How to Accept Bitcoin Payments in 2024: A Comprehensive Guide for Businesses

Aug 01, 2024

Bitcoin has transcended its roots as a niche digital asset to become a mainstream payment option. As of 2024, more businesses are embracing cryptocurrency, particularly Bitcoin, as a viable payment option. This shift not only enhances transactional efficiency but also appeals to a new demographic of tech-savvy consumers.

Businesses looking to expand their customer base and stay ahead of the curve can benefit significantly from accepting Bitcoin payments. This comprehensive guide will equip you with the knowledge and steps needed to start accepting Bitcoin in 2024.

Key Takeaways:

- Accepting Bitcoin payments opens your business to a broader customer base of crypto enthusiasts.

- Crypto payment processors simplify the process and offer features like instant settlements and conversion to fiat currencies.

- Consider factors like fees, supported currencies, and security measures when choosing a crypto payment provider.

- Securely storing your Bitcoin and understanding tax implications are crucial aspects of accepting cryptocurrency payments.

Why Accept Bitcoin Payments?

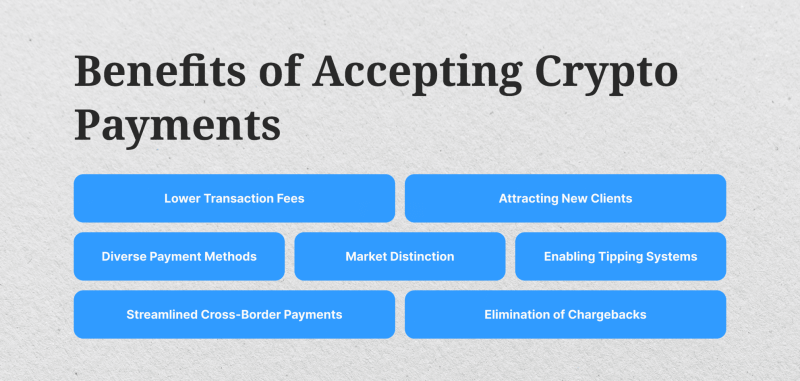

There are several compelling reasons why businesses should consider accepting Bitcoin payments:

Reach a Wider Audience

By accepting crypto payments, businesses can attract a global audience who prefer decentralized financial systems over traditional banking methods. This inclusivity can enhance brand loyalty and expand market reach.

Faster Transactions

Bitcoin transactions are processed swiftly, often within minutes, compared to the days traditional banking systems might require for cross-border transactions. This speed can improve cash flow and operational efficiency for businesses.

Lower Fees

Cryptocurrency transactions typically incur lower fees than traditional payment systems like credit card payments. This cost reduction can significantly benefit businesses by increasing profit margins and providing competitive pricing.

Increased Security

Bitcoin’s blockchain technology provides a secure, transparent, and immutable ledger, reducing the risk of fraud and chargebacks. This security feature is particularly appealing in a digital age tense with cybersecurity threats.

Future-Proofing Your Business

By embracing cryptocurrency payments, you demonstrate your business’s innovation and adaptability to the growing financial field.

Understanding Crypto Payment Gateways

While you can technically receive Bitcoin payments directly into your own Bitcoin wallet, this method can be cumbersome for managing everyday business transactions. This is where crypto payment gateways come in. These services act as intermediaries between your business and your customers, simplifying the process of accepting crypto payments.

Let’s outline the benefits of using a crypto payment gateway:

- Easy Integration: Most crypto payment gateways provide plugins and APIs that can be easily integrated into existing e-commerce platforms and point-of-sale systems. They simplify the payment process for both the customer and the merchant.

- Instant Settlements: Some gateways offer instant conversion to fiat currency, mitigating the volatility risk of cryptocurrencies.

- Customer-Friendly Checkout: Provide a familiar and convenient checkout experience for your customers accustomed to online payments.

- Fraud Protection: Crypto payment gateways often incorporate fraud prevention measures to protect your business from fraudulent transactions.

Fast Fact:

On May 22, 2010, a programmer named Laszlo Hanyecz made history by conducting the first documented real-world transaction using Bitcoin, purchasing two pizzas for 10,000 BTC.

