Order Book Depth: What It Is And Why It Matters?

Aug 05, 2025

In high-speed trading, time matters—but so does knowledge. As prices tick and bars flash, a hidden world of knowledge lies just one level down: the order book.

This article will examine how an order book functions, explain its relevance in modern trading, and show what it can reveal about potential future price movements.

Key Takeaways

- Book order depth reflects the strength of demand and supply at multiple price points, impacting execution quality and price stability.

- The type of market, trading, and infrastructure of an exchange all influence the depth or liquidity of an order book.

- A solid understanding of depth helps traders forecast slippage, identify support and resistance levels, and use more effective strategies.

Order Book Depth Meaning

An order book is a constantly updated, dynamic register of purchase and sale orders of a given financial instrument—a share, cryptocurrency, Forex pairing, or a commodity—retained by a trading platform or exchange.

It lies at the core of every electronic trading platform, bringing together all pending orders by price levels and enabling price discovery and best order execution. Every order book line represents a specific price and volume at which a trader wants to buy or sell an instrument.

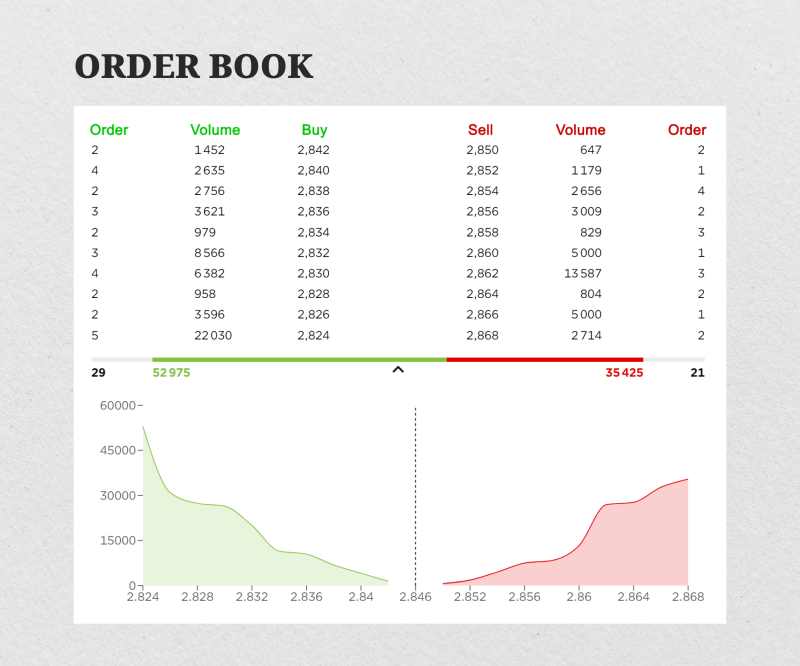

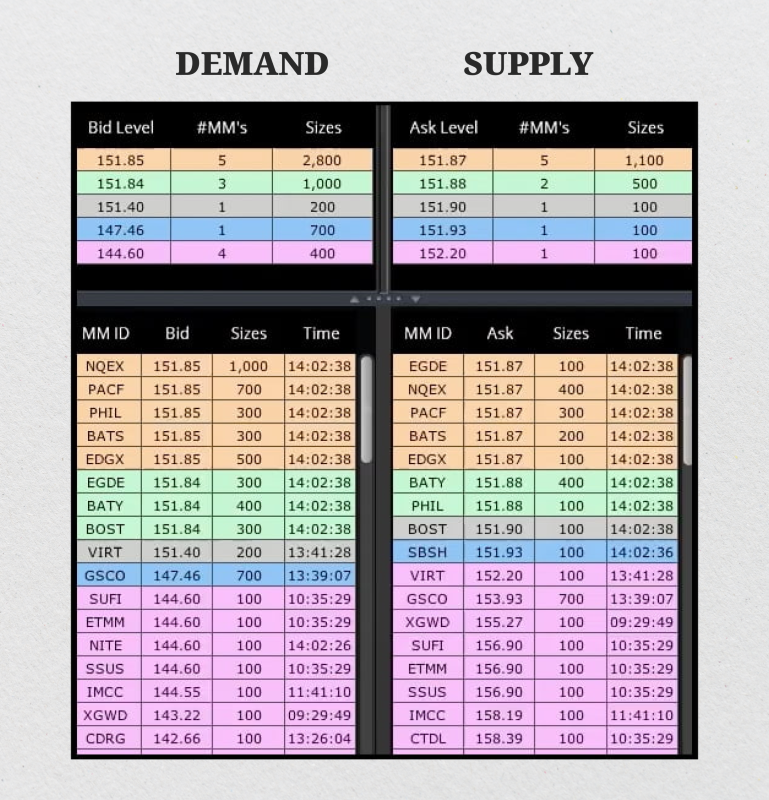

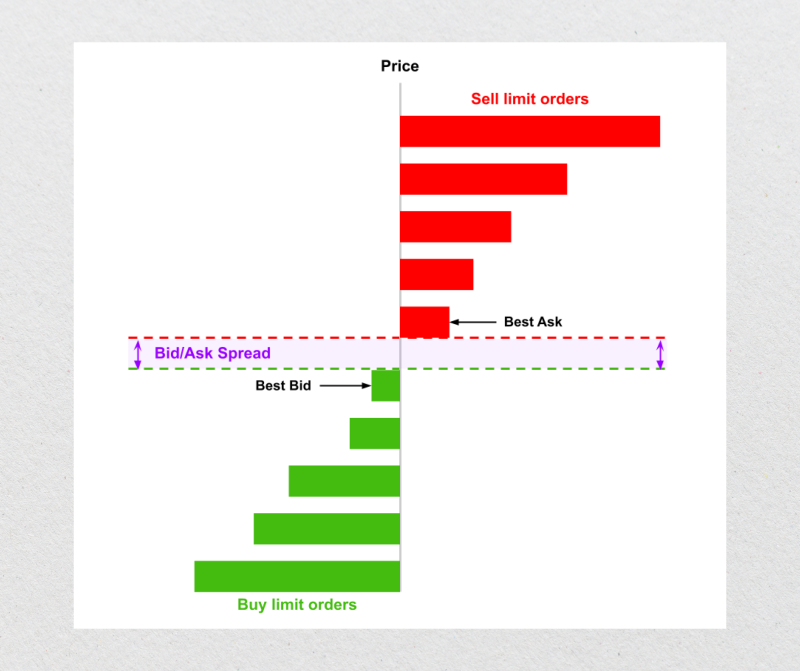

An order book always has two sides: the bids and the asks. Bids are simply the listed buy orders, showing the prices at which potential buyers are willing to purchase the asset. Asks (or offers) are the listed sell orders, showing the prices at which current holders are willing to sell.

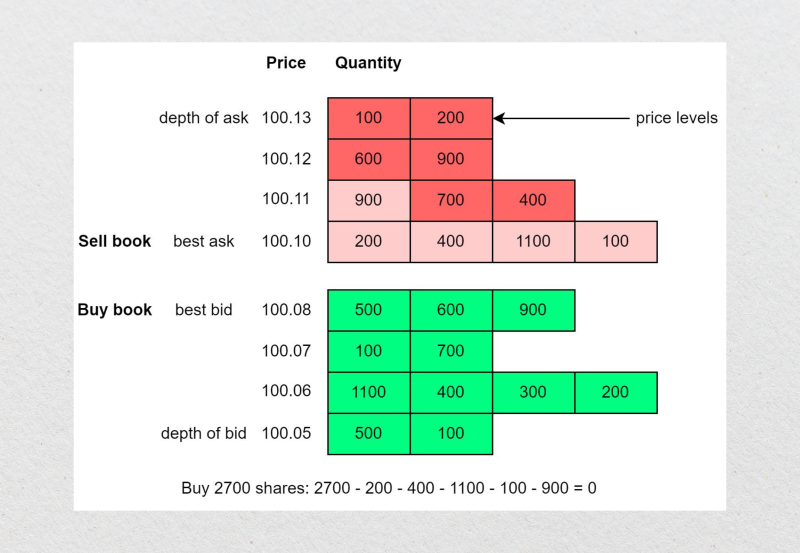

Each line within the order book displays key information: the price level, the total quantity of the asset available at that price, and occasionally, the total number of individual orders. When a trader places a market order to buy or sell immediately, it is executed against the best available price at the top of the opposite side of the order book.

