Discover The Top 10 KYC Providers in 2024

Apr 29, 2024

The Know Your Customer (KYC) market evolves rapidly alongside shifts in the financial industry, fueled by the emergence of AI and crypto technologies. According to the report by Facts & Factors, the global e-KYC market is expected to reach an impressive $2791.5 million by 2030, with a compound annual growth rate of 21.5%.

As the demand for digital identity solutions continues to rise, numerous KYC providers are present on the market, offering a wide range of services. In this article, we will examine the top KYC solution providers in 2024 and what sets them apart from the rest.

Key Takeaways

- KYC plays an important role in the AML framework used to combat financial crimes.

- The KYC technology framework includes four key steps: CIP, CDD, EDD, and ongoing monitoring.

- Some of the best KYC solution providers, like Shufti Pro, Trulioo, and Jumio, are tailored to meet the specific needs of various industries, such as e-commerce, financial services, and crypto exchanges.

What is KYC Technology?

KYC, or Know Your Customer, technology refers to the processes and tools used by financial institutions and businesses to verify customers’ identities and accurately assess their risk profiles.

It involves collecting and analyzing personal information, document verification, biometric authentication, and screening against global sanctions lists and watchlists. These processes are crucial in today’s financial environment to combat money laundering, terrorism financing, fraud, and other illegal activities.

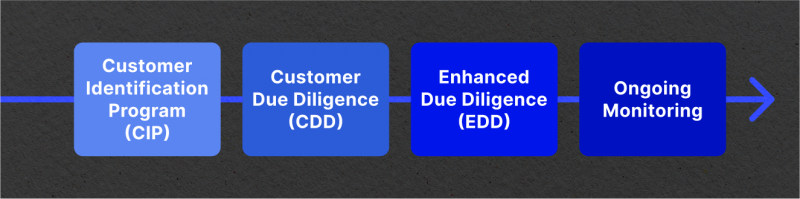

Key Steps in The KYC Technology Framework

The KYC technology framework consists of several essential steps:

- Customer Identification Program (CIP) – The first step, CIP, involves collecting and verifying customer information to establish their identity. Among these are personal information, such as name, date of birth, and address, along with document verification and biometric authentication.

- Customer Due Diligence (CDD) – The second step, CDD, is a comprehensive assessment of the customer’s financial activities and risk profile. This step requires financial institutions to understand the nature of their customers’ transactions and identify potential red flags.

- Enhanced Due Diligence (EDD) – If a customer is deemed high risk during this stage, the EDD step comes into play, where a deeper investigation into clients’ backgrounds, associations, and financial activities is conducted for enhanced security.

- Ongoing Monitoring – This step ensures that customer accounts and transactions are continuously monitored for suspicious or unusual activities, enabling institutions to take prompt action if necessary.

Fast Fact

KYC is a crucial component within the wider Anti-Money Laundering (AML) framework. Financial institutions and governments comply with AML to combat financial crimes.

Top 10 KYC Providers in 2024

Let’s explore the top 10 KYC AML providers in 2024:

