Complete Guide to the Over-the-Counter (OTC) Market

Aug 05, 2024

Financial markets are complex organizations with economic and institutional structures critical in determining how prices are established or “discovered.” These factors also shape the stability and orderliness of the marketplace. As holders of subprime collateralized debt obligations (CDOs) and some derivatives have found out in the months following the August 2007 onset of the current turmoil, some types of markets can quickly become unstable, disorderly, or otherwise dysfunctional.

There are two basic ways to organize financial markets — exchange and over-the-counter (OTC) — although some recent electronic facilities blur the traditional distinctions.

This article will tell you what OTC trading is and how the over-the-counter market for financial assets is organized. You will also learn what types of assets are traded on this type of market and into what types it is subdivided.

Key Takeaways

- OTC market securities are bought and sold directly between parties without a centralized exchange.

- Investors who trade OTC securities often benefit from increased privacy and reduced regulatory constraints compared to trading on a traditional exchange.

What Is the Over-the-counter (OTC) Market?

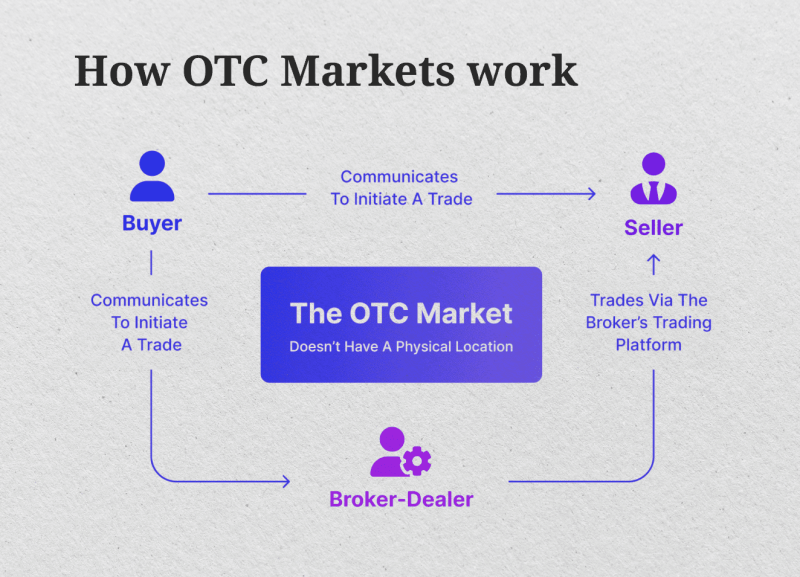

Decentralized or over-the-counter (OTC) markets facilitate direct securities trading between two parties without a centralized exchange or broker. These markets are commonly used to trade stocks, bonds, derivatives, and other financial products not listed on formal exchanges. Participants in OTC markets operate within a chain of dealers who proactively negotiate prices and trade terms with each other, allowing for a more personalized and flexible trading experience.

The decentralized nature of OTC markets offers a platform for direct securities exchange, liberating participants from the need for a centralized intermediary. This setup grants participants the freedom to engage in transactions that may not be available on traditional exchanges, thereby enhancing the overall trading experience. By enabling direct negotiation of prices and trade terms, OTC markets empower participants with a level of control and autonomy over their transactions, leading to increased customization and efficiency in trading activities.

In OTC markets, the absence of a centralized exchange or broker creates an environment where participants can easily engage in direct securities trading. This decentralized approach allows trading various financial instruments, including those not typically listed on formal exchanges.

Through the network of dealers, buyers and sellers can directly negotiate prices and trade terms, fostering a dynamic and flexible trading environment that is responsive to the diverse needs of market participants.

Fast Fact

Despite functioning as a dealer network, Nasdaq stocks are typically not categorized as OTC securities due to Nasdaq’s status as a recognized stock exchange.

Types of Securities Traded in OTC Markets

The OTC market encompasses various securities and financial tools traded directly between counterparties rather than on a centralized exchange. The main types of securities traded in OTC markets include:

Debt Securities

Debt securities primarily entail corporate bonds, which are debt securities issued by corporations and are traded in the OTC market. Moreover, there are municipal bonds, on the other hand, that are bonds granted by local governments and municipalities.

Also, in the category of debt securities, there are U.S. Treasury securities that are debt obligations issued by the U.S. government, while agency securities are debt instruments issued by government-sponsored entities like Fannie Mae and Freddie Mac.

Equity Securities

Equity Securities are actively traded within OTC markets, with various categories such as OTC Stocks, Pink Sheets, and OTCBB.

OTC stocks represent shares of public companies not listed on major stock exchanges like the NYSE or Nasdaq. Pink Sheets serve as a quotation system for OTC securities that do not meet the listing requirements of a major exchange.

At the same time, OTCBB (OTC Bulletin Board) is a regulated electronic quotation system designed explicitly for OTC equity securities.

Derivative Instruments

Derivative instruments encompass a broad spectrum of investment products, including swaps like interest rate swaps, currency swaps, and credit default swaps. Options are also part of this group, including over-the-counter options such as equity, commodity, and foreign exchange options.

Additionally, forwards and futures are part of derivative instruments, which consist of forward contracts and over-the-counter futures on different underlying assets. Lastly, structured products like collateralized debt obligations (CDOs) and mortgage-backed securities (MBS) are considered complex financial instruments within this category.

Commodities and Currencies

Within this category, there are spot and forward foreign exchange (FX) contracts, which are transactions that entail the exchange of one currency for another.

Additionally, this group encompasses commodity derivatives, which consist of forwards, futures, and options related to underlying commodities like gold, oil, and agricultural products.

