How to Earn Passive Income with DeFi in 2024?

May 20, 2024

The DeFi (decentralized finance) sector is poised to make a comeback in 2024, riding the wave of recurring interest in the crypto market. According to Bernstein’s report, six of the top ten revenue-generating protocols are DeFi applications as of March of this year.

Meanwhile, Ethereum, the second-largest blockchain and the main platform for DeFi projects, reported a net profit of $365.46 million in Q1 2024, an almost 200% increase from the previous quarter (Q4 2023), which saw profits of $123 million, The DeFi Report points out. The surge in activity has propelled the average daily transactions on Ethereum in 2024 to surpass last year’s numbers, edging close to the peak activity seen in 2021. The report specifically attributes this surge to increased DeFi activities throughout the quarter.

These developments clearly indicate that the DeFi sector is gaining momentum, potentially offering lucrative opportunities for investors wondering how to make money with smart contracts. This article aims to explore the current revenue-generating avenues within the DeFi space and offer insights on how to generate passive income with DeFi investments.

Key Takeaways

- The DeFi market operates 24/7, unhindered by geographical boundaries, and makes financial services accessible to everyone.

- DeFi offers various opportunities for generating passive income, including liquidity provision, lending, staking, and yield farming.

- DeFi participation comes with several risks, including market volatility, smart contract vulnerabilities, and regulatory uncertainties.

- To capitalize on the DeFi ecosystem’s earning potential, investors should research thoroughly, diversify their investments, and regularly monitor their portfolio’s performance.

Why Earning in DeFi?

The traditional finance system has been notoriously known for its exclusivity, with access to financial products and services limited to a select few. However, DeFi is changing the game by providing equal opportunities for anyone. Due to this, individuals from all walks of life can participate in the growing crypto economy and create passive income streams through DeFi investments.

Unlike traditional finance, DeFi is not hindered by geographical boundaries and operates 24/7, making it accessible to people worldwide. Additionally, with no central authority controlling the transactions, users have full control over their funds and do not have to worry about censorship or restrictions.

Moreover, DeFi offers a wide range of financial tools, such as lending, borrowing, and earning interest on crypto assets, among others, which can be particularly beneficial for individuals living in places facing economic instability. For example, Argentinians have turned to DeFi to escape rampant inflation and protect their assets from losing value.

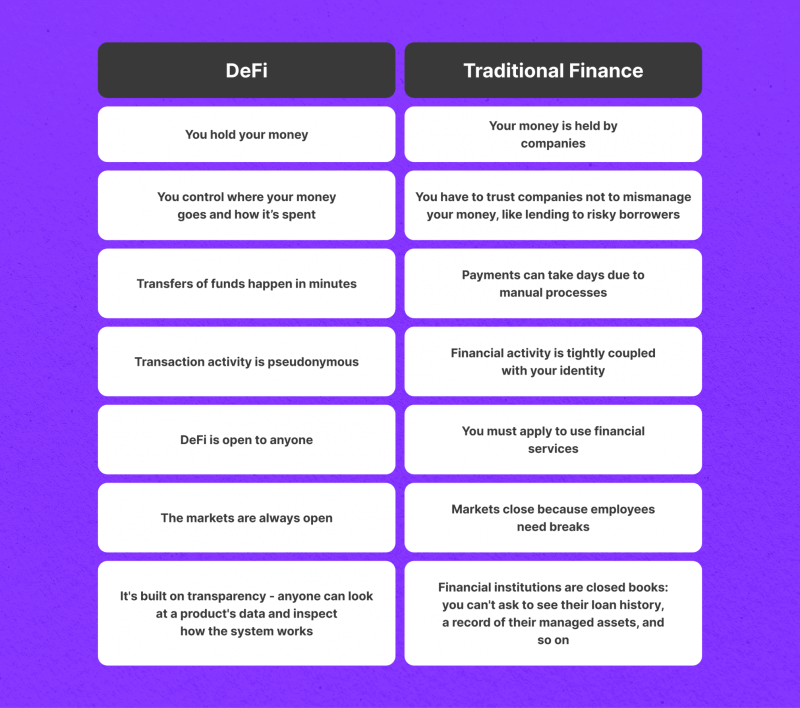

DeFi Income vs Traditional Finance Opportunities

In traditional finance, your money is held by companies, and you have to trust them not to mismanage it. In contrast, DeFi lets you control where your money goes and how it’s spent. This level of control gives investors the flexibility to choose their risk-reward ratio and diversify their investments accordingly.

