Explaining The Concept of Copy Trading

Aug 02, 2024

Copy trading enables new traders to earn money and helps save time for traders with hectic schedules. Traders can replicate the achievements of seasoned investors without requiring extensive prior knowledge.

This method, while practical, necessitates thorough investigation and diligence. This guide provides an overview of copy trading, evaluating its perks and weaknesses, aiming to enhance traders’ decision-making and overall trading experience.

Key Takeaways:

- Copying trades lets traders emulate the strategies of more experienced investors.

- In the 2000s, replicative trading transitioned from traditional newsletters to virtual trading rooms and chat rooms.

- This strategy can potentially generate profits but may also discourage traders from conducting their own market research.

- eToro, B2Copy, and AvaTrade are some of the best venues for copying deals.

What is Copy Trading?

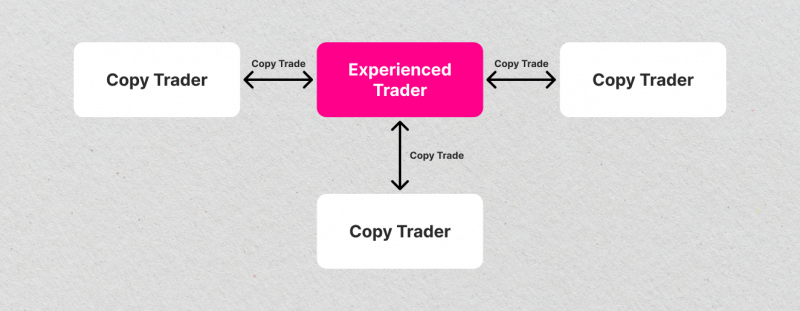

The idea of copy trading enables beginners to replicate the trading techniques of successful traders in order to learn from their expertise without needing extensive trading knowledge. The dedicated platforms let individuals stay updated on current events, monitor and view trading history, express their perspectives on the market, and mimic the commercial operations of others. This tool simplifies communication, knowledge sharing, and profit-making in the market, all without requiring advanced expertise.

Replicating trades is often confused with social and mirror trading. Social trading involves mimicking popular investor deals with features like tracking statistics and communication. It allows users to control their accounts, select a risk/reward ratio, and stay responsible for their trades. Mirroring implicates reproducing a specific trading strategy, often in the form of automated algorithm trading.

Copy trading makes it easier to decide where to invest your money. You can replicate the actions of other traders for a specific percentage of their trades.

You can emulate the trades of other individuals with a lot of different brokerage platforms. You can examine the historical track records of experienced traders and select one that suits your trading approach and comfort level with risk. The platform duplicates the same trade to the user’s account upon a trader making a trade. This feature allows users to choose the funds they want to invest, the trading style, and the level of risk they are comfortable with for every operation.

A Brief History of Copy Trading

People have been imitating trades for quite some time. In the past, traders would use traditional newsletters to communicate their purchasing and selling intentions. During the 1990s, traders used letters to share their methods and trades with followers, while in the 2000s, the popularity of the Internet led to the creation of virtual trading rooms and chat rooms where traders could communicate their plans and ideas.

The mid-to-late 2000s saw the rise of automated trading, leading to the emergence of mimicking trading. Tradency introduced an automatic trading system called Mirror Trader in 2005, allowing traders to post their strategies and mirror transactions generated from them.

By 2010, many brokers began offering trade copying, particularly in the foreign exchange market. Trade copying gained popularity, but the 2008 economic meltdown and increasing scams led to regulatory tightening, leading to the closure of many imitation trading services.

How Does it Work?

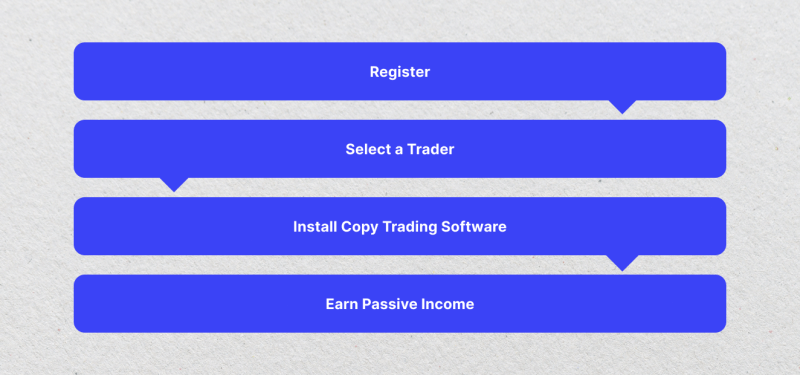

Copy trading implicates creating an account on a reputable stock trading platform and selecting a successful trader to replicate their trading strategies or profits. Utilise trading platforms to automatically copy trade the stock picks of other investors. Another way to do it is by manually mimicking others’ trading operations and keeping an eye on the stocks they buy and sell in their portfolios.

In copied trading, three main strategies exist: manual, semi-automated, and automated.

