5 Main Methods for Real Estate Investing

Aug 28, 2024

The investment sphere has gone through many stages of development and today includes a wide list of capital investments for financial products that can bring substantial income. At the same time, real estate has always been one of the most popular, stable, and profitable investment objects.

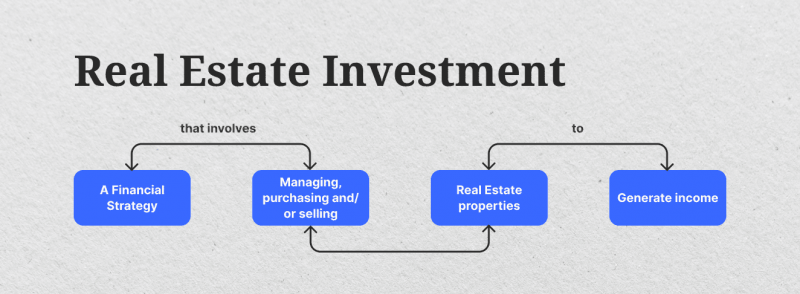

Real estate is a versatile and stable source of income within investing due to its nature and the constantly stable demand for its purchase, regardless of any factors affecting its value.

This article will be your short guide to the world of investing and will explain the top reasons for investing in real estate and the five ways to do so.

Key Takeaways

- Investing in real estate is one of the key investments for profile diversification among the overwhelming number of investors.

- The classic and simplest real estate investment today is renting a property.

Why Should You Add Real Estate to Your Investment Portfolio?

Real estate is one of the favorite investment objects among both ordinary investors and beginners. Despite the relatively low level of profitability, real estate investments have an impressive range of advantages that determine the choice of this type of investment for profile diversification by many capital market participants.

Among the main reasons for investing in the real estate market are:

1. Diversification

Real estate investments can offer valuable diversification to a portfolio predominantly composed of stocks and bonds. Their performance tends to be low-correlated with other asset classes, which can effectively decrease the portfolio’s overall risk.

This low correlation means that the value of real estate investments may not move in step with stocks or bonds, potentially providing a valuable hedge against market fluctuations.

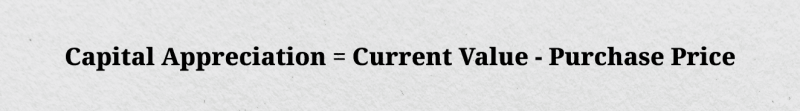

2. Potential for Appreciation

Real estate is known for its potential to increase value over an extended period. When you invest in properties or real estate-related assets, you gain the opportunity to benefit from capital gains as the value of the property appreciates over time.

This appreciation in value can result from various determinants such as location, demand for properties, economic trends, and improvements to the property itself. Real estate’s growth in value can offer a potentially rewarding long-range investment prospect.

3. Steady Income

Investing in rental properties can be a great way to generate reliable, passive income. Tenants pay monthly rent, which can provide a steady stream of income. Additionally, real estate investment trusts (REITs) offer another avenue for earning regular income through dividends, even if you’re not directly involved in property management.

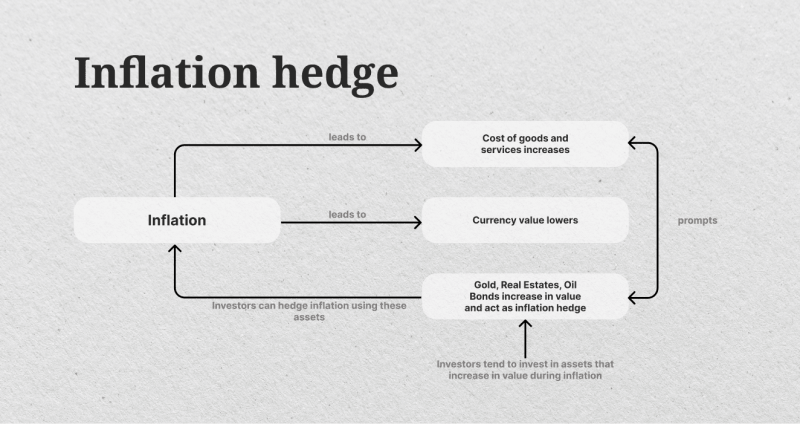

4. Inflation Hedge

Real estate has historically been a reliable hedge against inflation due to the tendency for property values to increase as inflation rises. In addition to property values, rental rates can also be adjusted to align with inflation, thereby safeguarding the purchasing power of the income generated from real estate investments.