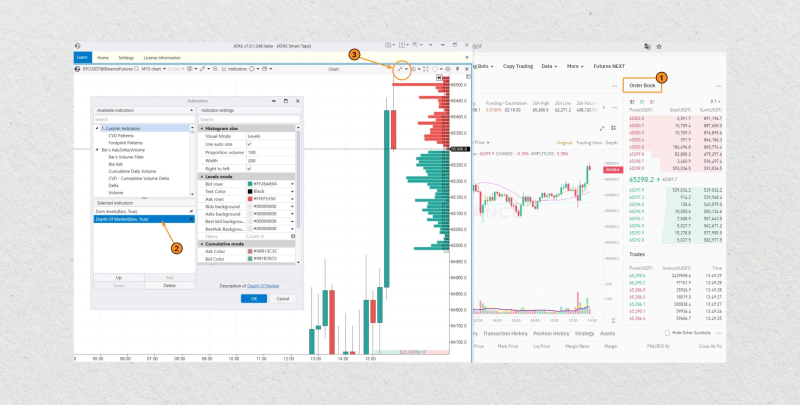

Modern trading interfaces can display order book data in Levels 1 (single best bid and ask only) and Levels 2 (multiple price levels), allowing traders to assess market structure and depths.

On more advanced interfaces, often found in cryptocurrency and foreign exchange, this data is displayed in a graphical format, featuring depth charts that show the cumulative order volume of buys and sells at several price levels.

Fast Fact

The bid-ask spread in liquid markets, such as EUR/USD, can be as low as 0.1 pip, while illiquid crypto tokens may have spreads that are over 100 times wider.

Key Components of an Order Book

The most prominent components of an order book—bids and asks, prices and quantities, and real-time updates—are the foundation of all trading interfaces.

Bids and Asks

All order books are founded upon buy and sell orders, which are statements of intentions of market agents to swap a particular asset at a particular price.

A bid represents a limit order placed by a trader to purchase an asset at or below a particular price—generally speaking, at or below the bid price—while an ask (or sell order) represents a willingness to sell the asset at or above a price target.

Such buy orders and sell orders are listed in the order book by price levels, where buy orders are ordered in descending order (i.e., from the maximum bid price downwards) and sell orders are ordered in ascending order (i.e., from the minimum price upwards).

Its highest bid and lowest ask together make up what we define as the top of the book, and the area in between makes up the bid-ask spread. It’s a key indicator of market efficiency and liquidity.

A narrow spread almost always indicates a highly liquid financial marketplace, but if it is too wide, it can represent volatility or thin trading, which significantly affects execution quality and the cost of trading.

Understanding the order placement of buy and sell orders across both sides of the sell side and buy side of the book is essential when considering order book depth, as it affords valuable market data for developing a good trading strategy.

Price Levels and Quantities

Every order book row represents a price level and the volume (or quantity) of the traded item that has been offered or requested at that price level. These price levels are signals of other people’s willingness to trade at various points, allowing a trader to observe, at a glance, the demand and supply pressure.

For instance, the order book will show 5 BTC available for sale at $60,000 and 3 BTC available for sale at $59,950. These are not just indicators of interest, but also likely resistance and support levels. If there are multiple buy or sell orders tied at a particular price, the order book will often aggregate them, displaying a cumulative size for that price.

Some trading platforms provide additional insight by displaying the number of individual orders at each price level. This data can reveal how concentrated or fragmented the interest is within specific price zones.

These indicators are essential for properly interpreting the depth of the order book. They allow a trader to better anticipate likely price action, quantify the available liquidity, and decide on the aggressiveness of their market or limit orders.

Real-Time Updates

The order book is continuously updated in real-time whenever buy or sell orders are added, canceled, or matched. Such a real-time feed portrays the changing scenario of demand and supply in the money market.

When settlements are completed, corresponding entries are removed from the book, and the current price scenario is reflected immediately at the top of the book.

For high-speed trading methods like algorithmic trading or scalping, real-time updates are non-negotiable, as even microsecond delays can lead to missed opportunities. A live order book offers a direct view of market sentiment. It can reveal large sell walls or accumulating buy orders—both of which can foreshadow the next directional price move.