Steps to Accept Bitcoin Payments

As mentioned above, accepting Bitcoin payments is a valuable addition to your business, providing your customers with a modern and flexible payment option. Here’s a detailed guide on how to start accepting Bitcoin payments:

Set Up a Bitcoin Wallet

To start accepting Bitcoin payments, you need a Bitcoin wallet, which is a digital storage for your cryptocurrency. There are various types of wallets available:

- Software Wallets: These are applications installed on your computer or mobile device, offering a balance of security and convenience (e.g., Electrum, Exodus).

- Hardware Wallets: These are physical devices that securely store your private keys offline, providing the highest level of security (e.g., Ledger, Trezor).

- Mobile Wallets: These smartphone apps are ideal for on-the-go transactions (e.g., Mycelium, Trust Wallet).

- Web Wallets: Online services that can be accessed from any device (e.g., Blockchain.com, Coinbase).

Steps:

- Choose a Crypto Wallet: Select a wallet based on your needs. For businesses, security and ease of use are paramount.

- Install and Set Up: Download the software or set up the hardware. Follow the instructions to secure your wallet with a strong password and back up your recovery phrases.

Choosing a Crypto Payment Gateway

It is crucial to select the best crypto payment gateway. Consider factors such as transaction fees, security features, ease of integration, and support for multiple cryptocurrencies.

- Transaction Fees: Look for gateways with competitive transaction processing fees to maximize your profit margins.

- Security: Ensure the gateway has robust security measures, such as two-factor authentication and encryption.

- Integration: Choose a gateway that offers easy integration with your current systems.

- Multi-Currency Support: Opt for a gateway that supports various cryptocurrencies if you plan to accept more than just Bitcoin.

Steps:

- Sign Up: Create an account with your chosen processor.

- Integrate with Your Platform: Connect the processor to your website or point of sale using plugins, APIs, or custom integrations.

Integrating Payment Solutions

Once you’ve chosen a payment gateway, integrate it into your e-commerce platform or point-of-sale system. Most gateways provide detailed instructions and plugins for popular platforms like Shopify, WooCommerce, and Magento.

- E-commerce Integration: Install the gateway’s plugin or use an API to connect it with your online store.

- Point-of-Sale Integration: For brick-and-mortar stores, set up a point-of-sale system that supports cryptocurrency payments.

Steps:

- Select a Plugin: Choose a plugin compatible with your e-commerce platform.

- Install and Configure: Follow the instructions to install and configure the plugin with your Bitcoin payment processor.

Set Up Payment Buttons and Invoicing

Businesses without an online store can accept Bitcoin through payment buttons or invoices.

Tools:

- Payment Buttons: Create buttons that can be embedded on websites or blogs.

- Invoicing Services: Generate invoices using the Bitcoin payment method (e.g., BitPay’s invoicing tool).

Steps:

- Generate Payment Buttons: Use your crypto payment processor to create and customize payment buttons.

- Send Invoices: Use the processor’s tools to generate and send invoices to customers, including a Bitcoin payment option.

Inform Customers and Promote Bitcoin Payments

Let your customers know that you accept cryptocurrency payments to encourage its use.

Tips:

- Website Announcements: Add information about Bitcoin acceptance to your site.

- Promotions: Offer discounts or incentives for paying with Bitcoin.

- Customer Communication: Inform existing customers via email or social media.

Manage and Secure Your Bitcoin Funds

Once you start receiving payments, managing and securing your funds is crucial.

Tips:

- Convert to Fiat Currency: Regularly convert Bitcoin to your local currency to mitigate volatility risks.

- Secure Your Wallet: Update your software regularly, use strong passwords, and consider multi-signature security for high-value wallets.

- Tax Compliance: Keep records of all transactions and comply with local tax regulations on Bitcoin earnings.

By following these steps, you can effectively start accepting Bitcoin payments, providing a modern payment option for your customers and potentially reaching a wider audience. Always stay updated on cryptocurrency’s latest trends and security practices to ensure smooth operations.

