What Is Crypto Arbitrage Trading?

Jun 07, 2023

During the whole 2022, the financial markets experienced unprecedented volatility, leaving investors and traders anxious about the uncertain future. With sudden liquidation cascades and the prevailing macroeconomic headwinds, fear gripped the market as numerous over-leveraged participants faced bankruptcy during the year.

In the face of such challenging market conditions, in 2023, market-neutral trading strategies emerged as a beacon of hope, with crypto arbitrage strategies taking center stage. Recognized for their low-risk nature, crypto arbitrage trading became an enticing approach for many.

But what exactly is crypto arbitrage trading, and how can one venture into this realm as a crypto arbitrage trader?

Key Takeaways

- Crypto arbitrage trading involves taking advantage of price differences between different cryptocurrency exchanges.

- Benefits of crypto arbitrage trading include potential for fixed profits, shorter trade durations, and reduced exposure to directional market risks.

- Crypto asset prices can vary significantly across exchanges, providing opportunities for arbitrage trading.

- While generally considered low-risk, crypto arbitrage trading still carries inherent risks, such as market volatility, liquidity issues, transaction costs, and regulatory uncertainties.

What Does Arbitrage Trading Mean?

Simply, arbitrage trading means buying a security or asset in one marketplace and selling it in another market at a higher price, making a profit. It’s a way for traders to exploit market inefficiencies and price discrepancies that go unnoticed.

For instance, traders can exploit arbitrage opportunities in the stock market by buying stock in foreign exchanges. Across different markets and exchanges, stocks often trade at slightly differing prices, whether due to exchange rate differences or other reasons. During this brief window, an arbitrage trader can buy the same stock in one market and sell it in the other while pocketing the difference.

How Crypto Arbitrage Trading Works?

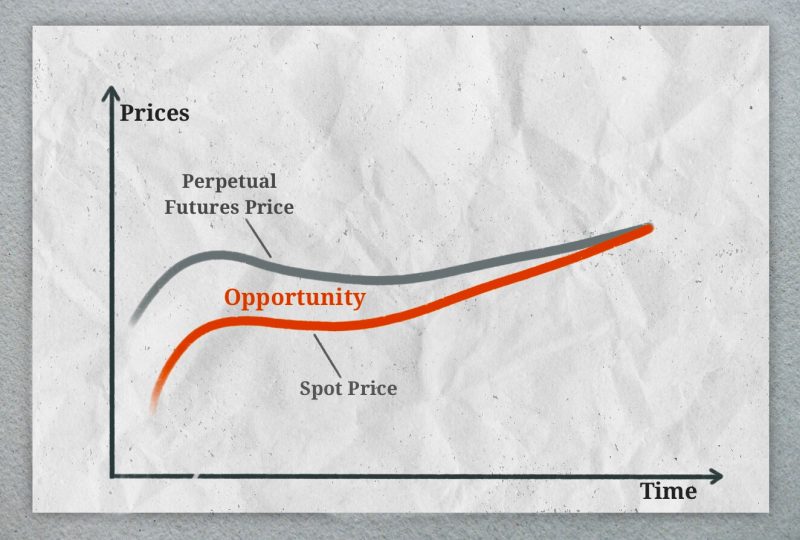

Crypto arbitrage is a trading strategy that involves exploiting price discrepancies and market inefficiencies in the cryptocurrency market to generate profits. Like traditional arbitrage, crypto arbitrage traders aim to buy a cryptocurrency at a lower price on one exchange and simultaneously sell it at a higher price on another exchange, capitalizing on the price differential.

Consider a scenario where Bitcoin trades at $30,000 on Exchange A but is priced slightly higher at $30,050 on Exchange B. A crypto arbitrage trader can swiftly purchase Bitcoin from Exchange A and sell it on Exchange B, profiting from the $50 price difference per Bitcoin. These opportunities typically arise briefly before market forces quickly correct the price discrepancy.

Crypto arbitrage allows traders to leverage market inefficiencies and price differentials to generate profits. By capitalizing on these fleeting opportunities, arbitrage traders contribute to market liquidity and ensure prices remain closely aligned across exchanges.

However, it’s important to note that crypto arbitrage requires careful consideration of transaction costs, withdrawal fees, and the overall reliability and security of the exchanges involved, as these factors can significantly impact the strategy’s profitability.

What Are Crypto Arbitrage Bots?

Nowadays, most arbitrage is done through algorithmic trading, which can spot and execute arbitrage opportunities faster than humans.

Sophisticated algorithms and trading bots equipped with real-time data analysis are employed to swiftly identify and execute arbitrage opportunities.