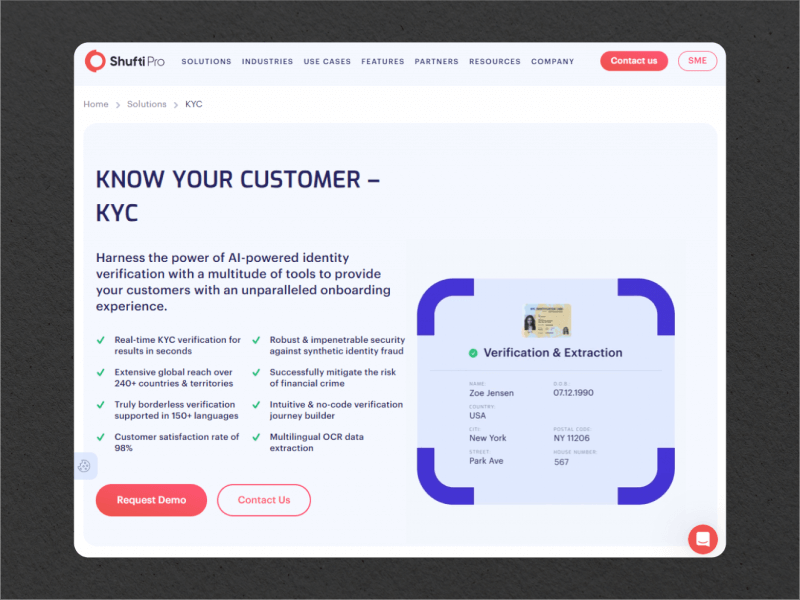

Shufti Pro

Shufti Pro is a UK-based identity verification firm that has gained significant recognition in the market for its AI and HI hybrid technology. The company offers a wide range of services, including KYC/AML/KYB screening, biometric authentication, ongoing KYC/AML screening, age verification, video KYC, and touchless airport security clearance kiosk.

With high-end technology like biometric facial recognition and anti-spoofing techniques, Shufti Pro allows its clients to trust and expand their business processes. The company is GDPR compliant and has a strong track record in end-user data protection. Moreover, it is certified by PCI DSS and Cyber Essentials.

Shufti Pro’s unique selling point lies in its single API integration, which makes it easy for businesses of all sizes to implement the solution into their existing systems. This multi-layered risk cover against digital identity theft, money laundering, and terrorist financing makes Shufti Pro a top choice for e-commerce, the financial industry, fintech, educational and healthcare platforms worldwide.

Trulioo

Trulioo is a global identity verification company that provides secure access to hundreds of identity networks worldwide. With its comprehensive suite of in-house capabilities integrated across a single automated platform, Trulioo offers customizable onboarding workflows tailored to meet any market requirement.

Covering 195 countries and being able to verify more than 13,000 ID documents and 700 million business entities, Trulioo is a trusted KYC software by leading companies for their verification needs. Its advanced technology and expert knowledge of diverse markets enable the highest verification assurance levels, optimising onboarding costs and fostering trust in the global digital economy.

Trulioo’s flexible solution allows for customizable rules, configurations, and workflows through a single API. This has made it a top choice for industries such as e-commerce, financial services, and cryptocurrency exchanges that require seamless, secure and robust KYC processes for their customers.

Sumsub

With over 2,000 clients across various industries, Sumsub is a leading identity verification platform that offers customisable solutions for KYC/AML compliance, KYB, monitoring of financial transactions, and fraud prevention.

The company’s unique approach, which includes orchestrating the entire verification process, has led to high conversion rates in many jurisdictions while verifying users in less than 50 seconds on average.

Sumsub follows international standards for AML/CTF rules and local regulatory requirements, making it a reliable choice for financial businesses globally. The platform’s modern UI, ease of use, and high accuracy rate have received positive client reviews. Additionally, the company’s ongoing product development ensures that its tools are constantly improving to meet the evolving needs of its clients.

Sumsub has a behaviour biometrics feature, which adds an extra layer of security by analysing user behaviour patterns, making it one of the most advanced KYC providers in 2024.

Jumio

Jumio is a well-known AI-based KYC provider founded in the US in 2016. The company has a proven track record of verifying over 300 million customer identities from more than 200 countries and territories. Jumio’s KYX Platform offers cutting-edge technology like AI, biometrics, liveness detection, and automation to establish, maintain and reassert trust in real-time web and mobile transactions.

Jumio’s seamless and intuitive user interface allows for a hassle-free identity verification process that takes less than one minute. Its solutions are trusted by leading companies in various industries, such as financial services, retail, travel, and online gaming.

One key feature of the solution is its PCI DSS Level 1 certification. The platform also supports multiple languages and document types, making it accessible to a global audience. With its easy integration options and strong encryption measures, Jumio will be a top choice for businesses looking for a reliable KYC provider in 2024.

Onfido

Onfido is an identity verification solution that offers businesses an advanced Real Identity Platform to streamline and secure their onboarding processes. The platform utilises AI-powered technology, Onfido Atlas, for automated end-to-end online identity verification.