Manual trading is akin to regular trading. You can decide whether or not to heed a trade suggestion from another trader and then proceed to carry out the trade independently. It’s like engaging in your own trading activities. This method requires additional time and effort, and the market conditions may have shifted by the time the trader and you execute it. Nevertheless, it provides additional flexibility and prevents you from making poor trades.

Utilizing an automated strategy, the mimic trading platform handles selecting a trader, establishing risk parameters, and observing outcomes, simplifying the process of copying deals.

Semi-automated copy trading allows traders to view their preferred traders’ positions, choose which to trade, and initiate with those positions. This requires minimal human effort and executes the other process automatically.

To start mimicking trades, find a suitable platform with a good reputation and a long history, register with major regulators, and test the platform using a demo account before starting replication trading. Then, find a trader to copy. Diversify your portfolio by choosing traders with different time frames or specialized markets.

Initially, trade with small sums of money and gradually increase the amount based on their performance. If the platform permits, establish boundaries for the risk you are comfortable with. Link your account with the trader, then be patient with the outcome. The trades of the traders you choose on the platform will be duplicated in your trading account. Adjust your investment amount according to your trading performance, and consider increasing it if you are satisfied with the outcomes.

Emulating commercial operations can expedite your journey to success and offer educational insights for your trading endeavors. Evaluating successes and mistakes can help refine the plan and increase the probability of success.

Benefits and Drawbacks of Copy Trading

Trade replicating lets you easily reproduce professional traders’ trades and enjoy the results. However, as with any market phenomenon, it has both positive and negative sides. Here are the main advantages and drawbacks of this method.

Advantages

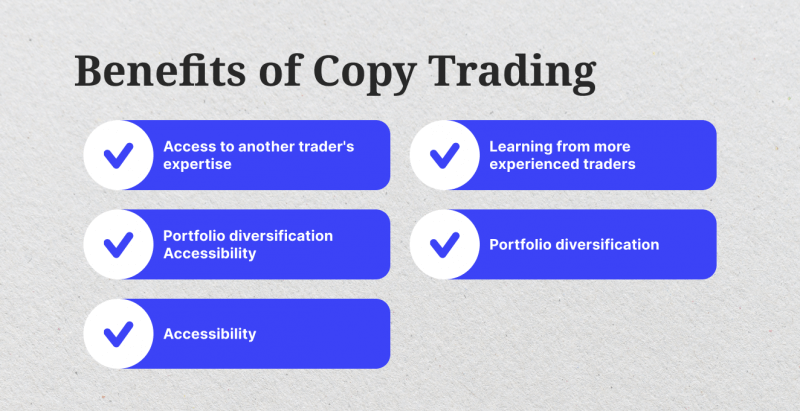

Emulate trading offers multiple advantages, including leveraging the expertise of another investor, saving time and effort, flexibility, and more returns.

The structured learning method from experienced traders aids beginners in gaining market exposure and developing trading skills, shortening the learning curve and enhancing their understanding of capital markets without market analysis expertise.

Trades simulating allows traders to spread their trades across multiple signal providers, reducing reliance on a single individual’s performance and potentially enhancing returns. It saves time and effort for traders who need more time to make decisions, allowing them to focus on other aspects of trading while still benefiting from seasoned professionals’ expertise. This results in a well-diversified portfolio with minimal effort.

Copy trading also provides flexibility, allowing users to pick the best traders and adjust their investment strategy based on risk tolerance and finance goals.

With copy trading, you can save time as the process can be automated, giving you more freedom. This suggests you can participate in trading while holding a day job. It prevents emotions from influencing trades, ensuring rational and sound decisions.

Moreover, experienced traders can make extra profits by allowing others to replicate their trades. It is suitable for novice and seasoned traders as it enables them to engage in various markets and trading techniques.

Weaknesses

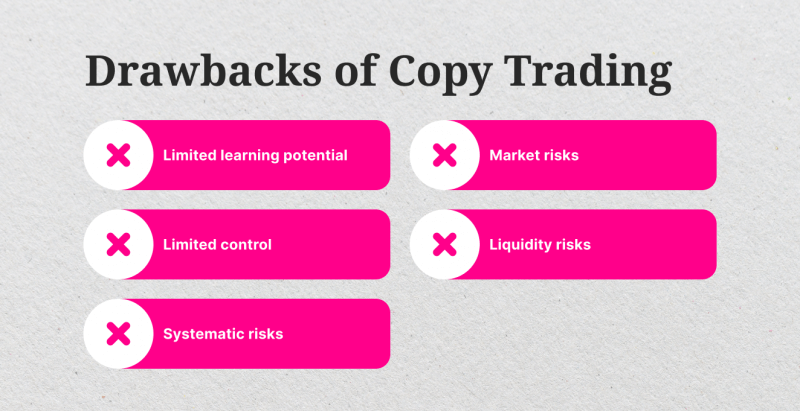

Copy trading offers numerous benefits but also carries risks, including conceivable loss due to the ability to follow successful investors in the market and limited control over trades.

