BTC Dominance: How It Impacts The Crypto Market

Apr 08, 2024

As the #1 crypto by market cap, BTC’s price action significantly affects the rest of the market. As crypto markets swing, so does BTC’s share of the total crypto market cap. Monitoring this metric helps traders and investors understand Bitcoin’s value in relation to the altcoin market and make wise investment decisions.

This article answers the question of what is Bitcoin dominance and explores the factors influencing it, its advantages and disadvantages, as well as its importance in the digital asset market.

Key Takeaways:

- BTCD indicates the relative share of BTC opposed to the global market cap.

- BTCD in crypto began in 2009.

- BTC dominance is affected by many factors, such as regulations, market sentiment, and supply and demand.

What Is BTC Domonance?

Bitcoin dominance (BTCD) is the ratio indicating Bitcoin’s relative share compared to the global market cap of cryptos. It provides insights into the current state of the digital market and is a useful metric for understanding its health. At the current rate, Bitcoin’s market cap is over $1 trillion, with a market cap of approximately 19.6 million BTCs.

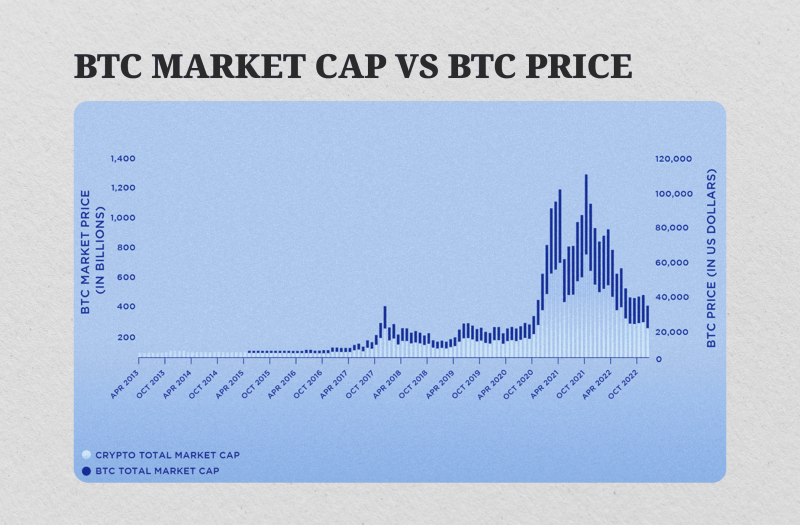

The market cap is calculated by multiplying the number of BTCs in circulation by its current market price per coin. This metric is crucial for understanding the crypto market and determining Bitcoin’s dominance.

This metric fluctuates with the rise of new altcoins, declining when they dominate the market and increasing when BTC performs better. However, fluctuations in BTCD do not necessarily indicate a rapid capital inflow; rather, they are metrical and based on Bitcoin’s current price and circulating supply.

How to Calculate BTCD

The BTCD index can be calculated by dividing Bitcoin’s market cap by the market cap of all other cryptocurrencies. For example, if Bitcoin’s market cap is $1 trillion and the total crypto market cap is $3 trillion, its dominance would be 33.33%, accounting for a third of the entire crypto market’s value.

Bitcoin’s market capitalization is calculated by dividing the total number of coins mined by the price of a single coin. This figure indicates the cryptocurrency’s popularity among investors and its position relative to other coins in the crypto market.

Large-cap cryptos typically have a market cap of $10 billion, while mid-cap ones offer more volatility and growth potential. With their volatility and riskiness, small-cap cryptocurrencies may have the potential for short-term growth. In January 2024, Bitcoin’s market cap was $843 billion, primarily due to its position as the leading crypto coin in the market.

The Importance of BTCD

BTCD is a crucial metric for understanding the virtual coins market’s health, indicating its strength, popularity, and market sentiment. Investors should monitor this to understand the current state of the market.

BTC dominance is a key market sentiment indicator that measures the trading value of certain assets based on overall market sentiment. A rise in BTC dominance usually signals fear. When BTCD drops, it can signal the onset of an altcoin season, where altcoins increase in price against the dollar and BTC simultaneously.