Moreover, traditional financial services often require individuals to go through lengthy application processes before being able to access their services. Thanks to the decentralized nature of DeFi, anyone with an internet connection can participate in these financial activities without any prior approval or KYC (know-your-customer) procedures.

Another significant advantage of DeFi over traditional finance is its 24/7 market availability. Unlike traditional markets that close during non-working hours and on weekends, DeFi operates round the clock. This accessibility ensures that investors can capitalize on market movements and react to any changes in real-time.

DeFi also leads in terms of transparency. With blockchain technology at its core, all transactions are recorded on a public ledger, providing complete transparency and traceability. In contrast, traditional financial institutions keep their activities private, making it difficult for individuals to access information about their loan history or managed assets.

Ways to Earn Passively in DeFi

DeFi provides several avenues for earning passive income. Let’s explore the different options available:

1. Lending

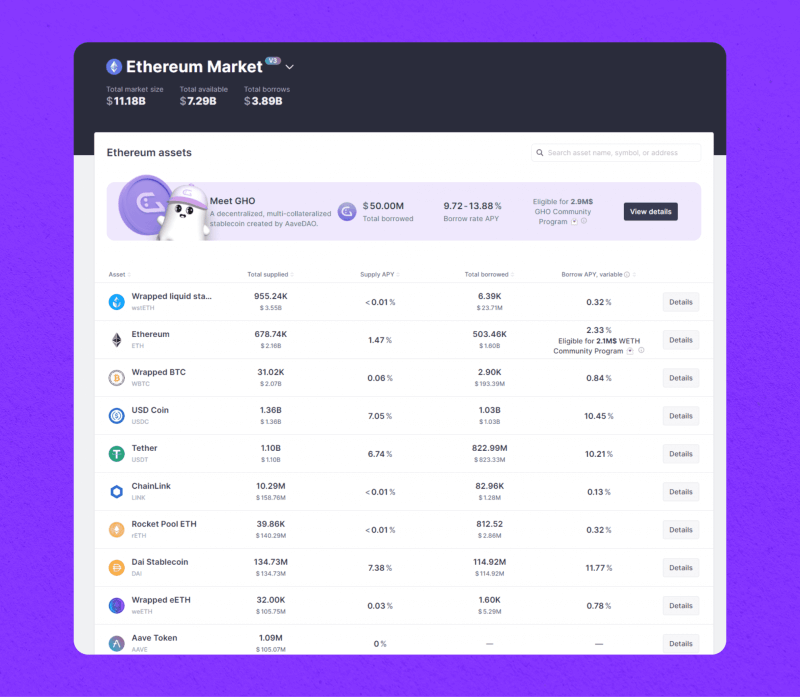

Lending and borrowing are fundamental features of traditional finance, and they have also been successfully implemented in the DeFi world. Through lending protocols, users can lend their digital assets to borrowers on the platform and earn interest.

Here’s how it works:

- Users lock their digital assets into a smart contract on the lending platform.

- Borrowers can then access these assets as loans and pay back interest to the platform.

- The platform distributes the interest earned to lenders in proportion to the amount they have locked in.

Annual Percentage Yields (APYs) in DeFi lending protocols can range from about 1% to over 20%, depending on the platform and type of asset. Therefore, it is a great choice for earning DeFi crypto passive income, especially compared to traditional interest-bearing accounts with banks.

DeFi lending is the reduced risk of default. Borrowers must lock up collateral to borrow assets, and smart contracts enforce interest repayments from the collateral if borrowers fail to pay.

