Is Now a Good Time to Invest? Exploring Investment Opportunities in 2023

Oct 05, 2023

In the world of investing, timing is everything. As an investor, you may often wonder if now is a good time to invest. With market fluctuations and economic uncertainties, it can be challenging to determine whether you need to start investing now or wait until the right time comes.

In this article, we will explore the factors to consider when evaluating investment opportunities in 2023. By understanding the principles of long-term investing and analysing market trends, you can make informed decisions to grow your wealth.

Key Takeaways:

- When investing, look for the long-term picture, as short-term market movements are unpredictable.

- The earlier you invest, the better.

- If you’re considering investing in 2023, assess the current investment landscape and look for opportunities.

- Some of the top investment options for 2023 include Indexed ETFs, bonds, dividend stocks, and others.

The Short-Term Volatility Dilemma

The volatility of global stock markets often leads to uncertainty among investors. Obviously, it is natural to be concerned about short-term fluctuations, as they can lead to large losses for your holdings in just a few days.

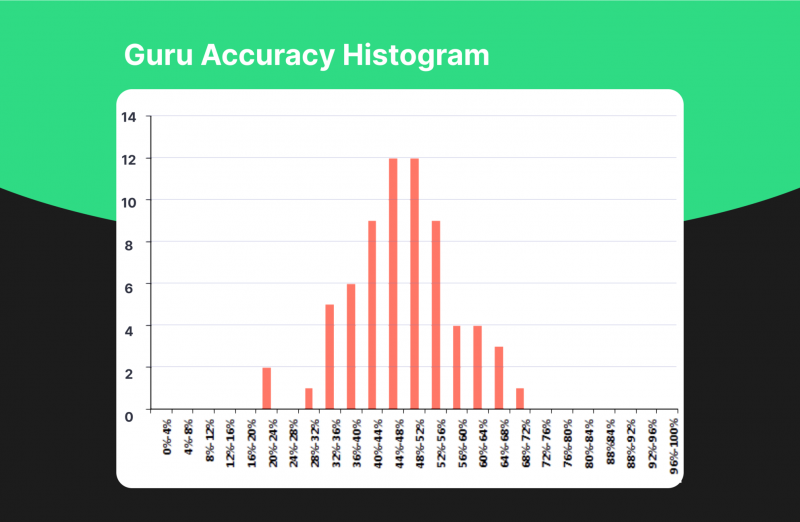

However, it’s essential to understand that predicting short-term market movements correctly is virtually impossible, and even experienced investors struggle to forecast market trends accurately. According to the study by CXO Advisory Group, the accuracy of guru forecasts was found to be just under 47% on average.

The Chaotic Nature of Short-Term Changes

Short-term changes in the market are inherently chaotic and random. Various factors, such as investor sentiment, geopolitical events, and economic indicators, influence short-term market movements. These factors are difficult to predict accurately, making it futile to base investment decisions solely on short-term market conditions.

For example, the stock market is very sensitive to news events, such as the release of earnings reports, which can have an immediate impact on the prices of certain companies or even sectors. The unexpected COVID-19 pandemic, which caused sharp drops in stock prices in a short period of time, also caused heavy market losses for millions.

Instead of trying to time the market, it’s crucial to focus on long-term investment strategies.

The Certainty of Long-Term Growth

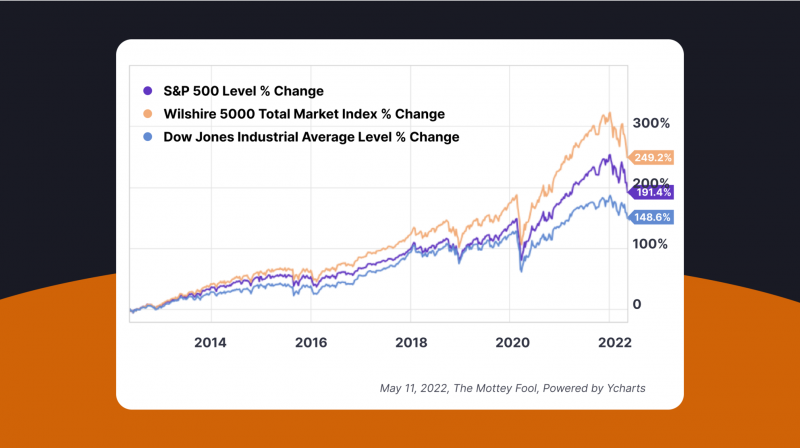

While short-term market movements are unpredictable, the long-term growth of the market is a certainty. The fundamental principle behind investing is that companies exist to generate profits, and as an investor, you can benefit from their success. By owning shares in companies, you become a part-owner and are entitled to a share of their profits. Over the long term, the growth and profitability of these companies are invariably passed on to the investors.

