From Gold to Index Funds and Crypto: Where to Invest in 2023 for Long Term?

Sep 07, 2023

We are all familiar with the phrase “time is money”, but usually without realising how true it really is. This has been proven repeatedly for those who have invested wisely in the past three decades. In 1990, for example, a small investment in gold or stocks could have grown into an impressive nest egg.

The same holds today. With the advent of index funds and cryptocurrencies, there are more options than ever for savvy investors to capitalise on long-term growth opportunities. But just where should one look in 2023?

Key Takeaways:

- Gold is still one of the safest bets when it comes to investing, providing stability and longevity for investors.

- There are multiple ways to gain exposure to commodities, including physical ownership, futures contracts, individual securities, and exchange-traded products.

- Investing in stocks can be a great way to create long-term wealth, but it comes with risks that could lead to significant losses; researching and monitoring investments are essential for successful investing.

- Mutual funds, index funds, and ETFs offer diversification and professional management with lower costs and liquidity.

- Cryptocurrency is a high-risk, highly volatile asset class that has potential long-term gains for investors who are able to correctly predict the markets.

Investing in Gold

Gold has been a store of value for centuries and is still one of the safest bets when it comes to the financial sector. In times of economic hardship, its value tends to hold up well. While it’s not as flashy as cryptocurrency or as reliable as index funds, gold does have its own unique qualities that make it an excellent choice for the long-term investor.

The history of gold as a medium of exchange and store of value goes back thousands of years. Gold has been used to buy goods, pay debts, and settle disputes since ancient times. This trend continues today, with gold being the preferred investment choice for many investors due to its stability and longevity.

Gold has kept up with inflation over time. A gold bar bought 100 years ago would have the same purchasing power today as it did then. From 1990 to 2020, gold has seen an average return of 2.5%, slightly higher than the average return of other 30-year periods of time in history. This makes it an attractive long-term investment with a solid track record for preserving wealth.

Pros of Investing in Gold

- Preservation of Wealth: One of the most significant advantages of investing in gold is its ability to preserve wealth over long periods of time. Historically, gold has been an effective hedge against inflation and a declining U.S. dollar. By holding gold as part of your portfolio, you can protect yourself from the devaluation of paper-denominated currencies.

- Diversification: Gold is also an effective tool for diversifying your investments, as it is traditionally uncorrelated to other asset classes like stocks and bonds. It can help you spread out your risk and potentially increase returns by reducing volatility in your portfolio.

- Safe Haven: In times of political and economic uncertainty, gold is often seen as a safe haven. Because it is a hard asset that has maintained its value throughout history, investors tend to flock to gold when other markets are in turmoil.

Cons of Investing in Gold

- Price Volatility: While gold can be an effective way to diversify your portfolio, it is also known for its volatile price swings. This is especially true in the short term, as gold is considered to be an unstable asset.

- Storage: When investing in physical gold, you have to consider how you will store and protect your physical holdings. You’ll need to purchase a safe or rent a safety deposit box from a bank to store your gold securely.

- High Premiums: Depending on the form of gold you purchase, you may be subject to high premiums. This is due to the fact that gold bars and coins are typically melted down and resold at a markup, so they will cost more than their spot price.

How to Invest in Gold?

One of the significant differences between investing in gold a few hundred years ago and now is that there are a lot more investment options available, like:

- Physical Gold: Investors can buy physical gold, such as coins and bars, from dealers or brokers. This type of investment may require storage for security purposes.

- Exchange-Traded Funds (ETFs): ETFs provide investors with exposure to gold without the need for actual ownership. They track the price of gold and are traded on exchanges like stocks.

- Gold Mutual Funds: These mutual funds are professionally managed portfolios that invest in gold or other precious metals. They offer a more diversified approach to investing in gold, but they typically have higher fees than ETFs.

- Gold Futures: Futures contracts allow investors to buy or sell a particular amount of gold at a predetermined price at some point in the future. These can be used as hedges against market volatility, but they involve significant risk and should only be used by experienced investors.

- Gold Mining Stocks: Investing in gold miners can be another way to gain exposure to the price of gold. These stocks give investors the opportunity to benefit from the gold mining companies ‘ success, in addition to potential price increases due to gold itself.

At the moment, gold is experiencing a period of resurgence. While it may have been outshone by the S&P 500 over the past five years, its performance during the past twelve months puts it in a solid position to take advantage of certain economic conditions that make investing in gold an intelligent choice.