Here are some of the best DeFi projects for passive income could be these:

- Compound Finance

- Aave

- Maker

- InstaDApp

- dYdX

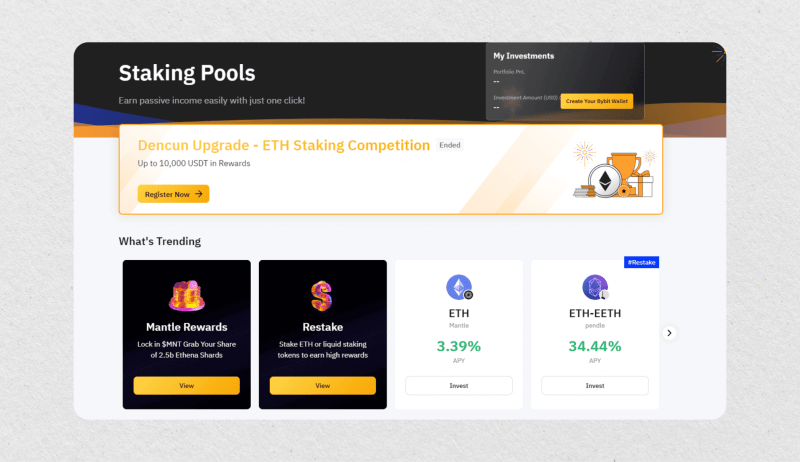

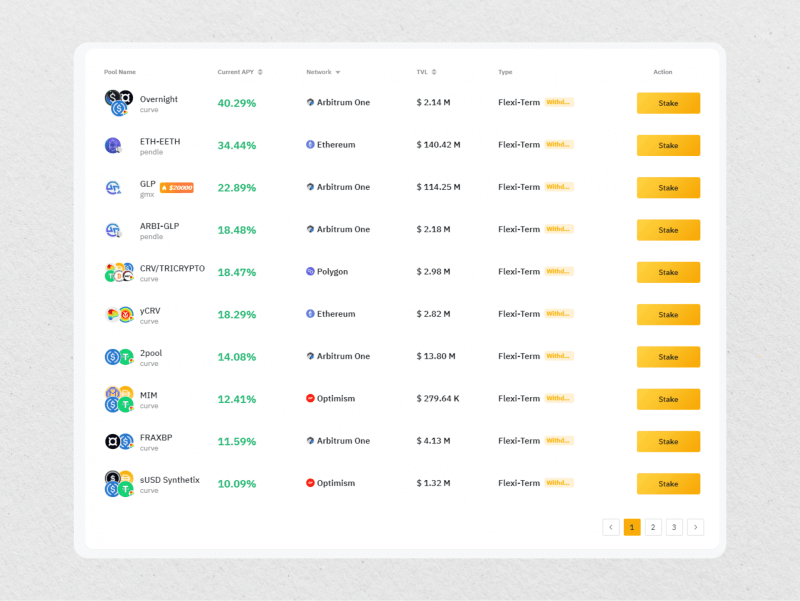

2. Staking

Staking in DeFi refers to locking digital assets into a smart contract, which allows users to generate income over time. The process can be compared to opening a savings account in traditional finance. Similarly to these investment vehicles, the user’s balance will accrue additional income in the form of tokens.

There are two main types of staking in DeFi:

- Proof-of-Stake (PoS) Staking: This type is integral to networks that run on the PoS algorithm. It involves holding a certain amount of tokens to validate transactions and earn staking rewards. The term “staking” originally came from PoS networks.

- Incentives Staking: Many DeFi platforms use incentives staking to encourage users to lock their assets for a longer period. In this method, users earn rewards in the form of additional tokens for staking and holding a particular asset. The longer the assets are staked, the higher the benefits will be.

PoS stakers need to have a minimum amount of tokens (usually 32 ETH in the Ethereum network) and run a node that validates transactions on the network. This process is also known as “solo staking”. On the other hand, incentivised staking happens through staking pools, where users interested in how to make money in DeFi can pool their assets together and receive rewards in proportion to their contribution.

APYs for staking in DeFi can vary per platform and asset being staked. Generally, higher return rates are offered for longer lockup periods or riskier assets. For example, staking stablecoins may offer lower APYs compared to staking more volatile tokens – ByBit offers about 1.8% APY for staking USDT.

However, staking in DeFi can offer higher APYs than traditional finance. For instance, some platforms offer yields up to 20%, while others may even reach 100% or more.