This ability to maintain pace with inflation makes real estate an attractive investment option for preserving and growing wealth.

5. Leverage

Real estate investments frequently use leverage, including obtaining mortgage financing, to magnify potential returns. Using leverage, investors can amplify the overall returns on their real estate investing. However, it’s important to note that leveraging also increases the level of risk associated with the investment.

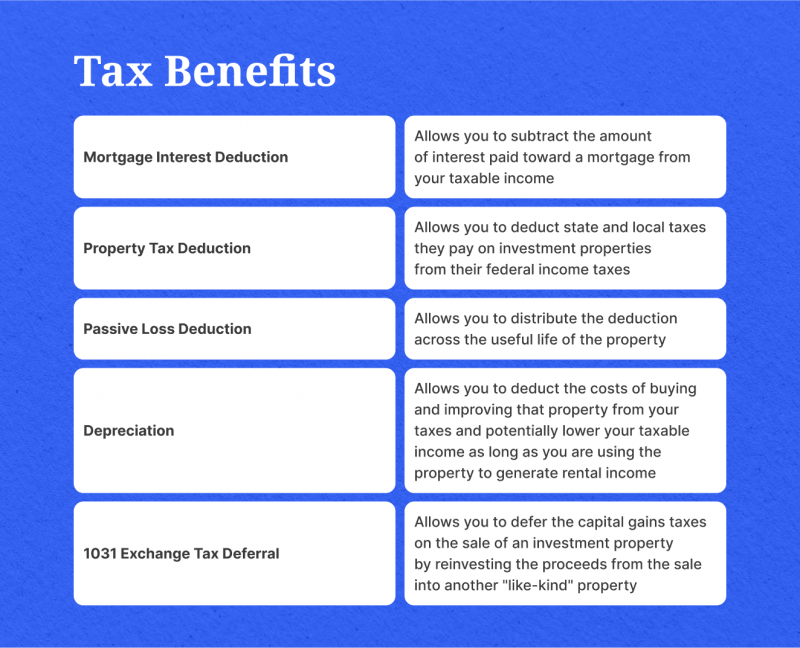

6. Tax Advantages

When it comes to real estate investments, several tax incentives can adversely shape their financial performance. For instance, investors can reap the rewards from deductions on mortgage interest, property taxes, and depreciation. These tax advantages play a crucial role in enhancing real estate investments’ overall profitability and attractiveness.

7. Portfolio Stability

The asset class of real estate is commonly viewed as relatively stable, especially compared to more unpredictable investments such as stocks.

Incorporating real estate into a portfolio can lower the overall volatility and offer a more consistent investment experience.

8. Tangible Asset

Real estate stands out as an investment option due to its physical presence. Unlike stocks and bonds, real estate is a tangible asset that can be seen and touched. This physical presence gives investors a clear sense of ownership and control over their investments.

Furthermore, real estate retains intrinsic value, providing investors with security and stability. This inherent value is derived from the essential need for shelter, commercial space, and land, making real estate an enduring asset class. Consequently, investors may find reassurance that real estate investments can withstand time and economic fluctuations.

9. Social and Economic Impact

Investing in real estate plays a significant role in developing and improving communities. Not only does it provide housing and commercial spaces, but it also contributes to the overall infrastructure and amenities within a community. Additionally, real estate investments directly impact job creation across various sectors.

Fast Fact

There are two types of real estate investments: direct and indirect. The former involves owning and managing properties. Indirect investments include putting money into a pool to buy and manage properties.

5 Straightforward Strategies for Investing in Real Estate

Due to the great popularity of investing in the real estate industry today, there is a wide list of ways that allow you to invest capital and get a significant profit, including in the emerging markets of both commercial and residential real estate. Here are the main ways that allow you to do this:

Rental Properties

Rental properties, with the right skill set and resources, can be a highly rewarding investment strategy. It’s an appealing option for those with DIY abilities, the patience to manage tenants, and the time to handle day-to-day activities properly.

The initial financial requirements can be a significant barrier, as acquiring rental properties often necessitates a relatively low down payment. However, this comes with the caveat of requiring substantial cash reserves to finance upfront maintenance costs and shroud spans when the vacant property or tenants fail to pay rent.