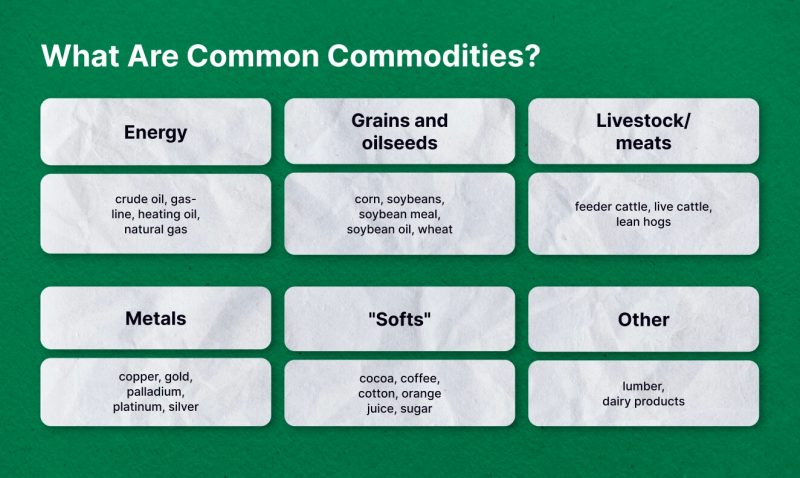

Investing in Other Commodities

Besides just gold, there are many other commodities that can be used to diversify a portfolio and potentially increase returns. Commodities are physical goods such as metals, energy products, agricultural products, and more. Like gold, they can be used to protect against inflation by hedging against the declining value of paper currencies.

Pros of Investing in Commodities

Inflation can have a significant impact on commodity prices, with an increase in demand caused by investors seeking to protect their investments from decreased buying power. As commodity prices rise due to inflationary pressures, the prices of goods and services are also driven up, making commodities a choice for investors looking to hedge against a currency’s decreased buying power during times of uncertain markets.

Another advantage to investing in commodities is that they can be traded quickly and easily due to their liquidity. This makes them an attractive option for investors looking to take advantage of short-term price movements, as they can enter and exit positions with little market impact.

Cons of Investing in Commodities

The commodity futures market can be a very liquid one with a high daily range and volatility, making it attractive to day traders. For one, they can be subject to price volatility, which means that even a small change in price can lead to large losses. In addition, macroeconomic events can also have an effect on the prices of commodities, making them difficult to predict and potentially leading to losses.

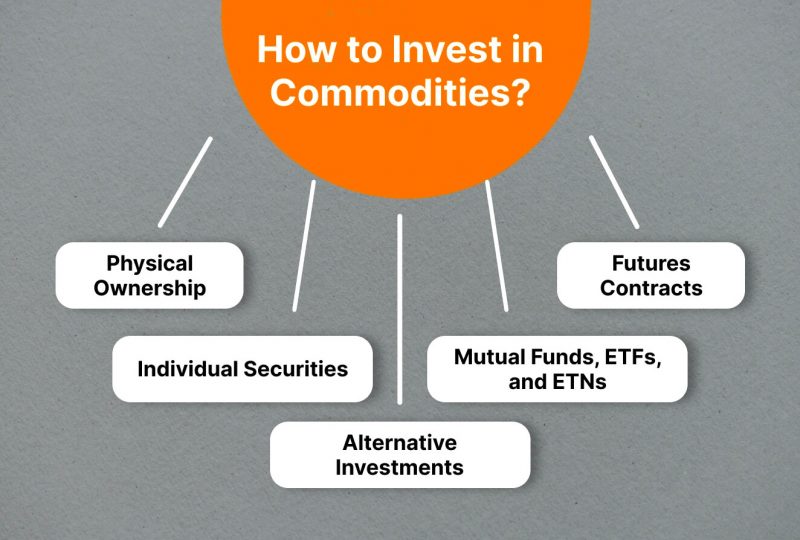

How to Invest in Commodities?

The following are some common ways for investors to gain exposure to commodities:

- Physical Ownership: This option comes with storage, insurance, and liquidity issues that must be considered when allocating capital.

- Futures Contracts: These are direct plays on commodity prices, allowing investors to use margin accounts to take larger positions with their existing capital.

- Individual Securities: Investors looking for commodity exposure through company shares generally have to gain some industry-specific knowledge for better results.

