What Are Futures Contracts, and How Do They Work?

Jan 10, 2025

Stocks, bonds, and Forex currencies are classic securities that most people use to grow their money and generate active or passive incomes. They are also easier for beginners to start trading.

However, derivatives contracts are sophisticated instruments that provide more flexibility in the underlying asset’s price, transaction date, and other specifications.

Futures contracts are popular ways to speculate on market movements and buy an asset later. They are useful hedging methods to protect from unpredictable volatility or to speculate on upcoming trends. So, what are futures contracts? How do we optimize the derivative’s value? Let’s find out.

Key Takeaways

- Futures are derivatives contracts allowing involved parties to trade securities at a predetermined price at a later date.

- Derivatives allow traders to hedge and speculate on price action or profit from arbitrage between markets.

- Futures derivatives are financial (FX – Stocks), commodities (oil – metal), or cryptocurrencies (BTC – ETH).

- Options differ from futures as they grant the right to execute or decline to exchange the underlying assets.

What are Futures?

Futures are derivative contracts that allow traders to buy and sell securities without directly owning the underlying asset. They facilitate access to financial markets through compulsory agreements.

They allow traders to buy a specific asset in the future at a predetermined price and date. When the contract expires, the seller is obligated to transfer the asset in exchange for the buyer and receive the predetermined amount.

Traders must analyze the contract’s current and potential price to ensure they gain a positive intrinsic value. Additionally, the buyer must pay a premium to the seller for holding the asset for the contracted period.

How Futures Trading Works?

A futures contract is a legally binding agreement that is standardized, specifying the traded securities, quantity, initial value (purchase price), strike price, and maturity date.

You can find these instruments at exchanges like the Chicago Mercantile Exchange (CME) or Intercontinental Exchange (ICE), which are governed by the Commodity Futures Trading Commission (CFTC).

Buyers aim to profit from price increases, while sellers gain from price drops in market trends. Predicting price movements requires careful analysis of supply-demand dynamics and macroeconomic indicators.

Upon expiration, contracts are settled either via physical delivery of the asset or cash, depending on the contract terms and the governing exchange rules.

Cash vs Non-Cash Settlement

Futures contracts can be delivered in cash or non-cash settlement.

Cash settlement: No physical asset is involved. Instead, the difference between the contract and market prices at expiration is paid in cash. This method is common for financial-based contracts, such as stock indices or interest rates.

Non-cash settlement: A physical delivery of the actual underlying asset, such as commodities like oil or wheat, to fulfill the agreement. This method suits traders who need the physical product for business purposes.

Cash settlements are simpler and widely used, while non-cash delivery involves logistical complexities and higher costs.

Market Size and Overview

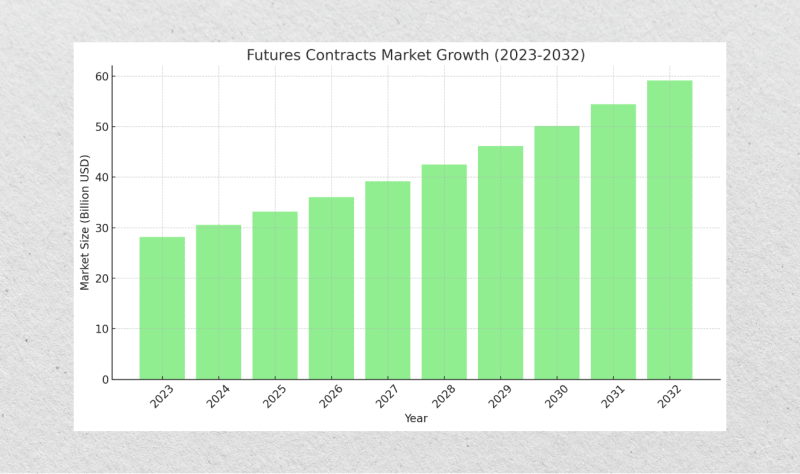

Futures trading is part of the overall derivatives market, which was valued at $28 billion in 2023 and is expected to grow at an 8.6% CAGR between 2025 and 2032 to almost $60 billion.

