Order Matching Engine – the Heart of a Crypto Exchange

Sep 22, 2022

Assume you are a trader. You’ve placed a purchase order for $10,000 and a sell order for $11,000 in Bitcoin. Then, all of a sudden, both of your commands have been carried out! What caused this to happen?

You may believe that your purchases were simply supplied at the best possible pricing, but there is a lot more going on behind the scenes. The order matching engine – the core of every cryptocurrency exchange – will be examined in this article. We’ll go through how it works and why it’s so important to ensure fast and correct order execution.

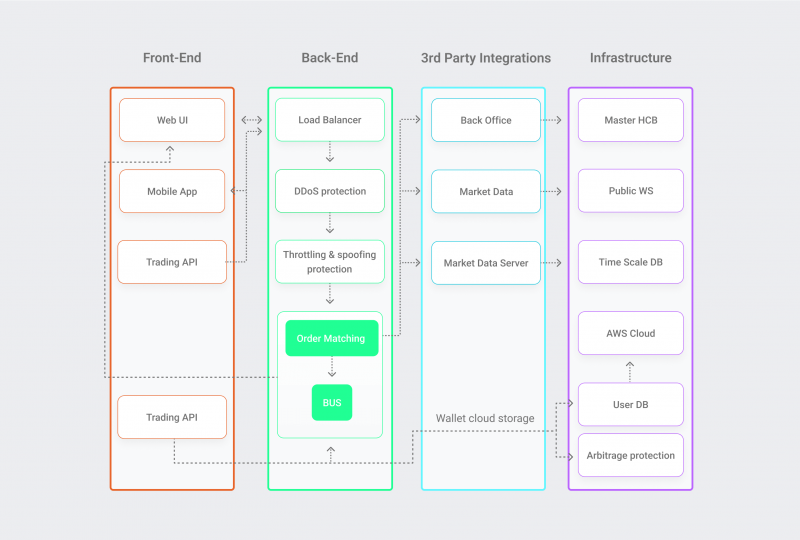

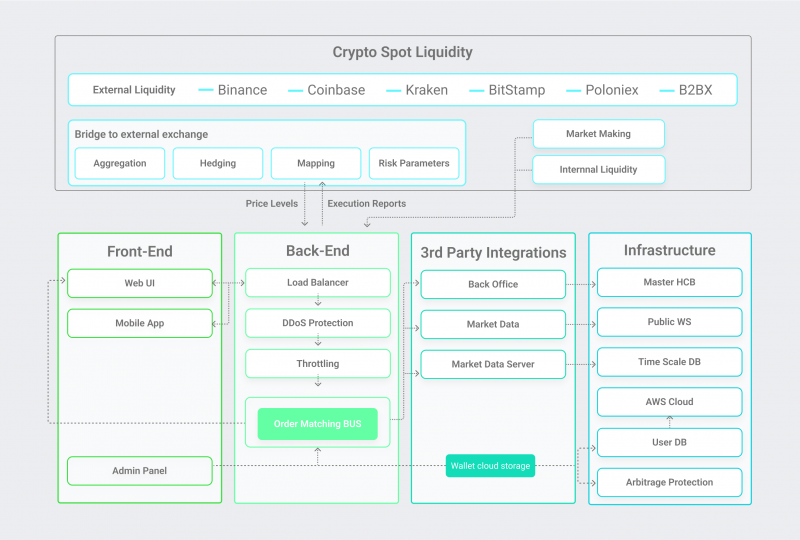

Matching Engine Architecture

An Order Matching Engine: What Is It?

A cryptocurrency exchange’s order matching engine is the software that matches buy and sell orders. It is the heart of every exchange, allowing traders to purchase and sell cryptocurrencies quickly and efficiently.

The order matching engine operates by continually scanning the order book for new orders. When an order comes in, the engine will try to match it with another order in the book. If no matching orders are found, the order will be entered to the order book and will be held until another order that can be matched with it comes. If a match is identified, the transaction will be completed, and both parties will be notified.

What Are the Methods of an Order Matching Engine?

A crypto matching engine must be capable of handling a huge amount of orders while maintaining low latency. Incorrect or malicious commands must also be handled by the engine. For these reasons, creating an order matching engine is a difficult undertaking.

Order matching may be accomplished using a variety of algorithms. The First In First Out (FIFO) algorithm is the most commonly used. This algorithm simply matches orders depending on their arrival time. The first order received will be matched with the first order that can be matched.

The Price Time Priority (PTP) method is another popular algorithm. This algorithm considers both the price and the time of the orders. Orders will be matched based on price, but older orders will be prioritized. This guarantees that orders are not kept in the book for an extended period of time.

The algorithm chosen is determined by the needs of the exchange. Some exchanges may need to match a large number of orders fast, while others may need to guarantee that all orders are fairly matched.

The Order Book’s Function

The order book is a listing of all buy and sell orders placed on an exchange. The order matching engine maintains it and uses it to match incoming orders with current ones. Consider the order book to be a database of orders.

The order book is split into two halves: buy and sell. Each half comprises a list of orders placed by buyers or sellers. The lists are arranged by the price of the orders.

An order book is a useful tool for traders since it informs them about the current situation of the market. It is capable of placing orders, monitoring positions, and tracking price fluctuations.

Building an Engine

When creating an order matching engine, several ways may be employed. A centralized design, in which a single server handles all orders, is one way. If the server fails, the entire system fails with it. This method has the benefit of being easy to apply and scale. It does, however, have the drawback of being susceptible to a single point of failure. Another alternative is to employ a decentralized architecture, in which each order is processed by a distinct node. This technique is more resilient to failure since the system can continue to function even if certain nodes fail. However, it has the drawback of being more difficult to adopt and scale.

Which strategy is preferable is determined by the unique demands of the trade. In general, centralized exchanges are better suitable for small to medium-sized low-volume exchanges, whereas decentralized exchanges are better suited for big high-volume exchanges.

How Do I Locate a Reliable Order Matching Engine for My Cryptocurrency Exchange?

When looking for a solid order matching engine for your cryptocurrency exchange, there are a few factors to consider. The first consideration is speed. The more powerful the engine, the better. You want an engine that can swiftly and efficiently match orders.

Another factor to consider is precision. You want an engine that can accurately match orders. A decent engine will be highly accurate, so you won’t have to worry about mismatched orders.

Finally, you need a dependable engine. You don’t want an engine that will break down or cause additional issues. A competent engine will be able to manage a huge quantity of traffic while remaining operational even under severe load.

So, Which Is The Best Order Matching Engine Available?

There are other possibilities, but the B2Trader from B2Broker is one of the finest. This engine has a recognized track record of performance and dependability. It can handle a lot of traffic and is quite accurate. It’s also simple to use and set up, so you’ll have no problem getting started.

If you’re searching for a solid order matching engine, B2Broker’s B2Trader is a wonderful choice. It is quick, dependable, accurate, and simple to use. The engine can process 10,000 orders per second with a request time of 0.05 milliseconds. Furthermore, the engine works continually with less downtime for maintenance. Furthermore, because the solution is available in three unique sets, you may pick and choose the features you want.

So, if you’re searching for a solid order matching engine for your cryptocurrency exchange, B2Broker’s B2Trader is a great choice.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.