- Mutual Funds, ETFs, and ETNs: Exchange-traded products that are specific to individual commodities can provide exposure without having to purchase physical goods or figure out how to profit from them.

- Alternative Investments: Commodities such as bullion coins and jewellery can also be seen as alternative investments. These items have an aesthetic and historical value that generally sees them trade at a premium compared to the melt price of the metals they contain, but their prices are less connected to market prices.

Investing in Stock Markets

Stocks are shares of publicly traded corporations. They offer investors the potential for long-term capital appreciation and also provide a source of steady income in the form of dividends.

Investing in stocks can seem intimidating, but it’s worth the effort. Historically, stocks (also known as equities) have consistently outperformed other asset classes and offer solid returns over time. On average, the stock market rises by around 10% each year.

There are two primary types of stocks: common and preferred. Common stock often includes voting rights and eligibility for certain matters, while the preferred stock has first claim to dividends and must be paid off before any payments are made to common shareholders.

Another important factor to consider is whether to invest in growth or value stocks. Growth stocks refer to investing in a company while it’s still small and has not yet achieved market success, while value stocks are investments made in more established companies whose stock prices may not reflect their true value.

Pros of Investing in Stocks

Stock markets offer a number of benefits to investors, particularly for those with a longer-term investment horizon:

- Great potential for significant returns over the long term. With a solid investment strategy and an understanding of the stock market, investors can earn higher returns relative to other investments, such as bonds or even cash savings accounts.

- Stocks are liquid, meaning that you can convert them into cash quickly and with low transaction costs. This is particularly helpful in the event of an emergency or if you need to withdraw funds for any reason.

- Stocks offer a way to diversify your portfolio and spread your investments across multiple industries, thereby reducing risk. By investing in stocks from different sectors, investors can reduce their total risk while still gaining exposure to potentially high returns.

- Investing in stocks is easy, convenient, and cost-effective. Most retail brokers offer commission-free trading, and some don’t even require minimum account balances.

- Many stocks pay dividends which can provide a steady stream of income for investors. Dividend payments are usually in the form of cash, but they can also be reinvested back into the company or given as stock options.

- Investing in stocks gives you the opportunity to participate in a company’s growth. As companies become more successful, their stock prices tend to increase, and investors benefit from this appreciation.

Cons of Investing in Stocks

The stock market can be volatile, and there is no guarantee that you will make a profit or even get back the money that you invested. Additionally:

- Stocks are much more risky than investing in other asset classes, such as bonds or real estate. If the stock market falls, your investments could take a significant hit.

- Stocks can be difficult to value and are subject to speculation. This makes it hard for investors to know whether they are getting a good deal or not.

- Investing in stocks requires time and effort to research the companies you are considering investing in and monitor their performance over time.

- Investing in stocks can be costly, as brokerage fees and taxes must be paid.

How to Invest in Stocks?

Here are some key points to keep in mind when investing in stocks:

- Consider using an online broker to buy and sell stocks easily and efficiently.

- Research and select stocks that fit your risk tolerance, investment horizon, and financial goals.

- Diversify your investments across different sectors, industries, and asset classes.

- Monitor your investment performance regularly and adjust accordingly.

- Use sound financial planning strategies to ensure you’re on track for retirement.

- Stay up to date with the latest news, trends, and economic developments.

- Invest consistently over time to maximise returns.

- Don’t invest money that you might need for expenses in the short term.

- Make sure to keep costs low by minimising trading and management fees.

- Remain disciplined when making decisions, and don’t make emotional investments.

Investing in Funds

Investment funds are pools of capital from multiple investors who invest together in a variety of markets and asset classes. Such funds provide access to a wide range of different investments, such as stocks, bonds, commodities, and currencies. Funds provide greater diversification than individual stocks and can use various strategies to generate returns.

There are different types of funds, such as mutual funds, ETFs, and index funds.

Mutual Funds

Mutual funds are actively managed investment products that are professionally overseen by a firm. This means that fund managers are constantly seeking out opportunities to outperform certain benchmarks in order to generate returns for investors. Active management comes with a higher price tag, though, as mutual funds typically cost more than their index fund counterparts.

Index Funds

In comparison, index funds are passively managed and seek to replicate or track certain market indexes. This means that the manager of an index fund isn’t actively seeking to beat a benchmark but instead is content with simply matching one over time. Because index funds don’t involve complex trading strategies, they often come with lower associated costs for investors.