Over 29 billion futures contracts were traded last year, while the combined options and futures amount to 137 billion contracts, a 64% increase from the previous year. The open interest in trading futures without being settled or executed increased by 8% to almost 300 billion contracts in 2023.

Most of the growth was driven by key market players, such as Goldman Sachs, Deutsche Bank, J.P. Morgan, and Bank of America.

Much of this rising interest came due to the global instability in financial markets, while Asia-Pacific markets led the trading volume with over 100 billion derivatives contracts.

Types of Futures Contracts

Futures contracts come in multiple types, catering to different asset classes and market participants, including those who trade for physical product ownership or earn from price fluctuations.

Commodity

Commodity futures are contracts that pertain to physical goods, such as agricultural, grains, precious metals, and other consumer products like:

- Energy (crude oil, natural gas)

- Metal (gold, silver, copper)

- Agricultural (wheat, corn, soybeans)

These are crucial for producers and consumers to hedge against price volatility and ensure supply or revenue stability. Additionally, traders use them to speculate on price movements and profit when the market moves in their direction.

Commodity futures are highly liquid, and prices are influenced by supply-demand dynamics, geopolitical factors, and weather conditions. Thus, they are vital for risk management and portfolio diversification.

Financial

Financial futures are contracts linked to non-physical assets that generate income, like currencies, interest rates, and stock indices.

- Currencies (USD/EUR) help businesses and traders hedge foreign exchange risks.

- Interest rates (bonds or Treasury bills) are used to protect against changes in borrowing costs.

- Stock indices (S&P 500 or FTSE 100) enable investors to hedge or speculate on market performance.

These contracts reflect the real-time movements of the underlying asset and are cash-settled, making them convenient for traders without the need for physical delivery.

Financial derivatives add massive liquidity to exchanges and participants, making them pivotal in stabilizing financial markets.

Cryptocurrency

Crypto futures contracts are tied to digital assets like Bitcoin (BTC), Ethereum (ETH), or other tokens. They are highly accessible as they allow traders to speculate on price movements and gain from market volatility without owning the actual cryptocurrency.

These contracts are offered on exchanges like Binance and Coinbase with cash settlement or asset delivery options. Crypto derivatives provide leverage, allowing traders to explore larger positions with smaller capital.

However, they are prone to regulatory changes, adoption rates, and macroeconomic trends, which can influence their availability, prices, and stability.

The rapid growth of cryptocurrency contracts comes from the increasing institutional and retail interest in digital assets as a speculative and hedging instrument.

Alternatives

Other derivative contracts are based on unique or unconventional assets, offering diversification beyond traditional markets. They can be used to anticipate a certain event, trade outcome, or other occurrences.

- Weather: Payouts depend on temperature, rainfall, or snow levels, benefiting industries like agriculture and energy.

- Environmental: Include carbon credit futures and allow companies to trade emissions allowances.

- Volatility: Derivatives enable speculation on market turbulence, like VIX futures.

- Events: Speculating on the happening of an event or its outcome, like elections, corporate earnings, or economic indicators.

These contracts address specific hedging needs and attract speculators seeking exposure to distinct markets. They showcase the versatility and innovation within the derivatives ecosystem.

However, they are niche products with wider bid-ask spreads and less liquidity because they are less commonly traded.

Futures vs. Options vs. Forwards

Options and forwards are other derivatives that are usually compared to futures. Although they share similar characteristics of entering a contractual agreement to trade at a predetermined date and price, they have some core differences.

Futures are financial instruments that involve exchanging particular securities at an agreed-upon price and date. Participants are mandated to deliver the promised asset.

Options are derivative contracts between buyers and sellers who agree to trade certain assets later at a predetermined price. However, options are not compulsory, and the buyer may decline the right to execute, allowing them to minimize losses if markets move sideways.

