen in decentralized autonomous organizations (DAOs), where decisions are made through a democratic voting process.

- Payment/Currency Tokens: As the name suggests, currency tokens act as a means of exchange and store of value within a blockchain network. They can be used to make payments, purchase goods and services, or simply held as an investment. Examples of currency tokens include Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

- Non-fungible tokens (NFTs): These are unique digital assets that cannot be replaced or exchanged for something else. Each NFT has a distinct value and ownership, making them valuable for collectibles, digital art, and in-game items. They are often used to represent ownership of rare or limited-edition items.

How Does a Token Creator Work?

Token makers simplify the tokenization process by automating the creation and management of tokens. They eliminate the need for manual coding and streamline the entire process, making it accessible to individuals with little to no programming knowledge.

Customization and Flexibility

A good token maker offers a range of customization options, allowing users to define the characteristics and functionalities of their tokens. Users can specify, for example:

- token names

- symbols

- total supply

- divisibility

- other essential attributes

User-Friendly Interface

Token makers prioritize user experience, providing intuitive interfaces that guide users through the tokenization process. They often employ drag-and-drop functionality, allowing users to add features and customize token parameters easily.

Automated Smart Contract Generation

Smart contracts are self-executing agreements that facilitate the transfer of digital tokens in accordance with a predefined set of rules. Token makers automate the generation of smart contracts, eliminating the need for users to code complex contract logic manually.

Security and Randomness

Token makers utilize advanced entropy sources to ensure the highest level of security for generated tokens. An entropy source is a computer input device that supplies random bits, increasing the difficulty for potential attackers to exploit vulnerabilities. This additional layer of protection ensures that tokens are genuinely random and virtually invulnerable to malicious actors.

Process of Token Creation with a Token Maker

Creating tokens with a maker follows a streamlined process that involves several steps, from selecting a platform to distributing them.

Selecting a Token Maker Platform

The first step is to choose a suitable maker platform. There are several reputable options available, each offering unique features and functionalities to help you create your own token. Some popular token-maker platforms include:

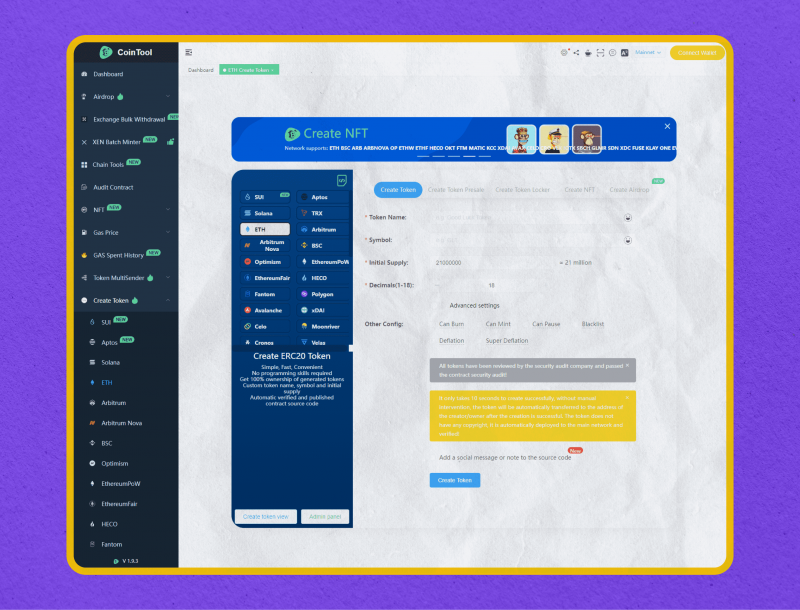

- CoinTool: A versatile token generator that supports multiple blockchain networks, including the Ethereum network, Solana, Polygon, and Avalanche. It offers an intuitive drag-and-drop interface and additional features like NFT creation and contract auditing.