Best Crypto Payment Providers in 2024

In 2024, several top-notch crypto payment providers offer robust solutions for businesses looking to integrate cryptocurrency payments. Here’s a detailed look at some of the best providers to consider:

Coinbase Commerce

Coinbase Commerce is a leader in the crypto payment space, especially for businesses in the US. It supports many cryptocurrencies, including Bitcoin, Ethereum, and USD Coin, and offers seamless integration with popular e-commerce platforms like Shopify and WooCommerce. Coinbase Commerce provides features such as custom checkouts, invoicing, and volatility shielding, making it a comprehensive solution for online merchants. The transaction fee is 1%, which is relatively standard for the industry.

BitPay

BitPay is renowned for its stability features, such as locking in exchange rates at the transaction time to shield businesses from cryptocurrency volatility. It supports over 200 cryptocurrencies and offers direct bank transfers and invoicing. BitPay is exceptionally user-friendly and integrates well with existing business systems, making it an ideal choice for those who want to manage cryptocurrency risk effectively.

B2BinPay

B2BinPay supports over 800 cryptocurrencies and tokens, including major ones like Bitcoin, Ethereum, Litecoin, and stablecoins such as USDT and USDC. This extensive support allows businesses to cater to a broad customer base interested in various digital assets. The platform offers easy integration with a single API, allowing businesses to get up and running quickly, typically within an hour.

This benefits various sectors, including e-commerce, gaming, and online services. B2BinPay ensures high security for transactions with features like DDoS protection and fraud prevention measures. It supports both on-chain and off-chain transactions, providing flexibility in processing payments. The platform offers real-time balance and transaction history, downloadable reports, and detailed insights, helping businesses manage their crypto transactions efficiently.

When choosing a crypto payment provider, consider factors such as transaction fees, the range of supported cryptocurrencies, integration options, and whether the provider offers volatility protection. These features can significantly impact your business’s ability to manage and benefit from cryptocurrency payments effectively.

CoinGate

CoinGate is an optimal choice for businesses operating outside the US. It supports over 50 cryptocurrencies and provides features like invoicing, payment buttons, and integration with various shopping cart platforms. CoinGate’s fees are around 1%, and it offers fiat settlements, making it easier for businesses to handle cross-border transactions.

PayPal

PayPal has integrated cryptocurrency features, allowing users to buy, sell, and hold digital currencies directly through its platform. PayPal’s wide acceptance makes it a convenient choice for businesses aiming to tap into the crypto market while maintaining a simple, familiar interface for customers.

Compliance and Security Considerations

Having a deep understanding of the regulatory landscape is crucial when accepting Bitcoin payments. Compliance requirements vary by country, so understanding your region’s legal implications is essential.

- Know Your Customer (KYC): Some jurisdictions require businesses to implement KYC procedures to verify customer identities.

- Anti-Money Laundering (AML): Compliance with AML regulations is necessary to prevent illicit activities through cryptocurrency transactions.

- Tax Reporting: Ensure you accurately report cryptocurrency transactions for tax purposes to avoid legal issues.

Security Best Practices

Use Secure Wallets: Opt for wallets with robust security features and consider using hardware wallets to store large amounts of cryptocurrency.

Implement Two-Factor Authentication: Enhance the security of your payment systems by enabling two-factor authentication.

Regular Audits: Conduct regular security audits to identify and address vulnerabilities in your payment infrastructure.

Customer Education and Engagement

Educate your customers on using cryptocurrency for transactions to ensure a smooth transition to accepting Bitcoin payments. Provide clear instructions and resources to guide them through the process.

Create Tutorials: Offer step-by-step guides on how to make payments using Bitcoin.

FAQs and Support: Develop a comprehensive FAQ section and provide customer support for crypto-related queries.

Promoting Bitcoin Payments

To encourage more customers to use cryptocurrency, highlight the benefits of using Bitcoin, such as lower transaction fees and enhanced security.

Marketing Campaigns: Run campaigns highlighting the acceptance of Bitcoin to attract crypto enthusiasts.

Incentives: Offer discounts or special promotions for customers who pay with Bitcoin.

Case Studies of Businesses Accepting Bitcoin

Numerous small businesses, from coffee shops to tech startups, have successfully integrated Bitcoin payments, enjoying increased sales and customer loyalty. Furthermore, several big and well-known players have started accepting crypto payments. Among them are Apple, Christian Dior, Disney, Nike, PlayStation, Ray-Ban, Walmart, Tesla, Overstock, etc.

Overstock was one of the first major retailers to accept Bitcoin. The company has seen significant benefits, including attracting a new customer base and reducing payment processing fees.