The best DeFi platforms for “opening crypto savings accounts” in 2024 include:

- ByBit

- Binance

- Cake DeFi

- Atomic Wallet

- Kraken

- Coinbase

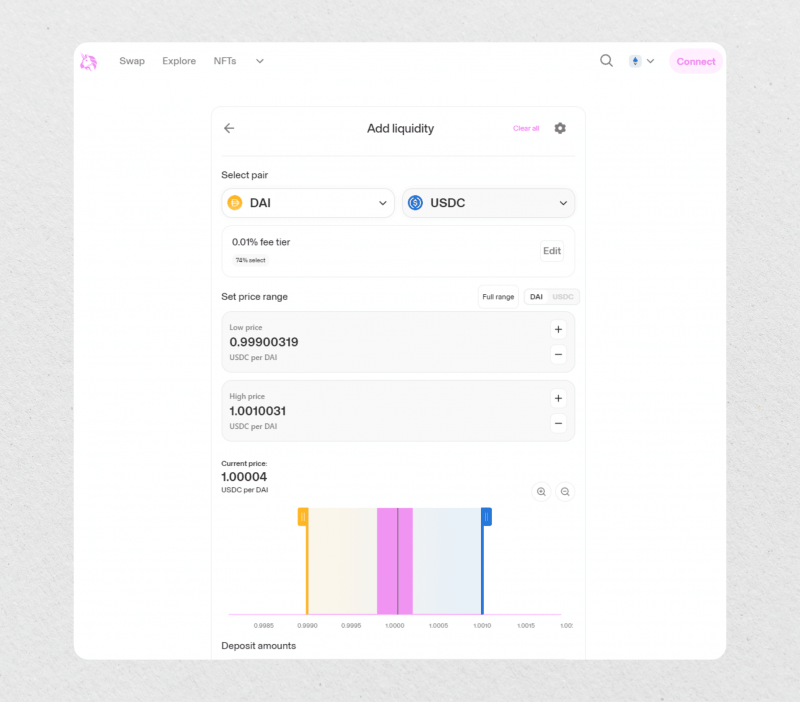

3. Liquidity Provision

Liquidity provision is a method for earning DeFi passive income by contributing liquidity to decentralized exchanges (DEXs). These DEXs use automated market maker (AMM) protocols, creating crypto liquidity pools made up of equal-value token pairs. How do liquidity pools work?

Let’s look at an example. In a DAI/USDC liquidity pool, users can contribute $1000 worth of liquidity by providing $500 in DAI and $500 in USDC. In return, they receive LP tokens representing their share in the total liquidity pool crypto. These tokens can be redeemed for their stake plus any revenues generated from swaps.

LPs earn a share of the swap fee or commission proportional to their share of the liquidity pool—the more swaps in the pool, the more income they earn.

However, there is a risk of impermanent loss for LPs, which occurs due to fluctuations in the price of pooled tokens. To mitigate this risk, users can choose highly liquid pools or those consisting of stablecoins and less volatile pairs.

Some popular DeFi liquidity pool provider platforms include:

- Uniswap

- Curve Finance

- Compound

- PancakeSwap

- Balancer

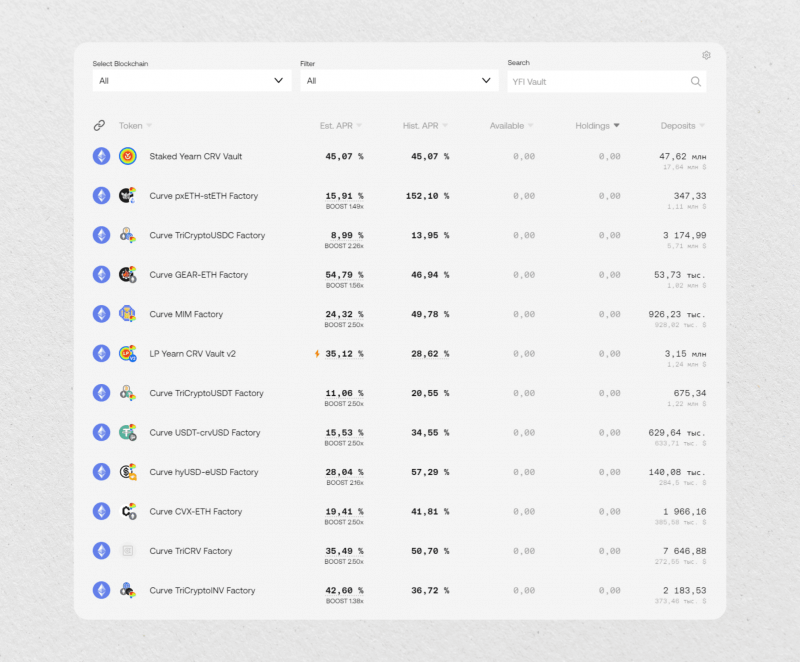

4. Yield Farming

Yield farming is a popular method for earning passive income with DeFi. It involves locking LP tokens into specific “farms” where they can earn even more rewards on top of those earned from providing liquidity to liquidity pools crypto. Essentially, yield farming combines both staking and liquidity provisions to maximize profits.

To start yield farming, users first need to become LPs by providing liquidity to a pool. They then stake their LP tokens in various yield-generating activities such as lending and borrowing protocols or participating in leveraged trading strategies. These activities generate additional rewards through new tokens or interest payments. Users can then compound their earnings by reinvesting them into the farm or withdrawing them.

Yield farming strategies can range from simple single-step approaches to complex multi-step ones. For example, a 3-step yield farming strategy could involve:

- Taking out a loan in stablecoins using crypto as collateral

- Becoming an LP on a DEX by adding stablecoins to a liquidity pool

- Staking earned rewards to earn an additional yield on return.

Popular DeFi projects for yield farming in 2024 include:

- Yearn Finance

- Uniswap

- Aave

- MakerDAO

Pros and Cons of DeFi Passive Earnings

Let’s take a closer look at some of the main benefits that make DeFi money income an attractive choice for investors:

- Higher Profits: One of the most significant advantages of DeFi is its potential for higher returns compared to traditional investment options. With minimal barriers to entry, individuals can earn a greater yield on their assets.

- Incredible Accessibility: DeFi is open to anyone with an internet connection, making it accessible to individuals worldwide. This inclusivity allows for a more diverse range of participants and provides opportunities for those who may not have access to traditional financial services.

- Greater Control: DeFi gives users complete control over their funds, with no intermediaries involved. Users can choose where to invest and how to allocate their assets, giving them a sense of autonomy over their finances.

- Ultimate Transparency: DeFi operates using blockchain technology, which ensures transparency and immutability of transactions. This feature provides individuals with a level of trust and security in their investments.

While DeFi passive earnings offer undeniable benefits, there are also some significant drawbacks:

- Dangerous Volatility: The cryptocurrency market is highly volatile, and the value of assets can fluctuate rapidly, impacting passive earnings. This volatility can be a significant risk for investors, and they must carefully consider their risk tolerance before participating in DeFi. Consider this factor when deciding which assets to invest in.

- Smart Contract Risks: DeFi platforms rely on smart contracts, which sometimes can be exploited by hackers, leading to significant losses for investors. Lately, cross-chain bridges, which enable users to transfer cryptocurrency between blockchains, have become prime targets for these hackers.

- Technical Complexity: Participating in DeFi passive earnings requires technical knowledge and understanding of the underlying protocols. This complexity can be a barrier for those who are new to the world of crypto and blockchain technology.

- Legal Uncertainties: The regulatory landscape for DeFi is still evolving, and there may be legal implications and uncertainties surrounding these activities. As governments and financial institutions grapple with the emergence of DeFi, there may be changes in future regulations that could impact investors.

Fast Fact

The average APY for a traditional savings account in the United States is currently around 0.24% in 2024, while DeFi platforms offer APYs up to 20% or more.

