The Role of Maximum Extractable Value (MEV) in Blockchain Validation

Feb 09, 2024

Ever since the creation of blockchain technology, tech-savvy individuals have devised new ways to benefit from this unique system. From mining and block validation to yield farming and staking, blockchain networks present many opportunities to earn substantial and reliable income.

The maximal extractable value (MEV) is one of the recent discoveries in this niche, allowing miners, block validators, and other related parties to increase their profitability in blockchain operations. This article will discuss the nature of extracting MEV, its practical applications, and how this novel methodology affects the blockchain landscape.

Key Takeaways:

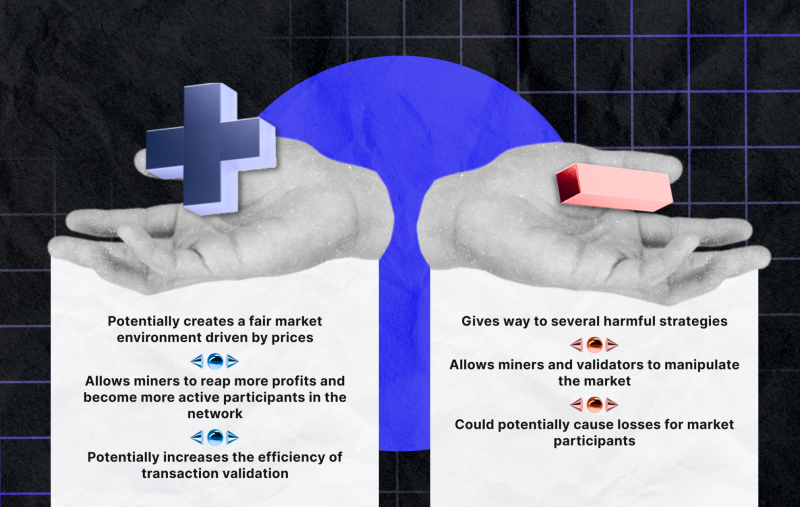

- Maximal Extractable Value (MEV) is a mechanism that allows miners or validators to maximize their network earnings in the blockchain.

- MEV has positive connotations for the market, incentivizing fair prices and the correct order of transactions.

- In recent years, indirect MEV strategies have emerged, creating unfair and sometimes harmful user environments.

- Some of the most popular MEV strategies are sandwich attacks, arbitrage, DEX liquidation, and front-running.

- The MEV concept is quite controversial, as it has positive and negative implications for blockchain.

A Quick Refresher on Blockchain Validation

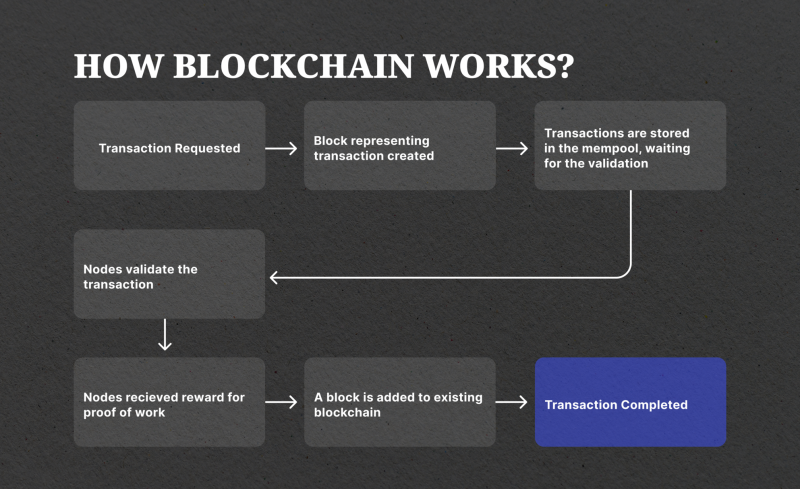

Before discussing the maximum extractable value and its inner workings, it is crucial to understand the system behind creating new blockchain blocks and validating network transactions. Despite its complex technical makeup, the blockchain transaction workflow is relatively straightforward. Transactions are initiated by the network members, entering all relevant details into their respective accounts.

