How Does Polymarket Work? Detailed Guide

Jan 27, 2025

Imagine a marketplace where your insights and suggestions about mundane events can turn into tangible rewards — this is the world Polymarket is creating. As a decentralized prediction platform, Polymarket transcends traditional systems, replacing intermediaries with cutting-edge distributed ledger technology.

Polymarket’s innovation lies in its ability to foster trust while unlocking the power of collective intelligence. It’s not just about trading; it’s about redefining how we understand and participate in uncertainty dynamics while staying at the forefront of technological progress.

This article will help you understand the intricacies of Polymarket, how it works, and whether it is legal. You will also learn about the future prospects of this decentralized prediction marketplace.

Key Takeaways

- Polymarket enables trading on real-world events using a distributed ledger, smart contracts, and oracles for secure and transparent operations.

- Share prices reflect probabilities and adjust dynamically, allowing users to profit from accurate predictions.

- Polymarket’s model and infrastructure position it for growth in public health, climate forecasting, and corporate insights.

What is Polymarket?

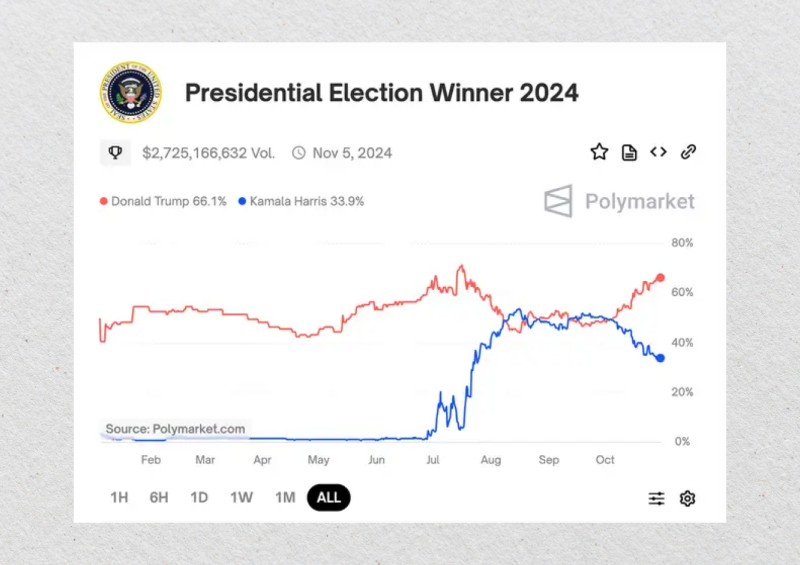

Polymarket is a decentralized prediction market platform that allows users to speculate on the outcome of real-world events. Built on blockchain technology, Polymarket leverages smart contracts to assure trading transparency, security, and reliability.

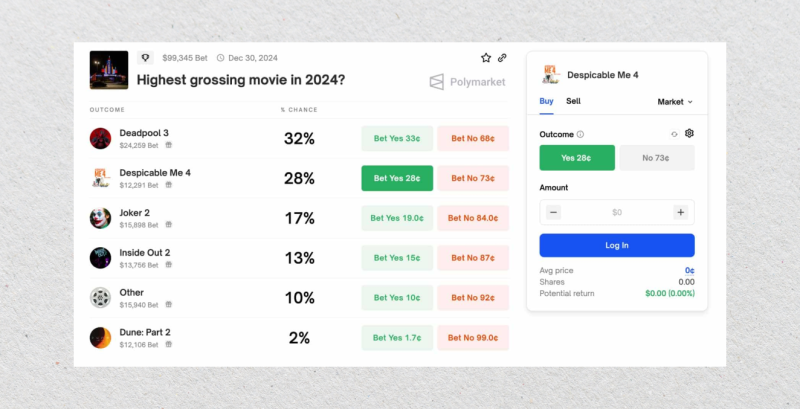

Users can create or participate in markets that cover a wide range of topics, including politics, sports, technology, entertainment, and global events. By buying and selling shares tied to specific outcomes, participants can profit based on the accuracy of their predictions.

The platform operates on a decentralized infrastructure, distinct from traditional futures markets. This decentralization ensures that all transactions and market activities on the blockchain are secure and verifiable.

Polymarket also utilizes oracles, which are external data providers, to confirm the results of events and resolve markets accurately. This innovative approach eliminates the need for intermediaries and fosters a transparent trading environment where users have complete control over their assets.