The Timeless Wisdom of Investing

One of the most enduring pieces of investment advice is that the best time to start investing was 20 years ago, and the second best time is today. This proverbial wisdom emphasises the importance of taking action and not waiting for the perfect market conditions – the sooner you begin investing, the better.

According to the data, the average stock market return is about 10% per year, with reference to the S&P 500 index. This means that if you invested $10,000 in the market today, you could potentially double your wealth and have more than $20,000 in several years. While the stock market is unpredictable and there are some risks, over the long term, it has consistently provided good returns.

The Power of Compounding

Compounding is the process of reinvesting your investment earnings to generate additional returns over time. By reinvesting dividends or capital gains, you can harness the power of compounding to accelerate the growth of your investments. The earlier you start investing, the more time your investments have to compound, resulting in exponential growth over the long term.

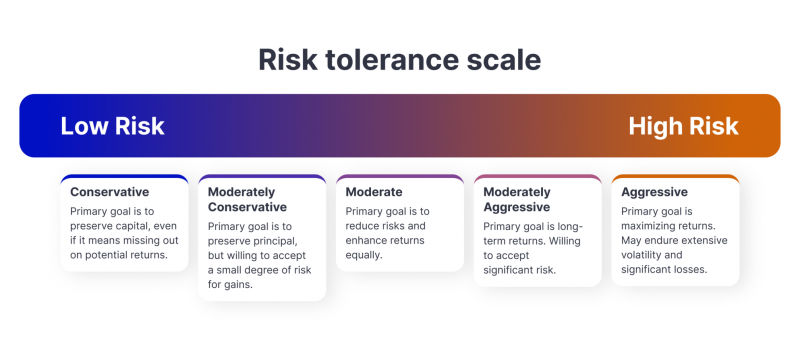

Evaluate Your Risk Tolerance

Another factor to consider when determining whether now is a good time to invest is how much risk you are willing to take. Risk tolerance refers to your ability and willingness to endure fluctuations in the value of your investments. If you have a high-risk tolerance, you may be comfortable with greater volatility and potential losses in pursuit of higher returns. In contrast, if you have a low-risk tolerance, you may prefer more conservative investments with lower potential returns but greater stability.

Fast Fact:

Investment portfolio size is directly correlated with risk tolerance – the larger the portfolio, the more the investor is tolerant of risk. Portfolios worth $10 million will allow investors to take on more risky decisions compared to those with portfolios worth $50,000.

It’s important to assess your risk tolerance honestly and align your investment strategy accordingly. If you are uneasy about market volatility, it may be advisable to allocate a larger portion of your portfolio to less risky assets, such as bonds or cash equivalents.

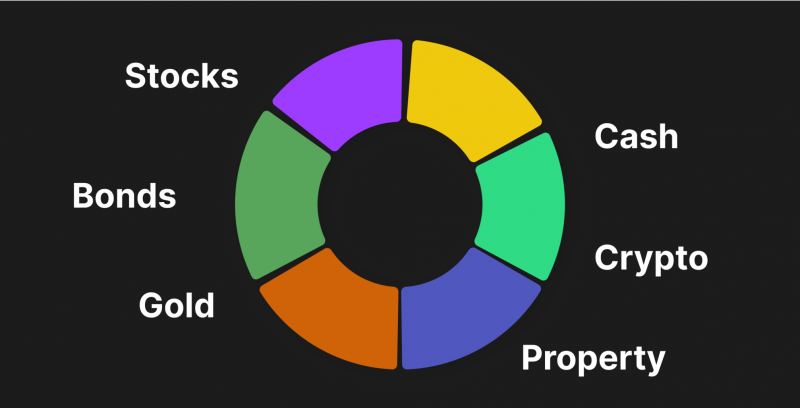

Diversify Your Portfolio

Regardless of market conditions, diversification is a key principle of successful investing. Diversification involves spreading your investments across different asset classes, industries, and geographic regions. By diversifying your portfolio, you can reduce the impact of any single investment on your overall returns.

