What Is A Supplemental Liquidity Provider (SLP) On The NYSE?

Nov 29, 2024

The New York Stock Exchange (NYSE) is a cornerstone of global financial markets, facilitating the daily buying and selling of securities for millions of investors. To ensure a smooth and efficient trading experience, the NYSE relies on a robust market model with various participants playing crucial roles.

Among these are Supplemental Liquidity Providers (SLPs), who work alongside Designated Market Makers (DMMs) to improve market liquidity.

In this article, we’ll define what a supplemental liquidity provider is, explain their role in the NYSE market structure, and discuss the benefits they bring to both institutional and public market participants.

Key Takeaways:

- Supplemental Liquidity Providers are a crucial element of the NYSE market model, working alongside DMMs to enhance market liquidity.

- By actively quoting bid and ask prices, SLPs contribute to tighter spreads, improved price discovery, and a more efficient trading experience for all market participants.

- The NYSE incentivizes SLPs through financial rebates based on their quoting activity, encouraging greater participation and liquidity provision.

Supplemental Liquidity Provider Definition

The NYSE introduced the supplemental liquidity provider program after the 2008 financial crisis, specifically following Lehman Brothers’ collapse, which caused major concerns about market liquidity. The program aims to enhance market stability by incentivizing participants to provide consistent liquidity across NYSE-listed securities.

SLPs are specialized market participants that increase liquidity and support efficient pricing. Unlike traditional market makers who operate on multiple exchanges, SLPs focus exclusively on the NYSE, where they trade specific securities to improve market depth.

The NYSE created the SLP program to encourage continuous liquidity and reduce trading volatility, helping maintain the NYSE’s competitive edge among global exchanges.

An SLP is a high-frequency trading firm that utilizes advanced, sophisticated systems to buy and sell NYSE-listed securities. Assigned by an NYSE staff committee, these providers post bids and offers that are competitive and timely, thereby promoting price discovery and expanding liquidity.

Importantly, SLPs operate alongside traditional DMMs and floor brokers, creating a multilayered system of liquidity providers on the NYSE.

Key Features and Responsibilities of SLPs

The SLP program is structured around specific criteria and performance benchmarks. To qualify, SLPs must consistently meet minimum quoting requirements and post liquidity on a competitive basis. Here are some primary responsibilities of SLPs on the NYSE:

- Posting Competitive Quotes: SLPs must post high-quality bids and offers on their assigned securities. Their quotes must be competitive to ensure they contribute meaningfully to the overall market.

- Trading in Assigned Securities: The NYSE staff assigns SLPs specific liquid stocks, typically those with higher trading volumes. By focusing on particular securities, SLPs can add liquidity in areas where it’s needed most, helping maintain a stable and efficient trading environment.

- Meeting Average Daily Volume (ADV) Requirements: SLPs must meet minimum trading volume targets on their assigned securities to qualify for incentives. The NYSE uses these targets to assess whether SLPs contribute adequately to the market’s liquidity needs.

How SLPs Operate on the NYSE

SLPs are unique because they employ proprietary algorithms to execute trades rapidly, contributing to increased trading volume and ensuring competitive quotes. While DMMs are responsible for stabilizing stock prices and acting as a point of contact for other brokers, SLPs are primarily focused on supplying liquidity electronically.

This high-speed trading model allows them to adapt quickly to market fluctuations, creating an environment of greater liquidity and lower volatility.

SLPs play a vital role in enhancing liquidity by:

- Providing Additional Quotes: By actively quoting bid and ask prices, SLPs contribute to tighter spreads (the difference between the bid and ask price).

- Improved Price Discovery: Increased competition among market makers, including SLPs, leads to more efficient price discovery.

- Enhanced Market Efficiency: SLPs contribute to a more efficient trading environment by facilitating smoother order execution and reducing price volatility.

Fast Fact:

The NYSE is owned by Intercontinental Exchange, an American holding company that it also lists (ticker symbol ICE). Previously, it was part of NYSE Euronext (NYX), formed by the NYSE’s 2007 merger with Euronext.

Advantages of the SLP Program for the NYSE

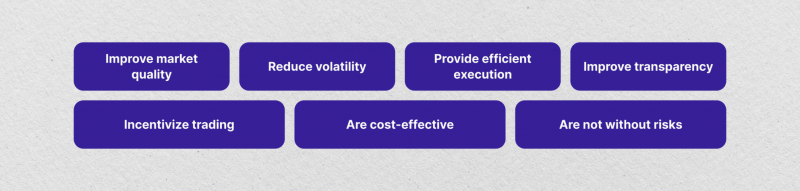

The SLP program offers several benefits for the NYSE, investors, and other key market participants. By adding a layer of liquidity, SLPs help stabilize prices, especially during periods of high volatility. Some of the advantages include:

- Improved Liquidity: The primary purpose of the SLP program is to ensure that the NYSE has sufficient liquidity, even for high-demand stocks. This liquidity makes it easier for investors to buy and sell shares without significantly affecting stock prices.

