5 Best Small Cap ETFs to Buy in 2024 for High Growth Potential

Nov 04, 2024

In 2024, small-cap companies are expected to benefit from improving economic conditions and easing inflationary pressures. Many of the best small cap ETFs focus on companies well-positioned for growth, making them attractive options for investors looking for higher returns.

Additionally, small-cap stocks often outperform large-cap stocks during periods of economic expansion, making this a prime time to explore these ETFs.

Let’s explore the 5 best small cap ETFs to buy in 2024.

Key Takeaways

- Small cap ETFs provide diversified exposure to smaller companies with high growth potential, typically with a market cap between $300 million and $2 billion.

- Top small cap ETFs for 2024 include broad market funds tracking indexes like the Russell 2000 and more targeted funds focused on growth or value stocks.

- When selecting a small cap ETF, consider factors like expense ratio, trading volume, investment portfolio holdings, and investment strategy to find the best fit for your goals.

What Are Small-Cap ETFs?

Small-cap ETFs (Exchange-Traded Funds) are designed to track the performance of small-capitalization stocks. These funds expose investors to companies with a minimum market cap of $300 million.

The term “small-cap” refers to the company’s market capitalization, calculated by multiplying the total number of outstanding shares by the current share price. Small-cap companies are often younger or niche businesses in the earlier stages of their growth cycle than larger, more established ones.

Small-cap ETFs can be either passively managed, tracking a specific small-cap index, or actively managed by fund managers who select stocks based on their analysis and strategy. These funds offer a way for investors to gain diversified exposure to the small-cap segment of the market without needing to research and select individual stocks.

Over long periods, small-cap stocks have typically delivered higher returns than their large-cap counterparts. However, this outperformance comes with a trade-off: small-cap stocks often experience more pronounced short-term volatility.

A prime example of this volatility can be seen during the Dotcom era. In this period, small-cap stocks saw dramatic swings in their performance from one year to the next:

- 1999: 21.25% gain

- 2000: -3.02% loss

- 2001: 2.49% gain

- 2002: -20.48% loss

- 2003: 47.25% gain

Several indexes track small-cap stocks, the most notable being the Russell 2000, representing the bottom two-thirds of the Russell 3000. This broader index tracks the 3,000 largest U.S. companies. Many small-cap ETFs also follow other indices like the S&P 600 and the Wilshire 5000, with the Wilshire 5000 capturing nearly every publicly traded U.S. company.

Fast Fact

Moderate investors with a medium risk appetite: Choose a balanced mix of 50-60% in large-caps, 30-40% in mid-caps, and 10-20% in small-caps. This offers a combination of stability and growth potential.

Best Small Cap ETFs to Buy Now

There are many different small cap ETFs available. Some small cap funds focus on specific sectors or industries, while others are more broadly diversified. The best small cap ETF for you will depend on your individual risk tolerance and investment goals.

For investors looking to capitalize on the growth potential of small caps in 2024, here are 5 of the best small cap ETFs to consider adding to your portfolio:

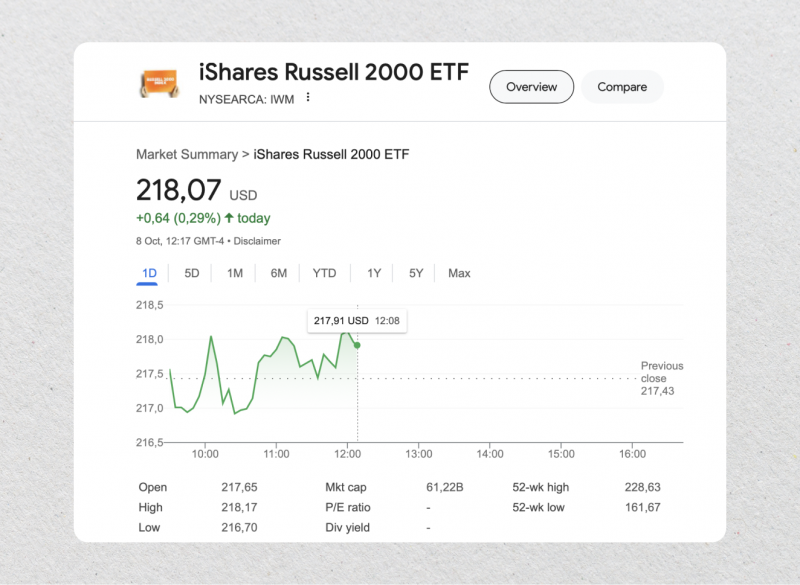

1. iShares Russell 2000 ETF (IWM)

Widely regarded as a leader in the small-cap sector, the iShares Russell 2000 ETF is one of the best ETFs for 2024. The fund seeks to track the performance of the Russell 2000 Index, which includes 2,000 of the smallest stocks in the U.S. market. With a competitive expense ratio of 0.19%, IWM offers broad exposure to U.S. small-cap funds across various industries.