On the positive side, once the rental property generates consistent cash flow, the investor can leverage that income to acquire additional properties. Over time, this can accumulate multiple income streams from a portfolio of rental properties. This diversification can help offset unexpected costs and losses, as new rental income can help absorb such setbacks.

Real Estate Investment Groups (REIGs)

Real estate investment groups (REIGs) allow individuals with available capital to invest in rental properties without the burden of day-to-day management. These groups function as a collective investment, like a mutual fund, where multiple investors pool their resources to purchase or develop rental properties.

In a typical REIG setup, a company acquires a portfolio of rental units, such as apartment buildings or condominiums, and manages all aspects of property maintenance, tenant selection, and advertising. Investors in the group own individual units within the properties, but the company overseeing the REIG handles the operational responsibilities in exchange for a percentage of the rental income.

By participating in a real estate investment group, investors can reap the advantages of a diversified profile of rental properties without requiring direct involvement in property management. The pooled resources from multiple investors help alleviate the liabilities entailed with vacancies, as rental income is shared among all unit owners to cover potential losses.

Such a structure allows investors to gain passive earnings from rental properties while leaving the day-to-day operations to the professional management team, making it an attractive option for those seeking to invest in real estate without the hassles of hands-on management.

House Flipping

Real estate investors often use house-flipping as a strategic investment approach. This method involves acquiring undervalued properties, enhancing them through renovations or improvements, and subsequently selling them at a higher price to make a profit. The primary objective is to pinpoint properties that can be purchased at a bargain, undergo necessary upgrades, and then be resold at an increased market value, yielding a financial gain for the investor.

Real Estate Investment Trusts (REITs)

REITs serve as an investment vehicle that enables individuals to participate in the real estate market without the need to directly own physical properties.

These companies, which can own, operate, or finance income-generating real estate assets like office buildings, retail properties, and hotels, are structured as publicly traded entities with shares available for purchase and sale on stock exchanges. Investors in REITs own a portion of the company’s real estate portfolio, offering a way to broaden their investment holdings.

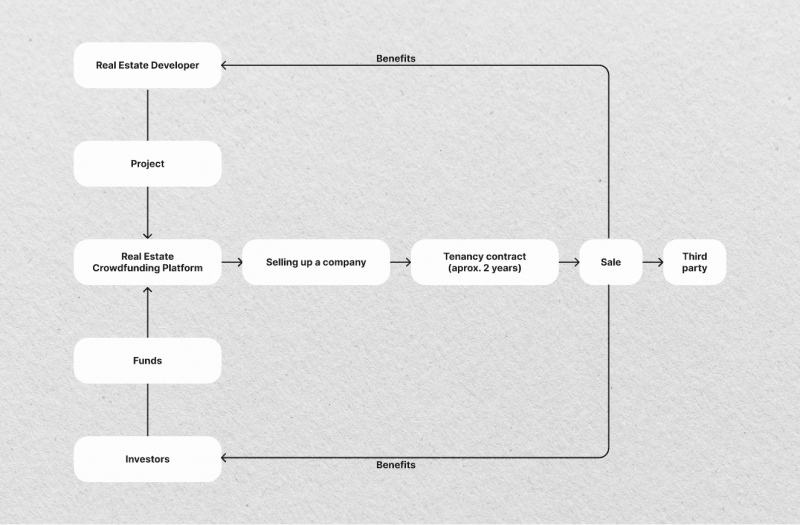

Crowdfunded Real Estate Platforms

Crowdfunded real estate platforms are online platforms that facilitate the collective investment of funds from a multitude of investors to finance real estate projects or acquire properties. These platforms have emerged as a popular alternative to traditional real estate investing, offering several benefits to investors.

Online platforms for crowdfunded property investment enable individuals to participate in fractional ownership of properties. These platforms facilitate purchasing and managing various properties by pooling funds from multiple investors. This approach offers the advantage of real estate investment with a reduced minimum investment requirement, making it more accessible to a broader range of potential investors.

Conclusion

The real estate market will always be a valuable asset from the point of view of capital investment, both for short-run dividends and long-run investment, based on any of the above-reviewed methods of capital investment in real estate.

On the other hand, the real estate market will play a key role in the framework of investment activity as a backbone element of investment potential, forming a stable source of constant return for investors and an important tool for portfolio diversification.