The rise of high-frequency algorithmic trading means that any remaining arbitrage opportunities tend to be incredibly narrow in margins, and even those don’t go unnoticed for long.

Why Are Crypto Prices Difference Across Exchanges?

The variation in crypto prices across different exchanges can be attributed to several factors.

Firstly, unlike traditional fiat currencies pegged to government regulations and standards, cryptocurrencies are decentralized and not directly linked to any specific authority. This lack of regulation and centralization means there is no standardized price for a particular cryptocurrency, except for stablecoins designed to maintain a stable value relative to a specific fiat currency.

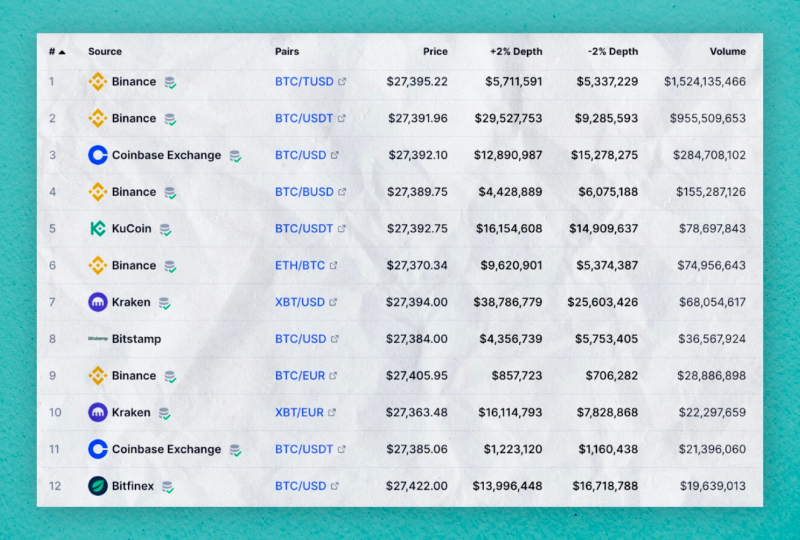

Furthermore, crypto exchanges’ size and trading volume play a significant role in price discrepancies. More extensive exchanges with higher trading volumes tend to have more liquidity and a larger pool of buyers and sellers, which can impact the overall supply and demand dynamics. Consequently, the prices of cryptocurrencies on these exchanges may differ from those on smaller exchanges with lower trading volumes.

Moreover, each exchange has its fee structure for trading cryptocurrencies. These trading fees can vary between exchanges and add to the overall cost of executing trades. Traders need to consider these exchange fees when calculating potential profits or losses.

- Centralized Exchanges

Regarding centralized exchanges, asset pricing primarily depends on the most recent matched orders on the exchange order book. The latest price at which a buyer and seller agreed to trade a particular cryptocurrency determines its real-time price on that exchange. The continuous process of price discovery is driven by the most recent transactions, and slight variations in investor demand across different exchanges can further contribute to price differences.

- Decentralized Exchanges

On the other hand, decentralized exchanges (DEXs) utilize an automated market maker (AMM) system for pricing crypto assets. Decentralized exchanges rely on liquidity pools, where users contribute their assets to provide liquidity for trading pairs.

A separate pool is created for each trading pair, and traders can execute trades directly from these pools. The prices of assets within the pool are maintained through a mathematical formula that balances the ratio of assets.

When a trader wishes to buy or sell an asset from a liquidity pool, they must provide an opposite asset to remove the desired asset. This action alters the ratio of assets within the pool, prompting the protocol to adjust the prices to restore balance automatically.

For instance, if more UNI tokens are added and fewer ETH tokens remain in the ETH/UNI pool, the price of UNI decreases while ETH increases. This incentivizes traders to remove the cheaper asset and add more of the relatively more expensive asset until the prices align with the broader market.

However, significant trades that disrupt the ratio in a liquidity pool can cause substantial price differences between the assets within the pool and their market value reflected on other crypto exchanges.

The efficiency of the AMM system relies on the actions of crypto arbitrage traders who actively participate in maintaining price consistency across exchanges.

Crypto Arbitrage Trading from A to Z

Crypto arbitrage is a trading strategy that doesn’t necessarily demand advanced trading skills. Still, it has complexities and requires a certain understanding of the crypto markets.

How to Start Crypto Arbitrage Trading: Beginner’s Guide

Step 1: Create an Account With an Exchange

To begin your crypto arbitrage trading journey, the first step is to create an account with a reputable cryptocurrency exchange. Choosing an exchange that offers a user-friendly interface, excellent customer service, a wide selection of crypto assets, and low trading fees is recommended.