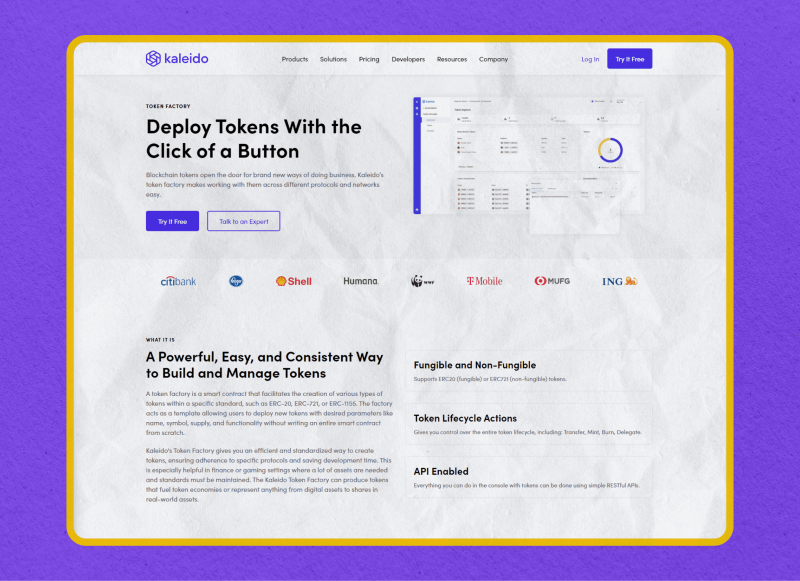

- Token Factory: This platform, developed by Kaleido, provides a standardized and efficient process for creating various token standards, including ERC-20, ERC-721, and ERC-1155. It also integrates with Kaleido’s REST API Gateway for easy deployment and interaction.

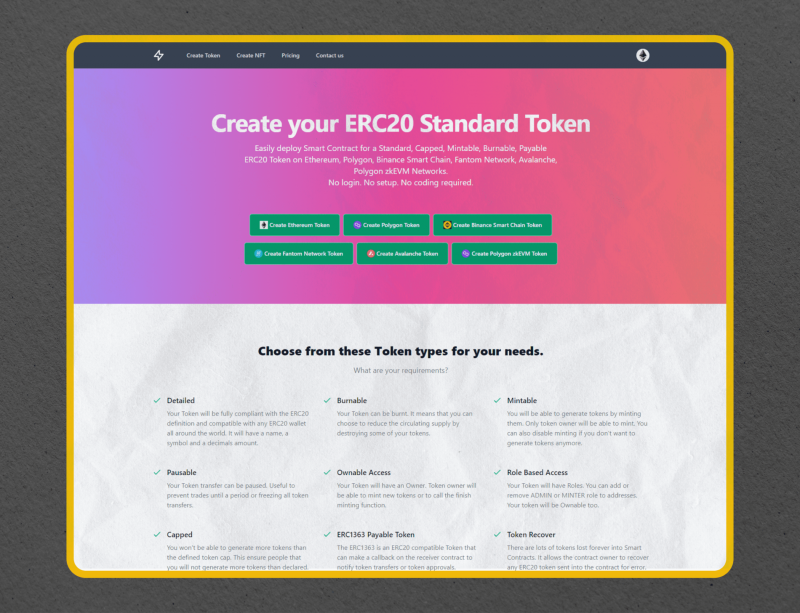

- BakeMyToken: A user-friendly maker that allows for the easy deployment of tokens on popular networks like Ethereum, Polygon, Binance Smart Chain, Fantom Network, and Avalanche. It requires no coding or setup and offers a wide range of customization options.

Registering and Providing Information

After selecting a token maker platform, create an account and provide the necessary information. This step is essential to ensure seamless processing of token creation requests and the generation of smart contracts.

Defining Token Parameters

Determine the type of token you want to create, then customize parameters, including the name, symbol, total supply, divisibility, and other relevant attributes. These parameters define the characteristics and functionalities of your token.

Creating a Smart Contract

The platform will generate the required smart contracts based on the parameters defined in the previous step. Smart contracts are programmable agreements that govern the behavior of tokens and automate transactions. The generated smart contracts ensure the secure and transparent execution of token transfers.

Testing and Deploying

Before deploying the smart contract to the blockchain, make sure you test its functionality in test networks. Many platforms provide testing environments where users can simulate token creation and transactions. This allows for the identification and resolution of any potential errors or bugs in the smart contract logic.

Once the smart contract setup has been tested and validated, it can be deployed to the blockchain. This step unlocks the ability to initiate token sales.

Issuing Tokens

After deploying the smart contract, tokens can be distributed to users or investors. The distribution process depends on the type of token being created and can involve airdrops, ICOs, and IEOs. After the tokens have been issued, they can be traded or sold on exchanges by token holders.