Onfido’s Real Identity Platform allows businesses to adapt their verification methods based on individual user and market needs. This no-code orchestration layer combines document and biometric verifications, trusted data sources, and passive fraud signals to meet regulatory requirements while reducing risk and friction for customers.

With over 1100 clients, Onfido is a trusted choice for seamless and secure customer onboarding at scale. Furthermore, its SDKs and excellent customer experience make it easy for businesses to capture identity documents and selfies with high accuracy through both desktop and mobile devices.

SEON

SEON is a leading fraud prevention startup that offers a cutting-edge software solution to detect and prevent fraud in real-time. Founded in 2017, the company has gained recognition for its innovative approach to transactional data analysis using machine learning and human intelligence algorithms.

The company’s software integrates with device fingerprinting modules and utilises advanced features such as email verification and IP address analysis to detect and report fraudulent activities. SEON’s solution is highly customisable, allowing businesses to tailor it to their specific fraud prevention needs.

In addition to its advanced technology, SEON prioritizes data security and offers its clients the option of on-premise deployment for additional control.

Fractal ID

Fractal ID is a Berlin-based identity verification platform offering decentralised solutions for Web3 users and chains. Focusing on human uniqueness and KYC/AML compliance, Fractal empowers users to exchange their data in a privacy-preserving way.

Fractal has quickly gained recognition for its fast and accurate global verifications, with a success rate 40% higher than the industry standard. The company’s experts in finance, design, law, and technology have a combined track record of 45 years in successful product shipping.

The solution offers state-of-the-art security measures, including encryption, to protect user data. Fractal is also committed to GDPR compliance and ensures that its privacy policy contains all necessary information regarding data processors.

iDenfy

iDenfy, a Lithuania-based anti-fraud and compliance company, is recognized as one of the top KYC providers for its comprehensive identity verification solution. With over 3000 supported identity documents from 200 countries and territories, iDenfy offers a global reach for businesses looking to verify the identities of their customers.

A notable feature of iDentify is its direct integration of PEPs, sanctions, and adverse media checks, providing ongoing screening to ensure continuous compliance. The company also offers a unique pricing model where clients only pay for approved customers, omitting denied verifications due to fraud, expiry, or bad image quality.

In addition, iDenfy offers business verification with access to official credit bureaus for 160 countries and government-issued registry reports. This integration into a single platform allows businesses to streamline their compliance processes and generate reports required by auditors.

With widespread integration options, including mobile SDKs, iFrame, WordPress, Zapier, Bubble, and others, iDenfy is a versatile solution suitable for any business size or industry. Its focus on providing a seamless and secure identity verification process has earned it a spot among the robust KYC solutions in 2024.

IDology

IDology, founded in 2003, is a US-based identity verification and fraud prevention solution provider that caters to organizations operating in a customer-not-present environment. Their platform is a collaborative hub for monitoring and stopping fraudulent activity while driving revenue, decreasing costs, and meeting compliance regulations.

One of IDology’s key features is its on-demand technology platform, which allows clients to control the entire proofing process. This provides flexibility for configuration changes without relying on internal IT resources or IDology’s customer service.

The company also offers a solution-driven approach to identity verification and fraud prevention, with streamlined processes that help increase customer acquisition and improve customer experience. IDology has made significant strides in the market with its innovative technology solutions and has become a trusted partner for organisations looking to secure their digital transactions.

AMLBot

AMLBot delivers comprehensive compliance solutions for crypto businesses, automating AML/KYC processes.

The firm has helped companies become more cost-effective, achieve VASP registration, and comply with AML regulations. AMLBot Pro, an advanced blockchain analytics tool, is designed for compliance teams, ensuring swift and effective asset recovery and regulatory compliance. With over $100 million in risky funds detected and 60,000+ service providers checked, choose AMLBot for cutting-edge technology and proven results in crypto compliance.

Service offerings:

- AML KYT: Comprehensive screening of crypto transactions and wallets.

- KYC/KYB: Know Your Customer/Know Your Business verification services.

- Crypto Consulting: Expertise in AML training, policy development, business registration, licensing, and opening bank/CEX accounts.