Polymarket’s functionality revolves around a simple yet powerful mechanism. Users who participate in a market buy shares representing their belief in a particular outcome. The price of these shares fluctuates based on supply and demand, reflecting the collective confidence of the market in a specific outcome.

If the predicted event occurs, participants holding shares of the correct outcome receive payouts proportional to their holdings. This dynamic trading process allows users to adjust their positions in response to new information, making Polymarket an engaging and intellectually stimulating platform.

Fast Fact

Polymarket leverages blockchain and oracles to create a tamper-proof system, assuring market outcomes are securely verified with real-world data.

How Does Polymarket Decentralized Prediction Market Work?

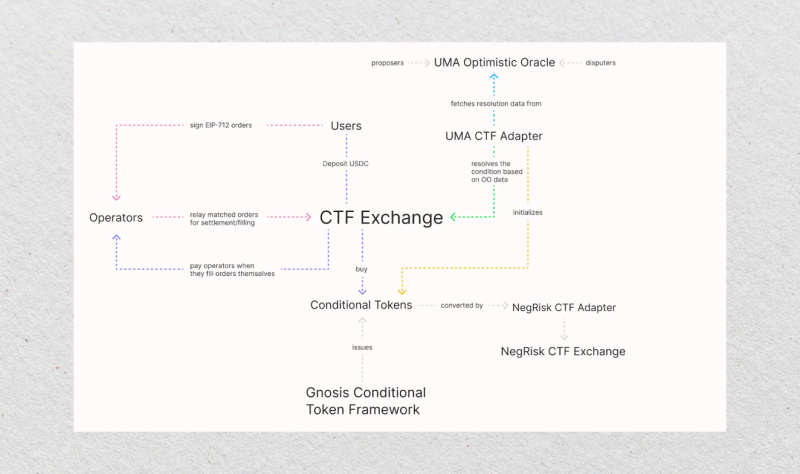

Polymarket operates as a decentralized prediction market where users can trade on the outcome of real-world events. The platform leverages blockchain technology, smart contracts, and oracles to provide a transparent, secure, and efficient system for speculating on the future.

Here’s a step-by-step breakdown of how Polymarket works:

Market Creation

Polymarket allows users to create their own prediction markets or participate in those already established ones. These markets are focused on specific questions or events, such as political elections, sports results, or economic trends.

Each market specifies key details, including the question being addressed (e.g., “Will candidate X win the election?”), The resolution date is when the market outcome will be finalized, and the potential outcomes can be binary (Yes/No) or multi-choice.

Trading Mechanism

Participants trade shares based on the predicted outcomes of the market. Share prices range from $0 to $1, reflecting the collective market estimate of an outcome’s likelihood. For instance, if a “Yes” share is priced at $0.70, it implies a 70% probability for that scenario.

Prices fluctuate with trading activity — when demand increases for one outcome, its price rises, while the alternative outcome’s price declines. If the predicted event occurs, shares for the correct outcome are redeemed for $1 each, allowing traders to profit from the difference between their buying price and the payout.

Decentralized Infrastructure

Polymarket is built on distributed ledger technology to provide a secure and transparent environment. Smart contracts automate trades and payouts, removing the need for intermediaries and reducing risks like fraud or manipulation. Polymarket relies on oracles — trusted external data sources that supply verified event outcomes to the blockchain to resolve markets. This ensures accurate and tamper-proof market resolution.

User Participation

The platform is accessible to a global audience and requires minimal setup. Participants need a cryptocurrency wallet compatible with Ethereum or Polygon and funds in stablecoins, such as USDC, for trading. The decentralized nature of Polymarket eliminates reliance on centralized authorities, making it accessible to anyone with an internet connection and the necessary tools.

Market Settlement

After the event, oracles verify and communicate the outcome to the blockchain. The market is then settled, with holders of shares corresponding to the correct outcome receiving $1 per share, while shares of incorrect outcomes become worthless. All transactions, trades, and payouts are transparently recorded on the blockchain for full accountability.

Is Polymarket Legit?

Polymarket is widely regarded as a legitimate decentralized prediction market platform, leveraging blockchain technology to ensure transparency, security, and trust. As mentioned above, it operates on the Ethereum and Polygon blockchains, using smart contracts to automate transactions and oracles to provide verified data for market resolutions. This decentralized infrastructure minimizes the risk of manipulation and fraud, as all trades and outcomes are recorded on an immutable blockchain ledger.

Regulatory compliance is a common concern for platforms like Polymarket. While the platform itself operates without a central authority, it has been scrutinized by regulatory bodies in certain jurisdictions.