Choosing a Good Token Maker

Selecting a good token maker is crucial to ensure a successful process. Consider the following factors when choosing a platform:

Reputation and Security

Research the platform’s history, read user reviews, and assess its overall reputation in the blockchain community. Security should be a top priority to protect your assets and provide a safe environment for token creation.

Features and Customization Options

Evaluate the features and customization options offered by the token maker platform. Look for platforms that allow you to define token parameters, such as supply divisibility and additional functionalities like burning, minting, or expiration.

User Experience and Ease of Use

Consider the user experience and interface of the token maker platform. A user-friendly design and intuitiveness are essential for individuals with little to no programming knowledge. Look for platforms that provide a seamless and guided token creation process, ensuring that users can navigate through the steps easily.

Pricing and Cost

Evaluate the pricing structure of the token maker platform. Token creation usually includes gas fees, platforms can take their part for deployment, etc.

Regular Updates and Maintenance

Choose a token maker platform that is regularly updated and maintained by its developers. Look for bug-reporting facilities and update schedules to ensure that the platform remains secure and up-to-date with the latest blockchain protocols.

Pros and Cons of Token Makers vs. Coding Tokens

Token makers offer numerous benefits, but it is essential to understand their limitations and compare them to traditional coding-based token creation.

Pros of Token Makers

- Convenience: Token makers eliminate the need for programming knowledge, thus expanding the pool of users who can create tokens. They provide a user-friendly interface and automate the tokenization process, saving time and effort.

- Cost-Effective: These programs can be more cost-effective compared to hiring blockchain developers or allocating resources for coding and testing smart contracts.

- Customization: Token creators provide flexibility and customization options, allowing users to define token parameters and functionalities.

- Security: Token makers incorporate advanced security measures, such as entropy sources, to ensure the randomness and unpredictability of generated tokens.

Cons of Token Makers

- Limited Complexity: These makers may have limitations in terms of complexity and advanced functionalities. They are designed to simplify the token creation process, which may restrict the ability to create highly customized or complex smart contracts.

- Lack of Coding Control: Makers remove the coding aspect of token creation, which means users have limited control over the underlying logic of the smart contract.

- Platform Reliability: The reliability and reputation of the token maker platform are crucial. Choosing an unreliable or less reputable platform may pose security risks or result in a subpar experience.

Conclusion

Yes, coding tokens from scratch provides complete control over the smart contract logic and allows for more advanced functionalities. However, it requires significant technical knowledge, time, and resources. Thus, token makers provide an accessible entry point for non-technical users to enter the world of blockchain.

FAQs

What is the difference between crypto coins and tokens?

Crypto coins, such as Bitcoin, are digital currencies that are decentralized and have their own blockchains. Tokens, on the other hand, are digital assets that are created on top of existing blockchains, such as Ethereum and are used to represent a variety of assets, such as rewards or in-game items.

Is it necessary to create a crypto token for my project?

It depends on the project. Yet, creating a crypto token for your project can offer numerous benefits. It can serve as a fundraising tool, allowing you to raise capital by selling tokens to interested investors. Additionally, it can also incentivize users and create a community around your project by offering rewards or discounts in the form of tokens.

How hard is it to create your own coin?

Creating your own cryptocurrency can be quite a challenging task. It requires knowledge of blockchain technology, coding, and cryptography. You must create a blockchain network to launch a cryptocurrency, which includes writing and deploying smart contracts, setting up nodes, and building a consensus system for the network, like Proof of Work or Proof of Stake, and deploying blockchain permissions.

Creating a new cryptocurrency typically costs around $15,000. The whole process usually takes from one to six months, depending on how complex the project is.

How do you list your tokens on major crypto exchanges and increase liquidity?

Before listing your own token on a major exchange, it’s crucial to understand the listing requirements and processes. Different exchanges have various criteria, like market capitalization, trading volume, and listing fees. Research and compare exchanges to find the best fit for your token.

Once you’ve identified potential exchanges, prepare the necessary documentation like a whitepaper, website, social media presence, and marketing strategy. Exchanges review these materials to assess the token’s value and legitimacy.

Some exchanges may require a minimum number of holders or evidence of community support. Engage with your community and promote your token to increase your chances of listing on a major exchange.

When submitting a token, follow each exchange’s guidelines and provide accurate information. Details about your project, team, roadmap, and tokenomics may be required. Failure to comply may result in delays or rejection.

After listing, continue promoting and supporting trading activity. Engage with traders, provide updates, and maintain market liquidity. A strong community and market demand can attract further listings on other exchanges.