What Is The Wheel Strategy in Trading?

Nov 23, 2023

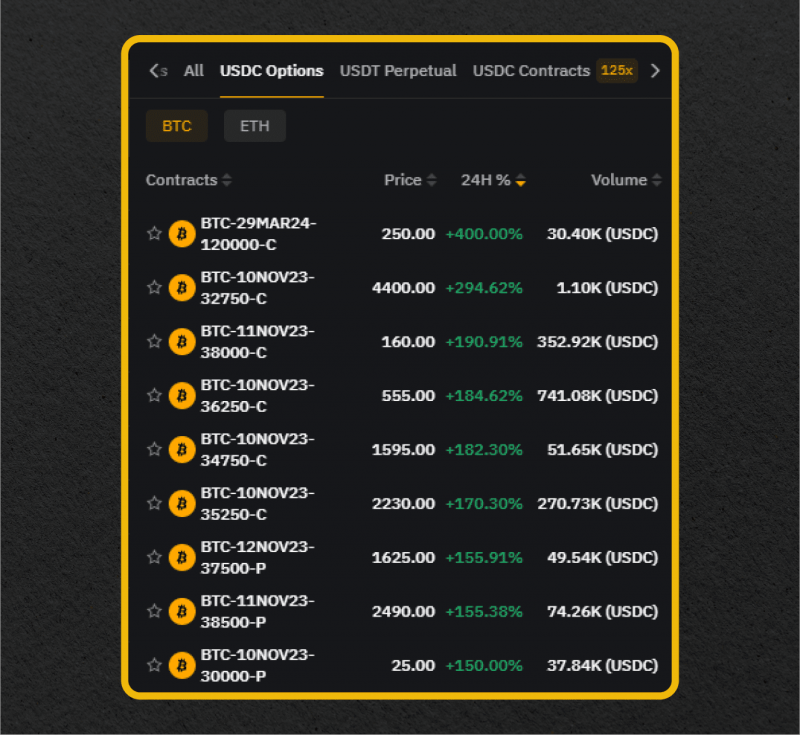

Options trading has become a highly favored method for trading assets across various markets, including Forex, stocks and even crypto. As reported by Bloomberg, options trading volumes have recently surpassed those of futures. At the same time, traders in the BTC options market show unwavering confidence, indicating the growing popularity of this type of contract.

Among the many strategies used by option traders and investors, one stands out for its methodical approach and steady returns – the options wheel strategy. Originally intended for stock trading, this technique has now made its way into other markets, including the ever-growing world of crypto trading.

In this article, we will delve into the intricacies of the wheel trading strategy, exploring its setup, execution, potential risks, and rewards.

Key Takeaways:

- The wheel strategy is performed with options – financial contracts that allow traders to benefit from changes in the price of an underlying asset.

- The strategy is based on selling puts and calls and repeating the process, thus creating a cycle.

- When executing this strategy, carefully choose the right assets and stick to the recommendations and risk management tactics.

Few Words about Fundamentals

Before we dive into the specifics of the wheel trading strategy, let’s cover some fundamentals in brief.

What Are Options?

First and foremost, the “wheel” approach relies heavily on options contracts – financial instruments that offer traders the right to buy or sell an underlying instrument at a set price within a specified period.

Options traders usually speculate on the price movement of an underlying asset without actually owning it. Simply put, options give traders the option to “bet” on whether the price of an asset will go up or down within a specific timeframe. The underlying asset can be anything from stocks, currencies, commodities, or cryptocurrencies.

Furthermore, when trading options, two crucial terms to remember:

- Strike Price: This is the price at which the option holder has the right to buy or sell the underlying asset at a specific expiration date. The strike price is determined at the time the option is purchased and cannot be changed.

- Option Premium: This refers to the current cost of buying an option contract.

As an example, if you purchase an option to buy Bitcoin at a strike price of $40,000 for next week with a premium of $500, this means that you will have the right to buy one Bitcoin for $40,000 by paying $500.