This active process also sheds light on why order book depth varies from minute to minute. A surge in sell-side pressure can thin book depth, yet a stream of buy orders at incremental, higher rates can deepen it. Recognition of this movement helps one cultivate prudent trading conclusions and identify fleeting trend shifts.

Regardless of whether your platform of choice is a trading terminal or a graphical representation, such as a depth chart, staying in touch with the latest updates ensures that you have the latest market pulse available at all times. This is particularly useful when examining order book depth and the extent to which it can impact your efficiency when concluding trades.

Why Order Book Depth Is Important?

Understanding order book depth is imperative for all traders, brokers, and even market analysts. It unveils a vivid picture of all purchase and sales orders executed at various price levels, revealing not only the volume of liquidity available in the financial market but also the quality of trade execution that could take place.

A deeper order book—one that enjoys high volume on both the purchase and sales sides across multiple levels—allows for greater stability, better execution, and more enriched market data.

The following are the key reasons why order book depth matters.

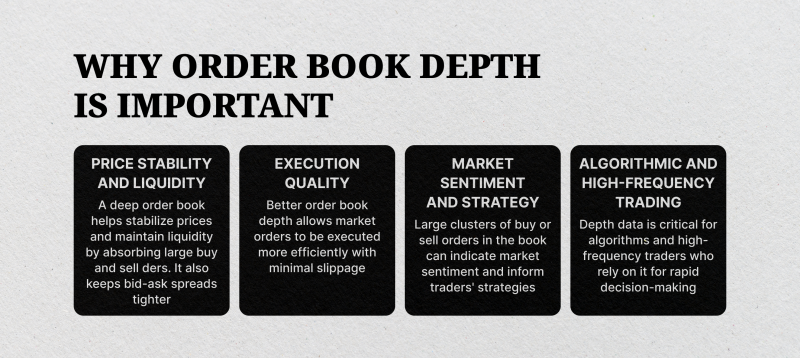

Price Stability and Liquidity

A deep order book maintains price stability by absorbing large trades that would otherwise cause abrupt price changes. As there are more purchase and sales orders stacked at different price tiers, it makes the market more stable for large orders that would otherwise force the current price to change abruptly.

For example, when a trader initiates a large market order to buy an asset, a deep order book is crucial. It ensures enough sell orders exist at incrementally higher price levels to absorb the large buy order without causing a dramatic price spike.

Greater liquidity translates to more order book depth. This, in turn, generally leads to tighter bid-ask spreads, which is often a sign of a healthy and competitive market. In contrast, shallow order books can result in wider price swings and higher slippage. This risk is amplified when trading highly volatile or thinly traded assets.

Execution Quality

From a trader’s perspective, order execution quality is the most important factor. A deep order book will enable market orders to be executed at prices close to or around the intended entry or exit point while maintaining the absolute minimum slippage—the spread between the expected and final trade price.

If, for example, a trader wants to buy 10,000 units of an instrument, and thin depth is present on the sell side, then that trade will be executed across multiple price levels, resulting in a poorer average price.

A healthy order book depth means there is sufficient volume at various price levels to fill large trades efficiently. This is particularly important for institutional investors and algorithmic traders who must execute high-volume orders with minimal market impact. Ultimately, efficient execution directly affects both profitability and risk management.

Market Sentiment and Strategy

Furthermore, order book depth also reflects market sentiment. Traders often perceive large buy orders (support) or sell orders (resistance) lingering in the book as psychological levels. For example, a large cluster of buy orders just below or above the current price can reflect strong demand and probable resistance building.

Some traders use this information towards strategic placement, following trends, or anticipating reversals. However, one should also be aware of the potential for manipulation.

Techniques like spoofing—submitting large fraudulent orders to disorient other traders—or front-running, which high-speed traders conduct in front of large future orders, will distort that perceived depth. Most exchanges have also implemented surveillance to prevent such tactics, but one should still interpret order book depth charts with caution.

Algorithmic and High-Frequency Trading

Algorithmic trading and high-frequency trading (HFT) programs in today’s markets attach significant importance to order book depth information. Automated systems analyze the micro-level dynamics of book depth, including shifts and bunching of purchase and sale orders, to make buying and selling decisions in milliseconds.

Scalping methods, for instance, rely on precise order book depth readings to profit from minuscule price fluctuations. Traders of this type can open and close trades in a matter of seconds, so precise and immediate access to the latest order book data is critical.