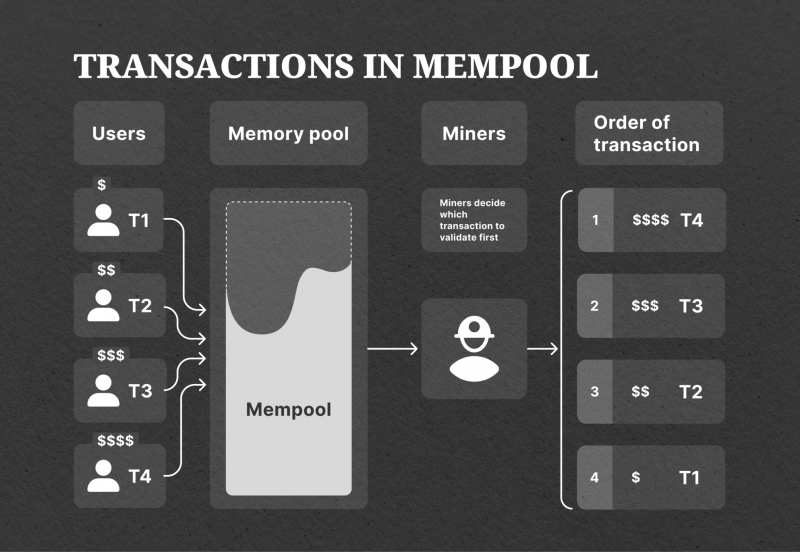

After that, every transaction is stored in the blockchain mempool. The term mempool originates from the Bitcoin ecosystem. However, most blockchain networks use this system, storing the pending transactions within the memory pool of the crypto block itself. Next, the miners, validators, or other parties responsible for block validation decide the sequence of transactions.

While there is a default ranking of transactions, mostly ordered by the transaction size and gas fees, the miners have the transaction reordering capability, allowing them to validate transactions that are most profitable for their purposes.

The described validation process is present mainly in Proof-of-Work (PoW) consensus algorithms. The Proof-of-Stake (PoS) algorithms also support this model but with several differences in the validation process.

What is MEV in the Blockchain Network

The maximal extractable value (MEV) is the byproduct of the transaction validation process described above. Miners and validators can dictate the sequence of transactions to be processed out of the mempool. While this capability might seem limited and trivial, it can help miners and validators have a massive impact on crypto prices, volumes, and distribution in the market.

Miners and validators can effectively change the sequence of transactions, validating the transfers that are most profitable for them. However, after realizing the full extent of the MEV crypto capabilities, this practice has also started to influence market prices and volumes. Users who have access to including, excluding, and reordering transactions can manipulate this power and increase or decrease asset prices as a result.

The MEV blockchain capabilities were first predicted in 2014 when some blockchain experts outlined the possibility of manipulating the crypto market prices using transaction reordering powers.

This method is applicable both for Bitcoin and Ethereum, but it is much more lucrative through Ethereum transactions thanks to the smart contracts. The smart contract ecosystem allows validators to swiftly alter the transaction ordering sequence and extract MEV as a transaction fee.

How Does MEV Extraction Work in Practice?

To capture MEV, miners and validators must use their reordering privileges on the blockchain network. This process varies depending on the network. For example, Bitcoin network miners can manually select the processing order for transactions, whereas Ethereum user transactions are automatically ranked depending on their gas price volumes.

Regardless of the system, miners can always select the transactions with the maximal extractable value and choose to process them first. Finally, the miners or validators use their computational resources or staking algorithms to confirm the selected transactions and receive corresponding rewards.

As a result, their computational power is not wasted on lower-value transfers, resulting in usage inefficiency. On the surface level, the entire MEV process is very trivial, but the consistent strategy of miners to select transactions with the most significant gas prices gives way to several advanced strategies. We will discuss these strategies at length in the following sections.

Miner Extractable Value vs. Maximal Extractable Value

Previously, the MEV abbreviation was exclusively used in the context of the network miners. However, Ethereum’s Proof-of-Stake (PoS) method has forced the industry to change the official term to maximal extractable value. After the PoS protocol became active, the validators became responsible for excluding, including, and ordering transactions within the mempools.

This subtle name change highlights that miners have lost some of their power on Ethereum, with validators gaining advanced sequencing capabilities. Aside from this detail, the two MEV models are virtually identical, providing the same capabilities to respective users.

Fast Fact

The introduction of Proof-of-Stake algorithms has promised to alleviate the MEV practices by delegating some of the duties to validators. However, so far, this reallocation of powers hasn’t produced any significant change.

Practical Applications of MEV in Blockchain

So far, the MEV concept can be described as a straightforward procedure that incentivizes efficiency in the blockchain validation process. Miners and validators are motivated to approve more significant transactions, creating a natural order of processing that classifies transactions by their size.

However, the ability to manipulate the transaction sequencing and ordering presents many potential strategies to identify profitable MEV opportunities. Let’s discuss the most popular ones in the current climate.