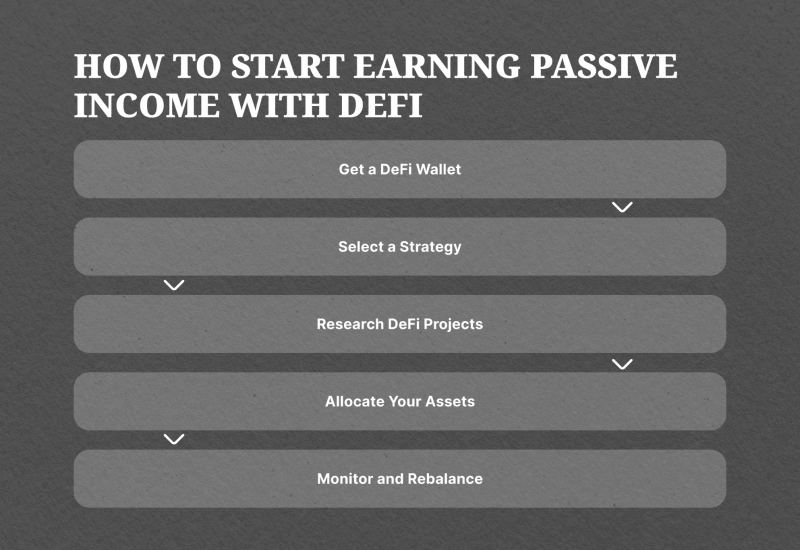

How to Start Earning Passive Income with DeFi

To start earning passive income from crypto, follow these steps:

Get a Digital Asset Wallet

The first step to participating in DeFi is to obtain a non-custodial digital asset wallet. This type of wallet allows you to interact with decentralized applications (Dapps) and smart contracts on Ethereum or other blockchains, where DeFi projects are built.

There are many Web3 wallets available, including MetaMask, Atomic Wallet, and Trust Wallet. To protect your assets, make sure you choose a secure wallet and properly secure your private keys.

Select a Strategy

It is time to select a passive earning strategy. Choose one that aligns with your financial goals and risk tolerance. For example, lending may be a suitable option if you are looking for stable returns, whereas yield farming can offer higher but more volatile rewards.

Research DeFi Projects

Before committing any of your digital assets, thoroughly research and evaluate different initiatives and DeFi protocols. With the growing number of players in the market, it is frequently difficult to determine which ones are legitimate and have growth potential.

When researching, consider the project’s reputation, security audits, and community engagement. You can also examine the project’s token economics and team members to understand its potential for success better.

Allocate Your Assets to Liquidity or Staking Pools

It is time to allocate your digital assets. Diversify your investments across different tokens and platforms to mitigate risk in case a project fails. Take the time to understand the risks associated with each pool fully.

Monitor and Rebalance

As with any investment, you need to monitor the performance of your DeFi portfolio and be aware of any changes or updates that may impact it. Stay informed about the latest developments in the DeFi space, as this can affect your earnings potential. If necessary, reassess and rebalance your portfolio to align with your goals and risk management strategy.

Closing Thoughts

DeFi has opened up exciting possibilities for individuals to generate passive income with crypto assets. Through strategies like liquidity provision, staking, yield farming, and lending, users can earn returns on their investments while participating in the vibrant ecosystem of Web3 finance.

However, one must approach DeFi cautiously, conduct thorough research, and manage risk effectively. The industry is relatively new and still highly experimental, with frequent security breaches and scams.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial or investment advice.

FAQ

Can you still make money in DeFi?

Yes, you can absolutely still make money in DeFi. You can make money on passive income by acting as a validator for transactions or supporting liquidity for an asset in a liquidity pool on a number of different platforms.

Can I unstake my assets at any time?

Some platforms allow you to unstake your cryptocurrencies (for example, exchanges like Binance and ByBit offer flexible periods for staking different tokens and stablecoins). However, most DeFi liquidity pools have lock-up periods during which you won’t be able to withdraw your tokens. Always remember to consider possible lock-up periods before providing funds to these pools.

Why are DeFi yields so high?

DeFi yields are often high initially due to the lower user base at the onset of each project. Other factors contributing to this include blockchain emission rates, reward allocations of liquidity mining pools, and the performance of the blockchain’s native token. These high yields attract more users, fostering a thriving, decentralized, and stable platform.

Why is DeFi the future?

With blockchain technology at its core, DeFi allows for automated and self-driving financial activities without human intervention. Thus, in the near future, all financial products and services could be run by codes and algorithms, making transactions faster and more efficient.

Additionally, DeFi enables the integration of financial services with non-financial products, leading to the concept of “embedded finance.” This technology will also play a crucial role in bridging the virtual and physical worlds in the metaverse.