Tesla’s brief acceptance of Bitcoin demonstrated the potential for mainstream adoption of cryptocurrency. Although they temporarily halted Bitcoin payments due to environmental concerns, their move sparked significant interest in crypto payments among large corporations.

Future Trends in Bitcoin Payments

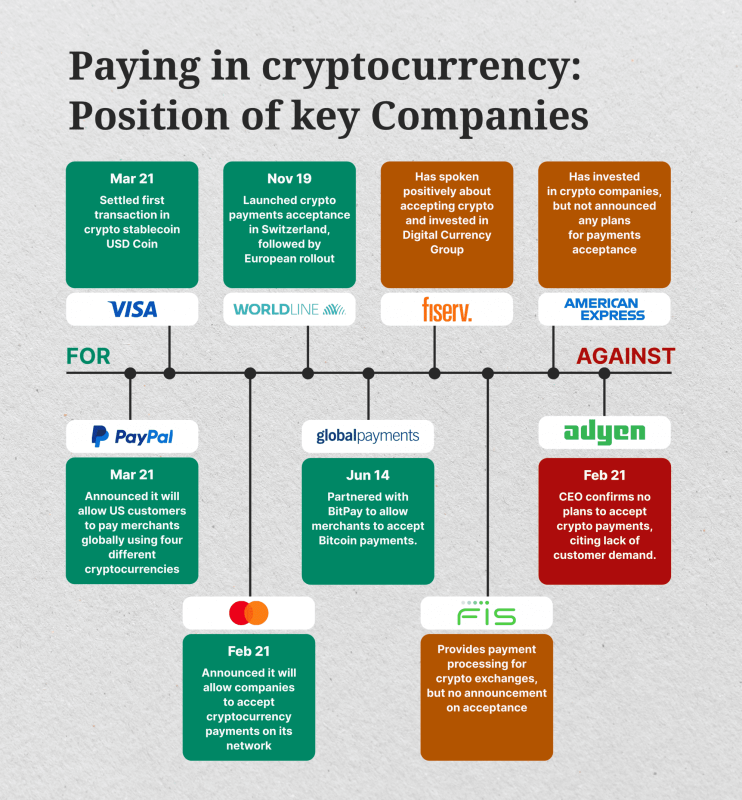

As cryptocurrencies become more mainstream, expect to see a significant increase in businesses accepting Bitcoin payments. This trend is driven by growing consumer demand and advancements in payment technology.

Integration with Traditional Finance

Expect greater integration of cryptocurrency with traditional financial systems, enabling seamless transactions between fiat and digital currencies.

Regulatory Evolution

As the crypto landscape evolves, anticipate more comprehensive regulatory frameworks that provide clarity and security for businesses accepting Bitcoin.

Conclusion

Accepting Bitcoin payments in 2024 offers numerous advantages, from expanding your customer base to reducing transaction fees. Understanding how to accept Bitcoin payments and choosing the best crypto payment gateway can position your business at the forefront of the digital economy.

By following the steps outlined in this guide, you can start accepting Bitcoin payments in 2024 and unlock the potential benefits for your business. Accepting Bitcoin payments demonstrates your business’s forward-thinking approach and opens doors to a new generation of tech-savvy customers. Stay compliant, secure, and informed to use the full potential of cryptocurrency in your business operations.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs:

How do you accept crypto payments in person?

To accept crypto payments in person, you may need a crypto-compatible QR code scanner or NFC terminal. If you use a mobile device, apps like the Bitcoin QR Scanner can help.

Is it legal to accept crypto as payment?

The IRS considers cryptocurrency to be “property” for tax purposes. This means that if you accept cryptocurrency, you must report it as gross income based on its fair market value when it was received. “In other words, each time you sell, buy, or use Bitcoin, you’re subject to a capital gains tax.”

Can banks accept crypto?

A crypto-friendly bank supports cryptocurrency transactions, allowing users to buy, sell, and securely store digital assets alongside traditional currencies.

How do you accept crypto from someone?

Your cryptocurrency wallet will allow you to copy crypto addresses to your clipboard. Then, you must provide the sender with that address via email, messaging app, etc. Make sure the sender and you are using the same blockchain.