Puts and Calls

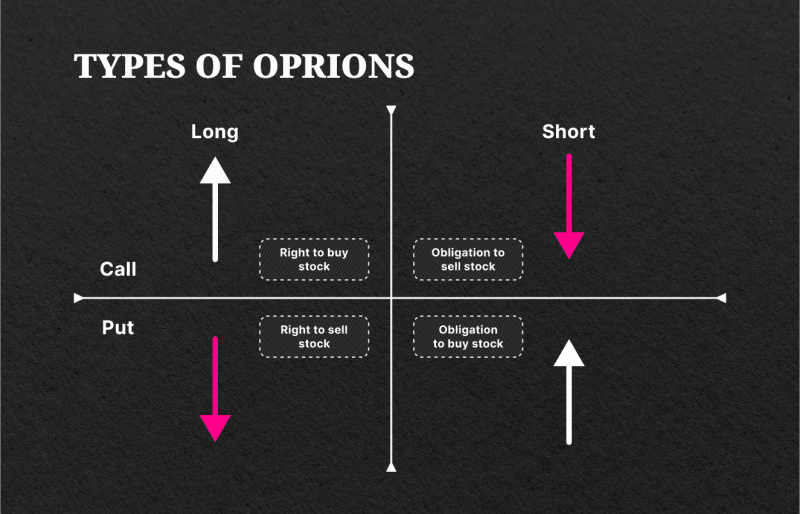

All options instruments can be divided into two categories:

- Put Options: These provide the investor with the right to sell the asset at a specific strike price within a given time frame. Traders typically use put options when they anticipate that the price of an asset will decrease.

- Call Options: These provide the holder with the right to buy this asset at a set price within a given time frame. In most cases, traders use call options when they believe an asset’s price will rise.

Let’s look at an example:

You buy a call option on XYZ stock at $100 with an expiration date of two weeks from now and a premium of $5. If the stock price goes up to $110 within that time, you can exercise your right to buy the stock for $100 and make a profit of $5.

Now that we have a basic understanding of options, let’s delve into the specifics of the wheel trading strategy.

What is the Option Wheel Strategy?

The Wheel Strategy is a popular options-trading strategy that offers traders the opportunity to generate steady income by profiting on selling options on assets that traders are bullish on.

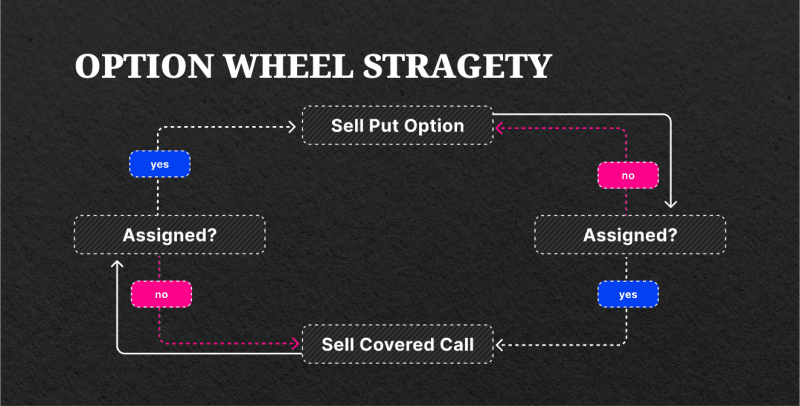

The key lies in the two techniques it combines: selling cash-secured puts and covered calls. Repeating these steps creates a cycle, or ‘wheel,’ that keeps generating revenue through ongoing trades.

Basically, the whole process of employing the wheel strategy can be broken down into three steps:

- Selling put options until an assignment

- Selling call options until an assignment

- Repeating the process

It is important to note that this is just a simplified example, and there are many variables to consider for executing the strategy successfully, including choosing the right stocks and instruments, taking into account strike prices, and evaluating expiration dates.

So, how do we trade the wheel strategy? Let’s head to the specifics.

Step 1: Selecting the Right Investment Asset

The wheel strategy starts with choosing an investment asset – it could be a stock, crypto, or some other instrument. Select a stable and profitable asset that has the potential for growth and, in the case of stocks, that pays dividends, as these factors contribute to long-term success.

In addition, it is crucial to ensure that the selected asset has high options liquidity, which means it is actively traded. This results in tighter bid-ask spreads and better pricing, enabling more effective management of positions.

