Here’s What to Do With Apple Stock Before The Release of The iPhone 14

Sep 01, 2022

It's time for Apple to reveal a new version of its flagship electronic gadget. The iPhone 14 will be unveiled on September 7 at 10 a.m. Cupertino time at the company's product launch event.

Should investors take advantage of this opportunity and purchase Apple stock (AAPL) - Get Apple Inc. Report ahead of this critical date? Let's discuss more hazards and potentials below.

Source: Apple.com

Will This Launch Be Another Story of Success?

Even 15 years after Steve Jobs unveiled the first model, it is indisputable that Apple's smartphone has been a success story. While Apple arrived at the 5G party at least one or two years late, with the release of the iPhone 12 in 2020, the Cupertino giant has clearly caught up with the competition, as sales and market share increases have excelled in the previous 24 months.

At least one expert believes that the iPhone 14 will retain the status quo – in the best manner imaginable. Wedbush analyst Dan Ives believes demand will remain near a peak, raising his price objective on AAPL to $220 for a 38% potential possibility.

According to the analyst's latest channel checks, iPhone 14 first orders should stay around 90 million units, similar to last year's iPhone 13. If true, this will be astonishing, in my opinion, given the several headwinds: concerns about decreasing consumer spending, a slowing global economy, and ongoing supply chain limitations.

Moreover, some bears think the iPhone 14 will accelerate Apple's 5G cycle. Thiago Kapulskis of ItauBBA is maybe the only sell-side analyst who rates Apple shares as underperforming. He is concerned that the new Pro and Pro Max versions would face a $100 price increase due to inflation, which may not even deter demand for the portable gadget. In fact, the analyst considers the iPhone 14 to be a major danger to his negative thesis on the shares.

So What to Expect from Sharing, Though?

The discussion about how well the iPhone 14 will do throughout the Holiday season and into next year is one thing. A totally separate topic of discussion is whether solid financial results, assuming they occur, will assist in propelling Apple stock higher from its present levels of around $159 per share.

When it comes to sharing price movement, iPhone debuts have generally promoted greater bearishness. The figure below demonstrates that AAPL outperforms throughout the spring and early summer months. However, after the new iPhone was introduced, investors appeared to "sell the news," causing Apple stock to underperform until the end of the year, all the way until January.

Chart: AAPL's average monthly return since the iPhone's debut. Data provided by Yahoo Finance.

We believe that the prospects for Apple investors are much worse in the short term, given the present market environment. The S&P 500 rebounded in sections of July and August, only to fall again later this month. The tale is all too familiar for equities investors: record-high inflation continues to pressure central banks to keep rising interest rates, which is bad news for most risky assets.

For these reasons, we believe the iPhone 14 event will most likely coincide with a drop in share price. Long-term investors, on the other hand, should look beyond the short-term issues and consider purchasing AAPL on weakness if the stock price drops in the next few weeks.

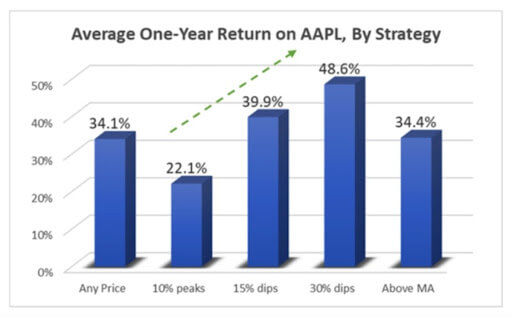

Chart: Average annual return on AAPL by strategy. Data provided by Yahoo Finance.

Keep in mind that, historically, buying AAPL on dips has consistently produced better 12-month returns (see chart below). At this moment, shares are only about 13% below all-time highs. A discount of another few dollars, however, could present a good opportunity.