Other Financial Instruments

Various financial instruments fall under this category, such as repurchase agreements (repos), which are short-term collateralized loans. Certificates of deposit (CDs) are also part of this group, representing time deposits issued by banks. Additionally, short-term debt instruments like commercial paper, bankers’ acceptances, and other money market products are included in this classification.

Major Kinds of OTC Market

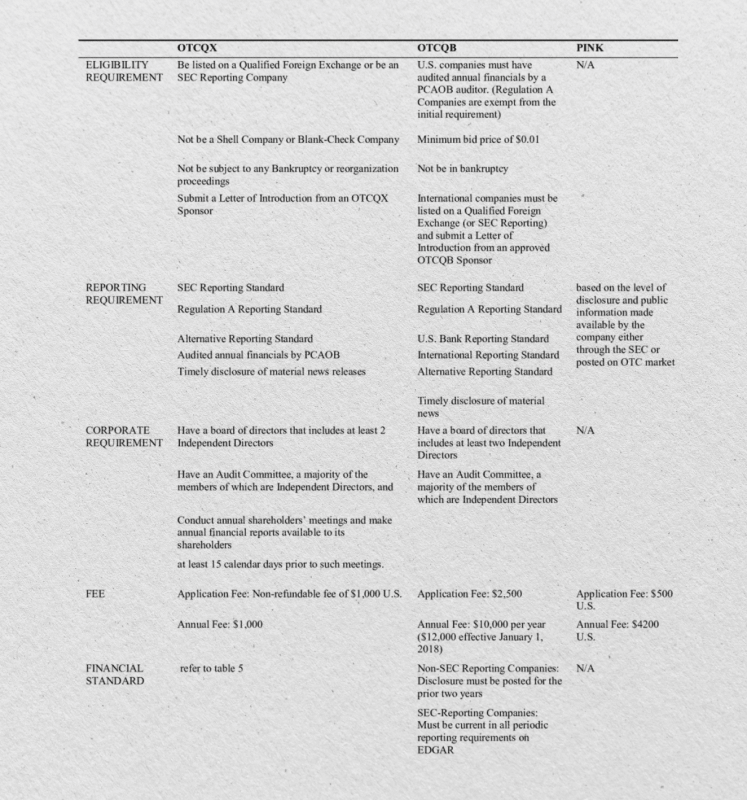

OTC Markets Group, an external entity, has established three levels categorized by the quality and quantity of publicly accessible data. These levels aim to give investors an understanding of the extent of information companies disclose. The transition of securities between tiers is determined by the regularity of financial reports. It is important to note that these tiers do not reflect the company’s investment value and should not be interpreted as a suggestion or endorsement.

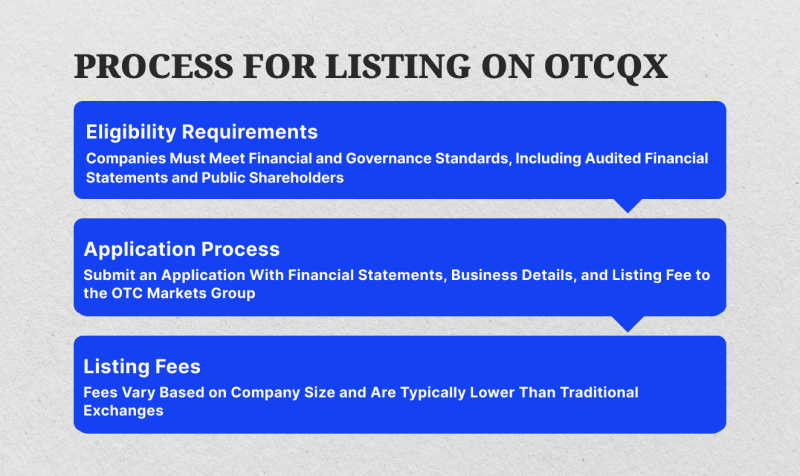

OTCQX

The OTCQX tier is recognized as the top level of OTC Markets’ securities due to the extensive range of data that is publicly available. To qualify for this tier, companies must ensure they are up-to-date with all regulatory disclosures, have audited financial statements, and are not classified as penny stocks, shell corporations, or in bankruptcy.

Meeting the requirements for the OTCQX tier signifies a company’s commitment to transparency and financial stability. By adhering to these strict criteria, firms can demonstrate their credibility to investors and stakeholders, ultimately enhancing their reputation within the market.

OTCQB

This tier is tailored explicitly for early-stage or growing companies that meet specific criteria. These companies must maintain a minimum bid price of $0.01, stay current with their regulatory filings, and have audited annual financials prepared per U.S. Generally Accepted Accounting Principles (GAAP). Similar to OTCQX, companies in this tier are not allowed to be in a state of bankruptcy.

Pink Market (Pink Sheets)

The Pink Market, also known as the Open Market, offers a platform for multiple sorts of corporations to be listed without strict financial standards. This tier accommodates a wide spectrum of entities, including foreign firms, penny stocks, shell companies, and those that choose not to disclose their financial details. The classification of companies within the Pink Market is based on the level of information they make available, which can range from Current Information to Limited Information or No Information.

Grey Market

Over-the-counter traded securities that do not fall into any other category are classified as Grey Market securities. These securities are not listed by broker-dealers because of reasons such as insufficient investor interest, inadequate financial records, or non-compliance with regulatory prerequisites.

Conclusion

The OTC market allows investors to trade securities through a broker-dealer network rather than on a centralized exchange such as the New York Stock Exchange. While OTC networks do not operate as formal exchanges, they are subject to eligibility requirements established by the SEC.

Investors can use the OTC market to buy and sell securities decentralized, offering flexibility and accessibility beyond traditional exchanges. Despite not being as regulated as formal exchanges, OTC networks still adhere to SEC guidelines to ensure transparency and investor protection.