When looking for the best stocks for wheel strategy, there are three key criteria to consider. Firstly, the company must have a demonstrated history of profitability. Secondly, moderate growth potential should be observed. Thirdly, the stock should typically pay dividends and have a low price-to-earnings ratio (P/E Ratio).

Fast Fact

Price/Earnings (P/E) ratio is a metric used to measure a stock’s price in relation to the company’s earnings. The P/E ratio is an important indicator of how investors value a company.

Moreover, it will be best to identify assets that are currently in a sideways range on a technical chart. This means that the asset has been trading within a certain price range for some time.

Step 2: Selling Cash-Secured Put Options

After carefully selecting an investment asset, the next step in implementing the wheel strategy is to sell cash-secured out-of-the-money (OTM) put options.

This step involves agreeing to buy the asset at a specified strike price if it falls below a certain level before the expiration date is reached. In return, you receive a premium from the buyer.

Fast Fact

An out-of-the-money option is a type of financial derivative contract in which the current market price of the security is lower than the option’s strike price.

This step requires having enough cash in your account to cover the cost of purchasing the underlying asset if you are assigned. In other words, you should have sufficient funds available to buy the asset at the fixed strike price.

After selling a put option, you will now need to observe the price of the stock and wait. There are two possible outcomes:

- The stock price holds above the strike price: In this scenario, the put option expires worthless, and you get to keep the premium as profit. This allows you to continue the cycle by selling another put option.

- The stock price falls below the strike price: If this happens, you must purchase the underlying asset at the strike price. While this may seem intimidating, remember that you entered into this trade with the willingness to purchase the stock at that price. Additionally, the premium received can help offset the cost of buying the asset.

How do you choose the right puts for selling?

If the goal is to collect a premium and let the option expire worthless, it’s best to sell a put with a strike price well below the current market value. This reduces the chances of the option expiring in-the-money. However, this also means receiving a lower premium for the option.

However, if the aim is to acquire the underlying asset, it’s advisable to choose a higher strike price closer to the current market value. This helps offset the premium received with a potential discount on purchasing the stock.

Step 3: Selling Covered Call Options

After successfully acquiring the underlying asset through the assignment of a put option, you can advance to the next step of the wheel trading strategy and sell covered calls.

This step involves selling the right for someone else to buy your stock at a predetermined strike price, ideally equal to or above your purchase price.

By selling covered calls, you add another layer of income to your portfolio. It is essential to note that if the stock’s price surpasses the call’s strike price, you will be obligated to sell the stock at the predetermined price (which is why it’s advisable to set a higher strike price than your purchase price).

There are two potential scenarios for this step:

- The stock price holds below the strike: In this case, the call option would expire worthless, and you can keep the premium as income.

- The stock price exceeds the strike: You will have to sell the shares at the predetermined strike price. However, once this transaction is complete, you can start over and sell another cash-secured put to continue the wheel strategy.

You must hold the underlying asset while the short call contract is active. The underlying asset serves as a “cover” for the short call, ensuring that you are able to fulfill your obligations in case of exercise.

Step 4: Repeating from the Beginning

One of the main strengths of the wheel strategy is its ability to be repeated over and over again. This means that, regardless of how a particular trade turns out, you can continue to utilize this strategy by simply starting the process from the beginning.

The consistent income from premiums and dividends is one of the most attractive features of the wheel options trading strategy. This consistent cash flow can help offset potential price declines, making it a well-rounded and balanced risk-return strategy.

What to Consider When Executing the Wheel Strategy

To successfully implement the wheel trading strategy, traders need to consider several factors.

Sufficient Cash in Your Trading Account

The most crucial factor when implementing the wheel strategy is having enough capital in your trading account. This ensures that you can cover any potential losses if the option expires in-the-money and you are assigned the underlying security. As a result, the strategy is “cash-secured,” which is essential for successful execution.

Confidence in the Underlying Asset

Since there is a chance of being assigned the stock through the put option, it’s crucial to have confidence in and be willing to hold the underlying asset for an extended period. Select companies that you believe in and are comfortable owning.