- Efficient Market Pricing: By adding liquidity and maintaining competitive quotes, SLPs contribute to the accurate pricing of stocks. This promotes a fair and transparent marketplace where prices are a reliable reflection of market activity.

- Reduced Volatility: High-frequency trading by SLPs allows the NYSE to maintain stable stock prices, particularly during market stress. This contributes to lower volatility, providing a more predictable environment for both traders and investors.

Incentives and Rebates for SLPs

The NYSE incentivizes SLPs with financial rebates to encourage continuous and competitive quoting. These rebates are essential to the SLP program, as they reward providers for meeting or exceeding liquidity requirements. Some of the benefits of this incentive structure include:

- Enhanced Financial Rebates: SLPs receive financial rewards based on the liquidity they provide. The more competitive their quotes and the higher their trading volume, the more they benefit from these rebates.

- Lower Transaction Costs: By receiving rebates, SLPs can lower their operational costs, which allows them to focus more resources on enhancing their proprietary algorithms and trading systems.

- Encouragement of High-Frequency Trading: Rebates encourage SLPs to engage in high-frequency trading, leading to increased trading volume and better price stability for NYSE-listed securities.

Differences Between SLPs and Other Market Participants

The NYSE’s market model is defined by three critical types of participants: SLPs, DMMs, and floor brokers. Every kind of participant plays a distinct role in ensuring the market operates smoothly and efficiently.

SLPs vs. DMMs

SLPs operate off-floor and provide supplemental liquidity across a range of assigned stocks but do not oversee specific stocks on the trading floor. DMMs are on-floor participants responsible for managing the order flow and overseeing the trading of particular stocks. They play a more direct role in maintaining order and stability for individual stocks, especially during periods of high volatility.

SLPs aim to enhance overall liquidity by electronically providing constant two-sided quotes for assigned securities. DMMs focus on facilitating price discovery and balancing supply and demand in their assigned stocks, often intervening to reduce volatility and ensure smoother trading.

SLPs receive financial rebates from the NYSE based on meeting liquidity benchmarks, such as quoting within a particular spread. DMMs have different obligations and incentives, including a responsibility to stabilize their assigned stocks, especially during opening and closing, and they can trade for their own accounts under specific rules.

SLPs rely heavily on high-frequency trading technology to provide continuous quotes and operate at high speeds. DMMs, though they use electronic trading tools, focus on human intervention and judgment to manage trading imbalances and smooth out price swings, particularly during opening and closing sessions.

SLPs vs. Floor Brokers

SLPs function electronically to continuously quote bid and ask prices, thus supplying liquidity across the market. Floor Brokers are agents who execute orders on behalf of clients, often large institutions, by navigating the best possible execution price. They do not provide liquidity on their own but rather seek liquidity from the market.

SLPs work primarily to fulfill liquidity quotas and ensure that buy and sell orders are always available. Floor Brokers aim to achieve specific client orders, meaning their participation in trades is sporadic and directed by customer orders rather than a mandate to enhance liquidity.

SLPs operate independently and do not interact directly with individual client orders. Floor Brokers often work closely with DMMs to find liquidity and obtain the best execution prices for their clients.

SLPs receive rebates based on liquidity provision, while Floor Brokers earn commissions for executing client orders.

Key Considerations and Potential Concerns Regarding SLPs

While SLPs offer significant benefits to the NYSE market model, some potential concerns warrant discussion:

- HFT Firms as SLPs: A growing number of SLPs are high-frequency trading firms utilizing sophisticated high-speed computers to quote and trade at lightning speed. While this can enhance liquidity, it raises concerns about the potential for unfair advantages over slower-reacting public customers.

- Human Judgment vs. Algorithmic Trading: The reliance on automated algorithms for quoting by SLPs may lead to decreased human judgment within the market. This could impact the market’s ability to react effectively to unforeseen events.

The NYSE takes steps to mitigate these concerns through regulations and oversight. The NYSE staff committee assigns specific securities to SLPs, ensuring a diverse pool of participants. Additionally, the exchange implements measures to prevent manipulative trading practices.

Conclusion

The Supplemental Liquidity Provider program is vital to the NYSE’s market model, enhancing liquidity and supporting efficient market pricing. Through advanced high-frequency trading, SLPs expand trading volume, reduce volatility, and contribute to a more robust trading environment.

SLPs play a crucial role in maintaining the competitive edge of the New York Stock Exchange, ensuring that it remains a global leader in stock exchange liquidity and stability.