Key features:

- High liquidity

- Exposure to fast-growing small-cap companies

- Diversified portfolio

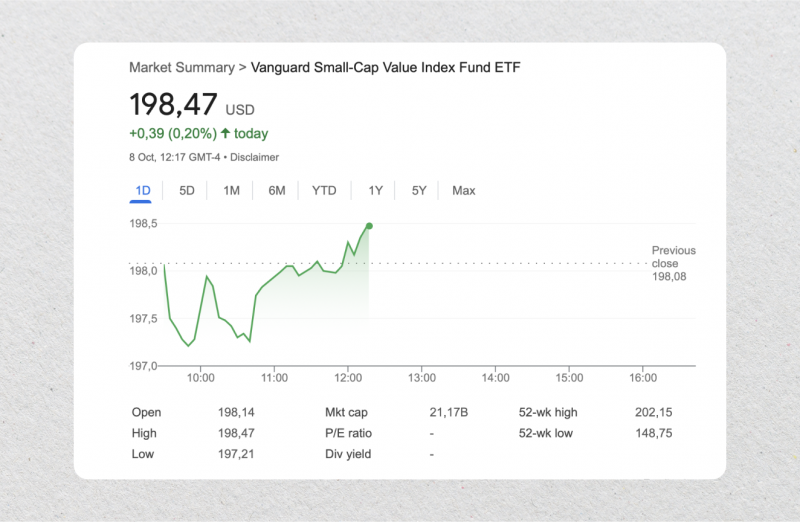

2. Vanguard Small-Cap Value ETF (VBR)

The Vanguard Small-Cap Value ETF is a top choice for investors seeking exposure to undervalued small caps. It tracks the CRSP US Small Cap Value Index, holding over 850 stocks selected based on value factors. With $26 billion in assets and a 0.07% expense ratio, VBR offers an efficient way to target small cap value stocks.

Key features:

- Expense Ratio: 0.07%

- Assets Under Management: $26 billion

- Average Daily Volume: 500,000 shares

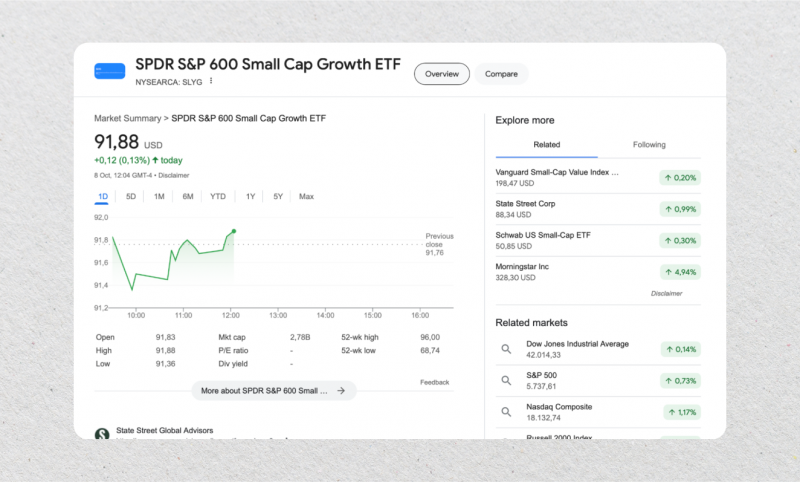

3. SPDR S&P 600 Small Cap ETF (SLYG)

The SPDR S&P 600 Small Cap ETF focuses on companies within the S&P 600 Index, known for their growth potential. It has an expense ratio of 0.15%, and the stocks in this ETF are selected based on strict criteria, including profitability.

Key features:

- Focuses on profitable small-cap companies

- Provides access to growth-focused stocks

- Competitive returns

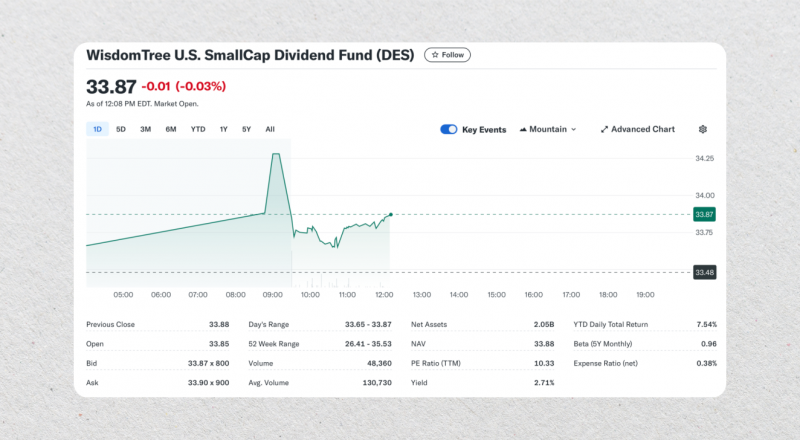

4. WisdomTree U.S. SmallCap Dividend Fund (DES)

The WisdomTree U.S. SmallCap Dividend Fund focuses on dividend-paying small caps, offering a unique approach to the asset class. It tracks a proprietary index of about 700 stocks weighted by dividend yield. With $2 billion in assets and a 0.38% expense ratio, DES appeals to income-oriented small cap investors.

Key features:

- Expense Ratio: 0.38%

- Assets Under Management: $2 billion

- Average Daily Volume: 50,000 shares

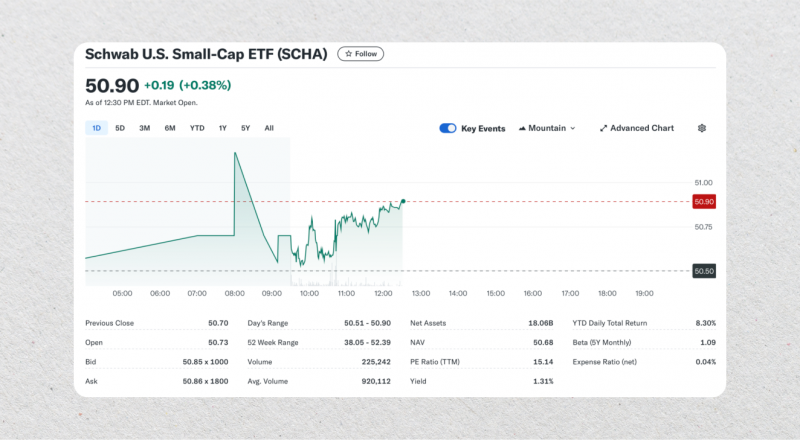

5. Schwab U.S. Small-Cap ETF (SCHA)

With a razor-thin expense ratio of 0.04%, the Schwab U.S. Small-Cap ETF is one of the cheapest small-cap ETFs available. This fund tracks the Dow Jones U.S. Small-Cap Total Stock Market Index and provides broad exposure to the U.S. small-cap market.

Key features:

- Ultra-low expense ratio

- Broad exposure to small-cap stocks

- Solid historical performance

Pros of Small-Cap ETFs

Higher growth potential: Small-cap stocks often represent emerging companies with innovative ideas and substantial growth opportunities. These stocks are more likely to achieve exponential gains than large-cap stocks, which are typically more mature.

Additional diversification: Small-cap ETFs provide exposure to companies that aren’t part of major indices like the Dow Jones Industrial Average (DJIA) or S&P 500. This diversification can reduce the risk of your portfolio moving in sync with large-cap indices.

Undervalued opportunities: Because small-cap companies receive limited attention from analysts, many high-quality companies remain underappreciated. Savvy investors can capitalize on these hidden gems before institutional investors take notice.

Agility: Small-cap companies are more adaptable and can pivot faster than their larger counterparts. Unlike established firms that may face bureaucratic obstacles, small companies can adjust their strategies quickly to capitalize on market opportunities or recover from challenges.

Cons of Small-Cap ETFs

Potential for fraud: The lack of coverage in the small-cap sector can create an environment suitable for fraudulent activity. Lightly traded small-cap stocks with low floats are especially vulnerable to pump-and-dump schemes, where unscrupulous actors artificially inflate stock prices and sell-offs.

High volatility: Small-cap stocks can experience dramatic price swings from one year to the next. While they tend to outperform large-cap stocks over time, the year-to-year fluctuations may be difficult for risk-averse investors to handle.

Economic vulnerability: Small-cap companies generally lack the large cash reserves and competitive advantages – known as “moats” – that protect large-cap companies during economic downturns. This makes them more susceptible to slow business cycles and financial crises, severely impacting their stock prices.

Conclusion

When choosing the best-performing small cap ETF for your portfolio, consider factors like expense ratio, trading volume, portfolio holdings, and investment strategy. Broad market funds like IJR, VB, and SCHA offer diversified exposure suitable for most investors, while more targeted funds like VBR, VBK, and RZV allow you to incline toward value or growth styles. Adding one or more of these top small cap ETFs to your portfolio in 2024 can gain exposure to some of the market’s most innovative and fastest-growing smaller companies. With their potential for best ETF returns, small caps can complement a well-diversified investment strategy focused on long-term growth.