Ethereum Name Service: Simplifying Decentralized Identity

Apr 16, 2024

In the modern world, simplicity is valued in all areas. Due to the fact that technological progress is taking place at a record speed, everyone is trying to simplify their use as much as possible and make them available to everyone.

In the early days of the internet, information was queried by using IP addresses. To find information, a set of machine-readable addresses had to be known to locate where that information resides on computer network servers. This numerical format is easy for computers to work with but less for humans.

Ethereum Name Service, often abbreviated as ENS, revolutionizes the way we interact with the ETH blockchain. It offers a decentralized domain naming system that translates complex ETH addresses into human-readable names, enhancing accessibility and usability.

Key Takeaways

- ENS streamlines ETH transactions by replacing complex wallet addresses with human-readable names.

- It enhances user experience and adoption by providing a familiar naming convention.

- ENS demonstrates the potential of decentralized systems to offer intuitive solutions for managing digital identities.

What is Ethereum Name Service?

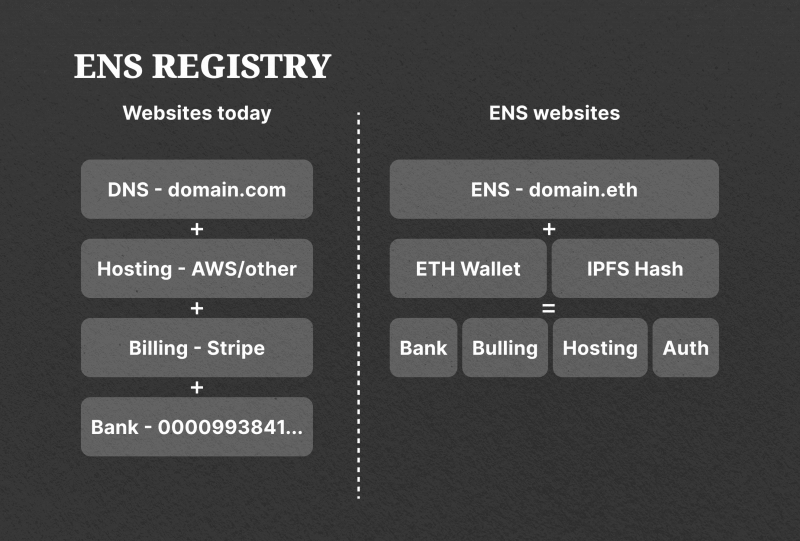

The Ethereum Name Service (ENS) is a decentralized, distributed system that operates on the ETH blockchain, aiming to simplify the process of interacting with ETH addresses by replacing complex hexadecimal addresses with human-readable names. Similar to the Domain Name System (DNS) used on the internet, ENS provides a mapping between DNS names (like “example.eth”) and ETH addresses (a long string of characters representing a user’s wallet or smart contract address).

With the ENS, users can register domain-like names ending in “.eth” and associate them with their ETH addresses. This makes it easier for users to send and receive transactions, interact with smart contracts, and identify recipients without remembering or copying long hexadecimal or IP addresses.

ENS operates through a decentralized architecture, utilizing smart contracts on the ETH blockchain to manage name registration and resolution. It provides features such as subdomains, expiration dates, and resolver contracts, allowing users to customize and manage their ENS domains.

Brief History and Purpose of ENS in the ETH Ecosystem

Nick Johnson proposed the Ethereum Name Service in late 2016 as a solution to the problem of user-unfriendly ETH addresses. It was launched on May 4, 2017, by Nick Johnson and Alex Van de Sande from the Ethereum Foundation (EF).

Johnson and Van de Sande, both with experience at Google and the Ethereum Foundation, led the development of the ENS protocol. Initially funded by the Ethereum Foundation, ENS received additional support from Chainlink in 2020.

Since its inception, ENS has become an integral part of the ETH ecosystem, providing a more user-friendly experience for interacting with ETH addresses. It has been widely adopted by wallets, DApps, and other ETH-based projects, further enhancing its importance in the ETH community.

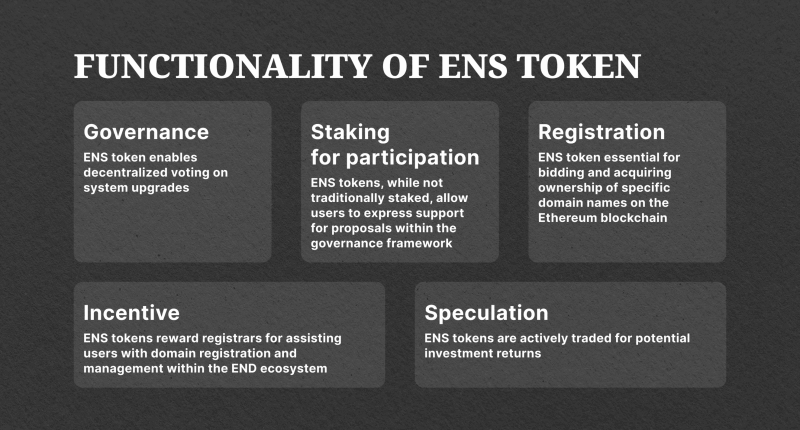

The launch of the ENS token further solidifies the platform’s importance in the blockchain ecosystem. ENS token holders gain governance rights within the ENS DAO (decentralized autonomous organization), influencing the protocol’s development and future direction. Moreover, owning an ENS domain grants access to unique opportunities within the ETH network, adding intrinsic value to ENS tokens.

Fast Fact

The live price of Ethereum Name Service is 20.35 per (ENS USD) with a current market cap of 628.07M USD. 24-hour trading volume is 111.63M USD.