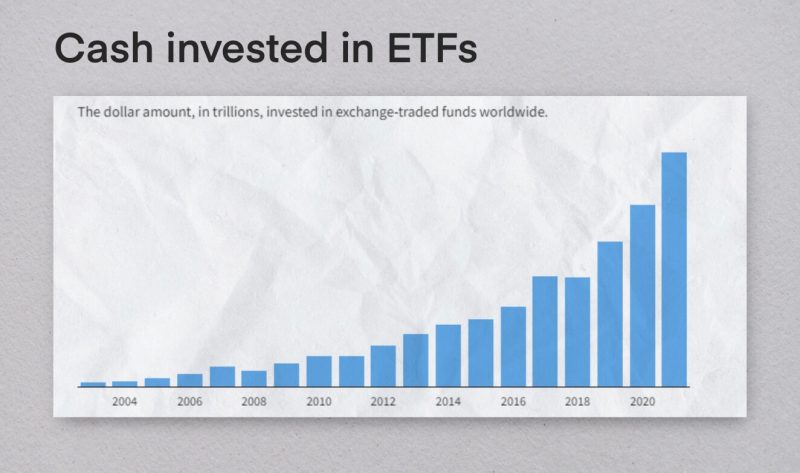

ETFs

Exchange-traded funds are similar to mutual funds and index funds in that they offer diversification across various asset classes. The main difference is that ETFs trade on a stock exchange, meaning their shares can be bought and sold throughout the trading day. Additionally, ETFs tend to be more cost-effective and liquid compared to mutual funds, making them a great choice for those looking to invest in certain markets or industries.

ETFs can own hundreds or thousands of stocks across different industries, such as banking, technology, and healthcare. They can also be isolated to one particular sector, offering investors access to focused investment management.

Why Invest in Funds?

The best way in stock markets long term is probably to buy ETFs on a stock exchange.

ETFs have several advantages, such as:

- Diversification – Funds give investors access to a wide range of investments that they may not be able to purchase on their own. This is unlike individual stock trading, where investors purchase each stock separately.

- Professional Management – Mutual funds and ETFs are managed by experienced professionals who can monitor the market for potential opportunities.

- Lower Costs – As funds are pooled investments, the cost of buying and selling is often lower than if investors bought individual stocks or assets.

- Liquidity – ETFs traded on an exchange can be bought and sold throughout the day, which offers greater flexibility for investors.

Also, remember that investing in funds requires thoughtful and disciplined planning. It is important for investors to understand their risk tolerance, financial goals, and time horizon before making any investments.

Is It a Good Time to Invest in the Stock Market?

Many are hesitant to invest during a recession due to record-high inflation, multiple interest rate hikes, and banking collapses. However, despite the current state of the economy, investing in stocks can still be a great way to meet financial goals — if you set your long-term financial goals.

Despite what is happening in the present, it’s important to remember that the stock market’s performance may not always align with current economic conditions. This is because institutional investors, like banks and wealth management firms, often take a long-term view of their investments. The stock market can act as an indicator of how investors feel about the future.

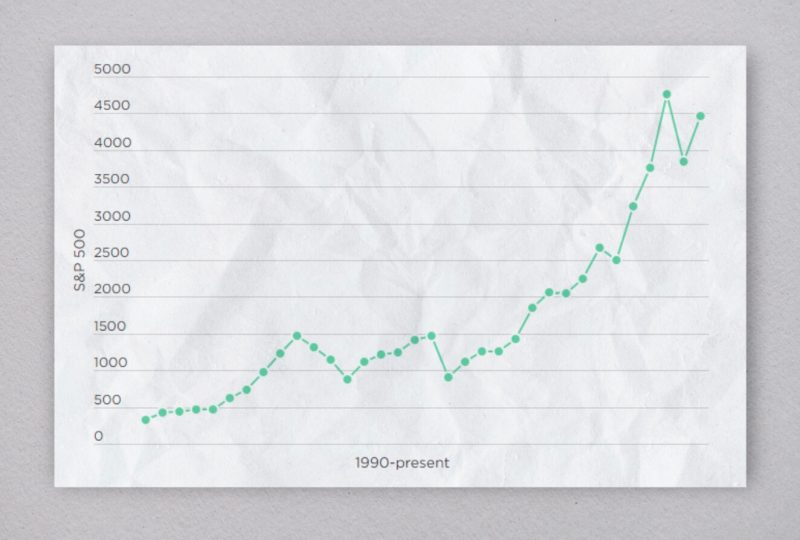

The S&P 500 is a market capitalisation-weighted index, which means stocks of larger companies have an outsize influence on their performance. A great deal of the biggest companies listed in the index are part of the technology industry. These stocks have propelled the S&P 500 to record highs, even while many other economic sectors are suffering due to the lingering effects of the virus.

