Tax Refund Timeline: When Will You Get Your Tax Return?

Mar 13, 2025

Many people share the same pressing question when the calendar turns and tax season starts: When will I get my tax return? In the United States, federal and state tax refunds can provide a much-needed financial lifeline for millions of taxpayers. But how long does it take to get your tax refund to hit your account? And when will tax refunds be issued in 2025?

In this guide, you’ll learn how long does it take to get a tax refund, what a typical tax refund calendar looks like, which factors can lead to delays, and how to track your money.

Key Takeaways:

- Most refunds arrive within 21 days if you e-file and opt for direct deposit. Paper returns may take significantly longer.

- Use the IRS (Internal Revenue Service) “Where’s My Refund?” tool to check your refund’s status—anytime after your return is accepted.

- Your state refund is separate from your federal refund, and the timeline can vary depending on where you live.

- Errors or special tax situations (like claiming specific credits) can delay processing, extending how long a tax return takes.

Tax Refund Process in 2025

Before diving into timelines, it helps to know what a tax refund really is: essentially, you’re getting back any extra money you paid throughout the year in federal or state income taxes. If your employer withheld more than you owed—or you qualified for certain tax credits—you’ll likely see a refund.

- Withholding and Estimated Payments: Throughout the year, you (or your employer) remit taxes to the government. If these payments exceed your final tax liability, you’re entitled to a refund.

- Filing Your Return: You submit a tax return (electronic or paper) with your total income, deductions, credits, and any taxes owed or overpaid.

- Processing by the IRS: The IRS reviews your return, checks for errors, verifies your identity, and calculates whether you owe additional taxes or qualify for a refund.

- Refund Approval: Once your return is approved, the IRS issues the refund either through direct deposit or a mailed check.

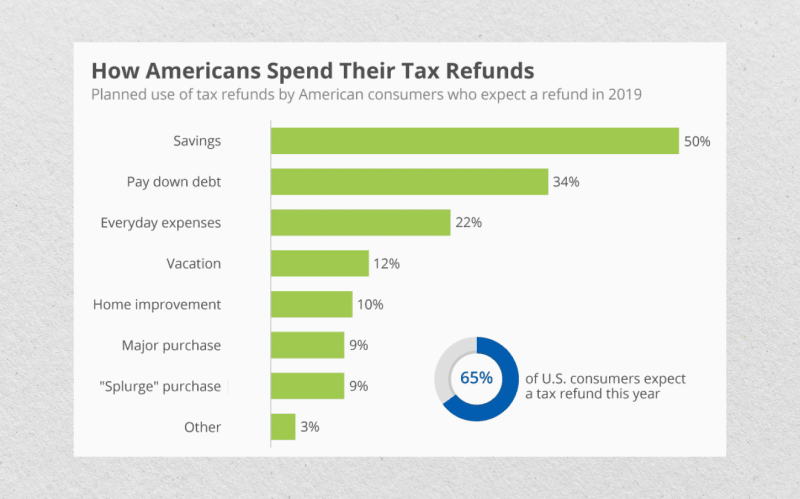

Why So Many Rely on Their Tax Refund

A recent survey from Credit Karma found that 37% of all taxpayers rely on their refunds to make ends meet, and the figure climbs to 50% among millennials.

The refund functions as an essential income boost or emergency fund for these individuals. When people ask, “When will tax refunds be issued?” or “How soon will I get my tax refund 2025?” they’re often counting on that money to cover immediate financial obligations, such as:

- Paying off credit card bills

- Setting aside savings

- Covering unexpected costs like car repairs or medical bills

- Paying down student loans

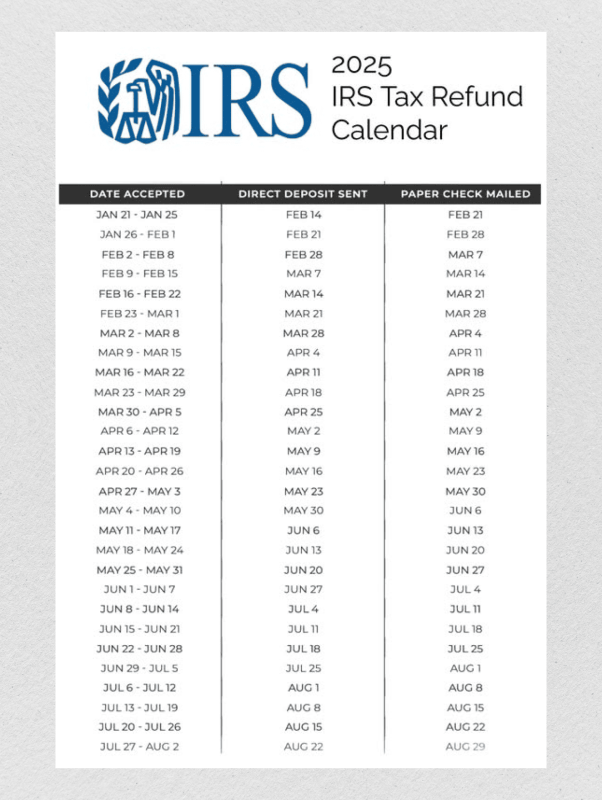

When Do Tax Returns Come 2025?

The IRS tax refund calendar can vary from year to year, but one thing generally remains consistent: e-filing combined with direct deposit is the quickest route to get your money.

Standard Timeline

- E-File + Direct Deposit: Typically issued in 21 days or less after the IRS accepts your return.

- Paper Filing + Check: The process takes longer, usually 6–8 weeks from the date the IRS receives your return.

If you’re wondering “How long for tax refund?” after e-filing, the standard guideline from the IRS is about three weeks, though many taxpayers receive their refunds even faster—sometimes within 7–10 days.

Keep in mind that timeframes ultimately depend on the date you file, the accuracy of your return, and whether you have any special tax situations.

Has Anyone Gotten Their Tax Refund Yet?

In many cases, early filers can see approved refunds as soon as the first couple of weeks in February. For those who wait until closer to the April deadline or paper-file their returns, the timeline could shift later into the season. If you need the money fast, file as early as possible and opt for direct deposit.

Fast Fact:

The IRS processed over 100 million tax returns electronically in a recent filing season, and the average federal tax refund in 2024 was $3,138. For many Americans, especially millennials, that’s a key financial lifeline.

How Long Does It Take to Get Your Tax Return?

Even if you’ve filed correctly, you may face delays. These delays can stretch the process beyond the usual 21 days or more. So, how long does it take to process a tax refund in cases of complications?

Errors or Incomplete Information

Mistyped SSN, incorrect bank account details, or missing forms can prompt the IRS to review your return manually. This manual intervention can tack on extra weeks—or even months—to your refund timeline.

Identity Theft or Fraud Prevention

The IRS implements robust measures to catch suspicious returns. If your return is flagged for potential identity theft, you may have to respond to additional verification requests.

Special Credits

Returns claiming the Earned Income Tax Credit (EITC) or Child Tax Credit often undergo additional scrutiny to prevent fraudulent claims. How long does it take IRS to approve refund in this case? Longer than usual.

Bank Processing Time

Even after the IRS approves your refund, banks sometimes need extra days to process the deposit. How long does it take for the tax refund to show in the bank account after approved? It can be up to 5 business days—though most receive it sooner.

Injured Spouse Allocation

If you filed Form 8379 to protect your share of a refund from your spouse’s debts, expect delays of up to 14 weeks for e-filed returns and 16 weeks for paper returns.

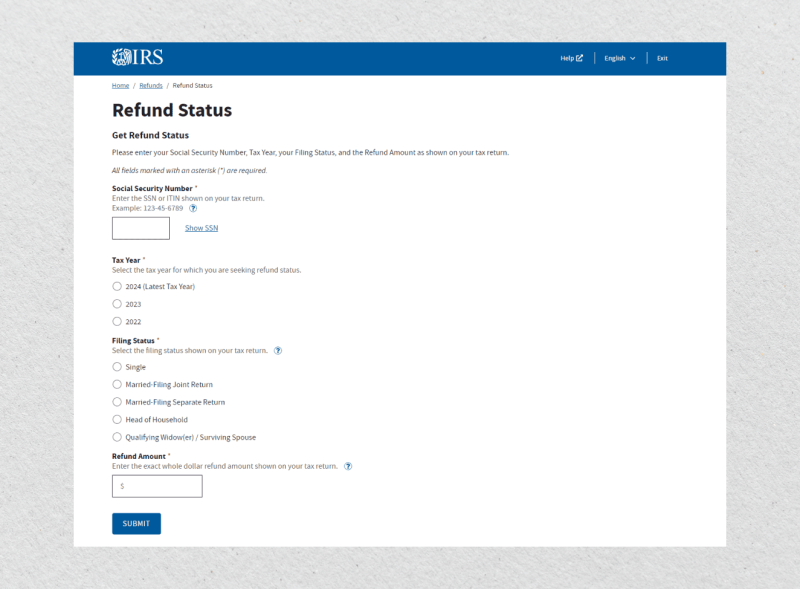

How to Track Your Federal Refund Status

If you can’t help but think, “How long are tax refunds taking?” or “How long does it take to process tax refund after e-filing?”, the best way to get real-time information is to use the IRS “Where’s My Refund?” tool:

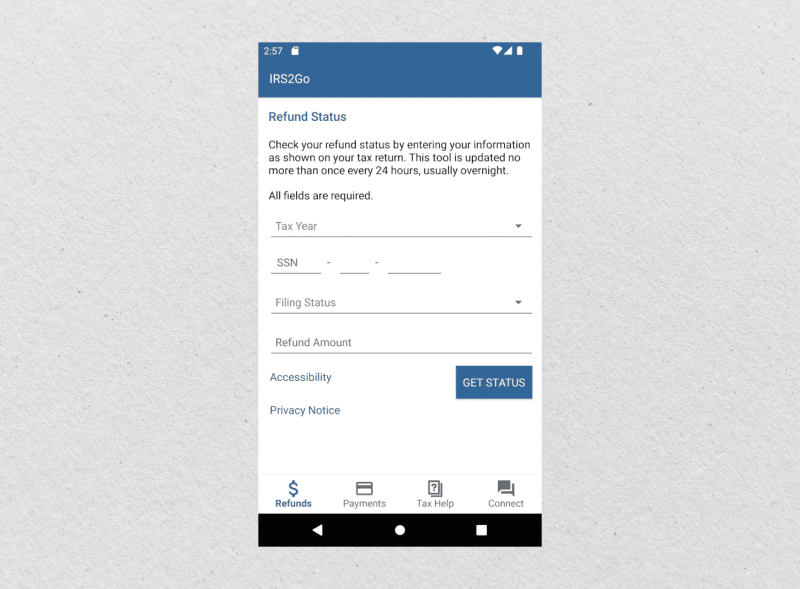

- Online: Visit Where’s My Refund? on the IRS website. You’ll need your Social Security number (or ITIN), filing status, and exact refund amount.

- Mobile: Download the IRS2Go app, the agency’s official application, to check your status on the go.

- Phone: If you lack internet access, call the automated refund hotline at 800-829-1954 (current-year refunds) or 866-464-2050 (amended returns).

The tool updates your status in three main phases: Return Received, Refund Approved, and Refund Sent. Each step shows you how far along you are and how long it takes to receive a tax refund once it’s approved.

Fast Fact:

The IRS recommends you wait at least 24 hours after e-filing (or four weeks after mailing a paper return) before using “Where’s My Refund?” to get an accurate status.

Why Some Taxpayers Don’t Get Refunds

Not everyone ends up with a refund at all. A refund indicates you overpaid your taxes, usually through your paycheck withholding. If your withholdings are precisely aligned with your actual tax liability—or if you end up owing extra due to underpayment—you won’t receive a refund.

Some taxpayers deliberately over-withhold to ensure they receive money back as a forced savings method. Others prefer to keep more money in each paycheck, adjusting their W-4 to aim for neither owing nor getting a large refund.

Conclusion

Your tax refund timeline can vary, but in most cases, the waiting period for an electronically filed and direct-deposited return is around 21 days. Key factors affecting how long your tax refund takes include your filing method (paper or e-file) and the accuracy of your return.

Double-check your personal information, use the “Where’s My Refund?” tool, and file promptly to boost your chances of a smooth, delay-free refund. Keep these best practices in mind for the 2025 tax season, and you’ll be better prepared for any refund checks that come your way.

FAQ

How long does a tax return take?

If you file electronically and opt for direct deposit, you can usually expect your federal tax refund in about 21 days. Paper returns can take 6–8 weeks to process.

Do state tax refunds follow the same timeline as federal refunds?

No. Each state has its own processing system, timeline, and refund tracking methods. While some states issue refunds almost as quickly as the federal government, others may take more time, especially if you file a paper return.

How long to receive tax refund if it is delayed?

If you’re experiencing a delay due to errors, identity checks, or special credit claims, your refund could take a few extra weeks to a few months. It could stretch longer in cases involving Form 8379 (Injured Spouse Allocation) or extensive fraud checks.

When will I get my tax return if I file early?

Filing early can expedite the process. If you file electronically in late January, you might see your federal refund by mid-February, assuming all information is accurate and your return isn’t flagged for further review.