Investing in multiple asset classes is like investing in multiple lottery tickets; even if one ticket doesn’t win, the others can still bring you a return.

During uncertain times like current ones, diversification becomes even more critical. By holding a mix of assets that may perform differently under various market conditions, you can mitigate the risk associated with any particular investment. This approach helps protect your portfolio from the potential negative impacts of short-term market volatility and downturns.

Assessing Investment Prospects in 2023

As you consider investing in 2023, it’s essential to assess the current investment landscape and identify potential opportunities. While it’s impossible to predict specific investment outcomes, you can use various strategies and tools to evaluate the attractiveness of different investment options.

Analysing Economic Indicators

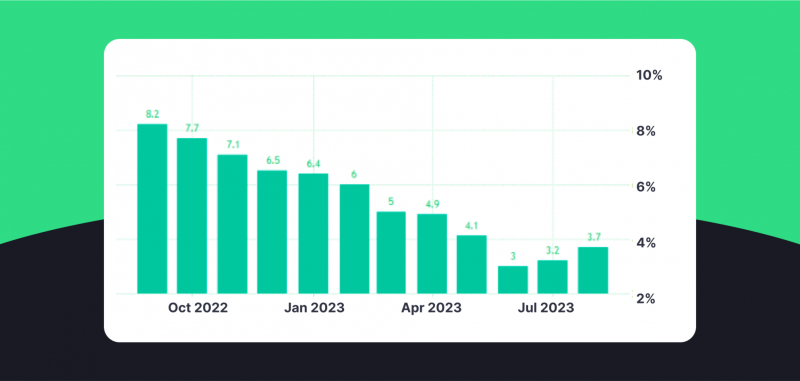

Economic indicators provide valuable insights into the overall health of the economy and can influence your particular investment decision. By monitoring indicators such as GDP growth, inflation rates, and employment data, you can gain a better understanding of the economic environment and its potential impact on your investments.

For example, the US Inflation Rate is currently at 3.7%, which is higher than the long-term average of 3.28%. This indicates that the economy is heating up and could lead to higher inflation and interest rates, which can have a negative impact on investments. Still, the financial situation is not as severe as it was in 2022.

Researching Industry Trends

Investing in specific industries or sectors can be a way to capitalise on emerging trends and technologies. Make sure you do thorough research on industries that show strong growth potential and match your investment goals. Look for sectors that are poised for expansion or disruption, and consider investing in companies at the forefront of these trends.

For instance, the AI sector is one of the most promising industries for investors today and for years to come. Companies that are investing in AI-related technologies are positioned to benefit from the increasing demand for automation, data analysis, and machine learning. Additionally, AI-related technologies are being used in a variety of industries, such as healthcare, finance, and transportation, making them attractive investments in the long term.

Diversifying Your Portfolio

As was already mentioned, diversification is a crucial strategy for managing risk and maximising returns. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the impact of any single investment on your overall portfolio. Diversification allows you to capture the potential upside of various investments while minimising the downside risk.