A well-ordered order book for such clients not only improves execution but also provides signals that drive short-term trading strategies. A surprise thin sell-side, for example, may trigger an algorithm to enter a long position, expecting a bullish movement.

Determinants of Order Book Depth

Depth in the order book is not a static figure; it changes constantly based on market structure and current events. For traders and brokers, understanding the factors that drive this depth is essential. This knowledge allows for a more accurate interpretation of depth charts, helps in avoiding unexpected slippage, and supports more informed strategic decisions. Let’s examine some of the key factors that influence order book liquidity.

Type of Market

The type of market dictates, to a large degree, how deep the order book is. Forex markets, with specific examples including major currency crosses like EUR/USD, have deep book depths due to unprecedented global liquidity and institutional buying and selling.

Such markets exhibit thin bid-ask spreads and high volumes across various price levels, resulting in minimal price movements within the usual trading hours.

For comparison, cryptocurrency markets are highly heterogeneous in terms of order book depth. Major pairs like BTC/USD on large exchanges will naturally have much deeper order books than obscure altcoins, which often have thin books and low liquidity.

Similarly, stock markets show a wide range of depth, from the highly liquid order books of large-cap stocks to the very thin books of small-cap or over-the-counter stocks. Each asset class operates under unique regulatory and technical conditions that directly impact the quality and consistency of its order book.

There are unique regulatory, operational, and technical conditions for each asset class, all of which impact order book quality and consistency.

Time of Day and Volume Traded

Time, too, is a significant indicator of book depth. Liquidity rises during peak overlap hours of a given market—the peak overlap of business hours between key world financial centers.

Forex, for example, shows deeper books during the London-New York overlap, while American equities show peak depth during typical NYSE/NASDAQ hours.

Trading volume almost always accompanies order book depth: high volume typically also means more active buy or sell orders fulfilled across the price ladder, resulting in better quality execution and lower slippage.

During off-peak hours or off-hours (for cryptocurrency markets), the order book depth may sometimes fall, creating a scenario susceptible to wider spreads and more abrupt price changes.

Exchange Design and Matching Engine Speed

Not all trading websites are of the same quality. It’s the exchange architecture that can have a severe influence on order book depth. More efficient and faster match engines that match market orders with their respective opposing limit orders have more liquidity and smaller price spreads.

Order processing delays will result in slower refreshes of real-time data, which lowers trader confidence and reduces the accuracy of depth charts.

Furthermore, the inclusion of high-end functionality, such as smart order routing, aggregated liquidity pools, and order types (e.g., hidden or post-only order types), can complement or obscure the graphical representation of order book depth.

High-performance architecture becomes more critical to support high-frequency trading and institutional flows that are premised upon millisecond execution and stable conduct across price levels.

Number of Market Participants

The more market participants—active retail traders, institutional investors, market makers, and algorithmic robots—the deeper and more liquid will be the order book.

A varied membership ensures that there will always be a wide range of limit orders at diverse price levels, acting as a cushion for large market orders that would otherwise disrupt the price.

Otherwise, low-participating or low-engagement markets often have thin books, which can lead to large price swings when relatively tiny trades are executed. It’s common in low-liquid altcoins, low-cap stocks, or newly listed trading pairs.

Traders will subsequently have a higher chance of slippage and low execution quality when they try to execute trades. Market depth also relies not only on the number of orders or the frequencies thereof but also on the diversity and sophistication of the orders.

Conclusion

Whether you’re a beginner or a seasoned pro, depth in the order book gives you a tactical edge. From tighter spreads to smarter trade execution and predictive insights into market sentiment, it helps decode what’s really happening behind the price chart.

FAQ

What is order book depth in simple terms?

It’s the number of buy and sell orders at different price levels for an asset—showing how much liquidity exists at each level.

How does order book depth affect slippage?

The shallow depth means fewer orders to fill large trades, which increases the chance of slippage—getting a worse price than expected.

How to read the order book depth chart?

Read the green side for buy orders (bids) and the red side for sell orders (asks). The height of the ‘walls’ shows the volume of orders at each price, indicating potential support or resistance.

Is Level 2 data the same as order book depth?

Yes, Level 2 displays multiple levels of bids and asks, giving a more complete view of order book depth compared to Level 1.