If you have the funds to commit for the long term, around five years or more, and don’t need immediate access to your money, then investing in stocks is an option worth exploring.

Exploring Cryptocurrency Investment Opportunities

Cryptocurrency is a popular investment option for many investors looking to diversify their portfolios. It has become one of the fastest-growing asset classes in the world, with its total market capitalisation reaching billions of dollars in 2020. The decentralised nature of cryptocurrency makes it attractive to investors who are wary of traditional investments and central banks.

However, investing in crypto is not without risks. Cryptocurrency markets are highly volatile and unpredictable. The price of cryptocurrencies can fluctuate wildly from one day to the next. This makes it difficult for investors to make informed decisions about when and how much to invest.

In addition, there are many uncertainties surrounding the future of cryptocurrency markets. There are no guarantees that a particular currency will remain valuable or even exist in the future. This means that investing in cryptocurrency is a speculative venture, and it can be difficult to predict how much of an investor’s money will return to them over time.

Cryptocurrency markets also present other risks, such as hacking and fraud. The decentralised structure of cryptocurrencies leaves them vulnerable to malicious actors who can exploit weaknesses in the system to steal funds or manipulate prices.

Still, some investors believe that cryptocurrency markets offer potential long-term gains, even after the recent bear markets of 2022. With its high volatility and unpredictable nature, cryptocurrency is still a relatively new asset class with a lot of potential. As the technology matures and more people become involved in the markets, it could become more stable over time.

How to Invest in Crypto: Spot, Staking, and More

Cryptocurrency markets offer a variety of ways for investors to get involved. The most common way is through spot trading, which involves buying and selling coins directly on an exchange.

Investors can also participate in staking, where they lock up their funds in a wallet for a certain time and receive rewards for doing so. Other options include crypto farming, where investors can earn rewards for providing computing power to the network, and lending, where investors can loan out their coins in exchange for interest payments.

It is also important to remember that investing in cryptocurrency is a high-risk venture with no surefire outcomes. Despite its potential long-term gains, cryptocurrency markets are still largely unregulated and unpredictable, and there is always the possibility of losing money.

Diversification is Key

No matter what type of investment you decide to pursue, diversification is key. Investing a portion of your money in different asset classes can help protect against market losses and increase the chances of achieving your financial goals. This means that investing some money in cryptocurrency markets while also investing in other, more traditional asset classes may be a smart strategy.

FAQs

What is the difference between a long-term and short-term investment strategy?

Long-term investments involve investing with the expectation of holding the asset for at least five years. Long-term investments tend to be less risky due to their longer time frame and can provide greater returns that may outpace inflation over time.

Short-term investments involve investing with an expectation of selling the asset within one year or less. These investments are generally higher risk but offer the potential for greater returns in shorter time frames.

Are there any tax implications associated with investing?

Yes. It is important to understand the taxation regulations in your country and consult an experienced tax professional before investing. Long-term investments are generally eligible for more favourable tax treatment than short-term investments.

Are there any special considerations for investing in any type of asset?

Yes. When filling your investment portfolio with stocks, bonds, or real estate, you must consider the market’s volatility and if it is right for your financial goals. With cryptocurrency, it is important to research and understand the risks associated with investing in a new currency that any government or central bank does not back. Additionally, when investing in index funds, investors should check to see if the fund’s fees are too high and if it is tracking its index as expected.

What is ROI?

ROI stands for “return on investment” and measures the profit or loss generated from an investment. This metric helps investors evaluate the performance of their investments relative to other options, as well as understand how their investments are performing over time.

What are the best strategies for managing investments?

The best strategies for managing investments are diversifying your portfolio, rebalancing periodically, and staying up-to-date on the latest news and trends in the market. Diversification means investing in a variety of asset classes to reduce risk. Rebalancing ensures that your portfolio maintains its desired risk profile. Lastly, staying informed allows investors to make more informed decisions and potentially take advantage of opportunities as they arise.