BTCD is a relevant metric for the altcoin season, where popular altcoins gain market favor and perform better than Bitcoin, reducing BTC’s share of the crypto market. Market participants use BTC dominance in buying and selling signals to determine the strongest trend.

BTCD rises as people buy or sell altcoins, indicating risk-off sentiment. This is used to gauge asset overvaluation or undervaluation due to investor exuberance or pessimism. By analyzing BTC dominance and price trends, investors can make informed decisions about allocating more to BTC or altcoins.

History of BTC Dominance

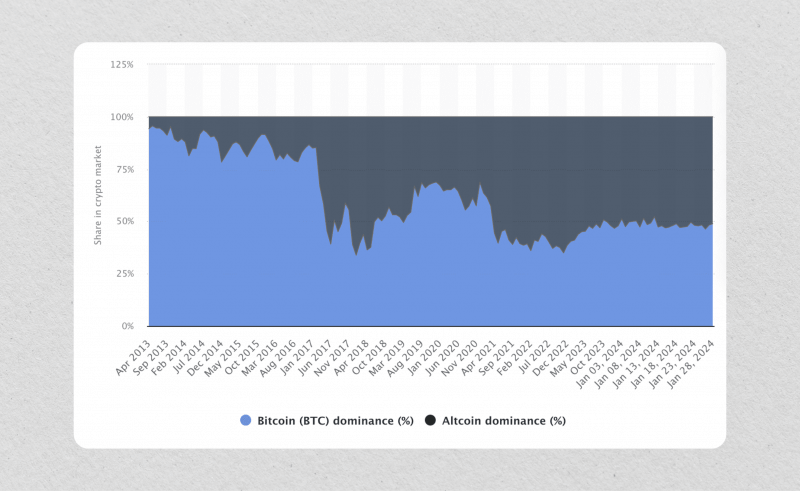

BTC’s dominance in the crypto market began in 2009 when it had 99% of the market cap share. It then fell to 94% by 2015, when ETH entered the space.

The BTCD index was introduced in 2017 to track price fluctuations of alternative currencies. Early platforms like CoinMarketCap and TradingView monitored BTCD, and until 2017, the main crypto accounted for 95% of the total crypto market cap.

However, in the same year, the index dropped to 37% due to Ethereum’s success in the initial coin offering (ICO) mania and increased interest in altcoins. Bitcoin’s price briefly reached an all-time high in December 2017 but remained low due to decreasing confidence and negative sentiment.

Bitcoin’s dominance continued to recover in 2019, with a halving in 2020, boosting its market share up to 71% after Ethereum’s 87% price crash. However, it dropped significantly to 55% due to the DeFi summer.

In 2021, Bitcoin’s market cap spiked to 700%, surpassing its previous all-time high. This was due to growing interest from institutional clients and celebrities, the rise of DeFi and NFTs, and retail clients investing in altcoins. Despite increased confidence in crypto markets, BTC gradually lost more market share to altcoins, and its dominance has remained under 40% since then.

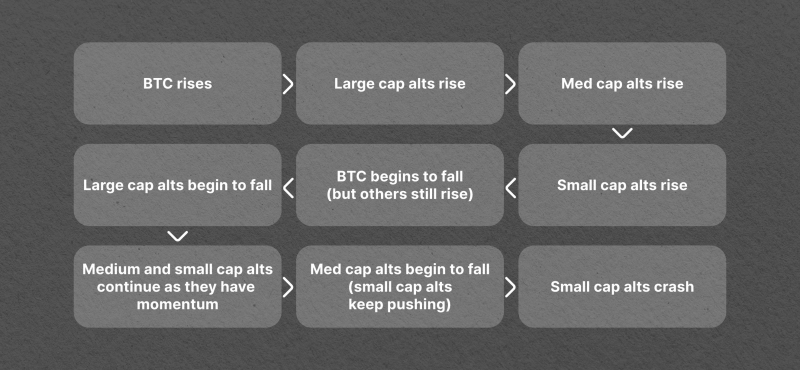

BTC, like other cryptocurrencies, typically follow a cyclical pattern: BTC is rising, then large-cap alts are rising, followed by the rise of medium- and small-cap alts. Next, BTC starts to fall while others are still rising, after this large-cap alts start to fall (with medium and small continue with the momentum) followed by the fall of mid-cap alts, and finally, small-cap crashes. This pattern is consistent with BTCD.