- AMLBot Pro: Advanced blockchain analytics and tracing software.

Why Choose AMLBot:

- All-in-One Solution: AML KYT, KYC, KYB, legal consulting, and investigations—all in one place.

- Flexible Onboarding: Start with low volumes without any monthly usage requirements.

- Client-Focused Approach: Tailored check volumes for specific periods with a pay-as-you-go model, offering complete flexibility.

- Extended Check Validity: Checks remain active for up to one year, not just one month.

- Enhanced Accuracy: We partner with top AML providers, utilizing both our internal and partner databases for precise results.

- Free Trial: Test our services at no cost.

- Easy Integration: Simple API setup or manual check options.

- Dedicated Support: Responsive managers ready to assist you.

Ondato

Ondato is an AML and KYC process optimisation technology company that offers high-precision AI-based OCR (Optical Character Recognition) technology as a standalone solution to other identity system providers.

Built into Ondato’s proprietary solutions for identity verification and onboarding processes, this efficient, accurate, and fast OCR technology is now available as an open API integration for third parties.

With the ability to read and digitise over 10,000 document templates in less than a second with 99.8% accuracy, Ondato’s OCR technology significantly speeds up KYC and AML compliance for organisations across all industry sectors and geographical locations. Thus, the solution is ideal for businesses looking to streamline their onboarding processes while ensuring regulatory compliance.

Furthermore, Ondato’s OCR technology is constantly updated and improved to keep up with the ever-evolving regulations and document templates, providing a reliable and future-proof solution for KYC needs. With customer data protection at its core, Ondato also ensures GDPR compliance and follows strict data privacy standards.

KYC-Chain

KYC-Chain is a leading KYC AML platform that helps compliance teams perform identity verification and KYC AML checks to onboard customers faster.

The platform comes with different features, such as ID document verification, AML watchlist screening, premium ID data verification, and crypto wallet screening, along with risk scoring and ongoing monitoring. A client can choose what features they need as per their AML CTF requirements.

KYC-Chain helps businesses in banking, payments, wealth management, blockchain, and fintech comply with global standards for AML/CTF rules and local regulatory requirements. The platform comes with an easy-to-use UI, guided verification flow, and high accuracy rates with ongoing reviews. Additionally, the company continually develops its products, consistently enhancing its tools to meet the evolving needs of its clients.

Closing Thoughts

As technology advances and requirements become stricter, KYC’s role in the fintech industry will only continue to grow. Businesses must stay up-to-date with the latest trends and adopt innovative solutions to effectively comply with regulations while providing a seamless onboarding experience for their customers.

From increased digital identity integration to the emergence of all-in-one verification solutions, the future of KYC solutions is set to bring forth more efficient and secure methods for preventing financial crimes. By prioritizing KYC measures, fintech companies can maintain customer trust, protect operations, and contribute to a safer and more transparent financial landscape.

FAQ

What are KYC providers?

KYC service providers offer solutions to help businesses and financial institutions with their KYC processes. These providers use advanced technology such as software and data analytics to collect, verify, and store customer information accurately and efficiently.

Are KYC checks necessary for financial companies?

Yes, KYC checks are mandatory for financial companies to comply with anti-money laundering and counter-financial terrorism regulations. These checks help financial institutions prevent fraud, money laundering, and other illegal activities.

How do I choose a KYC solution provider?

Consider your business’s size and reach. If you have a small business, opt for a KYC provider that offers basic services. However, if your company has customers worldwide, look for a provider that can handle larger volumes.

Check if the company meets industry requirements. Different industries have varying levels of KYC regulations, so choose a provider that follows the rules applicable to your industry.

Evaluate your budget. Identity verification companies have varying prices, so compare costs and features before choosing one. Remember to go for the provider that offers the best value for your money.

How does KYC API work?

KYC API integrates identity verification solutions into a business’s existing systems or applications. When a customer initiates an onboarding or verification process, the API collects their information and performs various checks to verify their identity.

These checks may include comparing the provided details against government databases, conducting facial recognition or biometric scans, and checking for suspicious activities.