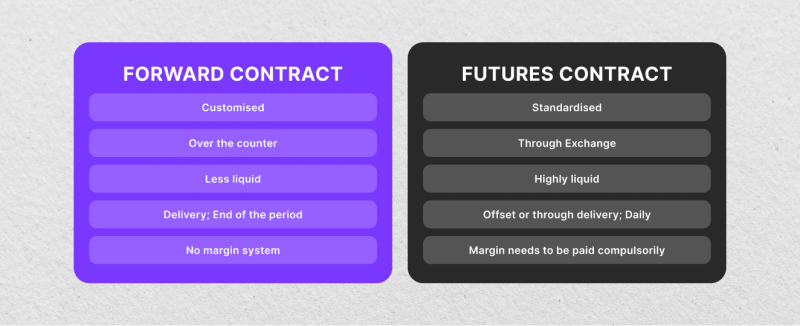

Forwards are derivatives that work similarly to futures. They are binding contracts, but they are not standardized instruments, offering participants more flexibility and customization.

Buyers and sellers can formulate the derivative contract, including the associated products, prices, maturity date, method of delivery, etc. This bespoke approach allows traders to pursue niche markets or specific products on their own terms.

However, forwards are less liquid because each contract is specific to its participants and can only be founded on over-the-counter exchanges.

Uses of Futures Contracts

Traders can combine these derivatives with classic investment strategies to diversify their portfolios and explore opportunities during market changes. For example, a trader may keep holding their stocks but find stock-based contracts when the market does not move in their favor, allowing them to gain from price movements on both sides much faster.

Arbitrage

Market arbitrage is an advanced technique that involves buying and selling between markets to capitalize on tiny discrepancies in price, liquidity, and volatility.

Futures are widely used for arbitrage, where traders buy an asset in one market and simultaneously sell its contract in another where prices differ. For example, if a commodity’s spot price is lower than its futures price, a trader can buy it in the spot market and sell it in the derivatives market for risk-free profits.

This approach ensures price convergence between spot and derivative markets by correcting inefficiencies. However, It requires quick execution, low transaction costs, and substantial capital, making it a common strategy for institutional traders and market makers.

Speculation

Derivative contract types are suitable for speculators who profit from trading momentum and swaying public demand. Futures contract speculation involves profiting from anticipated price changes in an asset without owning it.

Traders buy if they expect prices to rise or sell if they predict a decline. Leverage allows for significant exposure with a smaller capital outlay, magnifying potential profits and risks.

For example, a trader might speculate on oil price increases by purchasing crude oil futures, netting significant gains if the market moves in their direction. Speculation adds liquidity to the market, but it carries high risks due to volatile price movements, making it suitable for investors with a strong understanding of market dynamics.

Risk Management

Hedging with these contracts protects businesses and investors from adverse price movements. It involves taking an opposite position in the futures market to offset potential losses in the underlying asset.

For example, a farmer fearing price declines can sell wheat futures to lock in a favorable value. Conversely, an airline anticipating rising fuel costs can buy oil instruments to secure current rates.

Derivative hedging stabilizes cash flows and reduces risk, providing certainty in volatile markets. However, it can limit potential gains if the market moves favorably, leading to a negative intrinsic contract value.

Why Trade with Futures?

There has been an increasing interest in future derivatives due to their accessibility and flexible trading options. They are often advised for experienced investors because they require an accurate contract and strike price analysis, premium calculation, and market understanding.

However, trading platforms are offering smart tools to assist beginners in optimizing their analysis and decision-making. Here’s what makes this market highly competitive.

High Liquidity

The market is highly liquid due to contract standardization and broad participation by institutional and retail traders. High liquidity ensures tight bid-ask spreads, ease of trade execution, and minimal price impact, even for large transactions.

This makes futures attractive for hedging and speculation while reducing trading costs and enhancing market efficiency.

Hedging

Individual and institutional investors can hedge price risks in volatile markets by locking in future prices and protecting against adverse price movements.

These contracts are broadly compatible with most asset classes, so commodity producers, financial institutions, and hedge funds can use them to stabilize cash flows and mitigate risks for long-term planning and profitability.

Portfolio Diversification

Traders and corporations can diversify their portfolios by investing in various asset classes, such as commodities, currencies, indices, and cryptocurrencies.

This reduces overall risk by including assets with low correlations to traditional investments like stocks and bonds. Diversification through futures enhances portfolio stability while offering exposure to global markets and emerging trends.

Price Discovery

Futures markets play a vital role in price discovery by reflecting the collective expectations of market participants about supply, demand, and economic conditions.