Step 2: Fund Your New Exchange Account

Once you have chosen an exchange, you must fund your account with fiat currency to purchase cryptocurrencies. You can use debit cards or wire transfers to deposit funds into your account. It is advisable to select an exchange with low trading fees, as it can help minimize costs.

Step 3: Purchase Stable Coins

If you don’t own cryptocurrencies, you must buy them using fiat currency. Exchanges like Coinbase, Kucoin, or Crypto.com offer the ability to purchase crypto assets, albeit with small fees, when using bank accounts or debit cards. Buying stablecoins such as USDT (Tether) or BNB (Binance Coin) is recommended.

These stablecoins have relatively stable values and are widely accepted as trading pairs on most exchanges. USDT, in particular, is known for its lower volatility than other cryptocurrencies like BNB or Ethereum, providing a safer option for holding assets over a longer period without significant risks of value fluctuations.

Step 4: Transfer Tokens Between Exchanges and Wallets

Once you have purchased your desired tokens, you must familiarize yourself with transferring tokens between exchanges and wallets. This step is vital for successfully arbitraging crypto asset prices between platforms and swaps like Pancakeswap.

To capitalize on this arbitrage opportunity, you must transfer your tokens accordingly. Understanding the mechanics of seamless token transfers between exchanges and wallets is essential for executing successful crypto arbitrage trades.

Step 5: Research the Coins and Exchanges

Arbitrage opportunities in the crypto market can be rare, making conducting thorough research in advance crucial. It is recommended to research the tokens and exchanges you intend to trade on. A valuable tool for this purpose is CoinMarketCap, which provides comprehensive and sortable data on various cryptocurrencies, including price, market capitalization, volume, and ROI.

Utilizing CMC, you can identify promising investment targets that may present profitable arbitrage opportunities. Each token listing on CMC includes a section where you can review the swaps and exchanges where it is available for trading, along with their respective prices.

Crypto Arbitrage Trading Strategies

Several crypto arbitrage strategies exist, each with its own approach and methods. Understanding these strategies is crucial for successful crypto arbitrage trading. Here are the four major types of crypto arbitrage:

Inter-Exchange Arbitrage

Inter-exchange arbitrage involves buying an asset from one exchange and selling it on another to take advantage of price discrepancies. This strategy relies on real-time prices, making it impractical to transfer assets between exchanges. To overcome this, simultaneous buying and selling are executed using assets held on both exchanges.

For example, if you have $20,000 worth of USDT on Binance and 1 BTC on Kraken, and Bitcoin is priced at $20,300 on Kraken and $20,000 on Binance, you can buy Bitcoin on Binance with USDT while selling it on Kraken for $20,300. The $300 spread becomes your profit without incurring withdrawal or deposit fees.

Triangular Arbitrage

Triangular arbitrage is conducted within a single exchange but involves three different assets. By capitalizing on undervalued assets, traders can increase their holdings of a particular asset.

For instance, if you have Bitcoin, Solana, and Ethereum, and Solana and Ethereum are undervalued, you can use Bitcoin to buy Solana, then use Solana to buy Ethereum, and finally, use Ethereum to buy more Bitcoin. This allows you to end up with a greater amount of Bitcoin without the need for transfers between exchanges or associated fees.

Statistical Arbitrage

Statistical arbitrage involves using mathematical models and arbitrage bots to profit from price differences. These bots can trade multiple assets simultaneously based on predictive models determining the likelihood of a profitable trade.

The automated nature of this strategy reduces the need for manual intervention and minimizes the risk of errors. Traders can leverage the capabilities of arbitrage bots to execute trades efficiently and exploit market inefficiencies.

Spatial Arbitrage

Spatial arbitrage leverages price differences based on the geographical locations of exchanges. It shares similarities with inter-exchange arbitrage but considers variations in demand across different regions. For example, if there is high demand for Bitcoin in your country, you can purchase it from an exchange in a region with lower demand and sell it on local exchanges at a higher price.

This strategy allows you to capitalize on the disparity in demand and generate instant profits. Unlike inter-exchange arbitrage, spatial arbitrage allows for manual transfers between exchanges to facilitate profitable trades without the constraint of real-time prices.

Important Indicators for Crypto Arbitrage Trading

Crypto arbitrage trading analyzes various indicators beyond price movement to make informed trading decisions. These indicators include bid-ask spreads, market depth, price slippage, and market liquidity. By understanding these factors, investors can gain valuable insights into market structures and optimize their arbitrage strategies.