Arbitrage on Decentralised Exchanges

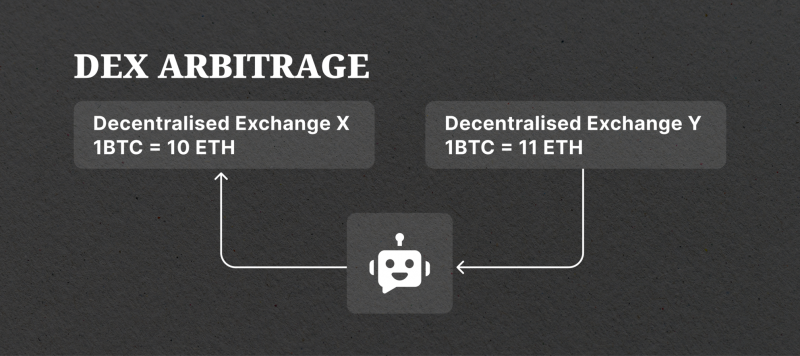

Arbitrage is a well-known strategy almost eliminated in the conventional financial world. However, thanks to the MEV extraction and the nature of decentralized exchange platforms, users can conduct arbitrage in the modern crypto setting.

As a quick refresher, arbitrage is the process of purchasing an asset in one market and selling it on the other to make profits. Naturally, arbitrage is only possible if the different markets, exchanges, and other niches don’t have perfectly aligned prices and deviate from each other. At this point, decentralized exchanges don’t have any effective means to combat their price discrepancies since the automated market makers control the entire system.

As a result, the price deviations between different exchanges can be standard in specific periods. So, many crypto traders have started to analyze the market and search for the price gaps between the different decentralized exchange platforms.

Once the opportunity is found, an MEV bot is required to execute the arbitrage itself, allowing users to purchase the desired currencies instantly and sell them without any delays on the next platform. MEV bots can place orders automatically and immediately within the blockchain network, increasing the gas fee numbers to bump the transaction ordering.

A Crypto Sandwich Attack

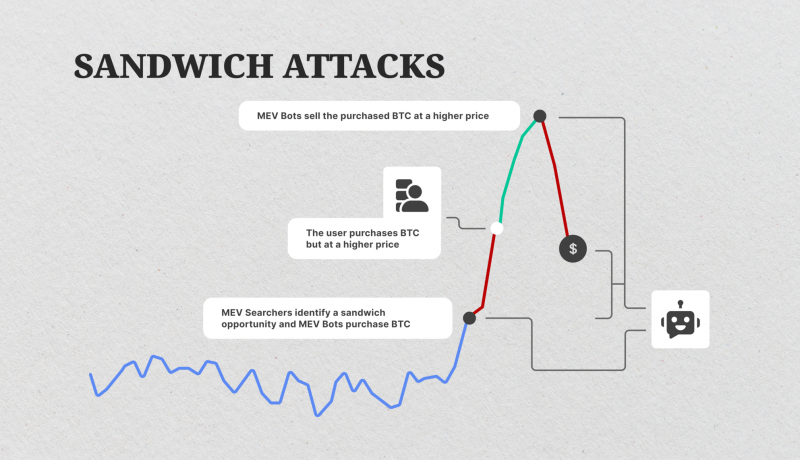

While crypto arbitrage is a relatively harmless process capitalizing on market inefficiencies, the crypto sandwich attack is far more manipulative and predatory. In simple terms, when MEV searchers detect a sizeable transaction in the ledger, they might decide to conduct a sandwich attack, causing the transaction owner to suffer losses from slippage and benefitting from the crypto price change.

Here’s how this malicious practice works. Suppose we have investor X who decides to purchase 50 ETH. While this amount is not colossal globally, it can easily influence smaller decentralized exchange platforms, causing the ETH price to spike upward. Experienced MEV searchers will detect this malicious opportunity and conduct two transactions using the MEV bots.

The first transfer will be placed right in front of Investor X’s user transaction of 50 ETH, artificially raising the price for Ethereum. After that, investor X’s pending transaction will get processed, causing the trader to suffer slippage losses but increasing the ETH price even further. The third transaction will come instantly after this, allowing malicious attackers to sell the purchased Ethereum instantly and pocket the profits in the process.