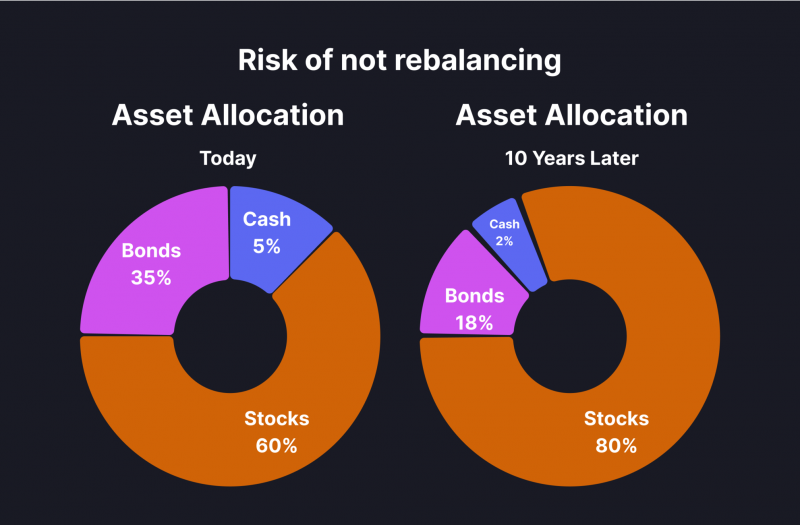

Rebalancing

Rebalancing portfolios is an important part of investing, as it helps to ensure that investments remain in line with the original goals. Investing rebalancing involves periodically changing the weighting of various investments in a portfolio in order to maintain a desired level of risk and return.

Seeking Professional Advice

If you are unsure about making investment decisions on your own, seeking professional advice can be beneficial. Financial advisors and advisory services can provide personalised guidance based on your financial goals, risk tolerance, and time horizon. They can help you develop a comprehensive investment strategy and navigate the complexities of the market.

Best Investment Opportunities for 2023

Let’s explore some of the top investment options for 2023. These options offer the potential for long-term growth and can help you achieve your financial goals:

1. Index ETFs

Index ETFs, or exchange-traded funds, are a popular investment option for both beginner and experienced investors. These funds track a specific index, such as the S&P 500, and allow you to invest in a diversified portfolio of growth stocks. Index funds offer low fees, liquidity, and the opportunity to participate in the overall growth of the market.

Besides ETFs, you can also invest in a mutual fund, which are professionally managed pools of money. Mutual funds offer investors the potential for higher returns than ETFs, but at a higher cost. They also require investors to commit their money for a longer period of time.

2. Government Bonds

Government bonds are considered to be a safe investment option that offers stable fixed income for investors. These bonds are issued by governments and pay interest over a fixed period of time. Investing in government bonds can provide stability and a decent return, making them a suitable choice for conservative investors or those nearing retirement.

Besides government bonds, there are also money market funds, corporate bond funds, certificates of deposit, and more. All of these investments provide stability and income, but they all have different levels of risk.

3. Dividend Stocks

Dividend stocks are shares of companies that distribute a portion of their profits to shareholders in the form of dividends. Investing in dividend stocks offers the potential for a steady income stream while also offering the potential for capital appreciation. Dividend stocks are particularly attractive for long-term investors looking for a combination of income and growth.

4. Cryptocurrency

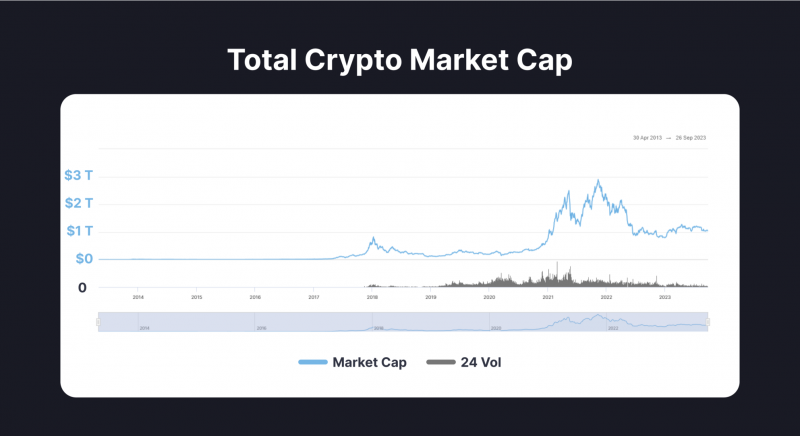

Among alternative investments, cryptocurrency has gained significant attention in recent years. While cryptocurrencies are known for their volatility, they also offer the potential for substantial returns.

However, in 2022, the crypto market survived a major market downturn called “crypto winter.” The price of Bitcoin dropped from around $64,000 in November of 2022 to just $18,000 by the end of 2022. The total market capitalisation of the crypto market fell from $ 2.9 trillion to $800 billion.