- Bid-Ask Spreads

The bid-ask spread is the price difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept for an asset. Wider spreads indicate lower liquidity and can contribute to increased market volatility.

Market makers, including exchanges, take advantage of bid-ask spreads to generate profits by buying at the asking price and selling at the bid price. Analyzing bid-ask spreads helps traders assess liquidity and transaction costs in the market.

- Market Depth

Market depth refers to the quantity and size of bids and asks at different price levels in the order book. It indicates the market’s ability to handle large market orders without significantly impacting the asset’s market value. Evaluating market depth is crucial for understanding a market’s potential liquidity and stability. A deeper market with sufficient liquidity allows for smoother and more efficient trade execution.

- Price Slippage

Price slippage occurs when there is a difference between the intended execution price and the actual execution price of a market order. It is influenced by factors such as market volatility and order size. Price slippage can work in both favorable and unfavorable directions for arbitrage traders. Higher volatility typically leads to increased slippage. Monitoring price slippage helps traders anticipate and manage execution risks during crypto arbitrage trading.

- Market Liquidity

Market liquidity refers to the ease with which an asset can be converted into another at market price. It is a measure of the overall ability of a market to facilitate smooth trading with minimal bid-ask spreads.

Assessing market liquidity is crucial for ensuring efficient trade execution and minimizing transaction costs. Highly liquid markets allow quick and seamless conversion between assets, reducing the risk of substantial price deviations.

Why Is Crypto Arbitrage Trading Low-Risk?

Crypto arbitrage is considered a low-risk trading strategy for several reasons. Unlike day traders, who rely on predicting future prices and holding trades for extended periods, arbitrage traders focus on identifying and capitalizing on price discrepancies across different exchanges or trading pairs. By leveraging these opportunities, they aim to generate fixed profits without relying on complex market analysis or predictive strategies.

Another key aspect contributing to crypto arbitrage’s low-risk nature is the short duration of trades. Arbitrage transactions typically involve entering and exiting positions within seconds or minutes. This limited exposure to the market significantly reduces the potential risks associated with longer-term trading, such as price volatility and sudden market fluctuations.

Moreover, crypto arbitrage trading eliminates the need for extensive predictive analysis. Instead of trying to forecast market sentiments or future price movements, traders rely on the immediate price differences between exchanges to execute profitable trades. This simplifies the decision-making process and minimizes the reliance on complex strategies.

However, it’s important to note that while crypto arbitrage presents lower risks than other trading approaches, it doesn’t imply that arbitrageurs are completely risk-free.

Crypto Arbitrage Trading Risks

Crypto arbitrage, like any form of arbitrage, carries certain risks that investors should be aware of. Understanding these drawbacks is crucial for successful crypto arbitrage trading. Here are the key risks to consider:

- Market Volatility and Losses

Executing trades swiftly is essential in crypto arbitrage to capitalize on price differences before they diminish. However, the thinly traded cryptocurrencies with the widest spreads require caution. Traders must be mindful not to inadvertently increase the purchase price or decrease the sale price of a digital asset through their own trades, potentially resulting in losses.

- Volume and Liquidity

Not all crypto exchanges possess equal trading volumes or activity levels. The trading volume on an exchange affects the liquidity and the availability of competitive prices. Low volume on an exchange may hinder the execution of large trades necessary to achieve desired profits. Additionally, even if a trade is feasible, it may take too long to seize the pricing opportunity due to low trading activity.

- Transaction Costs

Traders must monitor transaction fees associated with purchasing crypto assets across various trading platforms. These fees can fluctuate and vary between exchanges. Staying informed about transaction costs is crucial for optimizing profits and avoiding excessive expenses that can impact profitability.

- Security Risks: Fraud and Hacks

Cryptocurrencies operate in a largely unregulated landscape, which exposes traders to heightened risks of fraud, hacks, and potential currency collapses. Safely storing digital assets is paramount for investors, as securing cryptocurrencies is a prominent concern within the crypto community.

- Tax Considerations

Tax implications must be considered in jurisdictions like the United States, where cryptocurrency adoption has surged. Crypto assets are categorized as property, similar to stocks and bonds, and are subject to taxation. Traders should stay informed about relevant tax guidelines and obligations to ensure compliance with the law.

Wrapping Up

In the broad crypto market, characterized by its fragmented structure and numerous exchanges, broken liquidity creates ample opportunities for arbitrage. This environment, driven by market sentiment, offers favorable conditions for exploiting emerging market structures.

While risks are inherent in any operation involving crypto assets, arbitrage trading stands out as one of the safer methods to generate profits.