How ENS Works

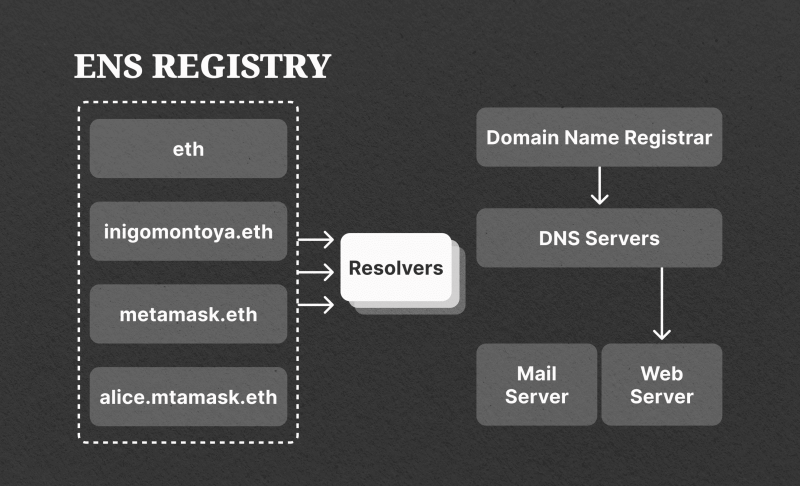

ENS operates through a series of smart contracts, namely the ENS registry and the resolver. The ENS registry maintains a list of ENS domains and subdomains, along with their corresponding owners and resolvers.

On the other hand, the resolver translates human-readable ENS domain names into ETH addresses and vice versa. This hierarchical structure empowers users to control their ETH domains and subdomains efficiently.

Overview of the Registration and Resolution Processes

ENS facilitates the registration and resolution of ENS domain names on the ETH blockchain. For more clarity, let’s delve deeper into the process.

1. Registration Process

- Choosing a Name: The user decides on a human-readable name they wish to register, typically ending in “.eth”. This could be a personal name, brand, or any other identifier they want to associate with their ETH address or other resources.

- Checking Availability: The user checks the availability of the desired name through various interfaces provided by ENS service providers or directly on the ENS website. If the name is available, they can proceed with the registration process.

- Interacting with Smart Contracts: The user interacts with the ENS smart contracts deployed on the ETH blockchain to register the chosen name. This typically involves submitting a transaction with specific parameters, including the desired name and the ETH address with which to associate it.

- Paying Registration Fees: To complete the registration process, the user pays a registration fee in ether (ETH). This fee helps prevent spam registrations and supports the operation of the ENS system. The registration fee is typically paid for a fixed duration, after which it must be renewed to maintain ownership of the ENS domain name.

- Confirmation: Once the registration transaction is confirmed on the ETH blockchain, the ENS domain name becomes officially registered to the user’s ENS address. The user now has full control over the name and can configure it to resolve various resources.

2.Resolution Process

- Configuration: After registering a domain name, the user configures the associated resolver smart contract. The resolver contract contains information mapping the domain name to specific resources, such as an ETH address, IPFS content hash, or other metadata.

- Resolving Requests: When someone wants to interact with a resource associated with a domain name (e.g., sending cryptocurrency to a wallet address), their ETH client or DApp queries the ENS resolver for the corresponding resource. The resolver retrieves the information from the ETH blockchain and returns it to the requester.

- Interoperability: ENS is designed to be interoperable with various ETH-based systems and standards, allowing domain name service to resolve to a wide range of resources across the Ethereum ecosystem. This includes integration with wallets, exchanges, DApps, and decentralized storage platforms.

- Decentralization and Security: The resolution process is decentralized and secure, leveraging the immutability and censorship resistance of the ETH blockchain. Once a domain name is registered and configured, its resolution cannot be tampered with or censored by any central authority.

Following these processes, users can register human-readable domain names on the ETH blockchain and configure them to resolve specific resources. This enables easier and more intuitive interactions within the decentralized web.

Benefits of Using ENS

Using the Ethereum Name Service offers several benefits for simplifying interactions with the ETH blockchain. Besides the easy use of ENS names, it offers:

User-Friendly Experience

By replacing ETH addresses with recognizable names, ENS significantly improves the user experience when interacting with DApps and sending transactions. Users can simply enter a domain name like “myname.eth” instead of copying and pasting or manually typing out a lengthy hexadecimal address.

Integration with DApps

Many decentralized applications integrate with ENS, allowing users to interact with them using ENS names rather than ETH addresses. This integration simplifies the onboarding process for new users and makes DApps more accessible to a broader audience.

Renewal and Management

ENS domain name service requires periodic renewal to maintain ownership, ensuring that unused or abandoned names are eventually released back into the pool for others to register. This helps keep the namespace vibrant and prevents the hoarding of valuable names.

Reduced Risk of Errors

ENS name minimizes the risk of transaction errors caused by mistyping or copying incorrect crypto addresses. This can help prevent the loss of funds and improve overall confidence in interacting with the ETH blockchain.

Brand Recognition and Identity

ENS allows individuals, businesses, and organizations to establish a recognizable and consistent brand identity on the ETH blockchain. Users can enhance their visibility and credibility within the decentralized ecosystem by registering domain names that reflect their brand or identity.

Conclusion

ENS represents a significant advancement in decentralized domain naming systems. Its ability to simplify ETH addresses and offer human-readable names enhances accessibility and usability within the blockchain space. Whether you’re a seasoned crypto enthusiast or a newcomer, ENS provides a seamless and intuitive experience that unlocks the full potential of the ETH blockchain.