Transparent pricing and continuous trading help businesses, policymakers, and investors make informed decisions, ensuring efficient allocation of resources in global financial and commodity markets.

Short-Selling

Traditionally, traders buy assets with capital and cash and sell securities they hold in their portfolios. However, futures contracts facilitate shorting (selling) without owning the underlying asset.

This enables investors to profit from declining prices by selling a futures contract at current prices with the intent to repurchase it at a lower price. It adds flexibility to trading strategies and enables risk management, hedging, and speculation in bearish or volatile markets.

Futures Options: How They Work?

Futures options are financial derivatives that provide the holder with the right, but not the obligation, to buy or sell a futures position at a strike value before or on a set expiration date.

They mix features of both futures and options, combining the best of the two worlds to provide versatile trading and risk management tools.

The order types look similar to those of ordinary options:

Call Options: Give holders the right to buy futures contracts at maturity.

Put Options: give holders the right to sell futures contracts at maturity.

Traders pay a premium to purchase options, representing the cost of the right to trade the underlying futures. If the market moves favorably, the trader can exercise the option, potentially gaining profits. Otherwise, the maximum loss is limited to the premium paid.

For example, a commodity producer might buy a put option to protect against falling prices, while a speculator might purchase a call option to capitalize on anticipated price rises. This flexibility and limited risk appeal to both institutional and retail investors, enhancing participation and improving liquidity even further.

How to Buy Futures Contracts?

Buying futures contracts involves several key steps, starting with understanding where to trade, evaluating contracts, and considering associated costs and requirements. More exchanges and operators offer multiple derivatives to attract more investors. Here’s how you can start.

Where to Find Futures?

Futures contracts are traded on regulated exchanges like the Chicago Mercantile Exchange (CME), Intercontinental Exchange (ICE), or Eurex.

On the other hand, cryptocurrency-based contracts are available on exchanges like Binance, CME, and Coinbase. These operators offer a wide range of asset classes, from commodities to financial derivatives.

How to Evaluate Futures?

To select a contract, analyze the underlying asset, its movement dynamics, price trends, market volatility, and expiration date.

Consider whether the contract is cash-settled or physically delivered, and choose the best settlement method. Research margin requirements for leveraged positions and monitor the market’s liquidity to ensure ease of trade execution.

What are The Fees?

Exchanges and brokers charge commissions, margin fees, and sometimes platform fees. For example, brokers may charge a fixed fee per contract, while exchanges may include clearing fees. Therefore, ensure you compare costs to maximize contract profitability.

How to Manage Active Contracts?

Ensure the broker offers tools like real-time data, charts, and risk management features to monitor the market and stay ahead of trend changes and potential price reversals.

Familiarise yourself with regulatory requirements, margin calls, and potential risks. You can also check if the platform offers a demo account to gain confidence before investing in real derivative contracts.

Conclusion

Unlike traditional stocks and Forex trading, futures are financial instruments that allow traders to buy and sell assets at a later date and a predetermined value, called the strike price.

The derivative contract obligates both parties to exchange the underlying asset and settlement method on expiration. The associated security could be a financial, commodity, crypto, or other asset defined by financial markets.

Options are another type that differs slightly. They give traders the right but not the obligation to exchange the underlying securities, while forwards are not standardized instruments with customized values, assets, and maturity dates.

FAQ

How do futures derivatives work?

Through contractual agreements to trade an asset at a predetermined price at a later date. Investors speculate on price movements, locking in a value for hedging or profit, while the contract’s value fluctuates with the market.

Are futures better than stock trading?

Futures are more flexible and ideal for hedging or speculation. However, they carry higher risk due to leverage and expiry dates, making them less suitable for long-term investors compared to stocks.

What is an example of a futures contract?

A trader can buy a crude oil contract to purchase 1,000 barrels at $80 each on a specified future date. When the contract expires, sellers must deliver the security regardless of market price changes by that time.

Are futures cheaper than stocks?

Futures often require lower initial capital due to margin requirements, but associated fees, premium payments, and potential losses from leverage can outweigh costs. Stocks, though more expensive upfront, offer long-term stability and straightforward fees without expiry constraints.