If Bitcoin’s value increases but its dominance decreases, it may indicate a potential bull market for altcoins. Investors holding mostly BTC may consider diversifying their portfolios by investing in altcoins that could appreciate in price. This cyclical pattern can help diversify portfolios.

What Affects The Dominance

The primary factors that affect BTCD are the Bitcoin market cap and the global crypto market cap. The Bitcoin dominance chart shows the correlation of these factors with the BTCD index.

Various macroeconomic factors also impact the metric. Thus, regulatory developments can encourage investors to buy BTC, while hostile ones discourage investment.

The adoption of new altcoins could increase the market cap, while fewer adoptions would decrease it. Altcoins have lost a significant portion of BTC’s market share due to the growth of chains like Ethereum, which can host dApps. BTCD usually rises when people invest more in BTC than altcoins, indicating either a faster or slower rise in BTC.

Market sentiments can also influence BTCD. Bullish investor sentiment increases BTC’s market cap, while bearish sentiment reduces it. Bull markets and bear markets are key factors in BTCD. In a bull market, altcoin popularity rises, leading investors to turn to altcoins, NFT projects, and riskier assets for big returns. In bear markets, BTC dominance usually rises as investors turn to virtual assets that have stood the test of time.

Supply and demand also play a role in BTCD. Increased demand leads to higher prices and market capitalization, while decreased demand decreases them.

Stablecoins, which maintain a stable value by pegging to a stable asset like the US dollar, have put pressure on BTC dominance. Risk-averse investors often use them during volatile market conditions. With the fall of USTC in 2022, this trend is not guaranteed to continue.

At present, there are thousands of digital coins with a total market cap of over $1 trillion, and NFT collections like VeeFriends and CryptoPunks have emerged as alternative crypto assets, potentially benefiting altcoins.

Positive And Negative Sides of the Dominance

BTC is the “gateway cryptocurrency” for crypto traders due to its high visibility, availability on almost every exchange, and deflationary supply. As market demand rises, BTC price rises, leading most other cryptos to follow. This positive correlation between BTC and the overall crypto market cap indicates a strong market presence.

BTCD offers several advantages, including liquidity, a strong network effect, and security.

Its liquidity surpasses traditional assets, making it easier for traders and investors to buy and sell. The network effect ensures BTC maintains its supremacy, as more people join the network as more users use it. BTC’s secure blockchain provides an immutable record of transactions, making it attractive to investors.

However, Bitcoin’s volatility, less efficient blockchain, and risk of forking can disadvantage investors. Volatility can make it difficult to predict future performance, while scalability can be slower for quick trades. Forking can also lead to confusion and uncertainty about the “real” blockchain version.

How to Use This Phenomenon in Trading

BTCD trading offers a lucrative way to make money in the virtual money market. Long-term traders can profit from Bitcoin’s long-term uptrend, while short-term traders can profit from Bitcoin’s short-term price fluctuations.

Momentum traders can profit from Bitcoin’s strong network effect by trading on its momentum. Altcoin investors can jump ship and invest in altcoins when BTC dominance decreases compared to altcoins. These strategies can be profitable if BTC continues to increase in value over time.

BTCD can be used to manage risk exposure to the cryptocurrency market, as it can indicate a potential bear market for altcoins. If BTC’s value decreases but BTCD increases, investors may consider selling their altcoin positions and moving into Bitcoin. Traders can also use BTC dominance to understand which cryptos have the most potential, as more capital flows into altcoins can dilute Bitcoin’s market cap, potentially causing BTC dominance to fall.

Closing Thoughts

Since 2017, various factors have influenced BTCD, which remains a significant metric and crucial for assessing the crypto market’s health. Due to its safe haven status and preeminent position as a crypto asset, BTCD provides insight into market sentiment and investor behavior.

BTCD metric is used to understand crypto markets, identify promising projects, and balance portfolios. However, it’s controversial, with some arguing it’s only relevant in the past due to limited virtual coins.