Front-Running Manipulations

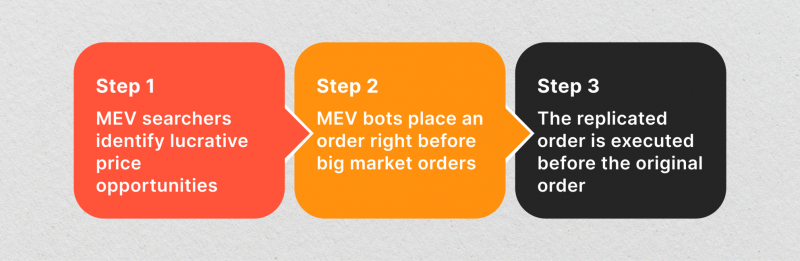

The front-running practice is a simplified version of a sandwich attack, which is considered far less harmful to the general market. However, the ethical nature of this strategy is still questionable. In practice, MEV searchers create automated bots to detect profitable transfer opportunities on the market. These opportunities might include purchasing crypto assets at favorable prices or selling them at higher prices.

Once such a transfer is identified, the bots will automatically replicate the transaction and increase the gas fee value. Since miners and validators mostly choose transactions with higher gas prices, they will reliably process the replicated transfer before the original one.

Some industry experts believe that front-running practice serves the market well and creates a fair user environment. After all, the capitalist system is designed to reward market participants who are willing to buy products at a higher price. However, the over-reliance on the front-running practice could cause the decentralized sector to become malicious and focus on leeching off others instead of creating value on their terms.

DeFi Liquidation

Finally, the DeFi liquidation practice is a widespread process of earning profits from decentralized networks. Some DeFi networks have the function of lending borrowing resources to users in exchange for collateral, which is mainly presented in the form of crypto assets. If users cannot repay the loan or interest rates within a specified deadline, the loan is canceled, and collateral needs to be liquidated.

However, since the decentralized exchanges don’t have any central authorities to take care of such tasks, MEV searchers can liquidate the collateral themselves and receive rewards for their efforts. This practice is by far the least harmful from this list, as it is a simple formality, doesn’t hurt other users in any other way, and helps the exchange become more efficient.

Ethical and Regulatory Considerations for MEVs

Naturally, the concept of profitable MEV transactions is more than a little ambiguous regarding ethics and legality. The idea of capitalizing on transaction sequencing to increase profits seems harmless at face value, but the potential market manipulation techniques could often lead to harmful consequences. Utilizing the transaction reordering capabilities to affect the price of currencies hurts market participants, directly causing them losses in the process.

Most of the strategies described above have been strictly prohibited in conventional markets and centralized exchanges, as they can drive market inefficiencies and directly harm some market participants. Many industry leaders have voiced their concerns regarding the MEV practice, describing it as unethical and borderline illegal.

Despite the mixed opinions, MEV extraction remains completely legal with decentralized exchanges. However, as the industry moves toward a more regulated environment, the crypto market will likely witness a fair share of MEV regulations and restrictions.

How Does Crypto MEV Practice Affect the Blockchain Landscape?

There are several areas in the blockchain landscape where MEV practices could have a significant influence. First and foremost, network congestion has become a bigger challenge ever since the popularisation of MEV. With front-running activities on the rise, the entire network suffers from delayed transactions, increased gas fees, and overall inefficiency.

While MEV was thought to fix the inefficiency issue, it has caused a reverse effect on the market, incentivizing too many superficial transactions and overloading the blockchain systems.

The second problem concerns ethics, which we discussed in the previous section. But aside from the regulatory considerations, the predatory nature of some MEV strategies has an adverse market effect. Many users might be reluctant to place orders since MEV searchers can decrease profits with sandwich attacks and front-running. As a result, the market becomes much less active and growth-driven.

The MEV concept, if left unchecked, might go against the nature of decentralized finance and its focus on fairness. Users might no longer feel safe and in control of their activities if malicious individuals constantly target their transactions. So, it is clear that current MEV practices require a limiting mechanism to minimize predatory attacks and incentivize fair market transactions instead.

Final Takeaways – Looking into the Future of MEV Extraction

The MEV practice has shaken up the blockchain landscape significantly. This systematic mechanism has long-reaching implications for the entire market. While there are ways to avoid falling into the MEV area of effect, like an atomic transaction, most crypto markets have to deal with this development directly.

In good hands, the MEV practice is an excellent mechanism for catalyzing market demand and supply. However, the secondary strategies devised from this method have caused adverse effects throughout the blockchain industry.

To get the most out of MEV, the crypto market must witness regulatory changes and systematic adjustments, making the practice fair and prohibiting some predatory strategies. It will be fascinating to see whether the MEV concept reaches its full potential or continues to have a mixed impact on the blockchain world.