However, today, as of September 2023, cryptocurrencies look relatively stable, with Bitcoin slowly growing again. Perhaps the market is on its way to recovery.

Cryptocurrencies are seen as high-risk investments, and it is advised to invest in these assets with great caution.

5. Robo-Advisors

Robo-advisors are online platforms that use algorithms to provide automated advice and investment management. These platforms offer low fees and personalised investment strategies based on your risk tolerance and financial goals. Robo-advisors are a convenient option for individuals who prefer a hands-off approach to investing.

6. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts allow investors to invest in real estate without the need for direct ownership or management. REITs pool money from multiple investors to purchase and manage income-generating properties. Investing in REITs can provide diversification and regular income through dividends.

7. ESG Investing

ESG (Environmental, Social, and Governance) investing involves considering environmental, social, and governance aspects when making investment decisions. ESG-focused investments aim to generate both financial returns and positive societal impact. Investing in ESG funds allows you to match your investment objectives while potentially achieving competitive returns.

8. Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers directly with lenders, bypassing traditional financial institutions. By participating in peer-to-peer lending, investors can earn interest income by lending money to individuals or businesses. However, it’s important to carefully assess the risks associated with lending to individual borrowers before investing in this asset class.

9. Retirement Accounts

Contributing to retirement accounts, such as 401(k)s or IRAs, offers significant tax advantages. These accounts allow you to defer taxes on your contributions and potentially grow your investments tax-free or tax-deferred until retirement. Taking advantage of retirement accounts can help you build a nest egg for your future while minimising your current tax liability.

10. Education Savings Accounts

If you have children or plan to pursue higher education yourself, investing in education savings accounts, such as 529 plans, can provide tax advantages for education expenses. These accounts allow you to invest funds that can grow tax-free and be withdrawn without penalties for qualified education expenses. Investing in education savings accounts is a smart way to plan for future education costs while potentially benefiting from tax savings.

So, Should You Invest Now?

In 2023, the market may be experiencing a downturn, which raises the question of whether it is a good time to invest.

When the market is hitting the bottom, stock prices are often lower, making it an ideal time to buy stocks at a discounted price. By investing during a downturn, investors have the potential to see greater returns in the long run as the market recovers.

However, it is important to approach investing with caution and careful analysis. Whenever you are considering investing in a company, it is crucial to thoroughly research and understand the company’s fundamentals or sectors you are considering investing in. This includes analysing their financial health, growth potential, and their position in the market.

Additionally, diversification is key during uncertain market conditions. Spreading your investments across multiple asset classes and sectors can help mitigate risk and protect against potential losses.

Conclusion

Investing is a long-term journey filled with both risks and rewards. While it may be tempting to wait for the perfect time to invest, the truth is that no one can accurately predict short-term market movements. Instead, focus on the principles of long-term investing, such as starting early, harnessing the power of compounding, and embracing a diversified portfolio. Evaluate investment opportunities based on economic indicators, industry trends, and professional advice. By staying informed, you can position yourself for long-term financial success.

Remember, the best time to start investing was yesterday, and the second best time is today. So, take action, educate yourself, and embark on your investment journey. The future growth of your wealth awaits.

FAQs

What are the steps to buying stocks?

The first step is to open a brokerage account with a company you trust. Once you have an account, you can start researching stocks and deciding on which ones to invest in. After you’ve made your selections, you’ll need to fund the account and then place your first order.

Public companies: how are they identified?

Public companies are identified by their stock symbols, which can be found on a company’s stock exchange listing. Stock symbols are typically made up of 3-4 letters and are used to identify a company’s shares on the stock exchange.

What is compound interest?

Compound interest in financial markets is the interest that is earned on the initial principal plus any accumulated interest from previous periods. This means that the interest earned in each period is added to the principal, so that the principal grows with each successive period. Compounding can be a powerful way to grow wealth over time, as the interest earned in one period can earn interest in the next period, resulting in exponential growth.

Why is market cap important?

Market cap is important because it provides an indication of the value of a company. It is calculated by multiplying the current stock price by the number of outstanding shares. The higher the market cap, the more valuable the company is and the more likely it is to attract investors.