Selecting Appropriate Strike Prices

When selecting strike prices for the options, choose ones that align with your long-term investment goals. These strike prices should represent a level at which you are comfortable holding the underlying asset for a significant period of time.

Timing of Option Sales

The timing of option sales is a critical component of the wheel strategy. By selling puts with a near-dated expiration date of 30-40 days, traders can capitalize on time decay. This is because options tend to lose value as they get closer to expiration.

Advantages and Disadvantages of the Wheel Strategy

The wheel strategy offers several advantages for options traders:

- Consistent Income: The strategy provides traders with a steady and reliable income throughout the year.

- Lower Risk: The wheel strategy is considered a low-risk one compared to some other others. However, the risk always remains, so make sure to fully understand the strategy before implementing it.

- Dividend Capture: If trading dividend stocks, traders can hold the shares long enough to capture dividend payments while implementing the wheel strategy.

- Flexibility: The strategy allows traders to adjust their positions and strike prices based on market conditions, volatility, and their own risk tolerance.

Despite its advantages, the wheel strategy also has some potential downsides:

- Potential Losses: While the strategy aims to reduce losses compared to simply buying stocks, there is still the potential for losses if the market conditions are unfavorable or unexpected events occur.

- Holding Periods: Traders implementing the wheel strategy should be prepared for potentially long holding periods if the stock price declines. This requires patience and confidence in the underlying assets.

- Limited Gains: The wheel strategy’s primary focus is on generating income and reducing cost basis. While there is potential for capital appreciation, the strategy may not maximize profits in bull markets.

Managing Risks When Trading Wheel Strategy

The wheel strategy, like any other investment strategy, is not immune to risks. So, traders should be aware of their potential risks and manage them accordingly.

Asset Selection

One of the most important factors in the wheel strategy is stock selection. Traders should look for stocks or ETFs with strong fundamentals, a track record of long-term growth, and expected future performance. Best ETFs for wheel strategy are often popular indexes and big names with large assets under management. These indexes tend to have lower volatility, pay dividends, and have a history of consistent growth.

Risk Management

Traders should have a clear understanding of their risk tolerance and select strike prices and premiums based on their comfort level. It is important to be realistic and not get carried away by high premiums, as they can also increase the risk involved.

Constant Monitoring and Adjustment

As with any investment strategy, constant monitoring and adjustment are necessary when implementing the wheel strategy. Traders should keep a close eye on their positions and be prepared to make changes if market conditions or individual stock performance shifts. This could include rolling out of options contracts, adjusting strike prices, or even closing positions altogether.

Last Words

The wheel trading strategy is a systematic and methodical approach to options trading that offers steady income and potential capital appreciation. While the strategy requires careful stock selection, risk management, and patience, it can provide consistent returns and outperform simple buy-and-hold strategies.

Disclaimer: This is not financial advice and should not be taken as such. Options trading comes with risks, so investors should research thoroughly and consult with a financial advisor before implementing any strategy.

FAQ

When is the best time to use the wheel strategy?

The wheel strategy is a great tool when the market is trending sideways with wide trading ranges. This means that the price of an asset is moving within a relatively narrow range and not showing any clear direction. In such scenarios, it becomes easier to identify critical support and resistance levels essential for successfully executing the wheel strategy.

Is wheel strategy applicable in bear markets?

Yes, the wheel strategy can be used in bear markets as well. This strategy is often favored during bear markets as it allows investors to generate income through option premiums while waiting for stock prices to recover.

What is better: the wheel strategy or the buy-and-hold strategy?

The answer depends on factors such as market conditions, risk tolerance, and other. When executed correctly, the options wheel can yield higher returns than a traditional buy-and-hold strategy. However, sometimes, simply holding onto your investments may be more profitable.

Can the wheel strategy be used with any asset?

The wheel strategy can be used with many assets, including stocks, ETFs, and even commodities. However, it works best with stable or moderately volatile assets that have liquid options markets.

How risky are options?

Options can be risky if not used properly. However, with proper research and risk management strategies in place, options trading can be no more risky than trading individual stocks or bonds. It all comes down to the level of knowledge and experience of the trader.