Systematic risk, including geopolitical events and rare or unique events, can also affect markets. While traders may experience failure, market conditions can change the risk of loss. The final decision to execute a trade remains unavoidable despite modifying investment and risk tolerance levels.

Сopy trading removes control over your funds, limits learning potential, and exposes you to market risk. Historical performance does not necessarily indicate future performance and liquidity risk can occur when your trade cannot be executed at the same price point as the deal copying. This risk is particularly prevalent when trading illiquid assets like exotic currency pairs or low-cap stocks.

Copy trading can discourage traders from conducting their own market research and may be used by those seeking monetary gain.

Copy trading can be expensive, with signal providers often charging large upfront fees or commissions for every transaction copied. It is crucial to be aware of broker spreads and follow active traders, as frequent trades can accumulate commissions.

To mitigate possible risks, it is essential to diversify your portfolio, allocate a limited amount of funds to specific traders, and set risk parameters on the platform.

The Most Popular Instruments for Copy Trading

The chosen copy trader determines the finance devices, market exposure, and strategies for your portfolio. Choosing the right trader depends on your exposure needs. Below, you will find the most popular means for duplicating trading.

Forex

Forex trading is a popular sector for traders and copy traders due to its short-term trading plans and high technical analysis requirements. Many inexperienced traders lack the knowledge to successfully trade FX, making it a common option for market exposure.

Stocks

Live markets offer numerous companies with shares ready for trading, including actual shares and stock CFDs. Trading strategies vary depending on sector, market conditions, and other factors. Short-term and long-term strategies are common, with copy trading stocks often involving a bundle of companies within the same sector, resulting in varying strategies.

Crypto

Virtual tokens have become a popular trading option due to their high volatility, making them a trader’s “best friend.” With options to buy and sell crypto CFDs, there is a significant increase in copy trading portfolios focusing solely on crypto. Trading crypto CFDs against base currencies like USD or EUR has allowed for significant gains. Fundamental and technical analysis are foremost in this sector, and copy trading a portfolio familiar with the digital currency sector may be a suitable solution.

Fractional Shares Trading

Fractional shares are a portion of a stock or share that allows traders or investors to purchase positions in expensive companies without purchasing an entire share at a specific price. This allows them to invest in a company without having to buy an entire share at the current price.

Top 3 Copy Trading Solutions

Dealing duplication is a popular investment strategy that can be a simple yet effective way to start. To maximize its benefits and avoid risks, one must conduct all-out research on the best platform, which involves checking reviews and comparing the performance of various platforms.

Here are top 3 best copy trading platforms that offer various features and are perfect for those with limited experience.

B2Copy

B2Copy is a top copy-trading software company that provides an investment platform for copy/social trading, PAMM, and MAM services for MT4/5 and cTrader.

The platform consists of a back office and a client web UI. Users can manage their investment settings, create and oversee master and investment accounts, manage subscriptions, track trading statistics, and customize the UI. B2Copy’s investment platform can be integrated into clients’ rooms or implemented as a standalone solution.

AvaTrade

AvaTrade is a user-oriented platform that offers a range of finance instruments, including FX, commodities, and indices. It features an uncomplicated interface, real-time updates, and risk management tools for beginners.

It supports mobile and web trading, integrates with AvaTrade’s trading venues, and requires a minimum deposit of $100. However, it has limitations, such as a smaller selection of copy traders and limited advanced analytical tools.

eToro

eToro is a favored medium that promotes imitating other traders’ investment strategies. With a user-friendly interface, this platform enables you to trade various investment options while providing risk management tools.

It also provides a transparent trading community with a wide selection of assets and markets. eToro is a highly regulated broker with multiple licenses, no commission on trades, and low non-trading fees. However, it has higher spreads and rates compared to other brokers, only allowing copy trading in one direction. Overall, eToro remains a top choice for novice copy traders.

Final Thoughts

Copy trading is a straightforward manner of trading that supports traders of all experiences. Even with limited knowledge, novice traders can gain from the expertise of more seasoned investors. This technique allows a broader range of people to engage in trading and earn profits from professionals without exerting much effort. It enables them to increase their income and provides them with a wider range of investment options.

However, this method has its downsides, such as giving up control over money to someone unknown and not learning much from watching others trade. It’s essential to approach trade emulation cautiously, comprehend the risks involved, and carefully select signals. With the right approach and a sharp eye for detail, copy trading can add value to your investing surroundings.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs:

Is copying trades legal?

Copy trading is legal in most countries, provided the broker is adequately regulated. Account onset procedures guarantee legal trading, conditioned upon the geographics.

Which asset types can be copied?

The platform lets users copy assorted assets like currencies, indices, stocks, cryptos, and so on.

Do I have to pay fees when replicating trades?

Copy trading functions normally don’t have special fees, but users may need to pay a portion of their profits to the strategy provider as commissions, and any brokerage fees for regular trades will also apply.