In response, Polymarket has tried adapting its services, ensuring they comply with local financial laws where applicable. Users should always check the regulatory status in their region before engaging with the platform.

Polymarket’s legitimacy is further supported by its user-friendly interface and active community of participants, ranging from traders to industry experts. It has been recognized for providing a transparent and efficient way to speculate on real-world events, from political outcomes to sports and economics. However, like any financial platform, users should exercise caution, conduct due diligence, and be mindful of market risks in prediction trading.

The Future of Polymarket and Prediction Markets

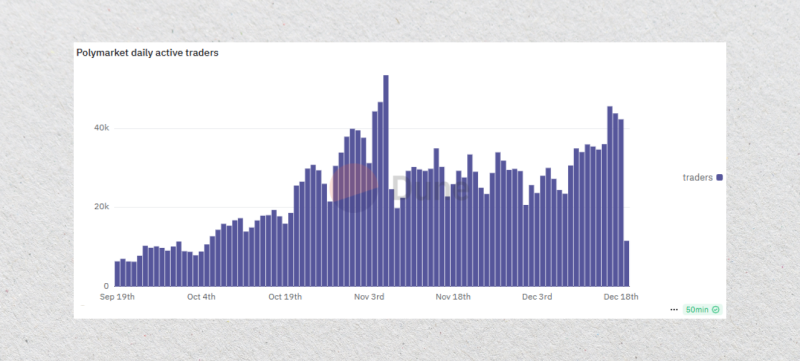

Polymarket and decentralized prediction markets’ future appears bright as blockchain technology reshapes the financial landscape. These platforms are gaining recognition as powerful tools for aggregating collective intelligence, facilitating data-driven decisions, and democratizing access to speculative markets.

Expansion of Use Cases

Polymarket’s innovative model has the potential to expand far beyond current use cases such as politics, sports, and financial trends. Future applications could include climate forecasting, public health predictions, and corporate decision-making. Polymarket can be a valuable resource for industries seeking actionable insights by enabling transparent and secure predictions on virtually any event.

Increased Adoption

As blockchain adoption grows, platforms like Polymarket will likely attract a broader audience, including institutional players and everyday users. Integration with more blockchain networks and increased compatibility with various cryptocurrencies could enhance accessibility and attract diverse user bases. Simplifying the onboarding process for new users could further reduce barriers to entry.

Advancements in Oracle Technology

The reliability of decentralized prediction markets hinges on accurate data from oracles. Future advancements in Oracle technology, including the adoption of decentralized Oracle networks, will enhance the integrity of market outcomes. This will reduce vulnerabilities to manipulation and improve user confidence in prediction markets.

Regulatory Challenges and Opportunities

While regulatory scrutiny presents challenges, it allows platforms like Polymarket to establish legitimacy and compliance frameworks. By proactively working with regulators, Polymarket can pave the way for mainstream acceptance and provide a blueprint for other prediction markets to follow.

Financial Inclusion and Democratisation

Decentralized prediction markets embody the principles of financial inclusion by allowing users from anywhere in the world to participate without centralized oversight. As internet access expands and blockchain education grows, these platforms can empower users in underbanked regions to engage in speculative markets and leverage predictive insights.

Integration with AI and Data Analytics

The future may also see prediction markets integrating with artificial intelligence and advanced data analytics tools. AI algorithms could refine market predictions by analyzing vast amounts of data, while machine learning models could provide insights to traders and improve decision-making

Conclusion

Polymarket is more than a glimpse into the future — it’s a testament to the transformative potential of decentralized technology. By combining the precision of blockchain with the power of predictive insight, Polymarket stands as a beacon for a new era of financial and informational inclusion.

As Polymarket grows and integrates with emerging technologies like AI and decentralized oracles, it’s poised to bridge the gap between speculation and meaningful, actionable insights, empowering a global community to navigate the complexities of an ever-changing world.

FAQ

What is Polymarket?

Polymarket is a decentralized platform where users decide on real-world scenario implications, using blockchain, smart contracts, and oracles for secure and transparent operations.

How do I trade on Polymarket?

Connect a crypto wallet with USDC to Polymarket, then buy or sell shares in prediction markets. Share prices reflect outcome probabilities and adjust dynamically.

How are market outcomes determined?

Oracles verify event outcomes and provide data to Polymarket’s smart contracts, which settle markets and pay $1 per share for correct predictions.

What makes Polymarket secure?

Polymarket’s blockchain-based system ensures transparency, with smart contracts automating trades, payouts, and oracles verifying market outcomes.